Current Report Filing (8-k)

22 Mai 2023 - 10:58PM

Edgar (US Regulatory)

TEGNA INC false 0000039899 0000039899 2023-05-22 2023-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2023

TEGNA INC.

(Exact name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

1-6961 |

|

16-0442930 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 8350 Broad Street, Suite 2000, Tysons, Virginia |

|

22102-5151 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(703) 873-6600

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

TGNA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.02 |

Termination of a Material Definitive Agreement. |

As previously disclosed, on February 22, 2022, TEGNA Inc., a Delaware corporation (the “Company”), entered into that certain Agreement and Plan of Merger (as amended by Amendment No. 1 thereto on March 10, 2022, the “Merger Agreement”), by and among Teton Parent Corp., a Delaware corporation (“Parent”), Teton Merger Corp., a Delaware corporation and an indirect wholly owned subsidiary of Parent, and solely for purposes of certain provisions specified therein, certain subsidiaries of Parent, certain affiliates of Standard General L.P., a Delaware limited partnership, CMG Media Corporation, a Delaware corporation (“CMG”), and certain of CMG’s subsidiaries. For a description of the Merger Agreement, please refer to Item 1.01 of the Company’s Current Reports on Form 8-K filed with the Securities and Exchange Commission on February 22, 2022 (the “February 2022 8-K”) and March 15, 2022 (the “March 2022 8-K”), which description is incorporated herein by reference. Such description is qualified in its entirety by reference to the full text of the Merger Agreement and Amendment No. 1 thereto, which are attached as Exhibit 2.1 to the February 2022 8-K and Exhibit 2.1 to the March 2022 8-K, respectively, and are incorporated herein by reference.

On May 22, 2023, pursuant to the terms of the Merger Agreement, the Company terminated the Merger Agreement effective immediately.

The Merger Agreement provided the Company with a right to terminate the Merger Agreement if the Federal Commissions Commission (“FCC”) issued a Hearing Designation Order with respect to certain transactions contemplated by the Merger Agreement. On February 24, 2023, the Media Bureau of the FCC issued a Hearing Designation Order (the “Hearing Designation Order”) in the matter captioned In the Matter of Consent to Transfer Control of Certain Subsidiaries of TEGNA Inc. to SGCI Holdings III LLC, et al., MB Docket No. 22-162. Under the terms of the Merger Agreement, Parent must pay the Company a termination fee of $136 million.

Accelerated Share Repurchase Program

On May 22, 2023, the Company announced that the Board of Directors of the Company (the “Board”) authorized an accelerated share repurchase program, which gives the Company the ability to repurchase up to $300 million of its common stock.

Dividend Increase

On May 22, 2023, the Company announced that the Board authorized a dividend increase of 1.875 cents per share on a quarterly basis, to 11.375 cents per share.

A copy of the Company’s press release announcing the termination of the Merger Agreement, the accelerated share repurchase program and the dividend increase is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 9.01. |

Financial Statements and Exhibits. |

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements within the meaning of the “safe harbor” provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on a number of assumptions about future events and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs, projections and estimates expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, risks and uncertainties related to: changes in the market price of TEGNA’s shares, general market conditions, access to credit or debt capital markets, applicable securities laws and alternative uses of capital; constraints, volatility, or disruptions in the capital markets or other factors affecting share repurchases, including TEGNA’s ability to complete the ASR on the expected terms and timing; delays or failures associated with implementation of TEGNA’s ASR program; the possibility that TEGNA’s ASR program, or any future share repurchases, may not enhance long-term stockholder value; the possibility that share repurchases pursuant to the ASR program could increase the volatility of the price of TEGNA’s common stock and diminish TEGNA’s cash reserves; legal proceedings, judgments or settlements; the response of customers, suppliers and business partners to the termination of the merger agreement, including impacts on and modifications to TEGNA’s plans, operations and business relating thereto; difficulties in employee retention due to the termination of the merger agreement; TEGNA’s ability to re-price or renew subscribers and execute on its capital allocation strategy; potential regulatory actions; changes in consumer behaviors and impacts on and modifications to TEGNA’s operations and business relating thereto; and economic, competitive, governmental, technological and other factors and risks that may affect TEGNA’s operations or financial results, which are discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Any forward-looking statements in this communication should be evaluated in light of these important risk factors. TEGNA is not responsible for updating the information contained in this communication beyond the published date, or for changes made to this communication by wire services, Internet service providers or other media.

Readers are cautioned not to place undue reliance on forward-looking statements made by or on behalf of TEGNA. Each such statement speaks only as of the day it was made. TEGNA undertakes no obligation to update or to revise any forward-looking statements. The factors described above cannot be controlled by TEGNA. When used in this communication, the words “believes,” “estimates,” “plans,” “expects,” “should,” “could,” “outlook,” and “anticipates” and similar expressions as they relate to TEGNA or its management are intended to identify forward-looking statements. Forward-looking statements in this communication may include, without limitation: anticipated growth rates and TEGNA’s plans, objectives and expectations.

-3-

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

TEGNA INC. |

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Akin S. Harrison |

|

|

|

|

|

|

Akin S. Harrison |

|

|

|

|

|

|

Senior Vice President and General Counsel |

Date: May 22, 2023

-4-

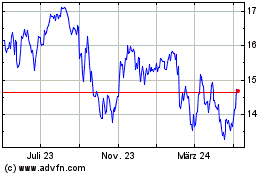

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

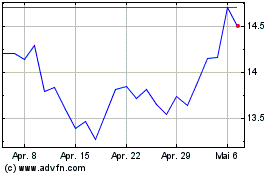

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024