Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA)

(“Teva”) announced today the early tender results in

connection with its previously announced tender offers (the

“Offers”) and that it is increasing the tender caps as

specified below for the following series of notes issued by finance

subsidiaries of Teva and guaranteed by Teva:

- 7.125% Senior Notes due 2025, CUSIP 88167AAN1 / ISIN

US88167AAN19 (Registered), CUSIP 88167A AM3 / ISIN US88167AAM36

(144A), CUSIP N8540W AC8 / ISIN USN8540WAC84 (Reg S), issued by

Teva Pharmaceutical Finance Netherlands III B.V. (the “Priority

1 Notes”);

- 6.000% Senior Notes due 2025, Common Code 219821395 / ISIN

XS2198213956 (Registered), Common Code 208396323 / ISIN

XS2083963236 (144A), Common Code 208396269 / ISIN XS2083962691 (Reg

S) issued by Teva Pharmaceutical Finance Netherlands II B.V. (the

“Priority 2 Notes”);

- 4.500% Senior Notes due 2025, CUSIP XS1813724603 (Registered),

Common Code 178945947 / ISIN XS1789459473 (144A), Common Code

178945602 / XS1789456024 (Reg S), issued by Teva Pharmaceutical

Finance Netherlands II B.V. (the “Priority 3 Notes,” and

together with the Priority 1 Notes and the Priority 2 Notes, the

“Pool 1 Notes”);

- 2.800% Senior Notes due 2023, CUSIP 88167A AD3 / US88167AAD37

(Registered), issued by Teva Pharmaceutical Finance Netherlands III

B.V. (the “Pool 2 Notes”);

- 6.000% Senior Notes due 2024, CUSIP 88167AAL5/ ISIN

US88167AAL52 (Registered), CUSIP 88167A AH4 / ISIN US88167AAH41

(144A), CUSIP N8540W AA2 / ISIN USN8540WAA29 (Reg S), issued by

Teva Pharmaceutical Finance Netherlands III B.V. (the “Pool 3

Notes”); and

- 3.150% Senior Notes due 2026, CUSIP 88167A AE1 / ISIN

US88167AAE10 (Registered), issued by Teva Pharmaceutical Finance

Netherlands III B.V. (the “Pool 4 Notes,” and together with

the Pool 1 Notes, the Pool 2 Notes and the Pool 3 Notes, the

“Notes”).

In addition, Teva has exercised its discretion to increase the

tender cap for the Pool 1 Notes from $1,600,000,000 (equivalent) to

$1,650,000,000 (equivalent) (the “Pool 1 Tender Cap”), the

tender cap for the Pool 2 Notes from $400,000,000 to $450,000,000

(the “Pool 2 Tender Cap”) and the tender cap for the Pool 3

Notes from $250,000,000 to $293,285,000 (the “Pool 3 Tender

Cap”). The tender cap for the Pool 4 Notes of $250,000,000 (the

“Pool 4 Tender Cap” and, together with the Pool 1 Tender

Cap, the Pool 2 Tender Cap and the Pool 3 Tender Cap, the

“Tender Caps”) will remain unchanged. Except as provided

above, the terms and conditions of the Offers remain unchanged,

including the combined aggregate purchase price (exclusive of

accrued and unpaid interest) of $2,500,000,000 (the “Total

Maximum Amount”).

Teva is engaging in the Offers to proactively manage and extend

the maturity profile of its debt. Teva expects to fund the Offers

with the proceeds from the registered public offering of Teva

Pharmaceutical Finance Netherlands II B.V. and Teva Pharmaceutical

Finance Netherlands III B.V. of debt securities that commenced

concurrently with the Offers and closed on March 9, 2023, with

gross proceeds, together with cash on hand, sufficient to fund the

Total Consideration for Notes to be purchased pursuant to the

Offers.

