Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA) today

reported results for the quarter ended March 31, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230510005122/en/

- Revenues of $3.7 billion

- GAAP loss per share of $0.18

- Non-GAAP diluted EPS of $0.40

- Cash flow used in operating activities of $145 million

- Free cash flow of $41 million

- Non-GAAP gross profit margin of 49.1% was mainly impacted by an

unfavorable portfolio mix and an increase in COGS due to

inflationary pressure. We expect our gross profit margin to improve

in the coming quarters due to improved portfolio mix driven by our

innovative products, namely AUSTEDO®, AJOVY® and UZEDY™, as well as

by lower COGS, driven by supply chain enhancements and easing of

certain elements of inflationary pressure.

- Full year 2023 business outlook reaffirmed:

- Revenues of $14.8 - $15.4 billion

- Adjusted EBITDA of $4.5 - $4.9 billion

- Non-GAAP diluted EPS of $2.25 - $2.55

- Free cash flow of $1.7 - $2.1 billion

Mr. Richard Francis, Teva's President and CEO, said, “I

am pleased to report that our revenues for the first quarter

reached $3.7 billion, marking a 4% increase in local currency

terms, compared to the first quarter of 2022: We have seen growth

across all regions - Europe is experiencing a solid 9% increase,

International Markets an 8% increase, and North America is up

2%.”

Mr. Francis continued, "Our innovative brands performed well

this quarter - AUSTEDO grew 10% year-over-year and AJOVY grew 35%

across all regions in local currency. We are also excited about the

recent approvals of AUSTEDO XR, the new once-daily formulation for

AUSTEDO, and UZEDY (risperidone), our new long-acting injectable

treatment for schizophrenia in adults. While we are seeing some

positive tailwinds, we are also taking decisive actions to address

some headwinds, mainly through improved portfolio mix driven by our

innovative products and supply chain enhancements. We expect these

actions will improve our gross profit margin in the coming

quarters, and today, we are reaffirming our 2023 outlook which was

provided in February.

As we prepare to launch our new strategy next week, I am filled

with enthusiasm and optimism. This strategy will build on Teva's

strong foundations, key strengths, and sets the stage for long-term

growth. We have worked hard over the last few months to challenge

ourselves, look at how the market is evolving and how we can create

substantial value both for Teva and for patients. I am really

excited about the outcome – a new roadmap where we will make

decisive choices and focus our resources to drive growth and

innovation."

First Quarter 2023 Consolidated Results

Revenues in the first quarter of 2023 were $3,661

million, flat compared to the first quarter of 2022. In local

currency terms, revenues increased by 4%, mainly due to higher

revenues from generic products in our Europe and International

Markets segments, certain innovative products primarily AUSTEDO and

AJOVY, as well as from Anda in our North America segment, partially

offset by lower revenues from generic products in our North America

segment, API sales to third parties and BENDEKA® and TREANDA® in

our North America segment.

Exchange rate movements during the first quarter of 2023,

including hedging effects, negatively impacted our revenues by $128

million compared to the first quarter of 2022. Exchange rate

movements during the first quarter of 2023, including hedging

effects, negatively impacted our operating income and non-GAAP

operating income by $32 million and $33 million, respectively,

compared to the first quarter of 2022.

Gross profit was $1,582 million in the first quarter of

2023, a decrease of 9% compared to the first quarter of 2022.

Gross profit margin was 43.2% in the first quarter of 2023,

compared to 47.5% in the first quarter of 2022. Non-GAAP gross

profit was $1,796 million in the first quarter of 2023, a

decrease of 10% compared to the first quarter of 2022. Non-GAAP

gross profit margin was 49.1% in the first quarter of 2023,

compared to 54.2% in the first quarter of 2022. This decrease in

both gross profit margin and non- GAAP gross profit margin was

mainly driven by rising costs due to inflationary and other

macroeconomic pressures, an increase in revenues with lower

profitability from Anda in our North America segment, lower

revenues from COPAXONE® and BENDEKA and TREANDA, and an unfavorable

impact of hedging activities, partially offset by higher revenues

from AUSTEDO and AJOVY.

Research and Development (R&D) expenses in the first

quarter of 2023 were $234 million, an increase of 4% compared to

$225 million, in the first quarter of 2022, mainly due to an

increase in neuroscience (mainly neuropsychiatry) and immunology as

well as various generics and biosimilar products.

Selling and Marketing (S&M) expenses in the

first quarter of 2023 were $546 million, a decrease of 6% compared

to the first quarter of 2022.

General and Administrative (G&A) expenses in the

first quarter of 2023 were $296 million, flat compared to the first

quarter of 2022.

Other income in the first quarter of 2023 was $2 million,

compared to $52 million in the first quarter of 2022. Other income

in the first quarter of 2022 was mainly the result of settlement

proceeds in our International Markets segment.

Operating income in the first quarter of 2023 was $2

million, compared to an operating loss of $713 million in the first

quarter of 2022. Operating income as a percentage of revenues was

0.1% in the first quarter of 2023, compared to operating loss as a

percentage of revenues of 19.5% in the first quarter of 2022. The

increase in operating income and in operating margin in the first

quarter of 2023 was mainly due to higher legal settlements and loss

contingencies in the first quarter of 2022. Non-GAAP operating

income in the first quarter of 2023 was $785 million

representing a non-GAAP operating margin of 21.4%, compared to

non-GAAP operating income of $1,013 million, representing a

non-GAAP operating margin of 27.7%, in the first quarter of 2022.

