TEEKAY CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| (in thousands of U.S. Dollars, except share and per share amounts) | 2023 | | 2022 |

| $ | | $ |

Revenues (note 2) | 418,701 | | 212,720 |

| Voyage expenses | (124,187) | | (101,622) |

| Vessel operating expenses | (60,922) | | (71,941) |

Time-charter hire expenses (note 7) | (12,945) | | (5,550) |

| Depreciation and amortization | (23,975) | | (25,080) |

| General and administrative expenses | (15,216) | | (16,083) |

Write-down of assets (note 12) | — | | (421) |

Restructuring charges (note 13) | (1,619) | | (4,597) |

| Income (loss) from vessel operations | 179,837 | | (12,574) |

| Interest expense | (11,377) | | (10,002) |

| Interest income | 5,588 | | 297 |

Realized and unrealized (losses) gains on derivative instruments (note 8) | (98) | | 1,967 |

| Equity income (loss) | 1,130 | | (754) |

Loss on bond repurchases (note 6) | — | | (12,410) |

| Other - net | (2,566) | | (283) |

| Income (loss) from continuing operations before income taxes | 172,514 | | (33,759) |

Income tax (expense) recovery (note 14) | (2,601) | | 636 |

| Income (loss) from continuing operations | 169,913 | | (33,123) |

Loss from discontinued operations (note 18) | — | | (20,276) |

| Net income (loss) | 169,913 | | (53,399) |

Net (income) loss attributable to non-controlling interests (note 18) | (121,150) | | 54,287 |

| Net income attributable to the shareholders of Teekay Corporation | 48,763 | | 888 |

| Amounts attributable to the shareholders of Teekay Corporation | | |

| Income (loss) from continuing operations | 169,913 | | (33,123) |

| Net income attributable to non-controlling interests, continuing operations | (121,150) | | (7,641) |

| Net income (loss) attributable to the shareholders of Teekay Corporation, continuing operations | 48,763 | | (40,764) |

Loss from discontinued operations (note 18) | — | | (20,276) |

| Net loss attributable to non-controlling interests, discontinued operations | — | | 61,928 |

Net income attributable to the shareholders of Teekay Corporation, discontinued operations | — | | 41,652 |

| Net income attributable to the shareholders of Teekay Corporation | 48,763 | | 888 |

| | | |

Per common share attributable to the shareholders of Teekay Corporation (note 15) |

• Basic income (loss) from continuing operations

attributable to shareholders of Teekay Corporation | 0.49 | | (0.40) |

• Basic income from discontinued operations attributable to shareholders of Teekay Corporation | — | | 0.41 |

| • Basic income | 0.49 | | 0.01 |

• Diluted income (loss) from continuing operations

attributable to shareholders of Teekay Corporation | 0.48 | | (0.40) |

• Diluted income from discontinued operations attributable to shareholders of Teekay Corporation | — | | 0.41 |

| • Diluted income | 0.48 | | 0.01 |

Weighted average number of common shares outstanding (note 15) |

| • Basic | 98,521,611 | | 102,347,141 |

| • Diluted | 100,476,663 | | 102,347,141 |

| | | |

| The accompanying notes are an integral part of the unaudited consolidated financial statements. | | | |

TEEKAY CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands of U.S. Dollars)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Net income (loss) | 169,913 | | (53,399) |

| Other comprehensive income: | | | |

| Other comprehensive income before reclassifications | | | |

| Pension adjustments, net of taxes | 20 | | 56 |

| Amounts reclassified from accumulated other comprehensive income | | | |

| Realized loss on qualifying cash flow hedging instruments - discontinued operations | — | | 686 |

| | | |

| Other comprehensive income | 20 | | 742 |

| Comprehensive income (loss) | 169,933 | | (52,657) |

| Comprehensive (income) loss attributable to non-controlling interests | (121,150) | | 53,879 |

| Comprehensive income attributable to shareholders of Teekay Corporation | 48,783 | | 1,222 |

| | | |

| The accompanying notes are an integral part of the unaudited consolidated financial statements. | | | |

TEEKAY CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands of U.S. Dollars, except share amounts)

| | | | | | | | | | | |

| As at March 31,

2023 | | As at December 31, 2022 |

| $ | | $ |

| ASSETS | | | |

| Current | | | |

Cash and cash equivalents (notes 9 and 16) | 252,519 | | 309,857 |

Short-term investments (note 9) | 208,252 | | 210,000 |

Restricted cash – current (notes 9 and 16) | 3,703 | | 3,714 |

| Accounts receivable | 180,850 | | 140,837 |

| Accrued revenue | 80,579 | | 82,923 |

| Bunker and lube oil inventory | 64,421 | | 60,832 |

| Prepaid expenses | 17,958 | | 15,442 |

| Total current assets | 808,282 | | 823,605 |

Restricted cash – non-current (notes 9 and 16) | 3,135 | | 3,135 |

Vessels and equipment | | | |

At cost, less accumulated depreciation of $284,200 (2022 – $171,800) | 680,986 | | 429,987 |

Vessels related to finance leases, at cost, less accumulated amortization of $201,400(2022 – $290,000) (note 7) | 548,961 | | 823,381 |

Operating lease right-of-use assets (note 7) | 92,691 | | 42,894 |

| Total vessels and equipment | 1,322,638 | | 1,296,262 |

| Investment in and loan to equity-accounted investment | 17,328 | | 16,198 |

| Goodwill, intangibles and other non-current assets | 23,804 | | 25,646 |

| | 2,175,187 | | 2,164,846 |

| LIABILITIES AND EQUITY | | | |

| Current | | | |

| Accounts payable | 47,703 | | 47,371 |

Accrued liabilities and other (note 4) | 87,057 | | 86,971 |

Current portion of long-term debt (notes 6 and 9) | — | | 21,184 |

Current obligations related to finance leases (notes 7 and 9) | 41,730 | | 60,161 |

Current portion of operating lease liabilities (note 7) | 32,345 | | 16,585 |

| Total current liabilities | 208,835 | | 232,272 |

Long-term obligations related to finance leases (notes 7 and 9) | 316,728 | | 472,599 |

Long-term operating lease liabilities (note 7) | 60,693 | | 26,858 |

Other long-term liabilities (note 4) | 61,684 | | 63,511 |

| Total liabilities | 647,940 | | 795,240 |

Commitments and contingencies (notes 5, 6, 7, 8, 9 and 17) | | | |

| Equity | | | |

Common stock and additional paid-in capital ($0.001 par value; 725,000,000 shares authorized; 96,027,318 shares outstanding and 102,505,007 shares issued (2022 – 98,318,395 shares outstanding and 102,077,387 shares issued)) (note 10) | 997,840 | | 1,022,040 |

| Accumulated deficit | (336,787) | | (396,605) |

| Non-controlling interest | 868,146 | | 746,143 |

| Accumulated other comprehensive loss | (1,952) | | (1,972) |

| Total equity | 1,527,247 | | 1,369,606 |

| Total liabilities and equity | 2,175,187 | | 2,164,846 |

| | | |

| Subsequent events (note 19) | | | |

| | | |

| The accompanying notes are an integral part of the unaudited consolidated financial statements. | | | |

TEEKAY CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of U.S. Dollars)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Cash, cash equivalents and restricted cash provided by (used for) | | | |

| OPERATING ACTIVITIES | | | |

| Net income (loss) | 169,913 | | (53,399) |

| Less: loss from discontinued operations | — | | 20,276 |

| Income (loss) from continuing operations | 169,913 | | (33,123) |

| Non-cash and non-operating items: | | | |

| Depreciation and amortization | 23,975 | | 25,080 |

Write-down of assets (note 12) | — | | 421 |

| | | |

| | | |

| Other | 7,765 | | 18,087 |

| Change in operating assets and liabilities: | | | |

| Change in other operating assets and liabilities | (44,675) | | (50,459) |

| Asset removal obligation costs | (80) | | — |

| Expenditures for dry docking | (1,465) | | (2,138) |

| Net operating cash flow - continuing operations | 155,433 | | (42,132) |

| Net operating cash flow - discontinued operations | — | | 26,866 |

| Net operating cash flow | 155,433 | | (15,266) |

| FINANCING ACTIVITIES | | | |

| Prepayments of long-term debt | — | | (494,104) |

| Scheduled repayments of long-term debt (note 6) | (21,184) | | (51,299) |

| Proceeds from short-term debt | 25,000 | | 23,000 |

| Prepayments of short-term debt | (25,000) | | (20,000) |

Proceeds from financings related to sales and leaseback of vessels, net of issuance costs (note 7) | — | | 175,341 |

| Prepayment of obligations related to finance leases (note 7) | (164,252) | | — |

| Scheduled repayments of obligations related to finance leases | (13,397) | | (6,718) |