The respective principal amounts of all series of Notes that

were validly tendered and not validly withdrawn at or prior to 5:00

p.m., Eastern Time, on Friday, March 10, 2023 (the “Early Tender

Time”) are specified in the table below. Holders who validly

tendered and did not validly withdraw Notes at or prior to the

Early Tender Time and whose Notes are accepted for purchase

pursuant to the Offers will receive the applicable “Total

Consideration,” (as defined in the table below), which includes an

early tender premium of $30.00 per $1,000 or €30.00 per €1,000, as

applicable, principal amount of the Notes accepted for purchase

pursuant to the Offers (the “Early Tender Premium”).

The following table sets forth certain terms of the Offers:

Dollars or Euros per $1,000 or

€1,000, as applicable, principal amount

Capped Tender Offers

Title of Notes

Issuer

CUSIP / ISIN / Common

Code

Principal Amount

Tendered(2)

Tender Caps (purchase

price)(1)(2)

Principal Amount to be

Accepted

Acceptance Priority

Level(3)

Tender Offer Consideration

(4)

Early Tender Premium

Total Consideration

(4)(5)

Pool 1 Tender Offers

7.125% Senior Notes due 2025

Teva Pharmaceutical Finance

Netherlands III B.V.

88167AAN1 /US88167AAN19

(Registered)

88167AAM3 /

US88167AAM36(144A)

N8540WAC8/

USN8540WAC84 (Reg S)

$573,486,000

$1,650,000,000

(equivalent) (increased from the

original Tender Cap of $1,600,000,000 (equivalent))

$573,486,000

1

$982.50

$30.00

$1,012.50

6.000% Senior Notes due 2025

Teva Pharmaceutical Finance

Netherlands II B.V.

219821395 / XS2198213956

(Registered)

208396323/

XS2083963236 (144A)/

208396269/

XS2083962691 (Reg S)

€589,393,000

€589,393,000(2)

2

€988.75

€30.00

€1,018.75

4.500% Senior Notes due 2025

Teva Pharmaceutical Finance

Netherlands II B.V.

XS1813724603 (Registered)

XS1789459473/

178945947 (144A)

XS1789456024/178945602 (Reg

S)

€472,591,000

€404,054,000 (2) (6)

3

€965.00

€30.00

€995.00

Pool 2 Tender Offers

2.800% Senior Notes due 2023

Teva Pharmaceutical Finance

Netherlands III B.V.

88167AAD3 / US88167AAD37

(Registered)

$559,531,000

$450,000,000 (increased from the

original Tender Cap of $400,000,000)

$453,951,000(7)

4

$961.25

$30.00

$991.25

Pool 3 Tender Offers

6.000% Senior Notes due 2024

Teva Pharmaceutical Finance

Netherlands III B.V.

88167AAL5/ US88167AAL52

(Registered)

88167AAH4 / US88167AAH41

(144A)

N8540WAA2 / USN8540WAA29 (Reg

S)

$707,741,000

$293,285,000 (increased from the

original Tender Cap of $250,000,000)

$293,285,000(8)

5

$970.00

$30.00

$1,000.00

Pool 4 Tender Offers

3.150% Senior Notes due 2026

Teva Pharmaceutical Finance

Netherlands III B.V.

88167AAE1 / US88167AAE10

(Registered)

$122,336,000

$250,000,000

$122,336,000

6

$842.50

$30.00

$872.50

(1)

The Pool 1 Tender Cap of

$1,650,000,000 (equivalent) represents the maximum aggregate

purchase price in respect of Pool 1 Notes that will be purchased in

the Pool 1 Tender Offers. The Pool 2 Tender Cap of $450,000,000

represents the maximum aggregate purchase price in respect of Pool

2 Notes that will be purchased in the Pool 2 Tender Offers. The

Pool 3 Tender Cap of $293,285,000 represents the maximum aggregate

purchase price in respect of Pool 3 Notes that will be purchased in

the Pool 3 Tender Offers. The Pool 4 Tender Cap of $250,000,000

represents the maximum aggregate purchase price in respect of Pool

4 Notes that will be purchased in the Pool 4 Tender Offers. The

Tender Caps can be increased or decreased at Teva’s sole

discretion.