The decrease in non-GAAP operating margin in the first quarter of

2023 was mainly impacted by lower non-GAAP gross profit margin as

discussed above, as well as higher other income in the first

quarter of 2022, which primarily included settlement proceeds in

our International Markets segment.

Adjusted EBITDA was $899 million in the first quarter of

2023, a decrease of 21%, compared to $1,135 million in the first

quarter of 2022.

Financial expenses, net in the first quarter of 2023 were

$260 million, compared to $258 million in the first quarter of

2022. Financial expenses, net in the first quarter of 2023 and 2022

were mainly comprised of interest expenses of $260 million and $238

million, respectively.

In the first quarter of 2023, we recognized a tax benefit

of $19 million on a pre-tax loss of $258 million. In the first

quarter of 2022, we recognized a tax expense of $2 million on a

pre-tax loss of $971 million.

Non-GAAP tax rate in the first quarter of 2023 was 15.5%,

compared to 18.5% in the first quarter of 2022. Our non-GAAP tax

rate in the first quarter of 2023 was mainly affected by the

geographic mix of earnings and interest expense disallowances.

We expect our annual non-GAAP tax rate for 2023 to

be between 14%-17%, higher than our non-GAAP tax rate for 2022,

which was 11.7%, mainly due to the effect of a portion of the

realization of losses related to an investment in one of our U.S.

subsidiaries in 2022.

Net loss attributable to Teva and loss per share

in the first quarter of 2023 were $205 million and $0.18,

respectively, compared to $955 million and $0.86, respectively, in

the first quarter of 2022. Non-GAAP net income attributable

to Teva and non-GAAP diluted earnings per share in the first

quarter of 2023 were $457 million and $0.40, respectively, compared

to $609 million and $0.55, respectively, in the first quarter of

2022.

As of March 31, 2023 and 2022, the fully diluted share

count for purposes of calculating our market capitalization was

approximately 1,158 million and 1,145 million, respectively.

Non-GAAP information: net non-GAAP adjustments in the

first quarter of 2023 were $661 million. Non-GAAP net income

attributable to Teva and non-GAAP diluted EPS for the first quarter

of 2023 were adjusted to exclude the following items:

- Amortization of purchased intangible assets of $165 million, of

which $145 million is included in cost of sales and the remaining

$20 million in S&M expenses;

- Legal settlements and loss contingencies of $233 million;

- Impairment of long-lived assets of $188 million;

- Restructuring expenses of $56 million;

- Equity compensation expenses of $32 million;

- Accelerated depreciation of $25 million;

- Financial expenses of $23 million;

- Contingent consideration expense of $20 million;

- Costs related to regulatory actions taken in facilities of $1

million;

- Other non-GAAP items of $63 million;

- Items attributable to non-controlling interests of $40 million;

and

- Corresponding tax effects and unusual tax items of $104

million.

We believe that excluding such items facilitates investors’

understanding of our business.

For further information, see the tables below for a

reconciliation of the U.S. GAAP results to the adjusted non-GAAP

figures and the information under “Non-GAAP Financial Measures.”

Investors should consider non-GAAP financial measures in addition

to, and not as replacement for, or superior to, measures of

financial performance prepared in accordance with GAAP.

Cash flow used in operating activities during the first

quarter of 2023 was $145 million, compared to $49 million in the

first quarter of 2022. The higher cash flow used in the first

quarter of 2023 resulted mainly from lower profit and changes in

working capital items, including an increase in accounts

receivables net of SR&A, partially offset by an increase in

accounts payables.

During the first quarter of 2023, we generated free cash

flow of $41 million, which we define as comprising $145 million

in cash flow used in operating activities, $323 million in

beneficial interest collected in exchange for securitized accounts

receivables (under our EU securitization program) and $2 million in

proceeds from divestitures of businesses and other assets,

partially offset by $139 million in cash used for capital

investment. During the first quarter of 2022, we generated free

cash flow of $117 million, which we define as comprising $49

million in cash flow used in operating activities, $305 million in

beneficial interest collected in exchange for securitized accounts

receivables (under our EU securitization program) and $25 million

in proceeds from divestitures of businesses and other assets,

partially offset by $157 million in cash used for capital

investment and $7 million in cash used for acquisition of

businesses, net of cash acquired. The decrease in the first quarter

of 2023, resulted mainly from higher cash flow used in operating

activities, as discussed above.

As of March 31, 2023, our debt was $20,691 million,

compared to $21,212 million as of December 31, 2022. This decrease

was mainly due to $646 million senior notes repaid at maturity,

partially offset by $176 million of exchange rate fluctuations.

Additionally, during the first quarter of 2023, we repurchased

$2,506 million aggregate principal amount of notes upon

consummation of a cash tender offer, and issued $2,445 million of

sustainability-linked senior notes, net of issuance costs. The

portion of our total debt classified as short-term as of March 31,

2023 was 5%, compared to 10% as of December 31, 2022. Our average

debt maturity was approximately 6.4 years as of March 31, 2023,

compared to 5.8 years as of December 31, 2022.

Segment Results for the first Quarter of 2023

North America Segment

Our North America segment includes the United States and

Canada.

The following table presents revenues, expenses and profit for

our North America segment for the three months ended March 31, 2023

and 2022:

Three months ended March

31,

2023

2022

(U.S. $ in millions / % of

Segment Revenues)

Revenues

$

1,766

100%

$

1,737

100%

Gross profit

812

46.0%

890

51.2%

R&D expenses

156

8.8%

143

8.2%

S&M expenses

223

12.6%

245

14.1%

G&A expenses

102

5.8%

112

6.4%

Other income

(1)

§

(11)

(0.7%)

Segment profit*

$

332

18.8%

$

402

23.1%

* Segment profit does not include

amortization and certain other items.

