Truist Financial Posts Lower 3Q Profit Amid Market Downturn

18 Oktober 2022 - 12:58PM

Dow Jones News

By Will Feuer

Truist Financial Corp. posted lower profit for the recently

ended quarter as a slowdown in residential mortgages and the

investment-banking business weighed on results.

Truist posted a profit available to common shareholders of $1.54

billion for the third quarter, compared with $1.62 billion a year

earlier. Earnings were $1.15 a share, compared with $1.20 a share.

Analysts surveyed by FactSet expected earnings of $1.19 a

share.

Stripping out merger-related costs and other one-time items,

adjusted earnings came to $1.24 a share.

Revenue rose to $5.85 billion from $5.60 billion a year earlier.

Analysts surveyed by FactSet expected revenue of $5.93 billion. The

company reported an efficiency ratio of 61.8% for the quarter.

Analysts expected a ratio of 58.6%, according to FactSet.

Noninterest income fell 11% from a year earlier to $2.1 billion,

primarily due to lower residential mortgage, investment banking and

other income, partially offset by growth in insurance revenues.

The company said it set aside $234 million for credit losses,

compared with a benefit of $324 million in the year-ago period.

Chief Executive Bill Rogers described the results as mixed,

saying the challenging market environment weighed on Truist's

capital-markets revenue.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

October 18, 2022 06:43 ET (10:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

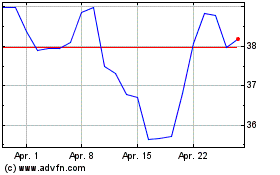

Truist Financial (NYSE:TFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

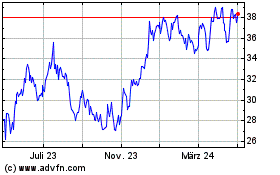

Truist Financial (NYSE:TFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024