Introduces Fiscal 2023 Second Quarter

Outlook

Tilly’s, Inc. (NYSE: TLYS, the "Company") today announced

financial results for the first quarter of fiscal 2023 ended April

29, 2023.

"We believe the highly uncertain and inflationary economic

environment continues to have a detrimental impact on our pre-teen,

teen, and young adult customer demographic," commented Ed Thomas,

President and Chief Executive Officer. "While we believe our

product assortments are trend right, the impact of inflation and

potential recessionary concerns remain a risk to our business over

the near term."

Operating Results Overview

Fiscal 2023 First Quarter Operating

Results Overview

The following comparisons refer to the Company's operating

results for the first quarter of fiscal 2023 ended April 29, 2023

versus the first quarter of fiscal 2022 ended April 30, 2022.

- Total net sales were $123.6 million, a decrease of $22.1

million or 15.2%, compared to $145.8 million last year. Total

comparable net sales, including both physical stores and e-commerce

("e-com"), decreased by 17.5%.

- Net sales from physical stores were $97.8 million, a decrease

of $19.7 million or 16.7%, compared to $117.5 million last year

with a comparable store net sales decrease of 19.7%. Net sales from

physical stores represented 79.1% of total net sales compared to

80.6% of total net sales last year. The Company ended the first

quarter with 248 total stores compared to 241 total stores at the

end of the first quarter last year.

- Net sales from e-com were $25.8 million, a decrease of $2.5

million or 8.7%, compared to $28.3 million last year. E-com net

sales represented 20.9% of total net sales compared to 19.4% of

total net sales last year.

- Gross profit, including buying, distribution, and occupancy

costs, was $25.9 million, or 21.0% of net sales, compared to $43.8

million, or 30.1% of net sales, last year. Buying, distribution,

and occupancy costs deleveraged by 620 basis points and increased

by $2.4 million collectively, largely due to occupancy costs, as a

result of operating 7 net additional stores. Product margins

declined by 290 basis points primarily due to increased markdowns

utilized to manage inventory levels.

- Selling, general and administrative ("SG&A") expenses were

$43.2 million, or 34.9% of net sales, compared to $42.7 million, or

29.3% of net sales, last year. The $0.5 million increase in

SG&A was primarily due to increases in corporate payroll, due

to the impact of wage inflation, software as a service and

recruiting expenses. Partially offsetting these increases was a

$0.8 million reduction in store payroll and related benefits,

despite operating 7 net additional stores and absorbing an average

8% hourly wage rate increase, compared to last year.

- Operating loss was $(17.3) million, or (14.0)% of net sales,

compared to operating income of $1.1 million, or 0.8% of net sales,

last year, due to the combined impact of the factors noted

above.

- Other income was $1.1 million compared to break-even last year,

primarily due to earning significantly higher rates of return on

our marketable securities compared to last year.

- Income tax benefit was $(4.2) million, or 26.1% of pre-tax

loss, compared to income tax expense of $0.3 million, or 26.9% of

pre-tax income, last year. The decrease in the effective income tax

rate was primarily attributable to a decrease in pre-tax

income.

- Net loss was $(12.0) million, or $(0.40) per share, compared to

net income of $0.8 million, or $0.03 per diluted share, last year.

Weighted average shares were 29.8 million this year compared to

31.0 million diluted shares last year.

Balance Sheet and Liquidity

As of April 29, 2023, the Company had $93.4 million of cash and

marketable securities and no debt outstanding compared to $111.0

million and no debt outstanding at the end of the first quarter

last year. Since the end of last year's first quarter, the Company

repurchased 366,297 shares of its common stock for a total of $2.7

million pursuant to its stock repurchase program, which expired on

March 14, 2023.

The Company ended the first quarter with inventories at cost up

1.6% per square foot while unit inventories were down 5.8% per

square foot compared to last year.

Total year-to-date capital expenditures at the end of the first

quarter were $4.3 million this year compared to $2.6 million last

year. For fiscal 2023 as a whole, the Company expects its total

capital expenditures to be approximately $15 million, inclusive of

7 new stores and upgrades to certain distribution and information

technology systems.

