Tilly’s, Inc. (NYSE: TLYS, the "Company") today announced

financial results for its fiscal 2022 fourth quarter and fiscal

year ended January 28, 2023.

"Our fourth quarter results exceeded our revised outlook ranges

provided in early January," commented Ed Thomas, President and

Chief Executive Officer. "Despite a disappointing year overall, the

ongoing impacts of the current inflationary environment, and

potential recession concerns ahead, we remain cautiously optimistic

that we will be well positioned to improve our operating results in

fiscal 2023 compared to fiscal 2022."

Operating Results Overview

For context, the Company's operating results for the comparative

periods last year were driven by significant pent-up consumer

demand and the impact of stimulus payments resulting from the

pandemic, producing Company-record results for net sales, gross

margin, operating income and earnings per share for the fourth

quarter and fifty-two weeks of fiscal 2021.

Fiscal 2022 Fourth Quarter Operating

Results Overview

The following comparisons refer to the Company's operating

results for the fourth quarter of fiscal 2022 ended January 28,

2023 versus the fourth quarter of fiscal 2021 ended January 29,

2022.

- Total net sales were $180.4 million, a decrease of $24.1

million or 11.8%, compared to $204.5 million last year. Total

comparable net sales, including both physical stores and e-commerce

("e-com"), decreased by 13.7%.

- Net sales from physical stores were $135.0 million, a decrease

of $17.1 million or 11.3%, compared to $152.2 million last year

with a comparable store net sales decrease of 14.1%. Net sales from

physical stores represented 74.9% of total net sales compared to

74.4% of total net sales last year. The Company ended the fourth

quarter with 249 total stores compared to 241 total stores at the

end of the fourth quarter last year.

- Net sales from e-com were $45.3 million, a decrease of $7.0

million or 13.4%, compared to $52.3 million last year. E-com net

sales represented 25.1% of total net sales compared to 25.6% of

total net sales last year.

- Gross profit, including buying, distribution, and occupancy

costs, was $52.4 million, or 29.1% of net sales, compared to $70.4

million, or 34.4% of net sales, last year. Product margins declined

by 290 basis points primarily due to an increased markdown rate

compared to last year, during which we experienced record

full-price selling with an abnormally low markdown rate. Buying,

distribution and occupancy costs deleveraged by 240 basis points

collectively, despite being $0.4 million lower than last year, due

to carrying these costs against a significantly lower level of net

sales compared to last year.

- Selling, general and administrative ("SG&A") expenses were

$53.5 million, or 29.7% of net sales, compared to $53.1 million, or

25.9% of net sales, last year. The increase in SG&A dollars was

primarily attributable to the impact of wage inflation on store,

corporate and e-commerce fulfillment payroll expenses as well as

operating 8 net additional stores compared to last year. These

increases were partially offset by a $1.0 million reduction in

bonus expense due to the lack of any bonus accrual this year.

- Operating loss was $(1.1) million, or (0.6)% of net sales,

compared to operating income of $17.3 million, or 8.5% of net

sales, last year, due to the combined impact of the factors noted

above.

- Other income was $1.1 million compared to other expense of

$(0.4) million last year primarily due to earning higher rates of

return on our marketable securities investments and the absence of

any costs associated with our former asset-backed credit facility

which were included in last year's results.

- Income tax benefit was $0.3 million, compared to income tax

expense of $4.9 million, or 28.7% of pre-tax income, last year.

This quarter's income tax benefit was primarily attributable to

certain allowable deductions and tax credits.

- Net income was $0.3 million, or $0.01 per diluted share,

compared to net income of $12.1 million, or $0.38 per diluted

share, last year. Weighted average diluted shares were 30.0 million

this year compared to 31.4 million last year.

Fiscal 2022 Full Year Operating Results

Overview

The following comparisons refer to the Company's operating

results for the fifty-two weeks of fiscal 2022 ended January 28,

2023 versus the fifty-two weeks of fiscal 2021 ended January 29,

2022.

- Total net sales were $672.3 million, a decrease of $103.4

million or 13.3%, compared to $775.7 million last year. Total

comparable net sales, including both physical stores and e-com,

decreased by 14.6%.

- Net sales from physical stores were $531.1 million, a decrease

of $78.6 million or 12.9%, compared to $609.7 million last year

with a comparable store net sales decrease of 14.5%. Net sales from

stores represented 79.0% of total net sales compared to 78.6% of

total net sales last year.