Purchase of Teekay Tankers common shares (note 11) | — | | (5,269) |

Repurchase of Teekay Corporation common shares (note 10) | (14,845) | | — |

| Other financing activities | (410) | | (985) |

| Net financing cash flow - continuing operations | (214,088) | | (380,034) |

| Net financing cash flow - discontinued operations | — | | — |

| Net financing cash flow | (214,088) | | (380,034) |

| INVESTING ACTIVITIES | | | |

| Expenditures for vessels and equipment | (442) | | (4,071) |

| Decrease (increase) in short-term investments | 1,748 | | (220,000) |

Proceeds from sale of vessels and equipment (note 12) | — | | 16,002 |

Proceeds from the sale of the Teekay Gas Business, net of cash sold ($178.0 million) (note 18) | — | | 454,789 |

| | | |

| | | |

| | | |

| Net investing cash flow - continuing operations | 1,306 | | 246,720 |

| Net investing cash flow - discontinued operations | — | | — |

| Net investing cash flow | 1,306 | | 246,720 |

| Decrease in cash, cash equivalents and restricted cash | (57,349) | | (148,580) |

| Cash, cash equivalents and restricted cash, beginning of the period | 316,706 | | 265,520 |

| Cash, cash equivalents and restricted cash, end of the period | 259,357 | | 116,940 |

| | | |

| Supplemental cash flow information (note 16) | | | |

| | | |

| The accompanying notes are an integral part of the unaudited consolidated financial statements. | | | |

TEEKAY CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN TOTAL EQUITY

(in thousands of U.S. Dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | TOTAL EQUITY |

| | Thousands

of Shares

of Common

Stock

Outstanding

# | | Common

Stock and

Additional

Paid-in

Capital

$ | | Accumulated

Deficit

$ | | Accumulated

Other

Compre-

hensive

Loss

$ | | Non-

controlling

Interests

$ | | Total

$ |

| Balance as at December 31, 2022 | 98,318 | | 1,022,040 | | (396,605) | | (1,972) | | 746,143 | | 1,369,606 |

| Net income | — | | — | | 48,763 | | — | | 121,150 | | 169,913 |

| Other comprehensive income | — | | — | | — | | 20 | | — | | 20 |

| Repurchase of common shares | (2,719) | | (25,852) | | 11,007 | | | | | | (14,845) |

Employee stock compensation | 428 | | 1,652 | | — | | — | | — | | 1,652 |

| | | | | | | | | | | |

Changes to non-controlling interest from equity contributions and other | — | | — | | 48 | | — | | 853 | | 901 |

| Balance as at March 31, 2023 | 96,027 | | 997,840 | | (336,787) | | (1,952) | | 868,146 | | 1,527,247 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | TOTAL EQUITY | | |

| | Thousands

of Shares

of Common

Stock

Outstanding

# | | Common

Stock and

Additional

Paid-in

Capital

$ | | Accumulated

Deficit

$ | | Accumulated

Other

Compre-

hensive

Loss

$ | | Non-

controlling

Interests

$ | | Total

$ | | |

| Balance as at December 31, 2021 | 101,571 | | 1,053,802 | | (513,242) | | (25,510) | | 1,917,433 | | 2,432,483 | | |

| Net income (loss) | — | | — | | 888 | | — | | (54,287) | | (53,399) | | |

| Other comprehensive income | — | | — | | — | | 334 | | 408 | | 742 | | |

Employee stock compensation | 122 | | 258 | | — | | — | | — | | 258 | | |

Impact of deconsolidation of the Teekay Gas Business (note 18) | — | | — | | — | | 22,241 | | (1,284,889) | | (1,262,648) | | |

Changes to non-controlling interest from equity contributions and other (note 11) | — | | — | | 19,723 | | — | | (24,558) | | (4,835) | | |

| Balance as at March 31, 2022 | 101,693 | | 1,054,060 | | (492,631) | | (2,935) | | 554,107 | | 1,112,601 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of the unaudited consolidated financial statements.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

1.Basis of Presentation

The unaudited interim consolidated financial statements (or unaudited consolidated financial statements) have been prepared in accordance with United States generally accepted accounting principles (or GAAP). They include the accounts of Teekay Corporation (or Teekay), which is incorporated under the laws of the Republic of the Marshall Islands, its wholly-owned or controlled subsidiaries and any variable interest entities of which Teekay is the primary beneficiary (collectively, the Company). Teekay's controlled subsidiaries include Teekay Tankers Ltd. (NYSE: TNK) (or Teekay Tankers). Teekay and its subsidiaries, other than Teekay Tankers, are referred to herein as Teekay Parent.

On October 4, 2021, Teekay LNG Partners L.P. (or Teekay LNG Partners) (now known as Seapeak LLC (or Seapeak)) and Stonepeak, together with affiliates, entered into an agreement and plan of merger pursuant to which Stonepeak would acquire Teekay LNG Partners. In connection with the merger, the Company agreed to sell its general partner interest in Teekay LNG Partners, all of its common units in Teekay LNG Partners and certain subsidiaries which collectively contained the shore-based management operations of Teekay LNG Partners and certain of Teekay LNG Partners’ joint ventures (collectively, the Teekay Gas Business). The transactions closed on January 13, 2022, which resulted in Teekay deconsolidating the Teekay Gas Business for accounting purposes on that date. The presentation of certain information from prior periods in these unaudited consolidated financial statements reflects that the Teekay Gas Business was a discontinued operation during the year ended December 31, 2022 (see note 18 - Deconsolidation of Teekay Gas Business and Discontinued Operations for further information).

Certain information and footnote disclosures required by GAAP for complete annual financial statements have been omitted from these unaudited consolidated financial statements and, therefore, these financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2022, included in the Company’s Annual Report on Form 20-F, filed with the U.S. Securities and Exchange Commission (or SEC) on March 31, 2023. In the opinion of management, these unaudited consolidated financial statements reflect all normal recurring adjustments necessary to present fairly, in all material respects, the Company’s consolidated financial position, results of operations, cash flows and changes in total equity for the interim periods presented. The results of operations for the three months ended March 31, 2023, are not necessarily indicative of those for a full fiscal year. Significant intercompany balances and transactions have been eliminated upon consolidation.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the unaudited consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

2. Revenues

The Company’s primary source of revenue is chartering its vessels to its customers and providing operational and maintenance marine services through its Australian operations. The Company utilizes three primary forms of contracts, consisting of voyage charter contracts, time charter contracts, and contracts for floating production storage and offloading (or FPSO) units. In October 2022, the Company divested its last remaining FPSO unit to a recycling yard. The extent to which the Company employs its vessels on voyage charters versus time charters is dependent upon the Company’s chartering strategy and the availability of time charters. Spot market rates for voyage charters are volatile from period to period, whereas time charters provide a stable source of monthly revenue. The Company also provides ship-to-ship (or STS) support services, which include managing the process of transferring cargo between seagoing ships positioned alongside each other. In addition, the Company generates revenue from the management and operation of vessels owned by third parties. For a description of these contracts, see "Item 18 – Financial Statements: Note 2" in the Company’s Annual Report on Form 20-F for the year ended December 31, 2022.