Fiscal 2023 Second Quarter Outlook

Total comparable net sales through May 30, 2023, including both

physical stores and e-com, decreased by 11.5% relative to the

comparable period last year. Based on current and historical

trends, the Company currently estimates that its fiscal 2023 second

quarter net sales will be in the range of approximately $148

million to $158 million, translating to an estimated comparable net

sales decrease of approximately 10% to 15% for the second quarter

of fiscal 2023 compared to last year. The Company currently

estimates its SG&A expenses for the second quarter of fiscal

2023 to be in the range of approximately $49 million to $50

million, pre-tax loss to be in the range of approximately $(5)

million to $(11) million, and estimated income tax rate to be

approximately 26%. The Company currently expects its loss per share

for the second quarter of fiscal 2023 to be in the range of $(0.13)

to $(0.27) based on estimated weighted average shares of

approximately 29.9 million. The Company expects to have 248 stores

open at the end of the second quarter, a net increase of six stores

from the end of last year's second quarter.

Conference Call Information

A conference call to discuss these financial results is

scheduled for today, June 1, 2023, at 4:30 p.m. ET (1:30 p.m. PT).

Investors and analysts interested in participating in the call are

invited to dial (877) 300-8521 (domestic) or (412) 317-6026

(international). The conference call will also be available to

interested parties through a live webcast at www.tillys.com. Please

visit the website and select the “Investor Relations” link at least

15 minutes prior to the start of the call to register and download

any necessary software. A telephone replay of the call will be

available until June 8, 2023, by dialing (844) 512-2921 (domestic)

or (412) 317-6671 (international) and entering the conference

identification number: 10178210.

About Tillys

Tillys is a leading, destination specialty retailer of casual

apparel, footwear, accessories and hardgoods for young men, young

women, boys and girls with an extensive selection of iconic global,

emerging, and proprietary brands rooted in an active, outdoor and

social lifestyle. Tillys is headquartered in Irvine, California and

currently operates 248 total stores across 33 states, as well as

its website, www.tillys.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. In particular, statements regarding our current

operating expectations in light of historical results, the impacts

of inflation and potential recession on us and our customers,

including on our future financial condition or operating results,

expectations regarding customer traffic, our supply chain, our

ability to properly manage our inventory levels, and any other

statements about our future cash position, financial flexibility,

expectations, plans, intentions, beliefs or prospects expressed by

management are forward-looking statements. These forward-looking

statements are based on management’s current expectations and

beliefs, but they involve a number of risks and uncertainties that

could cause actual results or events to differ materially from

those indicated by such forward-looking statements, including, but

not limited to the impact of inflation on consumer behavior and our

business and operations, supply chain difficulties, and our ability

to respond thereto, our ability to respond to changing customer

preferences and trends, attract customer traffic at our stores and

online, execute our growth and long-term strategies, expand into

new markets, grow our e-commerce business, effectively manage our

inventory and costs, effectively compete with other retailers,

attract talented employees, enhance awareness of our brand and

brand image, general consumer spending patterns and levels, the

markets generally, our ability to satisfy our financial

obligations, including under our credit facility and our leases,

and other factors that are detailed in our Annual Report on Form

10-K, filed with the Securities and Exchange Commission (“SEC”),

including those detailed in the section titled “Risk Factors” and

in our other filings with the SEC, which are available on the SEC’s

website at www.sec.gov and on our website at www.tillys.com under

the heading “Investor Relations”. Readers are urged not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. We do not undertake any

obligation to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise.

This release should be read in conjunction with our financial

statements and notes thereto contained in our Form 10-K.

Tilly’s, Inc.

Consolidated Balance

Sheets

(In thousands, except par

value)

(unaudited)

April 29, 2023

January 28,

2023

April 30, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

43,686

$

73,526

$

59,954

Marketable securities

49,695

39,753

50,997

Receivables

12,973

9,240

8,209

Merchandise inventories

77,182

62,117

74,112

Prepaid expenses and other current

assets

9,332

17,762

14,769

Total current assets

192,868

202,398

208,041

Operating lease assets

216,385

212,845

218,163

Property and equipment, net

49,438

50,635

46,606

Deferred tax assets

12,728

8,497

11,594

Other assets

1,765

1,377

1,253

TOTAL ASSETS

$

473,184

$

475,752

$

485,657

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

24,730

$

15,956

$

27,193

Accrued expenses

14,253

15,889

16,741

Deferred revenue

14,792

16,103

15,150

Accrued compensation and benefits

9,056

8,183

8,707

Current portion of operating lease

liabilities

49,567

48,864

51,237

Current portion of operating lease

liabilities, related party

2,908

2,839

2,483

Other liabilities

446

470

674

Total current liabilities

115,752

108,304

122,185

Long-term liabilities:

Noncurrent portion of operating lease

liabilities

169,791

167,913

174,301

Noncurrent portion of operating lease

liabilities, related party

21,633

22,388

20,364

Other liabilities

487

349

872

Total long-term liabilities

191,911

190,650

195,537

Total liabilities

307,663

298,954

317,722

Stockholders’ equity:

Common stock (Class A)

23

23

23

Common stock (Class B)

7

7

7

Preferred stock

—

—

—

Additional paid-in capital

170,608

170,033

167,512

(Accumulated deficit) retained

earnings

(5,438

)

6,530

391

Accumulated other comprehensive income

321

205

2

Total stockholders’ equity

165,521

176,798

167,935

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

473,184

$

475,752

$

485,657

Tilly’s, Inc.

