BellSouth Savings and Security Plan

Statement of Changes in Net Assets Available For Benefits

For the Year Ended December 31, 2021

(Dollars in Thousands)

| | | | | |

Net Assets Available for Benefits, December 31, 2020 | $ | 2,537,524 | |

| Changes in Net Assets: | |

| Contributions: | |

| Participant contributions | 62,478 | |

| Employer contributions | 16,260 | |

| Rollover contributions | 8,981 | |

| 87,719 | |

| |

| Investment Income: | |

| Net income from investment in AT&T Savings Group Investment Trust | 13,064 | |

| |

| Dividends | 19,962 | |

| Net appreciation in fair value of investments | 224,750 | |

| 257,776 | |

| |

| Interest income on notes receivable from participants | 2,787 | |

| |

| Distributions | (223,817) | |

| Administrative expenses | (1,434) | |

| |

| Net Increase | 123,031 | |

| |

Net Assets Available for Benefits, December 31, 2021 | $ | 2,660,555 | |

| | |

| |

See Notes to Financial Statements. | |

BellSouth Savings and Security Plan

Notes to Financial Statements

(Dollars in Thousands)

NOTE 1. PLAN DESCRIPTION

The BellSouth Savings and Security Plan (Plan) is a defined contribution plan originally established by BellSouth Corporation (BellSouth) to provide a convenient way for eligible nonmanagement employees of participating BellSouth companies to save on a regular and long-term basis. In December 2006, BellSouth was acquired by AT&T Inc. (AT&T or the Company). The following description of the Plan provides only general information. The Plan has detailed provisions covering participant eligibility, participant allotments from pay, participant withdrawals, participant loans, employer contributions and related vesting of contributions and Plan expenses. The Plan text and prospectus include complete descriptions of these and other Plan provisions. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

The Plan participates in the AT&T Savings Group Investment Trust (Group Trust) with respect to the AT&T Stable Value Fund, International Stock Fund, AT&T Total Return Bond Fund and AT&T U.S. Stock Fund. The Bank of New York Mellon Corporation (BNY Mellon) serves as trustee for both the Group Trust and the trust holding the Plan’s assets, known as the BellSouth Savings and Security Plan Trust. Fidelity Investments Institutional Operations Company, Inc. (Fidelity) serves as recordkeeper for the Plan.

During 2021 and 2020, participants could invest their contributions in one or more of fourteen funds in 1% increments:

| | | | | |

| • AT&T Shares Fund | • T. Rowe Price Mid-Cap Growth Fund*** |

| • Bond Fund ** | • Indexed Stock Fund |

| • Balanced Fund | • Russell 1000 Growth Index |

• AT&T Stable Value Fund * | • LifePath Funds (based on retirement date) |

• DFA U.S. Small Cap Value Portfolio ** | • Small and Mid-Sized U.S. Stock Index Fund |

| • DFA U.S. Large Cap Value Portfolio II ** | • International Stock Index Fund |

| • AT&T Total Return Bond Fund *† | • AT&T International Stock Fund * |

| • Total U.S. Stock Market Index Fund † | • AT&T U.S. Stock Fund *† |

* Investment fund option of the Group Trust

** Effective as of market close on February 28, 2020, the DFA U.S. Large Cap Value Portfolio II, DFA U.S. Small Cap Value Portfolio and Bond Fund ceased to exist as investment options.

*** Effective as of market close on March 31, 2021, the T.Rowe Price Mid-Cap Growth Fund ceased to exist as an investment option.

† Effective as of market open on March 2, 2020, the AT&T Total Return Bond Fund, Total U.S. Stock Market Index Fund and AT&T U.S. Stock Fund were introduced to plan participants for investing.

Participants contribute to the Plan through payroll allotments. Participants may also contribute amounts representing distributions from other qualified defined benefit and defined contribution plans (rollovers). The Company contributes to the Plan by matching the participants’ contributions based on the provisions of the Plan. All contributions are participant directed.

Dividends on shares in the AT&T Shares Fund can either be reinvested in the AT&T Shares Fund on a quarterly basis, or paid into a short-term interest bearing fund for distribution before the end of the year. Interest earned on dividends held in the short-term interest bearing fund are used to purchase additional units of the AT&T Shares Fund in the participant’s account. During 2021, Plan participants elected to receive $1,222 in dividend distributions. This amount is included in distributions on the Plan’s Statement of Changes in Net Assets Available for Benefits.

Each participant is entitled to exercise voting rights attributable to the AT&T shares allocated to their account and is notified by the Company prior to the time that such rights may be exercised. Subject to the fiduciary provisions of ERISA, the trustee will not vote any allocated shares for which instructions have not been given by a participant. The trustee votes any unallocated shares in the same proportion as it votes those shares that were allocated to the extent the proportionate

vote is consistent with the trustee’s fiduciary obligations under ERISA. Participants have the same voting rights in the event of a tender or exchange offer.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

Although it has not expressed any intent to do so, AT&T has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA and collectively bargained agreements. In the event that the Plan is terminated, subject to the conditions set forth by ERISA, the account balances of all participants shall be 100% vested.

