Heartland Express, Inc. (

NASDAQ: HTLD)

(“Heartland”) announced today that it will acquire the Contract

Freighters non-dedicated U.S. dry van and temperature-controlled

truckload business and CFI Logistica operations in Mexico (“CFI”)

from TFI International, Inc. (

NYSE: TFII) (“TFI”),

for a cash enterprise value of $525 million, subject to certain

adjustments. The term CFI does not include the CFI Dedicated or CFI

Logistics U.S. brokerage operations (“TFI Retained Operations”),

which are not part of the transaction.

Highlights

-

Acquisition will be Heartland Express’ largest, adding

CFI’s storied brand, talented team, and cross-border expertise; CFI

to continue under its existing brand, management, and terminal

locations

- Company

will be the 8th largest truckload fleet and 3rd largest irregular

route, asset-based truckload carrier in the U.S., with estimated

annual pro forma total revenue of approximately $1.3 billion and

estimated annual operating cash flow of approximately $260.0

million, as well as estimated pro forma total assets nearing $2.0

billion as of June 30, 2022(1)

-

Operating plan anticipates consolidated adjusted operating

ratio(2) of 85% or better within

three years and repayment of all indebtedness within four years

after closing

-

Transaction is expected to be immediately accretive to

earnings excluding transaction costs

-

Transaction value anticipated to be funded with existing

cash and borrowing under new $550 million revolving and term loan

agreement

Heartland Comments

Michael Gerdin, Chairman, President, and CEO of

Heartland Express, commented: “We are thrilled to welcome CFI to

the Heartland Express family of companies, where it will continue

to operate from Joplin under its own brand and current leadership

team. CFI has exactly what we look for as we expand – significant

scale, a respected and recognizable brand, capable management, safe

and experienced drivers, a strong asset base, and a complementary

terminal network. CFI’s strengths in the north-south midwestern

corridor will add to our driver and customer capability, and their

cross-border expertise will help us capitalize on the expected

long-term freight volume benefits of nearshoring activity by

manufacturers. At the same time, we can offer the CFI people a home

that is entirely focused on their core – high-service, irregular

route, asset-based truckload freight transportation. Over time, we

expect to gain meaningful synergies and operate our consolidated

business on a larger scale at our historical margins.”

TFI Comments

Alain Bédard, Chairman, CEO, and President of

TFI, said: “This transaction is a true 'win-win-win' for TFI, for

CFI, and for Heartland Express. CFI is a great company, but the

U.S. irregular route truckload business has become a small part of

our portfolio. CFI’s people have been a small part of big companies

for the past 15 years, and we wanted to find them a permanent home

with a leader in the asset-based truckload industry to show what

they can accomplish. Heartland Express is a truckload industry

leader, and they respect and support CFI’s brand, leadership, and

drivers. Mike Gerdin and I were able to quickly see the benefits to

all parties and come to fair terms. We could not have found a

better match culturally and financially for this transaction, which

will afford CFI the opportunity to flourish and allow us to

redeploy capital and focus our U.S. based efforts on LTL,

asset-light logistics, and specialized truckload units. We expect a

smooth path to closing and wish our colleagues at CFI and Heartland

Express only the best.”

About CFI

Headquartered in Joplin, Missouri, CFI provides

dry van and temperature-controlled truckload services to major

customers throughout the U.S. and into Mexico and Canada. CFI was a

pioneer in the cross-border Mexican logistics arena and remains one

of the sector’s largest and most respected supply chain partners,

with operations at five major entry points from California through

Texas. CFI Logistica provides asset-light truckload and

less-than-truckload services in Mexico, in particular serving as a

distribution partner for several large U.S. LTL companies.

CFI owns its headquarters which covers

approximately 200 acres in Joplin, along with strategically located

facilities in Laredo, TX, West Memphis, AR, Taylor, MI, Sanford,

FL, and Nuevo Laredo, Tamaulipas, Mexico. These six locations will

be acquired by Heartland and bring the total to 30 owned terminals

across the U.S. and Mexico.

Approximately 2,100 tractors and 8,000 dry van

and temperature-controlled trailers. All tractors and trailers are

owned except 93 tractors and 136 trailers. In addition, CFI

contracts with approximately 250 independent contractors who

provide their own tractors.

About the Transaction

The enterprise value of the transaction is $525

million calculated on a cash-free, debt-free basis and subject to

certain adjustments. Under the purchase agreement, Heartland

Express will acquire 100% of the equity of Transportation

Resources, Inc., the parent of Contract Freighters, Inc. and the

Mexican entities comprising CFI Logistica. The purchase agreement

contains customary terms and conditions, including regulatory

approval, as well as purchase price adjustments for net working

capital and retention by TFI of liability for all of CFI’s

pre-closing auto and workers’ compensation claims. The transaction

is expected to close in the third quarter of 2022 and be

immediately accretive to earnings per share.