§ Represents an amount less than 0.5%.

Revenues from our North America segment in the first

quarter of 2023 were $1,766 million, an increase of $29 million, or

2%, compared to the first quarter of 2022, mainly due to higher

revenues from certain innovative products, primarily AUSTEDO and

AJOVY, as well as Anda, partially offset by lower revenues from

generic products and BENDEKA and TREANDA.

Revenues in the United States, our largest market, were

$1,677 million in the first quarter of 2023, an increase of $39

million or 2% compared to the first quarter of 2022.

Revenues by Major Products and Activities

The following table presents revenues for our North America

segment by major products and activities for the three months ended

March 31, 2023 and 2022:

Three months ended

March 31,

Percentage

Change

2023

2022

2023-2022

(U.S. $ in millions)

Generic products

$

824

$

899

(8%)

AJOVY

49

36

36%

AUSTEDO

170

154

10%

BENDEKA and TREANDA

63

82

(23%)

COPAXONE

76

86

(12%)

Anda

424

342

24%

Other (*)

160

139

15%

Total

$

1,766

$

1,737

2%

____________________

(*) Other revenues in the first quarter of 2023 increased mainly

due to a reduction in estimated liabilities in connection with

ProAir® HFA following its discontinuation on October 1, 2022.

Generic products revenues in our North America segment

(including biosimilars) in the first quarter of 2023 were $824

million, a decrease of 8% compared to the first quarter of 2022,

mainly due to increased competition to parts of our portfolio.

On March 9, 2023, Teva and Natco Pharma Ltd. announced the

launch of additional strengths for lenalidomide capsules (the

generic equivalent of Revlimid®) in the U.S., in 2.5 mg and 20 mg

strengths.

In the first quarter of 2023, our total prescriptions for

generic products were approximately 81 million (based on trailing

twelve months), representing 8.3% of total U.S. generic

prescriptions according to IQVIA data.

AJOVY revenues in our North America segment in the first

quarter of 2023 increased by 36% to $49 million, compared to the

first quarter of 2022, mainly due to growth in volume. In the first

quarter of 2023, AJOVY’s exit market share in the United States in

terms of total number of prescriptions was 24.5% compared to 23.9%

in the first quarter of 2022.

AUSTEDO revenues in our North America segment in the

first quarter of 2023 increased by 10%, to $170 million, compared

to $154 million in the first quarter of 2022, mainly due to growth

in volume.

AUSTEDO XR (deutetrabenazine) extended-release tablets was

approved by the FDA on February 17, 2023. AUSTEDO XR is a new

once-daily formulation indicated in adults for tardive dyskinesia

and chorea associated with Huntington’s disease, additional to the

currently marketed twice-daily AUSTEDO.

On April 28, 2023, the FDA approved UZEDYTM (risperidone)

extended-release injectable suspension for the treatment of

schizophrenia in adults. UZEDY is the first subcutaneous,

long-acting formulation of risperidone that controls the steady

release of risperidone. UZEDY is expected to be available in the

U.S. in the coming weeks.

BENDEKA and TREANDA combined revenues in our North

America segment in the first quarter of 2023 decreased by 23% to

$63 million, compared to the first quarter of 2022, mainly due to

generic bendamustine product entry into the market. The orphan drug

exclusivity that had attached to bendamustine products expired in

December 2022.

COPAXONE revenues in our North America segment in the

first quarter of 2023 decreased by 12% to $76 million, compared to

the first quarter of 2022, mainly due to generic competition in the

United States and a decrease in glatiramer acetate market share due

to availability of alternative therapies.

Anda revenues from third-party products in our North

America segment in the first quarter of 2023 increased by 24% to

$424 million, compared to $342 million in the first quarter of

2022, mainly due to higher demand.

North America Gross Profit

Gross profit from our North America segment in the first

quarter of 2023 was $812 million, a decrease of 9%, compared to

$890 million in the first quarter of 2022.

Gross profit margin for our North America segment in the

first quarter of 2023 decreased to 46.0%, compared to 51.2% in the

first quarter of 2022. This decrease was mainly due to higher cost

of goods sold, mainly driven by rising costs due to inflationary

and other macroeconomic pressures, as well as an increase in

revenues with lower profitability from Anda.

North America Profit

Profit from our North America segment consists of gross profit

less R&D expenses, S&M expenses, G&A expenses and any

other income related to this segment. Segment profit does not

include amortization and certain other items.

Profit from our North America segment in the first

quarter of 2023 was $332 million, a decrease of 17% compared to

$402 million in the first quarter of 2022. This decrease was mainly

due to lower gross profit.

Europe Segment

Our Europe segment includes the European Union, the United

Kingdom and certain other European countries.

The following table presents revenues, expenses and profit for

our Europe segment for the three months ended March 31, 2023 and

2022:

Three months ended March

31,

2023

2022

(U.S. $ in millions / % of

Segment Revenues)

Revenues

$

1,184

100%

$

1,156

100%

Gross profit

655

55.3%

694

60.0%

R&D expenses

53

4.5%

58

5.0%

S&M expenses

187

15.8%

196

17.0%

G&A expenses

70

5.9%

59

5.1%

Other income

§

§

§

§

Segment profit*

$

345

29.1%

$

381

32.9%

§ Represents an amount less than $0.5

million or 0.5%, as applicable.

* Segment profit does not include

amortization and certain other items.