- Net sales from e-com were $141.1 million, a decrease of $24.8

million or 15.0%, compared to $165.9 million last year. E-com net

sales represented 21.0% of total net sales compared to 21.4% of

total net sales last year.

- Gross profit including buying, distribution, and occupancy

costs, was $202.8 million, or 30.2% of net sales, compared to

$276.7 million, or 35.7% of net sales, last year. Buying,

distribution and occupancy costs deleveraged by 280 basis points

collectively despite being $1.2 million lower than last year due to

carrying these costs against a significantly lower level of net

sales compared to last year. Product margins declined by 270 basis

points primarily due to an increased markdown rate compared to last

year, during which we experienced record full-price selling with an

abnormally low markdown rate.

- SG&A expenses were $191.3 million, or 28.5% of net sales,

compared to $189.1 million, or 24.4% of net sales, last year. The

increase in SG&A dollars was primarily attributable to the

impact of wage inflation on store payroll and operating 8 net

additional stores compared to last year, as well as increased

software as a service cost. These increases were partially offset

by a $7.1 million reduction in bonus expense due to the lack of any

bonus accrual this year.

- Operating income was $11.5 million, or 1.7% of net sales,

compared to 87.6 million, or 11.3% of net sales, last year.

- Other income was $2.0 million compared to other expense of

$(0.6) million last year primarily due to earning higher rates of

return on our marketable securities investments and the absence of

any costs associated with our former asset-backed credit facility

which were included in last year's results.

- Income tax expense was $3.3 million, or 24.9% of pre-tax

income, compared to $22.8 million, or 26.2% of pre-tax income, last

year. The decrease in the effective income tax rate was primarily

attributable to a decrease in pre-tax income.

- Net income was $10.1 million, or $0.33 per diluted share,

compared to 64.2 million, or 2.06 per diluted share, last year.

Weighted average diluted shares were 30.3 million this year

compared to 31.1 million last year.

Balance Sheet and Liquidity

As of January 28, 2023, the Company had $113.3 million of cash

and marketable securities and no debt outstanding compared to

$139.2 million and no debt outstanding as of January 29, 2022.

During fiscal 2022, the Company repurchased 1,258,330 shares of its

common stock for a total of $10.9 million pursuant to its

previously-announced stock repurchase program.

The Company ended the fourth quarter with inventories per square

foot down 8.2% compared to last year.

Total year-to-date capital expenditures at the end of the fourth

quarter were $15.1 million this year compared to $13.4 million last

year.

Fiscal 2023 First Quarter Outlook

Total comparable net sales through March 7, 2023, including both

physical stores and e-com, decreased by 19.9% relative to the

comparable period last year with a 21.0% decrease in fiscal

February and a 17.3% decrease thus far in fiscal March. The Company

believes its first quarter results have been adversely impacted by

weather, particularly in California wherein approximately 40% of

its stores reside and currently expects its comparable net sales

trend to improve over the remainder of the quarter given easier

prior year comparisons. Based on current and historical trends, the

Company currently estimates that its fiscal 2023 first quarter net

sales will be in the range of approximately $122 million to $133

million, translating to an estimated comparable net sales decrease

of approximately 11% to 18.5% compared to the first quarter of

fiscal 2022. The Company currently estimates its SG&A expenses

for the first quarter of fiscal 2023 to be in the range of

approximately $43 million to $44 million, pre-tax loss to be in the

range of approximately $(11.0) million to $(16.7) million, and

estimated income tax rate to be approximately 27%. The Company

currently expects its loss per share for the first quarter of

fiscal 2023 to be in the range of $(0.27) to $(0.41) based on

estimated weighted average shares of approximately 29.9

million.

Fiscal 2023 Capital Expenditure Plans

The Company currently expects its total capital expenditures for

fiscal 2023 to be in the range of approximately $15 million to $20

million, inclusive of up to 10 new stores and upgrades to certain

distribution and information technology systems.

Conference Call Information

A conference call to discuss these financial results is

scheduled for today, March 9, 2023, at 4:30 p.m. ET (1:30 p.m. PT).