Revenue Table

The following tables contain the Company’s revenue, excluding revenue of the Teekay Gas Business (see note 18), for the three months ended March 31, 2023 and 2022, by contract type, and by segment:

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2023 |

| | | Teekay Tankers Conventional Tankers | | Teekay

Parent

Marine Services

and Other | | | Total |

| | |

| | |

| | | $ | | $ | | | $ |

| Time charters | | | 7,010 | | — | | | 7,010 |

| Voyage charters | | | 384,744 | | — | | | 384,744 |

Management fees and other | | | 2,903 | | 24,044 | | | 26,947 |

| | | 394,657 | | 24,044 | | | 418,701 |

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2022 |

| | | Teekay

Tankers

Conventional

Tankers | | Teekay

Parent

Marine Services

and Other | | | Total |

| | |

| | |

| | | $ | | $ | | | $ |

| Time charters | | | 6,275 | | — | | | 6,275 |

| Voyage charters | | | 164,751 | | — | | | 164,751 |

FPSO contracts | | | — | | 12,838 | | | 12,838 |

Management fees and other | | | 2,992 | | 25,864 | | | 28,856 |

| | | 174,018 | | 38,702 | | | 212,720 |

The following table contains the Company's total revenue, excluding revenue of the Teekay Gas Business (see note 18), for the three months ended March 31, 2023 and 2022, by those contracts or components of contracts accounted for as leases and by those contracts or components not accounted for as leases:

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 |

| | $ | | $ |

| Lease revenue | | | | |

Lease revenue from lease payments of operating leases | | 391,754 | | 175,346 |

Variable lease payments – cost reimbursements (1) | | — | | 8,518 |

| | | | |

| | 391,754 | | 183,864 |

Non-lease revenue | | | | |

Management fees and other income | | 26,947 | | 28,856 |

| | 26,947 | | 28,856 |

| Total | | 418,701 | | 212,720 |

(1)Reimbursement for vessel operating and decommissioning expenditures received from the Company's customers relating to costs incurred by the Company to operate the vessel for the customer.

Charters-out

As at March 31, 2023, two (December 31, 2022 - two) of the Company’s vessels operated under fixed-rate time-charter contracts, both of which are scheduled to expire in 2024. As at March 31, 2023, the minimum scheduled future revenues to be received by the Company under these time charters were approximately $23.9 million (remainder of 2023) and $10.9 million (2024) (December 31, 2022 - $30.9 million (2023) and $10.9 million (2024)). The hire payments should not be construed to reflect a forecast of total charter hire revenue for any of the periods. Future hire payments do not include any hire payments generated from new contracts entered into after March 31, 2023, from unexercised option periods of contracts that existed on March 31, 2023, or from variable consideration, if any, under contracts. In addition, future hire payments presented above have been reduced by estimated off-hire time for required periodic maintenance. Actual amounts may vary given future events such as unplanned vessel maintenance.

Contract Liabilities

As at March 31, 2023, the Company had $8.3 million (December 31, 2022 - $1.7 million) of advanced payments recognized as contract liabilities that are expected to be recognized as voyage charter revenues or time-charter revenues in subsequent periods and which are included in other current liabilities on the Company's unaudited consolidated balance sheets.

3. Segment Reporting

The Company allocates capital and assesses performance from the separate perspectives of its publicly-traded subsidiary, Teekay Tankers, and from Teekay Parent, as well as from the perspective of the Company's lines of business. The primary focus of the Company’s organizational structure, internal reporting and allocation of resources by the chief operating decision maker is on Teekay Tankers and Teekay Parent, and its segments are presented accordingly on this basis. The Company has two primary lines of business: (1) conventional tankers and (2) marine services. The Company manages these businesses for the benefit of all stakeholders. As from 2023, Teekay Parent had elected to combine its Offshore Production segment with the Marine Services and Other segment, and presented the comparative figures accordingly.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

The following table includes the Company’s revenues by segment, excluding such amounts of the Teekay Gas Business (see note 18), for the three months ended March 31, 2023 and 2022:

| | | | | | | | | | | |

| Revenues |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Teekay Tankers - Conventional Tankers | 394,657 | | 174,018 |

| Teekay Parent - Marine Services and Other | 24,044 | | 38,702 |

| | | |

| 418,701 | | 212,720 |

The following table includes the Company’s income (loss) from vessel operations by segment, excluding such amounts of the Teekay Gas Business (see note 18), for the three months ended March 31, 2023 and 2022:

| | | | | | | | | | | |

| Income (Loss) from Vessel Operations(1) |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Teekay Tankers - Conventional Tankers | 181,851 | | (7,776) |

| Teekay Parent - Marine Services and Other | (2,014) | | (4,798) |

| | | |

| 179,837 | | (12,574) |

(1)Includes direct general and administrative expenses and indirect general and administrative expenses (allocated to each segment based on estimated use of corporate resources).

A reconciliation of total segment assets to consolidated total assets presented in the accompanying unaudited consolidated balance sheets is as follows:

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| $ | | $ |

| Teekay Tankers – Conventional Tankers | 1,669,129 | | 1,603,142 |

| Teekay Parent – Marine Services and Other | 45,498 | | 44,333 |

| Cash and cash equivalents | 252,519 | | 309,857 |

| Short-term investments | 208,252 | | 210,000 |

| Eliminations | (211) | | (2,486) |

| Consolidated total assets | 2,175,187 | | 2,164,846 |

4. Accrued Liabilities and Other and Other Long-Term Liabilities

Accrued Liabilities and Other

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| $ | | $ |

| Accrued liabilities | 68,663 | | 78,301 |

| Deferred revenues – current | 8,294 | | 1,650 |

| Office lease liability – current | 2,363 | | 2,232 |

| Asset retirement obligation – current | 7,737 | | 4,788 |

| 87,057 | | 86,971 |

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

Other Long-Term Liabilities

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| $ | | $ |

| Freight tax provisions (note 14) | 44,616 | | 42,477 |

Asset retirement obligation | — | | 2,923 |

Pension liabilities | 6,205 | | 6,194 |

| | | |

| Office lease liability – long-term | 10,051 | | 10,537 |

Other | 812 | | 1,380 |

| 61,684 | | 63,511 |

Asset Retirement Obligations

In April 2021, the charterer of the Petrojarl Foinaven FPSO unit announced its decision to suspend production from the Foinaven oil fields and permanently remove the Petrojarl Foinaven FPSO unit from the site. The FPSO unit was redelivered to Teekay Parent on August 30, 2022. Upon redelivery, the Company received a lump sum payment from the charterer, which the Company expects will cover the cost of recycling the FPSO unit. On October 21, 2022, the Company delivered the FPSO unit to an EU-approved shipyard for green recycling which is expected to be completed in mid-2024. As at March 31, 2023, the Petrojarl Foinaven FPSO unit's estimated ARO relating to recycling costs was $7.7 million.

5. Short-Term Debt

As at March 31, 2023, Teekay Tankers Chartering Pte. Ltd. (or TTCL), a wholly-owned subsidiary of Teekay Tankers, had a working capital loan facility (or the Working Capital Loan), which provided for aggregate borrowings up to $80.0 million. The amount available for drawdown is limited to a percentage of certain receivables and accrued revenue, which is assessed on a weekly basis. As at March 31, 2023, the next maturity date of the Working Capital Loan was in May 2023, and subsequently has been extended to November 2023. The Working Capital Loan maturity date is continually extended for further periods of six months thereafter unless and until the lender gives notice in writing that no further extensions shall occur. Proceeds of the Working Capital Loan are used to provide working capital in relation to certain vessels subject to revenue sharing agreements (or RSAs). Interest payments are based on the Secured Overnight Financing Rate (or SOFR) plus a margin of 2.85% (December 31, 2022 - 2.85%).