Revenues from our Europe segment in the first quarter of

2023 were $1,184 million, an increase of 2%, or $28 million,

compared to the first quarter of 2022. In local currency terms,

revenues increased by 9%, mainly due to higher revenues from

generic products and generic product launches.

In the first quarter of 2023, revenues were negatively impacted

by exchange rate fluctuations of $79 million, net of hedging

effects, compared to the first quarter of 2022. Revenues in the

first quarter of 2023 included $6 million from a negative hedging

impact, which is included in “Other” in the table below.

Revenues by Major Products and Activities

The following table presents revenues for our Europe segment by

major products and activities for the three months ended March 31,

2023 and 2022:

Three months ended

March 31,

Percentage

Change

2023

2022

2023-2022

(U.S. $ in millions)

Generic products

$

932

$

876

6%

AJOVY

36

30

17%

COPAXONE

59

72

(17%)

Respiratory products

68

71

(4%)

Other

89

107

(17%)

Total

$

1,184

$

1,156

2%

Generic products revenues (including OTC and biosimilar

products) in our Europe segment in the first quarter of 2023,

increased by 6% to $932 million, compared to the first quarter of

2022. In local currency terms, revenues increased by 12%, mainly

due to higher revenues from generic and OTC products and from

generic product launches.

AJOVY revenues in our Europe segment in the first quarter

of 2023 increased by 17% to $36 million, compared to $30 million in

the first quarter of 2022. In local currency terms, revenues

increased by 28%, mainly due to growth in European countries in

which AJOVY had previously been launched.

COPAXONE revenues in our Europe segment in the first

quarter of 2023 decreased by 17% to $59 million, compared to the

first quarter of 2022. In local currency terms, revenues decreased

by 12%, due to price reductions and a decline in volume resulting

from competing glatiramer acetate products.

Respiratory products revenues in our Europe segment in

the first quarter of 2023 decreased by 4% to $68 million compared

to the first quarter of 2022. In local currency terms, revenues

increased by 2%, mainly due to higher demand.

Europe Gross Profit

Gross profit from our Europe segment in the first quarter

of 2023 was $655 million, a decrease of 6% compared to $694 million

in the first quarter of 2022.

Gross profit margin for our Europe segment in the first

quarter of 2023 decreased to 55.3%, compared to 60.0% in the first

quarter of 2022. This decrease was mainly due to higher cost of

goods sold, mainly driven by rising costs due to inflationary and

other macroeconomic pressures.

Europe Profit

Profit from our Europe segment consists of gross profit less

R&D expenses, S&M expenses, G&A expenses and any other

income related to this segment. Segment profit does not include

amortization and certain other items.

Profit from our Europe segment in the first quarter of

2023 was $345 million, a decrease of 9%, compared to $381 million

in the first quarter of 2022. This decrease was mainly due to lower

gross profit as described above and exchange rate fluctuations.

International Markets Segment

Our International Markets segment includes all countries in

which we operate other than those in our North America and Europe

segments.

The following table presents revenues, expenses and profit for

our International Markets segment for the three months ended March

31, 2023 and 2022:

Three months ended March

31,

2023

2022

(U.S. $ in millions / % of

Segment Revenues)

Revenues

$

492

100%

$

492

100%

Gross profit

262

53.2%

286

58.1%

R&D expenses

20

4.0%

20

4.0%

S&M expenses

98

19.8%

97

19.8%

G&A expenses

31

6.4%

29

5.9%

Other income

(1)

§

(40)

(8.1%)

Segment profit*

$

114

23.1%

$

179

36.4%

* Segment profit does not include

amortization and certain other items.

§ Represents an amount less than 0.5%.

Revenues from our International Markets segment in the

first quarter of 2023 were $492 million, flat compared to the first

quarter of 2022. In local currency terms, revenues increased by 8%

compared to the first quarter of 2022.

In the first quarter of 2023, revenues were negatively impacted

by exchange rate fluctuations of $41 million, net of hedging

effects, compared to the first quarter of 2022. Revenues in the

first quarter of 2023 included a minimal hedging impact, compared

to a positive hedging impact of $12 million in the first quarter of

2022, which is included in “Other” in the table below.

Revenues by Major Products and Activities

The following table presents revenues for our International

Markets segment by major products and activities for the three

months ended March 31, 2023 and 2022:

Three months ended

March 31,

Percentage

Change

2023

2022

2023-2022

(U.S. $ in millions)

Generic products

$

400

$

388

3%

AJOVY

10

6

74%

COPAXONE

12

10

16%

Other

70

88

(20%)

Total

$

492

$

492

§

§ Represents an amount less than 0.5%.

Generic products revenues in our International Markets

segment in the first quarter of 2023, which include OTC products,

increased by 3% in U.S. dollars to $400 million. In local currency

terms, revenues increased by 9% compared to the first quarter of

2022, mainly due to higher revenues in certain markets, as well as

price increases largely as a result of rising costs due to

inflationary pressure, partially offset by regulatory price

reductions and generic competition to off-patented products in

Japan.

AJOVY was launched in certain markets in our

International Markets segment, including in Japan in August 2021.

We are moving forward with plans to launch AJOVY in other markets.

AJOVY revenues in our International Markets segment in the first

quarter of 2023 were $10 million, compared to $6 million in the

first quarter of 2022, mainly due to growth in volume.

COPAXONE revenues in our International Markets segment in

the first quarter of 2023 were $12 million compared to $10 million

in the first quarter of 2022.