Consolidated Statements of

Operations

(In thousands, except per share

data)

(unaudited)

Thirteen Weeks Ended

April 29, 2023

April 30, 2022

Net sales

$

123,637

$

145,775

Cost of goods sold (includes buying,

distribution, and occupancy costs)

96,768

101,100

Rent expense, related party

931

860

Total cost of goods sold (includes

buying, distribution, and occupancy costs)

97,699

101,960

Gross profit

25,938

43,815

Selling, general and administrative

expenses

43,066

42,574

Rent expense, related party

133

133

Total selling, general and

administrative expenses

43,199

42,707

Operating (loss) income

(17,261

)

1,108

Other income, net

1,064

4

(Loss) income before income

taxes

(16,197

)

1,112

Income tax (benefit) expense

(4,229

)

299

Net (loss) income

$

(11,968

)

$

813

Basic (loss) earnings per share of Class A

and Class B common stock

$

(0.40

)

$

0.03

Diluted (loss) earnings per share of Class

A and Class B common stock

$

(0.40

)

$

0.03

Weighted average basic shares

outstanding

29,798

30,762

Weighted average diluted shares

outstanding

29,798

31,046

Tilly’s, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(unaudited)

Thirteen Weeks Ended

April 29, 2023

April 30, 2022

Cash flows from operating

activities

Net (loss) income

$

(11,968

)

$

813

Adjustments to reconcile net (loss) income

to net cash used in operating activities:

Depreciation and amortization

3,214

3,508

Stock-based compensation expense

522

563

Impairment of assets

154

13

Loss on disposal of assets

16

43

Gain on sales and maturities of marketable

securities

(295

)

(26

)

Deferred income taxes

(4,231

)

(150

)

Changes in operating assets and

liabilities:

Receivables

(3,683

)

(356

)

Merchandise inventories

(15,065

)

(8,467

)

Prepaid expenses and other assets

8,162

1,667

Accounts payable

8,765

(955

)

Accrued expenses

441

(2,357

)

Accrued compensation and benefits

873

(8,349

)

Operating lease liabilities

(1,616

)

(1,361

)

Deferred revenue

(1,311

)

(1,946

)

Other liabilities

(173

)

(193

)

Net cash used in operating

activities

(16,195

)

(17,553

)

Cash flows from investing

activities

Proceeds from maturities of marketable

securities

15,081

51,028

Purchases of marketable securities

(24,524

)

(4,967

)

Purchases of property and equipment

(4,255

)

(2,598

)

Net cash (used in) provided by

investing activities

(13,698

)

43,463

Cash flows from financing

activities

Share repurchases related to share

repurchase program

—

(8,177

)

Proceeds from exercise of stock

options

53

20

Net cash provided by (used in)

financing activities

53

(8,157

)

Change in cash and cash

equivalents

(29,840

)

17,753

Cash and cash equivalents, beginning of

period

73,526

42,201

Cash and cash equivalents, end of

period

$

43,686

$

59,954

Tilly's, Inc.

Store Count and Square

Footage

Store Count at

Beginning of Quarter

New Stores Opened

During Quarter

Stores Permanently

Closed During Quarter

Store Count at End of

Quarter

Total Gross Square

Footage End of Quarter (in thousands)

2022 Q1

241

—

—

241

1,764

2022 Q2

241

2

1

242

1,767

2022 Q3

242

5

—

247

1,800

2022 Q4

247

4

2

249

1,818

2023 Q1

249

1

2

248

1,809

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230601005914/en/

Investor Relations Contact: Michael

Henry, Executive Vice President, Chief Financial Officer (949)

609-5599, ext. 17000 irelations@tillys.com

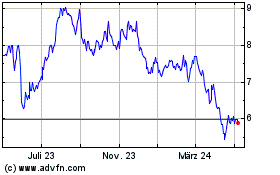

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

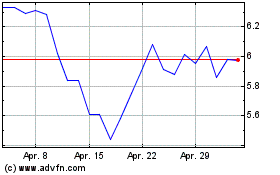

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024