The Working Capital Loan is collateralized by the assets of TTCL. The Working Capital Loan requires Teekay Tankers to maintain its paid-in capital contribution under the RSAs and the retained distributions of the RSA counterparties in an amount equal to the greater of (a) an amount equal to the minimum average capital contributed by the RSA counterparties per vessel in respect of the RSA (including cash, bunkers or other working capital contributions and amounts accrued to the RSA counterparties but unpaid) and (b) a minimum capital contribution ranging from $20.0 million to $30.0 million based on the amount borrowed. As at March 31, 2023, $nil (December 31, 2022 – $nil) was owing under this facility, the aggregate available borrowings were $80.0 million (December 31, 2022 - $80.0 million) and the interest rate on the facility was 7.8% (December 31, 2022 – 7.2%). As at March 31, 2023, Teekay Tankers was in compliance with all covenants in respect of this facility.

6. Long-Term Debt

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| $ | | $ |

Convertible Senior Notes (5%) | — | | 21,184 |

| Total principal | — | | 21,184 |

| Less: unamortized discount and debt issuance costs | — | | — |

| Total debt | — | | 21,184 |

| Less: current portion | — | | (21,184) |

| Long-term portion | — | | — |

| | | |

As at March 31, 2023, the Company had one revolving credit facility (or the 2020 Revolver), which, as at such date, provided for aggregate borrowings of up to $82.5 million (December 31, 2022 - $82.5 million), of which $82.5 million was undrawn (December 31, 2022 - $82.5 million). The facility matures in December 2024 and interest payments are based on LIBOR plus a margin of 2.40%. The Company is amending the 2020 Revolver's interest payments to be based on SOFR and is expected to be completed prior to LIBOR ceasing on June 30, 2023. The total amount available under the 2020 Revolver decreases by $29.9 million (remainder of 2023) and $52.6 million (2024). The 2020 Revolver is collateralized by 13 of the Company’s vessels, together with other related security.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

In May 2023, Teekay Tankers signed an agreement for a new secured revolving credit facility of up to $350.0 million to refinance 19 vessels (including six vessels that will be repurchased by Teekay Tankers in mid-May 2023 pursuant to repurchase options under the sale-leaseback arrangements described in note 7 and four vessels that are currently under sale-leaseback financing arrangements and are expected to be repurchased pursuant to repurchase options in the third quarter of 2023). The new loan agreement has a six-year term and an interest rate of SOFR plus a margin of 2.0%. The maximum amount of the facility is reduced by semi-annual reductions in revolver capacity commencing six months after the first drawdown date (see note 19).

In May 2019, the Company issued $250.0 million in aggregate principal amount of 9.25% senior secured notes at par due November 2022 (or the 2022 Notes). During the three months ended March 31, 2022, the Company redeemed the 2022 Notes in full at a redemption price equal to 102.313%, plus accrued and unpaid interest. The total consideration for the redemption was $249.0 million, resulting in a loss of $9.2 million, which is included in loss on bond repurchases on the Company's unaudited consolidated statements of income during the three months ended March 31, 2022.

On January 26, 2018, Teekay Parent completed a private offering of $125.0 million in aggregate principal amount of 5% Convertible Senior Notes due January 17, 2023 (or the Convertible Notes). During the three months ended March 31, 2022, the Company repurchased $88.8 million of the aggregate principal amount for total consideration of $90.6 million and recorded a loss on bond repurchase of $3.2 million. During the three months ended March 31, 2023, Teekay Parent repaid the remaining principal amount of the Convertible Notes of $21.2 million. The estimated fair value (Level 2) of the Convertible Notes was $nil as of March 31, 2023 (December 31, 2022 - $21.2 million).

The weighted-average interest rate on the Company’s aggregate long-term debt, until the redemption of the Convertible Notes on January 17, 2023, was 5%. Thereafter, the Company had no long-term debt outstanding (December 31, 2022 – 5%). This interest rate excludes the effect of the Company’s interest rate swap agreement (see note 8).

The 2020 Revolver requires the Company to maintain a minimum hull coverage ratio of 125% of the total outstanding drawn balance for the facility periods. This requirement is assessed on a semi-annual basis with reference to vessel valuations compiled by two or more agreed upon third parties. Should the ratio drop below the required amount, the lender may request that the Company either prepay a portion of the applicable loan in the amount of the shortfall or provide additional collateral in the amount of the shortfall, at the Company's option. As at March 31, 2023, the hull coverage ratio for the 2020 Revolver was not applicable due to no balance being drawn. In addition, the Company is required to maintain a minimum liquidity (cash, cash equivalents and undrawn committed revolving credit lines with at least six months to maturity) of the greater of $35.0 million and at least 5.0% of Teekay Tankers' total consolidated debt and obligations related to finance leases. As at March 31, 2023, the Company was in compliance with all covenants in respect of the 2020 Revolver.

7. Leases

Operating Leases

The Company charters-in vessels from other vessel owners on time-charter contracts, whereby the vessel owner provides use and technical operation of the vessel for the Company. A time-charter-in contract is typically for a fixed period of time, although in certain cases the Company may have the option to extend the charter. The Company typically pays the owner a daily hire rate that is fixed over the duration of the charter. The Company is generally not required to pay the daily hire rate during periods the vessel is not able to operate.

As at March 31, 2023, minimum commitments to be incurred by the Company under time-charter-in contracts were approximately $51.0 million (remainder of 2023), $49.1 million (2024), $31.5 million (2025), $18.8 million (2026), $11.2 million (2027) and $12.9 million (thereafter).

Obligations Related to Finance Leases

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| $ | | $ |

| | | |

| | | |

| | | |

| Obligations related to finance leases | 360,458 | | 536,480 |

| Less: unamortized discount and debt issuance costs | (2,000) | | (3,720) |

| Total obligations related to finance leases | 358,458 | | 532,760 |

Less: current portion | (41,730) | | (60,161) |

Long-term obligations related to finance leases | 316,728 | | 472,599 |

As at March 31, 2023, Teekay Tankers had sale-leaseback financing transactions with financial institutions relating to 18 of Teekay Tankers' vessels, excluding nine vessels which Teekay Tankers repurchased in March 2023 for a total cost of $164.3 million, pursuant to repurchase options under the sale-leaseback arrangements. In March 2023, Teekay Tankers gave notice to exercise its vessel repurchase options to acquire an additional six vessels for a total cost of $142.8 million, pursuant to repurchase options under the sale-leaseback arrangements. Teekay Tankers expects to complete the repurchase and delivery of these six vessels in mid-May 2023.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

Under the sale-leaseback arrangements, Teekay Tankers transferred the vessels to subsidiaries of the financial institutions (collectively, the Lessors) and leased the vessels back from the Lessors on bareboat charters ranging from 6 to 12-year terms ending between 2028 and 2031. Teekay Tankers also has the option to repurchase each of the 18 vessels, six of which can be repurchased between now and the end of their respective lease terms (and for which purchase options were declared in March 2023, as described above), four of which can be repurchased starting in September 2023 until the end of their respective lease terms, and the remaining eight of which can be repurchased starting in March 2024 until the end of their respective lease terms.

The bareboat charters related to all 18 of these vessels require that Teekay Tankers maintain a minimum liquidity (cash, cash equivalents and undrawn committed revolving credit lines with at least six months to maturity) of the greater of $35.0 million and at least 5.0% of Teekay Tankers' consolidated debt and obligations related to finance leases.

All of the 18 bareboat charters require Teekay Tankers to maintain, for each vessel, a minimum hull coverage ratio of 100% of the total outstanding principal balance. As at March 31, 2023, these ratios ranged from 177% to 302% (December 31, 2022 - ranged from 173% to 292%). For six of the bareboat charters, should any of these ratios drop below the required amount, the Lessor may request that the Company prepay additional charter hire. For the remaining 12 bareboat charters, should any of these ratios drop below the required amount, the Lessor may request that the Company either prepay additional charter hire in the amount of the shortfall or, in certain circumstances, make a payment to reduce the outstanding principal balance or provide additional collateral satisfactory to the relevant Lessor in the amount of the shortfall, in each case to restore compliance with the relevant ratio.

The requirements of the bareboat charters are assessed annually with reference to vessel valuations compiled by one or more agreed upon third parties. As at March 31, 2023, Teekay Tankers was in compliance with all covenants in respect of its obligations related to finance leases.