AUSTEDO was launched in early 2021 in China and was also

launched in Israel during 2021. During the third quarter of 2022,

AUSTEDO was launched in Brazil. We continue with additional

submissions in various other markets.

International Markets Gross Profit

Gross profit from our International Markets segment in

the first quarter of 2023 was $262 million, a decrease of 8%

compared to $286 million in the first quarter of 2022.

Gross profit margin for our International Markets segment

in the first quarter of 2023 decreased to 53.2%, compared to 58.1%

in the first quarter of 2022. This decrease was mainly due to

regulatory price reductions and generic competition to off-patented

products in Japan, the positive hedging impact of $12 million in

the first quarter of 2022, as well as rising costs due to

inflationary and other macroeconomic pressures, partially offset by

price increases largely as a result of such rising costs.

International Markets Profit

Profit from our International Markets segment consists of gross

profit less R&D expenses, S&M expenses, G&A expenses

and any other income related to this segment. Segment profit does

not include amortization and certain other items.

Profit from our International Markets segment in the

first quarter of 2023 was $114 million, a decrease of 36%, compared

to $179 million in the first quarter of 2022. This decrease was

mainly due to higher other income and higher gross profit in the

first quarter of 2022 as compared to the first quarter of 2023.

Other Activities

We have other sources of revenues, primarily the sale of active

pharmaceutical ingredients ("APIs") to third parties, certain

contract manufacturing services and an out-licensing platform

offering a portfolio of products to other pharmaceutical companies

through our affiliate Medis. Our other activities are not included

in our North America, Europe or International Markets segments

described above.

Revenues from other activities in the first quarter of

2023 were $219 million, a decrease of 20% compared to the first

quarter of 2022. In local currency terms, revenues decreased by

19%.

API sales to third parties in the first quarter of 2023

were $132 million, a decrease of 27% in both U.S. dollars and local

currency terms, compared to the first quarter of 2022 as many

pharmaceutical customers de-stocked inventory levels that had

remained high through the COVID-19 pandemic.

Conference Call

Teva will host a conference call and live webcast including a

slide presentation on Wednesday, May 10, 2023, at 8:00 a.m. ET to

discuss its first quarter 2023 results and overall business

environment. A question & answer session will follow.

In order to participate, please register in advance here to obtain a local or toll-free phone

number and your personal pin.

A live webcast of the call will be available on Teva’s website

at: ir.tevapharm.com.

Following the conclusion of the call, a replay of the webcast

will be available within 24 hours on Teva's website.

About Teva

Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA) has

been developing and producing medicines to improve people’s lives

for more than a century. We are a global leader in generic and

innovative medicines with a portfolio consisting of over 3,500

products in nearly every therapeutic area. Around 200 million

people around the world take a Teva medicine every day, and are

served by one of the largest and most complex supply chains in the

pharmaceutical industry. Along with our established presence in

generics, we have significant innovative research and operations

supporting our growing portfolio of innovative medicines and

biopharmaceutical products. Learn more at

http://www.tevapharm.com.

Some amounts in this press release may not add up due to

rounding. All percentages have been calculated using unrounded

amounts.

Non-GAAP Financial Measures

This press release contains certain financial information that

differs from what is reported under accounting principles generally

accepted in the United States ("GAAP"). These non-GAAP financial

measures, including, but not limited to, non-GAAP operating income,

non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross

profit margin, Adjusted EBITDA, free cash flow, non-GAAP tax rate,

non-GAAP net income (loss) attributable to Teva and non-GAAP

diluted EPS, are presented in order to facilitate investors'

understanding of our business. We utilize certain non-GAAP

financial measures to evaluate performance, in conjunction with

other performance metrics. The following are examples of how we

utilize the non-GAAP measures: our management and board of

directors use the non-GAAP measures to evaluate our operational

performance, to compare against work plans and budgets, and

ultimately to evaluate the performance of management; our annual

budgets are prepared on a non-GAAP basis; and senior management’s

annual compensation is derived, in part, using these non-GAAP

measures. See the attached tables for a reconciliation of the GAAP

results to the adjusted non-GAAP measures. Investors should

consider non-GAAP financial measures in addition to, and not as

replacements for, or superior to, measures of financial performance

prepared in accordance with GAAP. We are not providing forward

looking guidance for GAAP reported financial measures or a

quantitative reconciliation of forward-looking non-GAAP financial

measures to the most directly comparable GAAP measure because we

are unable to predict with reasonable certainty the ultimate

outcome of certain significant items including, but not limited to,

the amortization of purchased intangible assets, legal settlements

and loss contingencies, impairment of long-lived assets and

goodwill impairment, without unreasonable effort. These items are

uncertain, depend on various factors, and could be material to our

results computed in accordance with GAAP.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, which are based on management’s current beliefs and

expectations and are subject to substantial risks and

uncertainties, both known and unknown, that could cause our future

results, performance or achievements to differ significantly from

that expressed or implied by such forward-looking statements. You

can identify these forward-looking statements by the use of words

such as “should,” “expect,” “anticipate,” “estimate,” “target,”

“may,” “project,” “guidance,” “intend,” “plan,” “believe” and other

words and terms of similar meaning and expression in connection

with any discussion of future operating or financial performance.

