Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

14 November 2022 - 11:41PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-257098

November 14, 2022

TransAlta Corporation

Pricing Term Sheet

This pricing term

sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement, dated November 14, 2022 (the “Preliminary Prospectus Supplement”). The information in this pricing term sheet supplements the Preliminary

Prospectus Supplement and updates and supersedes the information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Terms used and not defined herein have the

meanings assigned in the Preliminary Prospectus Supplement.

|

|

|

| Issuer: |

|

TransAlta Corporation |

|

|

| Expected Ratings:(1) |

|

Ba1 / BB+ |

|

|

| Security Type: |

|

SEC-registered green senior unsecured notes |

|

|

| Size/Gross Proceeds: |

|

US$400,000,000 |

|

|

| Maturity: |

|

November 15, 2029 |

|

|

| Coupon: |

|

7.750% per annum, payable semi-annually |

|

|

| Price: |

|

100%, plus accrued interest, if any from November 17, 2022 |

|

|

| Yield to Maturity: |

|

7.750% |

|

|

| Spread: |

|

+ 390.5 basis points |

|

|

| Benchmark Treasury: |

|

UST 1.750% due November 15, 2029 |

|

|

| Treasury Yield: |

|

3.845% |

|

|

| Trade Date: |

|

November 14, 2022 |

|

|

|

|

|

| Settlement: |

|

November 17, 2022 (T+3) |

|

|

|

|

|

|

We expect that delivery of the Notes will be made to investors on or about November 17, 2022, which will be the third business day following the date of this Prospectus Supplement (such settlement being referred to

as “T+3”). Under Rule 15c6-1 under the U.S. Exchange Act, trades in the secondary market are required to settle in two business days, unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade Notes prior to the delivery of the Notes hereunder may be required, by virtue of the fact that the Notes initially settle in T+3, to specify an alternate settlement arrangement at the time of any such trade

to prevent a failed settlement. Purchasers of Notes who wish to trade Notes prior to their date of delivery hereunder should consult their advisors. |

|

|

| Interest Payment Dates: |

|

November 15 and May 15 of each year, commencing May 15, 2023 to the persons in whose names the Notes are registered at the close of business on the preceding May 1 or November 1,

respectively |

|

|

| Equity Clawback: |

|

Up to 35% in aggregate principal amount of the Notes at 107.750%, plus accrued and unpaid interest, if any, to, but not including, the redemption date, prior to November 15, 2025, provided that at least 65% of the

aggregate principal amount of the Notes remains outstanding, and redemption occurs within 180 days of the closing of any Equity Offering |

|

|

| Optional Redemption: |

|

On or after November 15, 2025, the Issuer may redeem the Notes on any one or more occasions, in whole or in part, at the following redemption prices (expressed as a percentage of principal amount), plus accrued and

unpaid interest, if any, to, but excluding, the redemption date, if redeemed during the 12-month period commencing on November 15 of the years set forth

below: |

|

|

|

| On or after: |

|

Price: |

| 2025 |

|

103.875% |

| 2026 |

|

101.938% |

| 2027 and thereafter |

|

100.000% |

|

|

|

|

|

|

|

| Make-whole redemption: |

|

Prior to November 15, 2025, at a make-whole premium discounted based on the Treasury Rate + 50 basis points |

|

|

|

| Change of control: |

|

Issuer to offer to repurchase the Notes at a price equal to 101% of principal plus accrued and unpaid interest, if any, to, but excluding, the repurchase date upon the occurrence of a Change of Control Triggering Event |

|

|

| CUSIP No.: |

|

89346D AH0 |

|

|

| ISIN No.: |

|

US89346DAH08 |

|

|

| Joint Book-Running Managers: |

|

RBC Capital Markets, LLC |

|

|

CIBC World Markets Corp. |

|

|

BofA Securities, Inc. |

|

|

| Co-Managers: |

|

Scotia Capital (USA) Inc. |

|

|

BMO Capital Markets Corp. |

|

|

TD Securities (USA) LLC |

|

|

National Bank of Canada Financial Inc. |

|

|

MUFG Securities Americas Inc. |

|

|

Desjardins Securities Inc. |

|

|

ATB Capital Markets Inc. |

|

|

Mizuho Securities USA LLC |

|

|

Loop Capital Markets LLC |

| (1) |

Note: a securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time |

The issuer has filed a registration statement (including a prospectus) with the United States

Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for

more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will

arrange to send you the prospectus if you request it by calling RBC Capital Markets, LLC toll free at 1-866-375-6829.

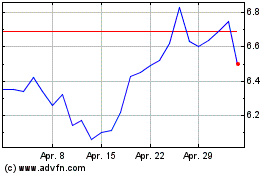

TransAlta (NYSE:TAC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

TransAlta (NYSE:TAC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024