The weighted average interest rate on Teekay Tankers’ obligations related to finance leases as at March 31, 2023 was 7.1% (December 31, 2022 – 7.2%). These interest rates exclude the effect of the Company’s interest rate swap agreement (see note 8).

As at March 31, 2023, the total remaining commitments related to the financial liabilities of these vessels were approximately $425.3 million (December 31, 2022 - $695.2 million), including imputed interest of $64.8 million (December 31, 2022 - $158.7 million), repayable from 2023 through 2031, as indicated below:

| | | | | | | | |

| | Commitments |

| | At March 31, 2023 |

Year | | $ |

Remainder of 2023 (1) | | 178,622 |

| 2024 | | 42,982 |

| 2025 | | 40,729 |

| 2026 | | 38,517 |

| 2027 | | 36,304 |

Thereafter | | 88,181 |

(1)Includes $142.8 million under Teekay Tankers' repurchase option notices that Teekay Tankers provided in March 2023 to acquire six vessels pursuant to repurchase options under Teekay Tankers' sale-leaseback arrangements described above.

8. Derivative Instruments and Hedging Activities

The Company uses derivative instruments to manage certain risks in accordance with its overall risk management policies.

Foreign Exchange Risk

From time to time, the Company economically hedges portions of its forecasted expenditures denominated in foreign currencies with foreign currency forward contracts. As at March 31, 2023, the Company was not committed to any foreign currency forward contracts.

Interest Rate Risk

The Company enters into interest rate swap agreements, which exchange a receipt of floating interest for a payment of fixed interest, to reduce the Company’s exposure to interest rate variability on its outstanding floating-rate debt. The Company has not designated, for accounting purposes, its interest rate swap agreement as a cash flow hedge of its U.S. Dollar LIBOR-denominated borrowings.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

In March 2020, the Company entered into an interest rate swap agreement which is scheduled to mature in December 2024. The following summarizes the Company's interest rate swap agreement as at March 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Rate Index | | Principal Amount | | Fair Value / Carrying Amount of Asset / (Liability) $ | | Weighted-

Average

Remaining

Term

(years) | | Fixed Swap Rate (%)(1) |

| LIBOR-Based Debt: | | | | | | | | | |

| U.S. Dollar-denominated interest rate swap agreement | LIBOR | | 50,000 | | | 3,125 | | | 2.3 | | 0.76 |

(1)Excludes the margins the Company pays on its variable-rate long-term debt which, as of March 31, 2023, was 2.40%.

Forward Freight Agreements

The Company uses forward freight agreements (or FFAs) in non-hedge-related transactions to increase or decrease its exposure to spot tanker market rates, within defined limits. Net gains and losses from FFAs are recorded within realized and unrealized (loss) gain on derivative instruments in the Company's unaudited consolidated statements of income (loss). As at March 31, 2023, the Company was not committed to any FFAs.

Tabular Disclosure

The following tables present the location and fair value amounts of derivative instruments, segregated by type of contract, on the Company’s unaudited consolidated balance sheets.

| | | | | | | | | | | | | | | |

| Prepaid Expenses and Other | | Goodwill, Intangibles and Other Non-Current Assets | | | | |

| $ | | $ | | | | |

| As at March 31, 2023 | | | | | | | |

| Derivatives not designated as a cash flow hedge: | | | | | | | |

| Interest rate swap agreement | 2,033 | | 1,092 | | | | |

| 2,033 | | 1,092 | | | | |

| | | | | | | | | | | | | | | |

| Prepaid Expenses and Other | | Goodwill, Intangibles and Other Non-Current Assets | | | | |

| $ | | $ | | | | |

| As at December 31, 2022 | | | | | | | |

| Derivatives not designated as a cash flow hedge: | | | | | | | |

| Interest rate swap agreement | 2,087 | | 1,622 | | | | |

| 2,087 | | 1,622 | | | | |

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

Realized and unrealized gains (losses) from derivative instruments that are not designated for accounting purposes as cash flow hedges are recognized in earnings and reported in realized and unrealized gains (losses) on derivatives in the unaudited consolidated statements of income (loss) as follows:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Realized gains (losses) relating to: | | | |

| Interest rate swap agreement | 496 | | (67) |

| | | |

| Foreign currency forward contracts | — | | (83) |

| Forward freight agreements | (10) | | (23) |

| 486 | | (173) |

| Unrealized (losses) gains relating to: | | | |

| Interest rate swap agreement | (584) | | 1,889 |

| Foreign currency forward contracts | — | | 22 |

| Forward freight agreements | — | | 229 |

| (584) | | 2,140 |

| Total realized and unrealized (losses) gains on derivative instruments | (98) | | 1,967 |

The Company is exposed to credit loss to the extent the fair value represents an asset in the event of non-performance by the counterparty to the interest rate swap agreement; however, the Company does not anticipate non-performance by the counterparty. In order to minimize counterparty risk, the Company only enters into interest rate swap agreements with counterparties that are rated A- or better by Standard & Poor’s or A3 or better by Moody’s at the time of the transaction. In addition, to the extent possible and practical, interest rate swaps are entered into with different counterparties to reduce concentration risk.

9. Fair Value Measurements

For a description of how the Company estimates fair value and for a description of the fair value hierarchy levels, see "Item 18 – Financial Statements: Note 11" in the Company’s Annual Report on Form 20-F for the year ended December 31, 2022.

The following table includes the estimated fair value and carrying value and categorization using the fair value hierarchy of those assets and liabilities that are measured at fair value on a recurring and non-recurring basis, as well as the estimated fair value of the Company’s financial instruments that are not accounted for at fair value on a recurring basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | March 31, 2023 | | December 31, 2022 |

| Fair

Value

Hierarchy

Level | | Carrying

Amount

Asset

(Liability)

$ | | Fair

Value

Asset

(Liability)

$ | | Carrying

Amount

Asset

(Liability)

$ | | Fair

Value

Asset

(Liability)

$ |

| Recurring | | | | | | | | | |

Cash, cash equivalents and restricted cash (note 17) | Level 1 | | 259,357 | | 259,357 | | 316,706 | | 316,706 |

| Short-term investments | Level 1 | | 208,252 | | 208,252 | | 210,000 | | 210,000 |

Derivative instruments (note 8) | | | | | | | | | |

Interest rate swap agreements - assets | Level 2 | | 3,125 | | 3,125 | | 3,709 | | 3,709 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other | | | | | | | | | |

| | | | | | | | | |

| Advances to equity-accounted joint venture – long-term | Level 2 | | 6,780 | | (1) | | 6,780 | | (1) |

Long-term debt, including current portion – other (note 6) | Level 2 | | — | | — | | (21,184) | | (21,078) |

Obligations related to finance leases, including current portion (note 7) | Level 2 | | (358,458) | | (360,728) | | (532,760) | | (533,977) |

(1)In these unaudited consolidated financial statements, the Company’s advances to and investments in equity-accounted investments form the aggregate carrying value of the Company’s interests in entities accounted for by the equity method. As at March 31, 2023, the fair value of the individual components of such aggregate interests is not determinable.

The Company is exposed to credit loss in the event of non-performance by the financial institutions where its cash, cash equivalents and short-term investments are held. In order to minimize credit risk, the Company only places deposits and short-term investments with counterparties that are rated A- or better by Standard & Poor’s or A3 or better by Moody’s at the time of the transaction. In addition, to the extent practical, cash deposits and short-term investments are held by and entered into with, as applicable, different counterparties to reduce concentration risk.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

10. Capital Stock

The authorized capital stock of Teekay as at March 31, 2023 and December 31, 2022 was 25 million shares of preferred stock, with a par value of $1 per share, and 725 million shares of common stock, with a par value of $0.001 per share. As at March 31, 2023 and December 31, 2022, Teekay had no shares of preferred stock that were issued and outstanding.

