Standard General Issues Statement on Acquisition of TEGNA Inc.

16 Dezember 2022 - 10:25PM

Business Wire

Standard General L.P. today issued the following statement

regarding its pending acquisition of TEGNA Inc. (NYSE: TGNA):

“Our proposed acquisition of TEGNA has been

the subject of regulatory review that continues into the phase

where the purchase price is increasing every day.

The regulatory authorities have expressed

concerns to us that our transaction could result in negative

impacts on cable and satellite TV consumers in an environment where

the government has a heightened focus on inflation.

To address these concerns in a manner

consistent with our obligations under our merger agreement, we have

committed to waive certain contractual rights we would have had as

a result of the transaction. This commitment further demonstrates

the public interest benefits of the transaction.

We continue to be excited about the bright

future we see for TEGNA under our leadership. We look forward to

continue working collaboratively with regulators to complete their

review of the proposed transaction and proceed to closing.”

About Standard General

Standard General was founded in 2007 and manages capital for

public and private pension funds, endowments, foundations, and

high-net-worth individuals. Standard General is a

minority-controlled and operated organization. Soo Kim, Standard

General’s Managing Partner and Chief Investment Officer, is

supported by a diverse, highly experienced 17-person team,

including seven investment professionals with over 120 years of

collective investing experience.

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes forward-looking statements within

the meaning of the “safe harbor” provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on a number of assumptions about future events

and are subject to various risks, uncertainties and other factors

that may cause actual results to differ materially from the views,

beliefs, projections and estimates expressed in such statements.

These risks, uncertainties and other factors include, but are not

limited to, the following: (1) the timing, receipt and terms and

conditions of the required governmental or regulatory approvals of

the proposed transaction and the related transactions involving the

parties that could reduce the anticipated benefits of or cause the

parties to abandon the proposed transaction, (2) risks related to

the satisfaction of the conditions to closing the proposed

transaction (including the failure to obtain necessary regulatory

approvals), and the related transactions involving the parties, in

the anticipated timeframe or at all, (3) the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of TEGNA’s common stock, (4)

disruption from the proposed transaction making it more difficult

to maintain business and operational relationships, including

retaining and hiring key personnel and maintaining relationships

with TEGNA’s customers, vendors and others with whom it does

business, (5) the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into pursuant to the proposed transaction or of

the transactions involving the parties, (6) risks related to

disruption of management’s attention from TEGNA’s ongoing business

operations due to the proposed transaction, (7) significant

transaction costs, (8) the risk of litigation and/or regulatory

actions related to the proposed transaction or unfavorable results

from currently pending litigation and proceedings or litigation and

proceedings that could arise in the future, (9) other business

effects, including the effects of industry, market, economic,

political or regulatory conditions, (10) information technology

system failures, data security breaches, data privacy compliance,

network disruptions, and cybersecurity, malware or ransomware

attacks, and (11) changes resulting from the COVID-19 pandemic,

which could exacerbate any of the risks described above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221216005478/en/

For media inquiries: Standard General Andy Brimmer / Jamie Moser

/ Jack Kelleher Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

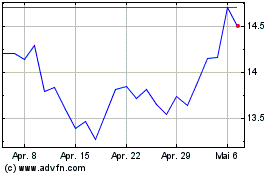

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

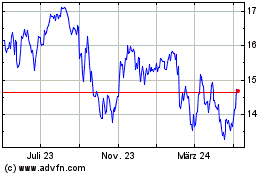

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024