For the twelve months ended June 30, 2022, CFI

generated approximately $575 million in total revenue. Heartland

Express estimates the enterprise value approximates 5x run rate

adjusted EBITDA.(2) The referenced period includes

seven months of operations of the former D&D Sexton, certain

costs associated with supporting the administrative functions of

the TFI Retained Operations that will be phased out over time, the

integration and subsequent exit of certain the TFI Retained

Operations, and significant gains from selling excess equipment.

Accordingly, this estimate is preliminary and subject to the

completion of the carve-out audit of CFI’s historical operations,

the completion of purchase accounting adjustments, the wind-down

and replacement of transition services, and other factors. Actual

results following a closing are likely to differ from this

preliminary estimate.

Operating Plan and

Synergies

Mr. Gerdin commented, “CFI will continue to

operate from Joplin under its current leadership team and famous

brand. Our first goal is to minimize changes experienced by drivers

and customers. Next, we will work with CFI’s management to optimize

the consolidated freight networks across Heartland Express, Millis

Transfer, Smith Transport, and CFI, as well as enhance driver

recruiting and retention, realize purchasing economies, and reduce

overhead per truck. We believe CFI’s drivers will benefit from our

extensive owned terminal network, in which we have invested

millions of dollars to improve our drivers’ experience. As with

every acquisition, our plan is to capitalize on each other’s

strengths and improve consolidated profitability. Our goal is for

our consolidated adjusted operating ratio(2) to be 85.0% or below

within three years after the closing.”

Pro Forma Heartland Express

The acquisition of CFI, together with the recent

Smith Transport acquisition, will make the consolidated Heartland

Express group the 8th largest truckload fleet in the U.S. and 3rd

largest based on irregular route, asset-based truckload carrier in

the U.S. Pro forma expectations(1) include the following:

- Estimated

annual total revenue of approximately $1.3 billion and estimated

annual operating cash flow of approximately $260.0 million, as well

as estimated total assets nearing $2.0 billion as of June 30,

2022.

- Approximately

5,550 tractors (including approximately 250 independent

contractors) with an average age of approximately 2.0 years and

approximately 17,800 trailers with an average age of approximately

5.6 years, substantially all owned.

- 30 owned

facilities, strategically located near almost every major

population and freight center in the U.S., with significant

opportunities to reduce leased facilities and improve the driver

experience.

- Diversified

freight basket with over 95% contracted capacity and no single

customer expected to be greater than 8% of revenue.

Financing

The transaction and related expenses will be

funded using a combination of balance sheet cash and borrowing

under a new $550 million credit agreement to be entered into at

closing of the transaction. The credit agreement is expected to

include a $100 million revolving credit availability and up to $450

million in term loans. The credit facility will be unsecured,

mature in five years, and contain customary terms and conditions,

including financial covenants. Heartland has received commitments

to fund the facility from a consortium of lenders, including joint

bookrunners JPMorgan Chase Bank, N.A. and Wells Fargo Bank, N.A.

Immediately after the closing, Heartland expects to have a net

leverage ratio of approximately 1.25x and approximately $160

million of cash and available borrowing under the credit

facility.(3)

Investor Conference Call

Information

Heartland will hold a conference call today at

10:00 AM CDT, to discuss the transaction. Interested participants

and investors are encouraged to dial in at least 5 minutes early to

ensure on-time admittance to the call. The dial in details are as

follows:

Participant US Local / Intl 1:

+1 (929) 272-1574

Participant US Local / Intl 2:

+1 (857) 999-3259

Participant US Toll Free: +1

(800) 528-1066

Conference ID: 5699

Additionally, presentation materials will be

available on Deal Roadshow as follows:

URL: https://dealroadshow.com

Entry Code: HTLD2022

Direct Link:

https://dealroadshow.com/e/HTLD2022

Advisors

Scudder Law Firm, P.C., L.L.O. serves as

transaction and legal advisor to Heartland.

About Heartland

Heartland Express, Inc. is an irregular route

truckload carrier based in North Liberty, Iowa, serving customers

with shipping lanes throughout the United States through its brands

Heartland Express, Millis Transfer, Smith Transport, and after

closing, CFI. Heartland focuses on medium to short haul regional

freight, offering shippers industry-leading on-time service so they

can achieve their strategic goals. Since its initial public

offering in 1986, Heartland has grown from approximately $20

million in revenue to one of North America’s largest, most

profitable, and best capitalized truckload carriers. Heartland has

been recognized 18 times by Forbes Magazine as one of the Top 200

Best Small Companies in America, as well as being ranked by

Logistics Management Magazine 18 out of the last 20 years as one of

the Best Truckload Carriers in America. Heartland was also

recognized as one of America’s Most Trustworthy Companies by

Newsweek in 2022. More information about Heartland can be found on

the company website at www.heartlandexpress.com.