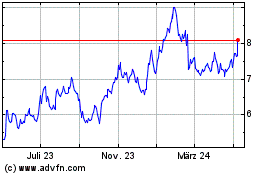

In August 2022, Teekay announced that its Board of Directors had authorized the repurchase of up to $30 million of its common shares in the open market and other transactions. Following the completion of this share repurchase program in March 2023, Teekay's Board of Directors authorized a new share repurchase program for the repurchase of up to an additional $30 million of Teekay common shares in the open market, through privately-negotiated transactions and by any other means permitted under the rules of the SEC.

During the year ended December 31, 2022, Teekay repurchased approximately 3.8 million of its common shares for $15.4 million, or an average of $4.07 per share, pursuant to such authorization, which resulted in the Company recording a reduction in capital stock of $35.8 million and a reduction to accumulated deficit of $20.4 million.

During the three months ended March 31, 2023, Teekay repurchased approximately 2.7 million common shares for $14.8 million, or an average of $5.44 per share, pursuant to such authorization, which resulted in the Company recording a reduction in capital stock of $25.9 million and a reduction to accumulated deficit of $11.0 million. As at March 31, 2023, the total remaining share repurchase authorization was $29.9 million.

In December 2020, Teekay filed a continuous offering program (or COP) under which Teekay may issue common shares at market prices up to a maximum aggregate amount of $65.0 million. As of March 31, 2023, no shares of common stock have been issued under this COP.

11. Equity Financing Transactions

In the first quarter of 2022, Teekay Parent purchased 0.5 million of Teekay Tankers Class A common shares through open market purchases for $5.3 million at an average price of $10.82 per share. As a result of the share transactions related to Teekay Tankers, the Company recorded a decrease of $6.5 million to the accumulated deficit . This amount represents Teekay's net dilution gain from the Teekay Tankers share transactions. In the third quarter of 2022, Teekay Parent sold 0.9 million of its investment in Teekay Tankers Class A common shares (consisting of the 0.5 million shares purchased in the first quarter of 2022, and 0.4 million shares purchased during December 2021) through open market sales for $22.8 million at an average price of $25.20 per share. The total cost of the 0.9 million shares purchased in the open market was $10.0 million or $11.03 per share.

12. Write-Down of Assets

During the three months ended March 31, 2022, Teekay Tankers agreed to the sale of an Aframax / LR2 vessel and reversed a previous write-down of $0.6 million to reflect its agreed sales price.

During the three months ended March 31, 2022, Teekay Tankers recorded a write-down of $1.1 million on its operating lease right-of-use assets, which were written-down to their estimated fair values, based on prevailing charter rates for comparable periods, due to a reduction in these charter rates.

13. Restructuring Charges

During the three months ended March 31, 2023, the Company recorded restructuring charges of $1.6 million, which were primarily related to organizational changes made to its commercial and technical operations teams. During the three months ended March 31, 2022, the Company recorded restructuring charges of $4.6 million primarily related to organizational changes following the sale of Seapeak (of which $2.4 million of the costs were recovered from Seapeak and recorded in revenues on the consolidated statements of income) as well as costs associated with the termination of the charter contract for the Sevan Hummingbird FPSO unit.

As at March 31, 2023 and December 31, 2022, $0.8 million and $3.0 million, respectively, of restructuring liabilities were recorded in accrued liabilities and other on the unaudited consolidated balance sheets.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

14. Income Tax (Expense) Recovery

The components of the provision for income tax recovery are as follows:

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Current | (2,534) | | 1,061 |

| Deferred | (67) | | (425) |

| Income tax (expense) recovery | (2,601) | | 636 |

The following table reflects changes in uncertain tax positions relating to freight tax liabilities, which are recorded in other long-term liabilities and accrued and other liabilities on the Company's unaudited consolidated balance sheets:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

| Balance as at January 1 | 42,477 | | 46,956 |

| Increases for positions related to the current year | 1,538 | | 426 |

| Increases for positions related to prior years | 1,634 | | 1,243 |

| Decreases for positions taken in prior years | (400) | | — |

| Decrease related to statute of limitations | (1,229) | | (2,344) |

| Foreign exchange loss | 596 | | 141 |

| Balance as at March 31 | 44,616 | | 46,422 |

Included in the Company's current income tax (expense) recovery are provisions for uncertain tax positions relating to freight taxes. Positions relating to freight taxes can vary each period depending on the trading patterns of the Company's vessels.

The Company does not presently anticipate that its provisions for uncertain tax positions relating to freight taxes will significantly increase in the next 12 months; however, this is dependent on the jurisdictions in which vessel trading activity occurs. The Company reviews its freight tax obligations on a regular basis and may update its assessment of its tax positions based on available information at the time. Such information may include legal advice as to the applicability of freight taxes in relevant jurisdictions. Freight tax regulations are subject to change and interpretation; therefore, the amounts recorded by the Company may change accordingly.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

15. Net Income (Loss) Per Share

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023 | | 2022 |

| $ | | $ |

Net income (loss) attributable to the shareholders of Teekay Corporation: | | | |

| - Continuing operations - basic | 48,763 | | (40,764) |

| - Discontinued operations - basic | — | | 41,652 |

| 48,763 | | 888 |

Reduction in net earnings due to dilutive impact of stock-based

awards in Teekay Tankers | (622) | | — |

| Net income attributable to the shareholders of Teekay Corporation - diluted | 48,141 | | 888 |

| | | |

Weighted average number of common shares (1) | 98,521,611 | | 102,347,141 |

| Dilutive effect of stock-based awards | 1,955,052 | | — |

| Common stock and common stock equivalents | 100,476,663 | | 102,347,141 |

| | | |

| Net income (loss) per common share | | | |

| - Continuing operations - basic | 0.49 | | (0.40) |

| - Discontinued operations - basic | — | | 0.41 |

| - Basic | 0.49 | | 0.01 |

| | | |

| - Continuing operations - diluted | 0.48 | | (0.40) |

| - Discontinued operations - diluted | — | | 0.41 |

| - Diluted | 0.48 | | 0.01 |

(1) Includes common stock related to non-forfeitable stock-based awards.

Stock-based awards that have an anti-dilutive effect on the calculation of diluted income (loss) per common share from continuing operations are excluded from diluted income (loss) per common share, including diluted income (loss) per common share from continuing operations and discontinued operations. For the three months ended March 31, 2023, 2.3 million shares of common stock from stock-based awards (three months ended March 31, 2022 - 5.1 million) were excluded from the computation of diluted earnings per common share for these periods, as including them would have had an anti-dilutive impact.

16. Supplemental Cash Flow Information

Total cash, cash equivalents and restricted cash are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 | | March 31, 2022 | | December 31, 2021 |

| $ | | $ | | $ | | $ |

| Cash and cash equivalents | 252,519 | | 309,857 | | 111,605 | | 108,977 |

| Restricted cash – current | 3,703 | | 3,714 | | 2,200 | | 2,227 |

| Restricted cash – non-current | 3,135 | | 3,135 | | 3,135 | | 3,135 |

Current assets - discontinued operations - cash | — | | — | | — | | 101,190 |

Current assets - discontinued operations - restricted cash | — | | — | | — | | 11,888 |

Non-current assets - discontinued operations - restricted cash | — | | — | | — | | 38,103 |

| 259,357 | | 316,706 | | 116,940 | | 265,520 |

The Company maintains restricted cash deposits relating to certain FFAs (see note 8) and as required by the Company's obligations related to certain finance leases (see note 7).

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

Non-cash items related to operating lease right-of-use assets and operating lease liabilities are as follows:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2023

$ | | 2022 $ |

| | | $ | | $ |

| Leased assets obtained in exchange for new operating lease liabilities | 56,223 | | — |

17. Commitments and Contingencies

a)Liquidity

Management is required to assess whether the Company will have sufficient liquidity to continue as a going concern for the one-year period following the issuance of its financial statements. The Company had consolidated net income from continuing operations of $169.9 million and consolidated cash flows from operating activities related to continuing operations of $155.4 million during the three months ended March 31, 2023, and had a consolidated working capital surplus of $599.4 million as at March 31, 2023. This working capital surplus included $208.3 million of short-term investments.