Administrative Expenses Each participant in the Plan may be charged for investment manager fees and administrative expenses, including, trustee and other expenses considered reasonable by the Plan administrator. Investment manager fees are charged through the applicable investment option. Administrative fees are divided on a pro rata basis among investment options of the participant. An additional fee is charged to individual participants for various services provided by the Plan’s recordkeeper and other service providers. Certain expenses are paid by the Plan, Group Trust, or Company.

AT&T has implemented certain benefit plan provisions of the March 2020 Coronavirus Aid, Relief, and Economic Security Act (CARES). The CARES Act includes funding relief for defined benefit plan sponsors, distribution and plan loan changes for participants and beneficiaries, and delay of minimum required distributions otherwise required in 2020. The following provisions of the CARES Act were implemented.

•Added an in-service withdrawal option for “coronavirus-related distributions” of up to $100. Participants may repay all or a portion of distributions within three years, and repayments will not count towards annual contribution limits. Distributions under this option will not have tax withheld, and for those under 59 ½, will not be subject to a 10% early withdrawal penalty;

•Increased limits on plan loans to $100 (from $50); or 100% (from 50%) of the present value of the participant’s vested benefit, during the 180-day period from March 27, 2020 to September 23, 2020;

•Waived required minimum distributions (RMD) otherwise due to be made in 2020.

NOTE 2. ACCOUNTING POLICIES

The accompanying financial statements were prepared in conformity with U.S. generally accepted accounting principles (GAAP), which require management to make estimates that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates. Distributions are recorded when paid.

Investment Valuation and Income Recognition Investments are stated at fair value except those investments that are fully benefit responsive which are stated at contract value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 3 for discussion of fair value measurements. Investments in securities traded on a national securities exchange are valued at the last reported sales price on the last business day of the year. If no sale was reported on that date, they are valued at the last reported bid price. Shares of registered investment companies (i.e. mutual funds) are valued based on quoted market prices, which represent the net asset value of shares held at year-end. Over-the-counter securities (OTC) and government obligations are valued at the bid price or the average of the bid and asked price on the last business day of the year from published sources where available and, if not available, from other sources considered reliable. Depending on the types and contractual terms of OTC derivatives, fair value is measured using valuation techniques such as Black-Scholes option price models, simulation models, or a combination of various models.

Common/collective trust funds and 103-12 investment entities (i.e. an investment entity that holds the assets of two or more plans which are not members of a related group or employee benefit plan) are valued at quoted redemption values that represent the net asset values (NAV) of units held at year-end. Publicly traded partnerships are valued using trades on a national securities exchange based on the last reported sales price on the last business day of the year.

Investment contracts held by a defined contribution plan are required to be reported at contract value. Contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The Group Trust invests in fully benefit-responsive guaranteed investment contracts (GICs) and synthetic guaranteed investment contracts (Synthetic GICs). The underlying investments of the Synthetic GICs are owned by the Group Trust and are comprised of corporate bonds and notes, registered investment companies and government securities and are also valued as described above. The contract value of the fully benefit-responsive investment contracts represents contributions plus earnings, less participant withdrawals and administrative expenses.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

Purchases and sales of securities are reflected as of the trade date. Dividend income is recognized on the ex-dividend date. Interest earned on investments is recognized on the accrual basis. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold as well as held during the year. Transfers in and out of Level 1 (quoted market prices), Level 2 (other significant observable inputs) and Level 3 (significant unobservable inputs) are recognized on the period ending date.

Notes Receivable from Participants Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued, but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2021 or 2020. If a participant ceases to make loan repayments and the Plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a distribution is recorded.

Recent Accounting Standards

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-13, Disclosure Framework- Changes to the Disclosure Requirements for Fair Value Measurement. This amendment to the Accounting Standards Codification Topic 820, Fair Value Measurement, eliminates, adds and modifies certain disclosure requirements for fair value measurements. The amendment was effective for fiscal years beginning on or after December 15, 2019. The adoption of this standard did not significantly impact the Plan's financial statements.

NOTE 3. FAIR VALUE MEASUREMENTS

Accounting Standards Codification 820, Fair Value Measurement, establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 Inputs to the valuation methodology include:

• Quoted prices for similar assets and liabilities in active markets;

• Quoted prices for identical or similar assets or liabilities in inactive markets;

• Inputs other than quoted market prices that are observable for the asset or liability;

• Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The valuation methodologies described in Note 2 may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while Plan management believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There have been no changes in the methodologies used at December 31, 2021 and 2020. See Note 4 for fair value hierarchy for the Group Trust’s and Plan’s investments.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

NOTE 4. INVESTMENTS

The Plan held investments in its own trust and in the Group Trust as of December 31, 2021 and 2020.