Notes

|

|

(1) |

Pro forma expectations include a full year of CFI and affiliates,

as well as Smith Transport and affiliates acquired on May 31, 2022.

CFI’s financial results are accounted for under International

Financial Reporting Standards (IFRS), consistent with TFI’s status

as a foreign private issuer. Heartland expects to file carve-out

audited annual and unaudited interim financial statements of CFI

prepared in accordance with U.S. GAAP, and associated pro forma

financial information, in the fourth quarter of 2022. |

|

|

(2) |

The terms "adjusted operating

ratio" and "adjusted EBITDA," as we define them, are not presented

in accordance with GAAP. Our calculation (i) adds back the

after-tax impact of intangible asset amortization, (ii) adds or

subtracts certain other infrequent or unusual items, which may

include, for example, gains or losses associated with the

disposition of certain asset and certain transaction-related

expenses, and which may vary over time, and (iii) calculates

adjusted operating ratio as adjusted operating expenses less fuel

surcharge revenue as a percentage of total revenue less fuel

surcharge revenue. EBITDA is defined for this purpose as net income

(loss) before interest, income taxes, depreciation, and

amortization. These financial measures supplement our GAAP results

in evaluating certain aspects of our business, including the

transaction. We believe that using these measures improves

comparability because they remove the impact of items that, in our

opinion, do not reflect core operating performance. We believe our

presentation of these non-GAAP financial measures is useful because

it provides investors and securities analysts the same information

that we expect to use internally for purposes of assessing the

transaction and our core operating performance. Adjusted operating

ratio and adjusted EBITDA are not substitutes for their comparable

GAAP financial measures, such as EPS, net income, or other measures

prescribed by GAAP. There are limitations to using non-GAAP

financial measures. Although we believe that they improve

comparability in analyzing performance, they could limit

comparability to other companies in our industry if those companies

define these measures differently. Because of these limitations,

our non-GAAP financial measures should not be considered measures

of income or discretionary cash available to us to invest in the

growth of our business. Management compensates for these

limitations by primarily relying on GAAP results and using non-GAAP

financial measures on a supplemental basis. We cannot estimate on a

forward-looking basis, the impact of certain income and expense

items on run rate adjusted operating ratio or run rate adjusted

EBITDA, because these items, which could be significant, may be

infrequent, are difficult to predict, and may be highly variable.

As a result, we do not provide a corresponding GAAP measure for, or

reconciliation to, our estimate of these measures. |

|

|

(3) |

Net leverage ratio is defined as

the following, calculated with respect to Heartland and its

subsidiaries on a consolidated basis: (a) total indebtedness minus

up to $50 million of unrestricted cash, to (b) EBITDA for the most

recently completed four consecutive fiscal quarters. For purposes

of this ratio, “EBITDA” means net income, plus (a) interest

expense, tax expense, depreciation and amortization, certain other

noncash charges, expenses associated with the transaction described

in this press release, and the projected amount of “run rate” cost

and expense reductions related to such transaction, minus (b)

certain non-cash gains. |

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, as amended. Forward-looking

statements generally may be identified by words such as

“anticipates,” “believes,” “estimates,” “plans,” “projects,”

“expects,” “hopes,” “intends,” “will,” “would,” “can,” “could,”

“may,” and terms and phrases of similar substance. In this press

release, forward-looking statements cover matters such as expected

closing dates, expected earnings accretion, estimated historical

and pro forma financial information, estimated adjusted operating

ratios and debt repayment, and predictions concerning other

financial measures, synergies, operating plans, and future

operations. Forward-looking statements are based upon

the current beliefs and expectations of Heartland’s management and

are inherently subject to risks and uncertainties, some of which

cannot be predicted or quantified, which could cause future events

and actual results to differ materially from those set forth in,

contemplated by, or underlying the forward-looking statements.

Accordingly, actual results may differ from those set forth in the

forward-looking statements. Readers should review and

consider the factors that may affect future results and other

disclosures by Heartland in its press releases, stockholder

reports, Annual Report on Form 10-K, and other filings with the

Securities and Exchange Commission. Heartland disclaims any

obligation to update or revise any forward-looking statements to

reflect actual results or changes in the factors affecting the

forward-looking information.

Contact: Michael Gerdin, Chief Executive

Officer, or Chris Strain, Chief Financial Officer – (319)

645-7060

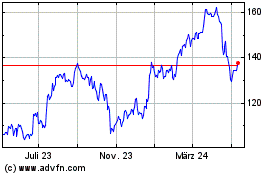

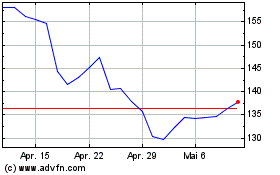

TFI (NYSE:TFII)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

TFI (NYSE:TFII)

Historical Stock Chart

Von Dez 2023 bis Dez 2024