Based on the Company’s liquidity at the date these consolidated financial statements were issued and the cash flows the Company expects to generate from operations over the following year, the Company expects that it will have sufficient liquidity to continue as a going concern for at least the one-year period following the issuance of these consolidated financial statements.

b)Legal Proceedings and Claims

The Company may, from time to time, be involved in legal proceedings and claims that arise in the ordinary course of business. The Company believes that any adverse outcome of existing claims, individually or in the aggregate, would not have a material effect on its financial position, results of operations or cash flows, when taking into account its insurance coverage and indemnifications from charterers.

c)Other

The Company enters into indemnification agreements with certain officers and directors. In addition, the Company enters into other indemnification agreements in the ordinary course of business. The maximum potential amount of future payments required under these indemnification agreements is unlimited. However, the Company maintains what it believes is appropriate liability insurance that reduces its exposure and enables the Company to recover future amounts paid up to the maximum amount of the insurance coverage, less any deductible amounts pursuant to the terms of the respective policies, the amounts of which are not considered material.

18. Deconsolidation of Teekay Gas Business and Discontinued Operations

On October 4, 2021, the Company entered into agreements to sell its general partner interest in Teekay LNG Partners (now known as Seapeak), all of its common units in Teekay LNG Partners and certain subsidiaries which collectively contained the shore-based management operations of the Teekay Gas Business. These transactions closed on January 13, 2022, and resulted in Teekay deconsolidating the Teekay Gas Business for accounting purposes on January 13, 2022. Upon closing of the transactions, the Company received gross proceeds of $641 million, at which date the Teekay Gas Business had a cash, cash equivalents and restricted cash balance of $178.0 million.

Upon closing, the Company recognized both the net cash proceeds it received from Stonepeak and derecognized the carrying value of both the Teekay Gas Business' net assets and the non-controlling interest in the Teekay Gas Business, with the difference between the amounts recognized and derecognized being the loss on deconsolidation of $58.7 million, which is included in loss from discontinued operations in the consolidated statements of income (loss) for the three months ended March 31, 2022.

Immediately prior to the sale of the Teekay Gas Business, the Company had unrecognized gains of $84.8 million on the sales of vessels in prior years from its wholly-owned subsidiaries to its non-wholly-owned subsidiary, Teekay LNG Partners (or Deferred Dropdown Gains). On sale of the Teekay Gas Business, the Deferred Dropdown Gains that were previously unrecognized due to their being eliminated upon consolidation of Teekay LNG Partners, were recognized by the Company through a transfer of income from non-controlling interests in Teekay LNG Partners to the Company. This transfer increased the carrying value of the Company’s interest in Teekay LNG Partners at the sale date and thus, increased the loss on deconsolidation of the Teekay Gas Business by $84.8 million (included in net (loss) income attributable to non-controlling interests, discontinued operations on the consolidated statements of income (loss)). As a result, net income attributable to shareholders of the Company on sale of the Teekay Gas Business was a net gain of $26.2 million, consisting of the recognition of the $84.8 million of Deferred Dropdown Gains (included in net (loss) income attributable to non-controlling interests, discontinued operations on the consolidated statements of income (loss)) less the loss on deconsolidation of $58.7 million.

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

All revenues and expenses of the Teekay Gas Business prior to the sale and for the periods covered by the consolidated statements of income (loss) in these unaudited consolidated financial statements have been aggregated and separately presented as a single component of net income (loss) entitled "Income (loss) from discontinued operations". Revenues and expenses of the Teekay Gas Business were determined as follows:

•Revenues and expenses of the Teekay Gas Business consist of all direct revenue and expenses that are clearly identifiable as solely for the benefit of the Teekay Gas Business and will not be recognized on an ongoing basis by the Company following completion of the sale of the Teekay Gas Business. As such, costs previously incurred by the Company for the benefit of both the Teekay Gas Business and the continuing operations of the Company (or Shared Costs) remain in the Company’s continuing operations, including the Teekay Gas Business’s proportionate share of such costs. The Company’s Shared Costs primarily relate to costs incurred to provide certain corporate services and ship management services for the benefit of both the Teekay Gas Business and the continuing operations of the Company. In preparation for the sale of the Teekay Gas Business, the Company completed an internal reorganization of the shore-based management operations for Seapeak and certain of Seapeak's joint ventures. Certain of the Company's subsidiaries were then transferred to Seapeak as part of the sale of the Teekay Gas Business. A substantial majority of the Company’s Shared Costs are reflected in general and administrative expenses. As a result of the Company’s historical practice of using a shared service operation for its different businesses and the allocation method explained above for such costs, general and administrative expenses presented within continuing operations and general and administrative expenses presented within discontinued operations will not represent what these costs would have been had the Company operated the Teekay Gas Business on a standalone basis and will not represent an existing cost run-rate, as adjusted for the completion of this transaction.

•Interest expense of the Teekay Gas Business consists of interest expense and amortization of discounts, premiums, and debt issuance costs related to long-term debt and obligations related to finance leases of Teekay LNG Partners that were assumed by the acquiror thereof.

The following table contains the major components of income (loss) from discontinued operations of the Teekay Gas Business for the periods presented:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2023

$ | | 2022 (1) $ |

| Revenues | — | | 25,083 |

| Voyage expenses | — | | (853) |

| Vessel operating expenses | — | | (5,937) |

| Time-charter hire expenses | — | | (845) |

| General and administrative expenses | — | | (781) |

| | | |

| | | |

| Income from vessel operations | — | | 16,667 |

| Interest expense | — | | (4,287) |

| Interest income | — | | 188 |

| Realized and unrealized gains on derivative instruments | — | | 3,675 |

| Equity income | — | | 17,881 |

| Foreign exchange gain | — | | 4,286 |

| Other income | — | | 9 |

Loss on deconsolidation of the Teekay Gas Business (2) | — | | (58,684) |

Loss from discontinued operations before income taxes | — | | (20,265) |

| Income tax expense | — | | (11) |

| Loss from discontinued operations | — | | (20,276) |

(1)On January 13, 2022, the Company deconsolidated the Teekay Gas Business. Figures represent the Teekay Gas Business's results for the period from January 1, 2022 to January 13, 2022.

(2)Net income attributable to shareholders of the Company on sale of the Teekay Gas Business was a net gain of $26.2 million, consisting of the recognition of the $84.8 million of Deferred Dropdown Gains (included in net income (loss) attributable to non-controlling interests, discontinued operations) less the loss on deconsolidation of $58.7 million.

19. Subsequent Events

a. In May 2023, Teekay Tankers signed an agreement for a new secured revolving credit facility of up to $350 million to refinance 19 vessels (including six vessels that will be repurchased by Teekay Tankers in mid-May 2023 as part of the repurchase options under the sale-leaseback arrangements described in note 7 and four vessels that are currently under sale-leaseback financing arrangements and are expected to be repurchased in the third quarter of 2023).

TEEKAY CORPORATION AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. Dollars, other than share and per share data)

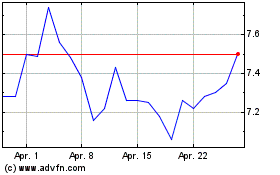

b. During April and May of 2023 (up until May 10, 2023), Teekay repurchased approximately 2.8 million common shares for $15.7 million, or an average of $5.58 per share, pursuant to the repurchase program authorized by Teekay's Board of Directors in March 2023.

c. In May 2023, the Teekay Tankers Board of Directors approved the initiation of a regular, fixed quarterly cash dividend in the amount of $0.25 per outstanding Class A and B common share. Consistent with the updated dividend policy, the Board of Directors declared a regular cash dividend of $0.25 per common share relating to the first quarter of 2023. In addition, the Board of Directors declared a special cash dividend of $1.00 per common share. These cash dividends are payable on June 2, 2023, to all common shareholders of record on May 22, 2023. The declaration and payment of any further dividends is subject to the discretion of the Teekay Tankers Board of Directors.

d. In May 2023, Teekay Tankers' Board of Directors has authorized a new share repurchase program for the repurchase of up to $100 million of Teekay Tankers' outstanding Class A common shares. Under the program, repurchases can be made from time to time in the open market, through privately-negotiated transactions and by any other means permitted under the rules of the SEC, in each case at times and prices considered appropriate by Teekay Tankers. The timing of any purchases and the exact number of shares to be purchased under the program will be subject to Teekay Tankers' discretion, market conditions and other factors.

