Canadian Digital Fraudsters Increasingly Target Insurance Industry in First Half of 2022

22 September 2022 - 12:00PM

According to a TransUnion Canada TruValidate study, for the second

consecutive quarter, the rate of suspected global digital fraud

attempts in the insurance industry experienced the greatest rise on

a year-over-year basis, increasing 159% between Q2 2021 and Q2 2022

(+125% originating from Canada). This follows a 134% global

increase between Q1 2021 and Q1 2022 (+151% originating from

Canada). Despite this rise in suspected fraud against the insurance

industry, TransUnion’s (NYSE:TRU) quarterly fraud analysis observed

that the overall rate of suspected digital fraud attempts across

industries globally declined by approximately -14% between Q2 2021

and Q2 2022. In Canada, suspected digital fraud attempts decreased

-37% in the same timeframe.

TransUnion observed declines in the rate of suspected digital

fraud attempts from Canada-based transactions across a number of

industries including: gaming (-66%), financial services (-52%),

retail (-31%), telecommunications (-13%), travel and leisure (-6%)

and logistics (-3%).

Conversely, the only industries beyond insurance that

experienced increases in suspected digital fraud attempts

originating from Canada year-over-year in Q2 2022 included

communities such as online dating, forums, etc. (+10%) and gambling

(+8%). However, the types of fraud each of these three industries

experienced were very different. First-party application fraud was

the top insurance-focused digital fraud globally impacting that

industry. This type of fraud involves fraudulent applications

containing intentionally inaccurate or manipulated information

provided by the policyholder with the intention of receiving

certification, lower rates or better terms for a policy/contract.

Whereas other communities were dominated by profile

misrepresentation, which is when users post inaccurate information

in a profile and/or use bogus profile photos.

“In recent years, we’ve seen fraudsters shift their industry

focus each quarter as they recognize that businesses have put more

controls in place. These fraudsters are like chameleons – always

adapting,” said Patrick Boudreau, head of identity management and

fraud solutions at TransUnion Canada. “We have observed interesting

trends in the first half of 2022 with suspected fraudulent activity

in the insurance industry spiking during the first six months of

the year. At this time, we believe the insurance industry is seeing

more ‘soft fraud’ – meaning when a policyholder misrepresents

certain information or circumstances in an effort to lower the

policy’s premium. It may be that some consumers are representing

their policies incorrectly to try to save money, especially in a

high inflation environment that places more pressure on their

wallets.”

Digital fraud continues to be a constant in the lives of many

Canadian consumers. TransUnion’s latest Consumer Pulse study found

that about 3 in 10 (31%) Canadian adults reported experiencing

digital fraud attempts. And 7% fell victim to fraud such as

phishing, identity theft or other types of fraud.

Suspected Digital Fraud Attempts Shift to New Industries

Globally vs. Canada

|

Industry |

Canada Rate Change from Q2 2021 to Q2 2022 |

Global Rate Change from Q2 2021 to Q2 2022 |

|

Insurance |

+125% |

+159% |

|

Communities (online dating, forums, etc.) |

+10% |

-8% |

|

Gambling |

+8% |

-14% |

|

Logistics |

-3% |

+13% |

|

Travel & Leisure |

-6% |

-28% |

|

Telecommunications |

-13% |

-12% |

|

Retail |

-31% |

-28% |

|

Financial Services |

-52% |

-22% |

|

Gaming |

-66% |

-63% |

“The digital acceleration brought about by the pandemic has

permeated industries that have traditionally operated offline,

which fraudsters are trying to capitalize on,” said Boudreau. “At

the same time, for the industries that are finding fraud instances

starting to stabilize, the focus has shifted to identifying the

‘good’ transactions and enabling them to sift through with less

friction. For many industries and businesses, it is a challenge to

balance implementing the necessary security measures to help weed

out potential fraudsters – without creating friction for their

genuine customers. Strong fraud and authentication practices can

dramatically decrease false positives and focus fraud-fighting

resources on the minority of interactions that warrant scrutiny. By

reducing the pool of manual reviews and customer interrogations,

organizations can dramatically reduce costs, increase revenue and

improve the overall customer experience.”

About The Study TransUnion came

to its conclusions about fraud against businesses based on

intelligence from billions of transactions and more than 40,000

websites and apps contained in its flagship identity proofing,

risk-based authentication and fraud analytics solution suite

– TransUnion TruValidate. The percent or rate of suspected

digital fraud attempts are those that TruValidate customers either

denied or reviewed due to fraudulent indicators compared to all

transactions that were assessed for fraud.

For worldwide and regional breakdowns around how much the

suspected digital fraud attempt rate recently changed, what types

of fraud are most prevalent in certain industries and more, please

download the infographic.

About TransUnion (NYSE: TRU)TransUnion is a

global information and insights company that makes trust possible

in the modern economy. We do this by providing an actionable

picture of each person so they can be reliably represented in the

marketplace. As a result, businesses and consumers can transact

with confidence and achieve great things. We call this Information

for Good.® TransUnion provides solutions that help create economic

opportunity, great experiences and personal empowerment for

hundreds of millions of people in more than 30 countries. Our

customers in Canada comprise some of the nation’s largest banks and

card issuers, and TransUnion is a major credit reporting, fraud,

and analytics solutions provider across the finance, retail,

telecommunications, utilities, government and insurance

sectors.

|

Contact |

|

Emma

Tiessen |

| |

|

|

| E-mail |

|

emma.tiessen@ketchum.com |

| |

|

|

| Telephone |

|

647-523-1594 |

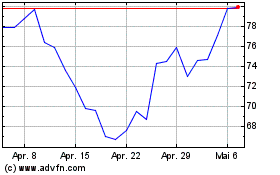

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024