Trending: Telefonica Sees Revenue, Earnings Growth in 2023

23 Februar 2023 - 3:29PM

Dow Jones News

1400 GMT - Telefonica is among the most mentioned companies

across news items over the past 12 hours, according to Factiva

data. The Spanish telecommunications company reported a swing to a

net profit for the fourth quarter on higher revenue, kept its

dividend unchanged at 0.30 euros ($0.32) a share and said it

expects organic growth in the low single percentage digits for both

revenue and operating income before depreciation and

amortization--a key profitability metric--in 2023. The company said

it anticipates a ratio of capital expenditure excluding spectrum to

sales of around 14% this year, down from 14.8% in 2022.

Telefonica's 2023 outlook looks mixed, as consensus expectations

for 1% growth in both revenue and Oibda are more conservative than

the company's guidance while its target for the capex-to-sales

ratio is higher than the consensus view of 13.3%, Bryan Garnier

analyst Thomas Coudry said in a research note. Dow Jones & Co.

owns Factiva. (adria.calatayud@dowjones.com)

(END) Dow Jones Newswires

February 23, 2023 09:14 ET (14:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

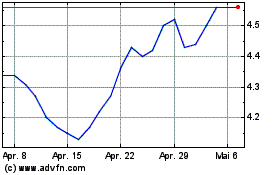

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

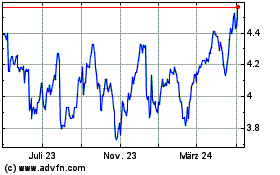

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024