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the unaudited interim consolidated financial statements (or unaudited consolidated financial statements) and accompanying notes contained in “Item 1 – Financial Statements” of this Report on Form 6-K and with our audited consolidated financial statements contained in “Item 18 – Financial Statements” and with Management’s Discussion and Analysis of Financial Condition and Results of Operations in “Item 5 – Operating and Financial Review and Prospects” in our Annual Report on Form 20-F for the year ended December 31, 2022. Included in our Annual Report on Form 20-F is important information about items that you should consider when evaluating our results, including an explanation of our organizational structure, information about the types of contracts we enter into and certain non-GAAP measures we utilize to measure our performance. Unless otherwise indicated, references in this Report to “Teekay,” the “Company,” “we,” “us” and “our” and similar terms refer to Teekay Corporation and its subsidiaries.

Overview

Teekay Corporation (or Teekay) is a leading provider of international crude oil marine transportation and other marine services. Teekay currently provides these services directly and through its controlling ownership interest in Teekay Tankers Ltd. (NYSE: TNK) (or Teekay Tankers), one of the world’s largest owners and operators of mid-sized crude oil tankers. As of March 31, 2023, we had an economic interest in Teekay Tankers of 28.5% and a majority of its voting power.

Teekay Parent has been operating in Australia for over 25 years, providing various marine services to the Commonwealth of Australia and other Australian companies; Teekay Parent is one of the largest employers of Australian seafarers. Our marine services business in Australia provides operations, supply, maintenance and engineering support, and crewing and training services, primarily under long-term contracts with the Commonwealth of Australia for ten Australian government-owned vessels. In addition, we provide crewing services for a third-party-owned FPSO unit in Western Australia. Teekay has developed extensive industry experience and industry-leading capabilities over its 50-year history and has significant financial strength and flexibility following the sale of the Teekay Gas Business in January 2022. We believe our strong balance sheet positions us well to pursue future investments both in the broader shipping space as well as other markets as the world pushes for greater energy diversification and a lower environmental footprint, where we can leverage our operating franchise and the proven capabilities of the Teekay platform to create long-term shareholder value.

As at March 31, 2023, we had no direct investment in any vessels or floating production storage and offloading (or FPSO) units, the last of which was delivered to a recycling yard in October 2022.

On October 4, 2021, Teekay LNG Partners L.P. (or Teekay LNG Partners) (now known as Seapeak LLC (or Seapeak)), Teekay LNG Partners' general partner, Teekay GP L.L.C. (or Teekay GP), an investment vehicle (or Acquiror) managed by Stonepeak Partners L.P., and a wholly-owned subsidiary of Acquiror (or Merger Sub) entered into an agreement and plan of merger (or the Merger Agreement) by which Stonepeak would acquire Teekay LNG Partners. On January 13, 2022, Teekay announced the closing of the merger (or the Merger) pursuant to the Merger Agreement and related transactions. As part of the Merger and other transactions, Teekay sold all of its ownership interest in Teekay LNG Partners, including approximately 36.0 million Teekay LNG Partners common units, and Teekay GP (equivalent to approximately 1.6 million Teekay LNG Partners common units), for $17.00 per common unit or common unit equivalent in cash. As consideration, Teekay received total gross cash proceeds of approximately $641 million.

Furthermore, on January 13, 2022, Teekay transferred certain management services companies to Teekay LNG Partners that provided, through existing services agreements, comprehensive managerial, operational and administrative services to Teekay LNG Partners, its subsidiaries and certain of its joint ventures. Due to negative working capital in these subsidiaries on the date of purchase, Teekay paid Teekay LNG Partners $4.9 million to assume ownership of them. Concurrently with the closing of the transaction, Teekay and Teekay LNG Partners entered into a transition services agreement whereby each party agreed to provides certain services, consisting primarily of corporate services that were previously shared by the entire Teekay organization, to the other party for a mutually agreed reasonable period following closing to allow for the orderly separation of these functions into two standalone operations. Teekay's former general partner interest in Teekay LNG Partners, all of its former common units in Teekay LNG Partners, and certain subsidiaries which collectively contained the shore-based management operations of Teekay LNG Partners and certain of Teekay LNG Partners’ joint ventures are referred to herein as the "Teekay Gas Business".

Following completion of these transactions, Teekay Parent's remaining assets primarily consist of our controlling interest in publicly-listed Teekay Tankers, our marine services business in Australia and a net cash and short-term investments position of approximately $290 million. Teekay and its current subsidiaries, other than Teekay Tankers, are referred to herein as Teekay Parent.

ITEMS YOU SHOULD CONSIDER WHEN EVALUATING OUR RESULTS

There are a number of factors that should be considered when evaluating our historical financial performance and assessing our future prospects and we use a variety of financial and operational terms and concepts when analyzing our results of operations. These items can be found in "Item 5 – Operating and Financial Review and Prospects” in our Annual Report on Form 20-F for the year ended December 31, 2022.

Conflict in Ukraine

In connection with Russia’s invasion of Ukraine, the U.S., several European nations and other countries have imposed numerous sanctions against Russia that are significant in scope. In addition, the U.S., Canada, Australia, the European Union, the United Kingdom and several other countries have announced prohibitions on the importation of Russian oil and petroleum products, or intentions to cut back on their reliance on Russian oil. Carriage of Russian origin oil is now prohibited by many countries (including all of the Group of Seven countries) unless it is at or below a price cap. The same applies to Russian refined petroleum products as of February 5, 2023. Furthermore, several of the world’s largest oil and gas companies, pension and wealth funds and other asset managers have announced divestments of Russian holdings and assets, including those related to the crude oil and petroleum products industries. Russia’s invasion of Ukraine, and related sanctions and other actions described above, have disrupted and led to a significant redrawing of global oil trade routes, which has contributed to significant increases in mid-size tanker tonne-mile demand and spot and charter rates. These changes are expected to be durable, and we expect that mid-size tanker trade routes will continue to be stretched in 2023, which will help support spot tanker rates.

Novel Coronavirus (COVID-19) Pandemic

For the three months ended March 31, 2023, we did not experience any material business interruptions as a result of the COVID-19 pandemic. Please read "Item 3 - Key Information - Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2022 for information about potential risks of the COVID-19 pandemic on our business.

Presentation of Our Results of the Teekay Gas Business

On October 4, 2021, we entered into agreements to sell our general partner interest in Teekay LNG Partners (now known as Seapeak), all of our common units in Teekay LNG Partners, and certain subsidiaries which collectively contained the shore-based management operations of the Teekay Gas Business (see "Overview" above). These transactions closed on January 13, 2022. All revenues and expenses of the Teekay Gas Business prior to the sale and for the periods covered by the consolidated statements of income (loss) in these unaudited consolidated financial statements have been aggregated and presented separately from the continuing operations of Teekay. As such, the following sections consisting of "Operating Results – Teekay Tankers", "Operating Results – Teekay Parent" and "Other Consolidated Operating Results" exclude the results of the Teekay Gas Business.

RECENT DEVELOPMENTS AND RESULTS OF OPERATIONS

The following table (a) presents revenues and income (loss) from vessel operations for Teekay Tankers and Teekay Parent, and (b) reconciles these amounts to our unaudited consolidated financial statements. Revenue and income from the Teekay Gas Business are not included in the following table and have been presented separately in “Operating Results – Teekay Gas Business”. Please read "Item 1 – Financial Statements: Note 3 – Segment Reporting" for information about our lines of business and segments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | Income (Loss) from Vessel Operations |

| Three Months ended | | Three Months ended |