(2)

In order to determine whether the

Total Maximum Amount and Tender Caps have been reached, an exchange

rate of $1.0667 = €1.00 has been used, as determined at 10:00 a.m.

Eastern Time on the date of the Early Tender Time.

(3)

Subject to the Total Maximum

Amount, the Tender Caps and proration, the principal amount of each

series of Notes that is purchased in each of the Offers will be

determined in accordance with the applicable acceptance priority

level (in numerical priority order) specified in this column.

(4)

Excludes accrued and unpaid

interest, which also will be paid.

(5)

Includes the Early Tender

Premium.

(6)

Reflects the approximate

proration factor of 82.94% for Teva Pharmaceutical Finance

Netherlands II B.V.’s 4.500% Senior Notes due 2025.

(7)

Reflects the approximate

proration factor of 81.20% for Teva Pharmaceutical Finance

Netherlands III B.V.’s. 2.800% Senior Notes due 2023

(8)

Reflects the approximate

proration factor of 39.38% for Teva Pharmaceutical Finance

Netherlands IiI B.V.’s 6.000% Senior Notes due 2024.

Subject to the terms and conditions of the Offers, Teva expects

that it will accept for purchase Notes validly tendered and not

validly withdrawn at or prior to the Early Tender Time for a

combined aggregate purchase price (exclusive of accrued and unpaid

interest but inclusive of tender premium) equal to approximately

the Total Maximum Amount. The settlement for the Notes accepted by

Teva in connection with the Early Tender Time is expected to take

place on Wednesday, March 15, 2023 (the “Settlement Date”).

The amount of each series of Notes that is to be purchased on the

Settlement Date will be determined in accordance with the

acceptance priority levels and the proration procedures described

in the Offer to Purchase, dated February 27, 2023 (the “Offer to

Purchase”), subject in each case to the Total Maximum Amount

and the Tender Caps. It is expected that the Notes tendered with

Acceptance Priority Levels 1, 2 and 6 shall be accepted in full

without proration. It is expected that the Notes with Acceptance

Priority Levels 3, 4 and 5 shall be accepted subject to a proration

factor of approximately 82.94%, 81.20% and 39.38%, respectively.

The amounts of each series of Notes expected to be accepted are

shown in the table. As a result of the Offers, the Company will

purchase approximately $1,633 million (equivalent) aggregate

principal amount of the Pool 1 Notes, approximately $454 million

aggregate principal amount of the Pool 2 Notes, approximately $293

million aggregate principal amount of the Pool 3 Notes and

approximately $122 million aggregate principal amount of the Pool 4

Notes.

The Withdrawal Deadline has passed and has not been extended.

Notes tendered pursuant to the Offers may no longer be withdrawn,

except as required by law.

The Offers will expire at 5:00 p.m., Eastern Time, on Monday,

March 27, 2023, unless extended or earlier terminated (as it may be

extended or earlier terminated, the “Expiration Time”).

However, as Teva intends, subject to the terms and conditions of

the Offers, to accept for purchase the Total Maximum Amount on the

Settlement Date, further tenders of Notes prior to the Expiration

Time will not be accepted for purchase.

Teva’s obligation to accept for purchase and to pay for the

Notes validly tendered (and not validly withdrawn) pursuant to the

Offers is subject to the satisfaction or waiver of certain

conditions set out in the Offer to Purchase. Teva reserves the

right, subject to applicable law and the terms of the Offers, to

waive any and all conditions to the Offers or to otherwise amend,

extend or terminate the Offers in any respect.