Important factors that could cause or contribute to such

differences include risks relating to:

- our ability to successfully compete in the marketplace,

including: that we are substantially dependent on our generic

products; concentration of our customer base and commercial

alliances among our customers; delays in launches of new generic

products; the increase in the number of competitors targeting

generic opportunities and seeking U.S. market exclusivity for

generic versions of significant products; our ability to develop

and commercialize biopharmaceutical products; competition for our

innovative medicines, including AUSTEDO, AJOVY and COPAXONE; our

ability to achieve expected results from investments in our product

pipeline; our ability to develop and commercialize additional

pharmaceutical products; and the effectiveness of our patents and

other measures to protect our intellectual property rights;

- our substantial indebtedness, which may limit our ability to

incur additional indebtedness, engage in additional transactions or

make new investments, may result in a further downgrade of our

credit ratings; and our inability to raise debt or borrow funds in

amounts or on terms that are favorable to us;

- our business and operations in general, including: the impact

of global economic conditions and other macroeconomic developments

and the governmental and societal responses thereto; the widespread

outbreak of an illness or any other communicable disease, or any

other public health crisis; effectiveness of our optimization

efforts; our ability to attract, hire, integrate and retain highly

skilled personnel; manufacturing or quality control problems;

interruptions in our supply chain; disruptions of information

technology systems; breaches of our data security; variations in

intellectual property laws; challenges associated with conducting

business globally, including political or economic instability,

major hostilities or terrorism; costs and delays resulting from the

extensive pharmaceutical regulation to which we are subject; the

effects of reforms in healthcare regulation and reductions in

pharmaceutical pricing, reimbursement and coverage; significant

sales to a limited number of customers; our ability to successfully

bid for suitable acquisition targets or licensing opportunities, or

to consummate and integrate acquisitions; and our prospects and

opportunities for growth if we sell assets;

- compliance, regulatory and litigation matters, including:

failure to comply with complex legal and regulatory environments;

increased legal and regulatory action in connection with public

concern over the abuse of opioid medications and any delay in our

ability to obtain sufficient participation of plaintiffs for the

nationwide settlement of our opioid-related litigation in the

United States; scrutiny from competition and pricing authorities

around the world, including our ability to successfully defend

against the U.S. Department of Justice criminal charges of Sherman

Act violations; potential liability for intellectual property right

infringement; product liability claims; failure to comply with

complex Medicare and Medicaid reporting and payment obligations;

compliance with anti-corruption, sanctions and trade control laws;

environmental risks; and the impact of ESG issues;

- other financial and economic risks, including: our exposure to

currency fluctuations and restrictions as well as credit risks;

potential impairments of our long-lived assets; the impact of

geopolitical conflicts including the ongoing conflict between

Russia and Ukraine; potential significant increases in tax

liabilities; and the effect on our overall effective tax rate of

the termination or expiration of governmental programs or tax

benefits, or of a change in our business; and other factors

discussed in this press release, in our Quarterly Report on Form

10-Q for the first quarter of 2023 and in our Annual Report on Form

10-K for the year ended December 31, 2022, including in the

sections captioned "Risk Factors” and “Forward Looking Statements.”

Forward-looking statements speak only as of the date on which they

are made, and we assume no obligation to update or revise any

forward-looking statements or other information contained herein,

whether as a result of new information, future events or otherwise.

You are cautioned not to put undue reliance on these

forward-looking statements.

Consolidated Statements of

Income (U.S. dollars in millions,

except share and per share data)

Three months ended

March 31,

2023

2022

Net revenues $

3,661

$

3,661

Cost of sales

2,079

1,921

Gross profit

1,582

1,740

Research and development expenses

234

225

Selling and marketing expenses

546

584

General and administrative expenses

296

296

Intangible assets impairments

178

149

Other asset impairments, restructuring and other items

96

128

Legal settlements and loss contingencies

233

1,124

Other income

(2

)

(52

)

Operating income (loss)

2

(713

)

Financial expenses, net

260

258

Income (loss) before income taxes

(258

)

(971

)

Income taxes (benefit)

(19

)

2

Share in (profits) losses of associated companies, net §

(21

)

Net income (loss)

(238

)

(952

)

Net income (loss) attributable to non-controlling interests

(33

)

3

Net income (loss) attributable to Teva

(205

)

(955

)

Earnings (loss) per share attributable to Teva:

Basic $

(0.18

)

(0.86

)

Diluted $

(0.18

)

(0.86

)

Weighted average number of shares (in millions):

Basic

1,115

1,107

Diluted

1,115

1,107

Non-GAAP net income attributable to Teva for

diluted earnings per share:*

457

609

Non-GAAP earnings per share attributable to Teva:*

Diluted $

0.40

0.55

Non-GAAP average number of shares (in millions):

Diluted

1,128

1,112

* See reconciliation attached.

Condensed Consolidated Balance Sheets

(U.S. dollars in millions)

March 31,

December 31,

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

2,143

$

2,801

Accounts receivables, net of allowance for credit losses of $88

million and $91 million as of March 31, 2023 and December 31, 2022

3,435

3,696

Inventories

4,118

3,833

Prepaid expenses

1,253

1,162

Other current assets

542

549

Assets held for sale

10

10

Total current assets

11,501

12,051

Deferred income taxes

1,572

1,453

Other non-current assets

450

441

Property, plant and equipment, net

5,751

5,739

Operating lease right-of-use assets

420

419

Identifiable intangible assets, net

5,964

6,270

Goodwill

17,799

17,633

Total assets

$

43,456

$

44,006

LIABILITIES & EQUITY

Current liabilities:

Short-term debt

$

1,023

$

2,109

Sales reserves and allowances

3,309

3,750

Accounts payables

2,381

1,887

Employee-related obligations

432

566

Accrued expenses

2,267

2,151

Other current liabilities

1,000

1,005

Total current liabilities

10,411

11,469

Long-term liabilities:

Deferred income taxes

550

548

Other taxes and long-term liabilities

3,869

3,847

Senior notes and loans

19,668

19,103

Operating lease liabilities

345

349

Total long-term liabilities

24,433

23,846

Equity:

Teva shareholders’ equity

7,860

7,897

Non-controlling interests

751

794

Total equity

8,612

8,691

Total liabilities and equity

$

43,456

$

44,006

TEVA PHARMACEUTICAL INDUSTRIES LIMITED CONSOLIDATED

STATEMENTS OF CASH FLOWS (U.S. dollars in millions)

Three months ended March 31,

2023

2022

Operating activities: Net income (loss)

$

(238

)

$

(952

)

Adjustments to reconcile net income (loss) to net cash provided by

operations: Depreciation and amortization

304

323

Impairment of goodwill, long-lived assets and assets held for sale

189

165

Net change in operating assets and liabilities

(364

)

559

Deferred income taxes – net and uncertain tax positions

(106

)

(175

)

Stock-based compensation

32

24

Other items

34

30

Net loss (gain) from investments and from sale of long lived assets

4

(23

)

Net cash provided by (used in) operating activities

(145

)

(49

)

Investing activities: Beneficial interest collected

in exchange for securitized accounts receivables

323

305

Purchases of property, plant and equipment

(139

)

(157

)

Proceeds from sale of business and long lived assets

2

25

Acquisition of businesses, net of cash acquired

-

(7

)

Purchases of investments and other assets

(4

)

(4

)

Other investing activities

(1

)

(1

)

Net cash provided by (used in) investing activities

181

161

Financing activities: Repayment of senior notes and

loans and other long term liabilities

(3,152

)

-

Proceeds from senior notes, net of issuance costs

2,451

-

Other financing activities

(5

)

2

Net cash provided by (used in) financing activities

(706

)

2

Translation adjustment on cash and cash equivalents

12

(62

)

Net change in cash, cash equivalents and restricted cash

(658

)

52

Balance of cash, cash equivalents and restricted cash at

beginning of period

2,834

2,198

Balance of cash, cash equivalents and restricted cash at end of

period

$

2,176

$

2,250

Reconciliation of cash, cash equivalents and restricted

cash reported in the consolidated balance sheets: Cash and cash

equivalents...

2,143

2,175

Restricted cash included in other current assets

33

75

Total cash, cash equivalents and restricted cash shown in the

statements of cash flows

2,176

2,250

Non-cash financing and investing activities:

Beneficial interest obtained in exchange for securitized accounts

receivables

$

334

$

299

Reconciliation of gross profit to Non-GAAP gross profit

Three months ended March 31, ($ in millions)

2023

2022

Gross profit

$

1,582

$

1,740

Gross profit margin

43.2

%

47.5

%

Increase (decrease) for excluded items: Amortization of purchased

intangible assets

145

178

Costs related to regulatory actions taken in facilities

1

1

Equity compensation

5

5

Accelerated depreciation

25

1

Other non-GAAP items*

38

61

Non-GAAP gross profit

$

1,796

$

1,986

Non-GAAP gross profit margin**

49.1

%

54.2

%

* Other non-GAAP items include

other exceptional items that we believe are sufficiently large that

their exclusion is important to facilitate an understanding of

trends in our financial results, such as inventory write offs,

primarily related to the rationalization of our plants and other

unusual events.

** Non-GAAP gross profit margin

is non-GAAP gross profit as a percentage of revenue.

Reconciliation of operating income (loss) to Non-GAAP operating

income (loss) Three months ended March 31, ($ in

millions)

2023

2022

Operating income (loss)

$

2

$

(713

)

Operating margin

0.1

%

(19.5

%)

Increase (decrease) for excluded items: Amortization of purchased

intangible assets

165

200

Legal settlements and loss contingencies

233

1,124

Impairment of long-lived assets

188

165

Restructuring costs

56

57

Costs related to regulatory actions taken in facilities

1

1

Equity compensation

32

24

Contingent consideration

20

33

Accelerated depreciation

25

1

Other non-GAAP items*

63

121

Non-GAAP operating income (loss)

$

785

$

1,013

Non-GAAP operating margin**

21.4

%

27.7

%

* Other non-GAAP items include

other exceptional items that we believe are sufficiently large that

their exclusion is important to facilitate an understanding of

trends in our financial results, such as inventory write offs,

primarily related to the rationalization of our plants, material

litigation fees and other unusual events.

** Non-GAAP operating margin is

Non-GAAP operating income as a percentage of revenues.

Reconciliation of net income (loss) attributable to Teva

to Non-GAAP net income (loss) attributable to Teva

Three months ended March 31, ($ in millions except per share

amounts)

2023

2022

Net income (loss) attributable to Teva

$

(205

)

$

(955

)

Increase (decrease) for excluded items: Amortization of purchased

intangible assets

165

200

Legal settlements and loss contingencies

233

1,124

Impairment of long-lived assets

188

165

Restructuring costs

56

57

Costs related to regulatory actions taken in facilities

1

1

Equity compensation

32

24

Contingent consideration

20

33

Accelerated depreciation

25

1

Financial expenses

23

11

Share in profits (losses) of associated companies- net

-

(22

)

Items attributable to non-controlling interests

(40

)

(11

)

Other non-GAAP items*

63

121

Corresponding tax effects and unusual tax items

(104

)

(140

)

Non-GAAP net income attributable to Teva

$

457

$

609

Non-GAAP tax rate**

15.5

%

18.5

%

GAAP Diluted earnings (loss) per share attributable to Teva

$

(0.18

)

$

(0.86

)

EPS difference***

0.59

1.41

Non-GAAP diluted EPS attributable to Teva***

$

0.40

$

0.55

Non-GAAP average number of shares (in millions)***

1,128

1,112

* Other non-GAAP items include

other exceptional items that we believe are sufficiently large that

their exclusion is important to facilitate an understanding of

trends in our financial results, such as certain inventory write

offs, primarily related to the rationalization of our plants,

material litigation fees and other unusual events.