Investors and analysts interested in participating in the call are

invited to dial (877) 300-8521 (domestic) or (412) 317-6026

(international). The conference call will also be available to

interested parties through a live webcast at www.tillys.com. Please

visit the website and select the “Investor Relations” link at least

15 minutes prior to the start of the call to register and download

any necessary software. A telephone replay of the call will be

available until March 16, 2023, by dialing (844) 512-2921

(domestic) or (412) 317-6671 (international) and entering the

conference identification number: 10175683.

About Tillys

Tillys is a leading, destination specialty retailer of casual

apparel, footwear, accessories and hardgoods for young men, young

women, boys and girls with an extensive selection of iconic global,

emerging, and proprietary brands rooted in an active, outdoor and

social lifestyle. Tillys is headquartered in Irvine, California and

currently operates 248 total stores across 33 states, as well as

its website, www.tillys.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. In particular, statements regarding our current

operating expectations in light of historical results, the impacts

of inflation and potential recession on us and our customers, the

overall effect of the novel coronavirus (COVID-19) pandemic,

including its impacts on us, our operations, or our future

financial condition or operating results, expectations regarding

customer traffic, our supply chain, our ability to properly manage

our inventory levels, and any other statements about our future

cash position, financial flexibility, expectations, plans,

intentions, beliefs or prospects expressed by management are

forward-looking statements. These forward-looking statements are

based on management’s current expectations and beliefs, but they

involve a number of risks and uncertainties that could cause actual

results or events to differ materially from those indicated by such

forward-looking statements, including, but not limited to, the

effects of the COVID-19 pandemic (including any surges in the

number of cases related thereto, or other weather, epidemics,

pandemics, or other public health issues), supply chain

difficulties, and inflation on our business and operations, and our

ability to respond thereto, our ability to respond to changing

customer preferences and trends, attract customer traffic at our

stores and online, execute our growth and long-term strategies,

expand into new markets, grow our e-commerce business, effectively

manage our inventory and costs, effectively compete with other

retailers, attract talented employees, enhance awareness of our

brand and brand image, general consumer spending patterns and

levels, the markets generally, our ability to satisfy our financial

obligations, including under our credit facility and our leases,

and other factors that are detailed in our Annual Report on Form

10-K, filed with the Securities and Exchange Commission (“SEC”),

including those detailed in the section titled “Risk Factors” and

in our other filings with the SEC, which are available on the SEC’s

website at www.sec.gov and on our website at www.tillys.com under

the heading “Investor Relations”. Readers are urged not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. We do not undertake any

obligation to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise.

This release should be read in conjunction with our financial

statements and notes thereto contained in our Form 10-K.

Tilly’s, Inc.

Consolidated Balance

Sheets

(In thousands, except par

value)

(unaudited)

January 28,

2023

January 29,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

73,526

$

42,201

Marketable securities

39,753

97,027

Receivables

9,240

6,705

Merchandise inventories

62,117

65,645

Prepaid expenses and other current

assets

18,136

16,400

Total current assets

202,772

227,978

Operating lease assets

212,845

216,508

Property and equipment, net

50,635

47,530

Deferred tax assets

8,269

11,446

Other assets

1,377

1,361

TOTAL ASSETS

$

475,898

$

504,823

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

15,956

$

28,144

Accrued expenses

15,889

19,073

Deferred revenue

16,103

17,096

Accrued compensation and benefits

7,916

17,056

Current portion of operating lease

liabilities

48,864

51,504

Current portion of operating lease

liabilities, related party

2,839

2,533

Other liabilities

470

761

Total current liabilities

108,037

136,167

Long-term liabilities:

Noncurrent portion of operating lease

liabilities

167,913

171,965

Noncurrent portion of operating lease

liabilities, related party

22,388

21,000

Other liabilities

349

978

Total long-term liabilities

190,650

193,943

Total liabilities

298,687

330,110

Stockholders’ equity:

Common stock (Class A)

23

24

Common stock (Class B)

7

7

Preferred stock

—

—

Additional paid-in capital

170,033

166,929

Retained earnings

6,943

7,754

Accumulated other comprehensive income

(loss)

205

(1

)

Total stockholders’ equity

177,211

174,713

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

475,898

$

504,823

Tilly’s, Inc.