Citigroup Global Markets Europe AG, Goldman Sachs & Co. LLC,

Mizuho Securities Europe GmbH, MUFG Securities (Europe) N.V. and

PNC Capital Markets LLC are acting as the Dealer Managers for the

Offer. The information and tender agent (the “Information and

Tender Agent”) for the Offers is D.F. King. Copies of the Offer

to Purchase are available by contacting the Information and Tender

Agent at (800) 713-9960 (toll-free), (212) 269-5550 (collect) or

+44 20-7920-9700 (UK) or by email at teva@dfkingltd.com. All

documentation relating to the offer, together with any updates,

will be available via the Offer Website:

https://sites.dfkingltd.com/teva. Questions regarding the Offers

should be directed to Citigroup Global Markets Europe AG, at +44 20

7986 8969 or by email at liabilitymanagement.europe@citi.com, to

Goldman Sachs & Co. LLC at (212) 902-5962 or +1 (800) 828- 3182

(toll-free) or by email at GS-LM-NYC@gs.com, to Mizuho Securities

Europe GmbH, at +44 20 7090 6134 or +1 (866) 271-7403 (toll-free)

or by email at liabilitymanagement@uk.mizuho-sc.com, to MUFG

Securities (Europe) N.V. at +33 1 70 91 42 55 (Europe), +1 (212)

405-7481 (U.S.) or +1 (877) 744-4532 (toll-free) and to PNC Capital

Markets LLC, at +1 (855) 881-0697 or by email at

secsett@pnc.com.

This announcement shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any Notes. The

Offers are being made only pursuant to the Offer to Purchase and

only in such jurisdictions as is permitted under applicable

law.

About Teva

Teva Pharmaceutical Industries Ltd. (NYSE and TASE: TEVA) has

been developing and producing medicines to improve people’s lives

for more than a century. We are a global leader in generic and

innovative medicines with a portfolio consisting of over 3,500

products in nearly every therapeutic area. Around 200 million

people around the world take a Teva medicine every day, and are

served by one of the largest and most complex supply chains in the

pharmaceutical industry. Along with our established presence in

generics, we have significant innovative medicines research and

operations supporting our growing portfolio of innovative medicines

and biopharmaceutical products.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, which are based on management’s current beliefs and

expectations and are subject to substantial risks and

uncertainties, both known and unknown, that could cause our future

results, performance or achievements to differ significantly from

that expressed or implied by such forward-looking statements.

Important factors that could cause or contribute to such

differences include risks relating to: settlement of the tender

offers for certain outstanding notes; our substantial indebtedness,

which may limit our ability to incur additional indebtedness,

engage in additional transactions or make new investments, may

result in a further downgrade of our credit ratings; and our

inability to raise debt or borrow funds in amounts or on terms that

are favorable to us; and other factors discussed in our Annual

Report on Form 10-K for the year ended December 31, 2022, including

the sections thereof captioned “Risk Factors” and

“Forward Looking Statements,” and in our subsequent

quarterly reports on Form 10-Q and other filings with the

Securities and Exchange Commission, which are available at

www.sec.gov. Forward-looking statements speak only as of the date

on which they are made, and we assume no obligation to update or

revise any forward-looking statements or other information

contained herein, whether as a result of new information, future

events or otherwise. You are cautioned not to put undue reliance on

these forward-looking statements. No assurance can be given that

the transactions described herein will be consummated or as to the

ultimate terms of any such transactions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230313005492/en/

IR Contacts:

Ran Meir United States (267) 468-4475

Yael Ashman Israel 972 (3) 914-8262

PR Contacts:

Kelley Dougherty United States (973) 832-2810

Eden Klein Israel 972 (3) 906-2645

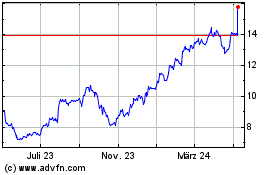

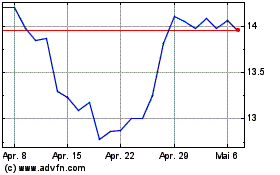

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024