** Non-GAAP tax rate is tax

expenses excluding the impact of non-GAAP tax adjustments presented

above as a percentage of income (loss) before income taxes

excluding the impact of non-GAAP adjustments presented above.

***EPS difference and diluted

non-GAAP EPS are calculated by dividing our non-GAAP net income

attributable to Teva by our non-GAAP diluted weighted average

number of shares.

Reconciliation of net income (loss) to adjusted EBITDA

Three months ended March 31, ($ in millions)

2023

2022

Net income (loss)

$

(238

)

$

(952

)

Increase (decrease) for excluded items: Financial expenses

260

258

Income taxes

(19

)

2

Share in profits (losses) of associated companies –net

(0

)

(21

)

Depreciation

139

123

Amortization

165

200

EBITDA

306

(390

)

Legal settlements and loss contingencies

233

1,124

Impairment of long-lived assets

188

165

Restructuring costs

56

57

Costs related to regulatory actions taken in facilities

1

1

Equity compensation

32

24

Contingent consideration

20

33

Other non-GAAP items*

63

121

Adjusted EBITDA

$

899

$

1,135

* Other non-GAAP items include

other exceptional items that we believe are sufficiently large that

their exclusion is important to facilitate an understanding of

trends in our financial results, such as inventory write offs,

primarily related to the rationalization of our plants, material

litigation fees and other unusual events.

Segment Information

North America

Europe

International Markets

Three months ended

March 31,

Three months ended

March 31,

Three months ended

March 31,

2023

2022

2023

2022

2023

2022

(U.S. $ in millions) (U.S. $ in millions)

(U.S. $ in millions) Revenues

$

1,766

$

1,737

$

1,184

$

1,156

$

492

$

492

Gross profit

812

890

655

694

262

286

R&D expenses

156

143

53

58

20

20

S&M expenses

223

245

187

196

98

97

G&A expenses

102

112

70

59

31

29

Other income

(1

)

(11

)

§

§

(1

)

(40

)

Segment profit

$

332

$

402

$

345

$

381

$

114

$

179

§ Represents an amount less than $0.5 million.

Reconciliation of our segment profit to consolidated

income before income taxes Three months ended March

31,

2023

2022

(U.S.$ in millions) North America profit

$

332

$

402

Europe profit

345

381

International Markets profit

114

179

Total reportable segment profit

791

962

Profit of other activities

(6

)

52

785

1,013

Amounts not allocated to segments: Amortization

165

200

Other asset impairments, restructuring and other items

96

128

Intangible asset impairments

178

149

Legal settlements and loss contingencies

233

1,124

Other unallocated amounts

112

127

Consolidated operating income (loss)

2

(713

)

Financial expenses - net

260

258

Consolidated income (loss) before income taxes

$

(258

)

$

(971

)

Segment revenues by major products and activities

(Unaudited)

Three months ended

March 31,

Percentage

Change

2023

2022

2022-2023

(U.S.$ in millions)

North America segment

Generic products

$

824

$

899

(8%)

AJOVY

49

36

36%

AUSTEDO

170

154

10%

BENDEKA/TREANDA

63

82

(23%)

COPAXONE

76

86

(12%)

Anda

424

342

24%

Other

160

139

15%

Total

1,766

1,737

2%

Three months ended

March 31,

Percentage

Change

2023

2022

2022-2023

(U.S.$ in millions)

Europe segment

Generic products

$

932

$

876

6%

AJOVY

36

30

17%

COPAXONE

59

72

(17%)

Respiratory products

68

71

(4%)

Other

89

107

(17%)

Total

1,184

1,156

2%

Three months ended

March 31,

Percentage

Change

2023

2022

2022-2023

(U.S.$ in millions)

International Markets segment

Generic products

$

400

$

388

3%

AJOVY

10

6

74%

COPAXONE

12

10

16%

Other

70

88

(20%)

Total

492

492

§

Free cash flow reconciliation (Unaudited)

Three months ended

March 31,

2023

2022

(U.S. $ in millions) Net cash provided by

(used in) operating activities

(145

)

(49

)

Beneficial interest collected in exchange for securitized trade

receivables

323

305

Purchases of property, plant and equipment

(139

)

(157

)

Proceeds from sale of business and long lived assets

2

25

Acquisition of businesses, net of cash acquired

-

(7

)

Free cash flow $

41

$

117

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510005122/en/

IR Contacts Ran Meir +1 (267) 468-4475 Yael Ashman +972

(3) 914 8262 Sanjeev Sharma +1 (267) 658-2700

PR Contacts Kelley Dougherty +1 (973) 832-2810

Eden Klein +972 (3) 906 2645

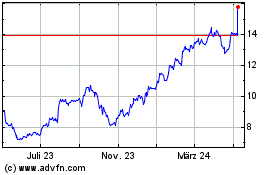

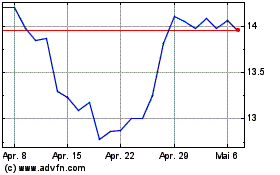

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024