Consolidated Statements of

Income

(In thousands, except per share

data)

(unaudited)

Thirteen Weeks Ended

Fifty-Two Weeks Ended

January 28, 2023

January 29, 2022

January 28, 2023

January 29, 2022

Net sales

$

180,350

$

204,489

$

672,280

$

775,694

Cost of goods sold (includes buying,

distribution, and occupancy costs)

127,005

133,332

465,875

496,083

Rent expense, related party

936

799

3,616

2,948

Total cost of goods sold (includes

buying, distribution, and occupancy costs)

127,941

134,131

469,491

499,031

Gross profit

52,409

70,358

202,789

276,663

Selling, general and administrative

expenses

53,397

52,919

190,802

188,527

Rent expense, related party

133

142

533

541

Total selling, general and

administrative expenses

53,530

53,061

191,335

189,068

Operating (loss) income

(1,121

)

17,297

11,454

87,595

Other income (expense), net

1,118

(375

)

1,980

(594

)

(Loss) Income before income

taxes

(3

)

16,922

13,434

87,001

Income tax (benefit) expense

(312

)

4,864

3,344

22,752

Net income

$

309

$

12,058

$

10,090

$

64,249

Basic earnings per share of Class A and

Class B common stock

$

0.01

$

0.39

$

0.34

$

2.10

Diluted earnings per share of Class A and

Class B common stock

$

0.01

$

0.38

$

0.33

$

2.06

Weighted average basic shares

outstanding

29,785

30,953

30,115

30,560

Weighted average diluted shares

outstanding

30,010

31,402

30,323

31,118

Tilly’s, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(unaudited)

Fifty-Two Weeks Ended

January 28,

2023

January 29,

2022

Cash flows from operating

activities

Net income

$

10,090

$

64,249

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Depreciation and amortization

14,134

16,836

Insurance proceeds from casualty loss

23

117

Stock-based compensation expense

2,267

1,920

Impairment of assets

17

136

Loss on disposal of assets

92

74

Gain on sales and maturities of marketable

securities

(466

)

(132

)

Deferred income taxes

3,201

503

Changes in operating assets and

liabilities:

Receivables

1,710

4,023

Merchandise inventories

3,505

(10,064

)

Prepaid expenses and other assets

(1,885

)

(10,275

)

Accounts payable

(12,194

)

3,168

Accrued expenses

(5,396

)

(10,194

)

Accrued compensation and benefits

(9,140

)

7,157

Operating lease liabilities

(5,231

)

(7,008

)

Deferred revenue

(993

)

3,604

Other liabilities

(1,149

)

(712

)

Net cash (used in) provided by

operating activities

(1,415

)

63,402

Cash flows from investing

activities

Proceeds from maturities of marketable

securities

147,271

130,352

Purchases of marketable securities

(89,349

)

(162,321

)

Purchases of property and equipment

(15,123

)

(13,425

)

Proceeds from sale of property and

equipment

6

37

Insurance proceeds from casualty loss

—

29

Net cash provided by (used in)

investing activities

42,805

(45,328

)

Cash flows from financing

activities

Share repurchases related to share

repurchase program

(10,902

)

—

Proceeds from exercise of stock

options

176

9,573

Short swing profit settlement

661

—

Dividends paid

—

(61,630

)

Net cash used in financing

activities

(10,065

)

(52,057

)

Change in cash and cash

equivalents

31,325

(33,983

)

Cash and cash equivalents, beginning of

period

42,201

76,184

Cash and cash equivalents, end of

period

$

73,526

$

42,201

Tilly's, Inc.

Store Count and Square

Footage

Store Count at

Beginning of Quarter

New Stores Opened

During Quarter

Stores Permanently

Closed During Quarter

Store Count at End of

Quarter

Total Gross Square

Footage End of Quarter (in thousands)

2022 Q1

241

—

—

241

1,764

2022 Q2

241

2

1

242

1,767

2022 Q3

242

5

—

247

1,800

2022 Q4

247

4

2

249

1,818

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230309005743/en/

Investor Relations Contact: Michael

Henry, Executive Vice President, Chief Financial Officer (949)

609-5599, ext. 17000 irelations@tillys.com

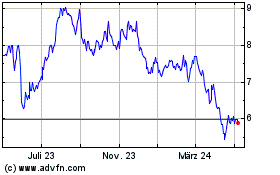

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

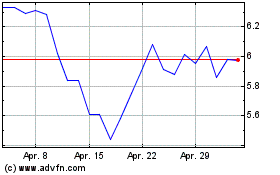

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024