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets, other than the Plan’s investment in the Group Trust, at fair value as of December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Plan Assets at Fair Value as of December 31, 2021 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Interest bearing investments | $ | 4,299 | | | $ | — | | | $ | — | | | $ | 4,299 | |

| AT&T common stock | 228,815 | | | — | | | — | | | 228,815 | |

| Mutual funds or exchange-traded funds | 21,076 | | | — | | | — | | | 21,076 | |

| Futures | 214 | | | — | | | — | | | 214 | |

| Total assets in fair value hierarchy | $ | 254,404 | | | $ | — | | | $ | — | | | $ | 254,404 | |

| | | | | | | |

| Common/collective trusts measured at net asset value: | | | | | | | |

U.S. index stock fund1 | | | | | | | 807,649 | |

International index stock fund2 | | | | | | | 81,116 | |

Blended equity & debt3 | | | | | | | 846,690 | |

Bond index fund4 | | | | | | | 29,784 | |

| Total assets at fair value | | | | | | | $ | 2,019,643 | |

| | | | | | | | |

1 This category includes common/collective trust funds with an objective of providing investment results that approximate the overall performance of the common stocks included in the Standard and Poor’s Composite Stock Price Index of 500 stocks (the “S&P 500®”), the Russell 1000 Index, the Dow Jones U.S. Completion Total Stock Market Index and the Dow Jones U.S. Total Stock Market Index. There are currently no redemption restrictions on these investments.

2 This category includes a common/collective trust fund with an objective of providing investment results that approximate the overall performance of the common stocks included in the All Country World Index ex U.S. Index. Except for a short-term trading fee applicable to certain participant transactions, there are currently no redemption restrictions on this investment.

3 This category includes common/collective trust funds also known as LifePath Portfolios which are well diversified portfolios that adjust the mix of the various underlying investments over time. The change in allocation of investments is designed to move from a more aggressive investment strategy to a more conservative strategy as the participants come closer to retirement. The year associated with the fund identification denotes the projected year of retirement of the participant selecting the fund. There are currently no redemption restrictions on these investments.

4 This category includes a common/collective trust fund with an objective to approximate the overall performance of the Barclays Capital Aggregate Bond Index. There are currently no redemption restrictions on these investments.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets, other than the Plan’s investment in the Group Trust, at fair value as of December 31, 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Plan Assets at Fair Value as of December 31, 2020 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Interest bearing investments | $ | 4,299 | | | $ | — | | | $ | — | | | $ | 4,299 | |

| AT&T common stock | 281,752 | | | — | | | — | | | 281,752 | |

| Mutual funds or exchange-traded funds | 363,141 | | | — | | | — | | | 363,141 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Futures | 405 | | | — | | | — | | | 405 | |

| Total assets in fair value hierarchy | $ | 649,597 | | | $ | — | | | $ | — | | | $ | 649,597 | |

| | | | | | | |

| Common/collective trusts measured at net asset value: | | | | | | | |

U.S. index stock fund1 | | | | | | | 571,267 | |

International index stock fund2 | | | | | | | 66,738 | |

Blended equity & debt3 | | | | | | | 573,573 | |

Bond index fund4 | | | | | | | 30,264 | |

| Total assets at fair value | | | | | | | $ | 1,891,439 | |

| | | | | | | | |

1 This category includes common/collective trust funds with an objective of providing investment results that approximate the overall performance of the common stocks included in the Standard and Poor’s Composite Stock Price Index of 500 stocks (the “S&P 500®”), the Russell 1000 Index and the Dow Jones U.S. Completion Total Stock Market Index. There are currently no redemption restrictions on these investments.

2 This category includes a common/collective trust fund with an objective of providing investment results that approximate the overall performance of the common stocks included in the All Country World Index ex U.S. Index. Except for a short-term trading fee applicable to certain participant transactions, there are currently no redemption restrictions on this investment.

3 This category includes common/collective trust funds also known as LifePath Portfolios which are well diversified portfolios that adjust the mix of the various underlying investments over time. The change in allocation of investments is designed to move from a more aggressive investment strategy to a more conservative strategy as the participants come closer to retirement. The year associated with the fund identification denotes the projected year of retirement of the participant selecting the fund. There are currently no redemption restrictions on these investments.

4 This category includes a common/collective trust fund with an objective to approximate the overall performance of the Barclays Capital Aggregate Bond Index. There are currently no redemption restrictions on these investments.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

AT&T Savings Group Investment Trust Investments

AT&T established the Group Trust to manage assets of pooled investment options among various AT&T sponsored employee benefit trusts. Each participating trust’s interest in the investment fund options (i.e., separate accounts) of the Group Trust is based on account balances of the participants and their elected investment fund options. The Group Trust assets are allocated among the participating plans by assigning to each trust those transactions (primarily contributions, distributions, and expenses) that can be specifically identified and by allocating investment income and administrative expenses to the individual plans on a daily basis based on each participant’s account balance within each investment fund option.

The Plan’s interest in each of the investment fund options within the Group Trust is disclosed below as of December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AT&T Total Return Bond Fund | | AT&T U.S. Stock Fund | | AT&T International Stock Fund | | AT&T Stable Value Fund | | Group Trust |

| AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | Total |

| Interest bearing cash | $ | 2,369 | | $ | 25 | | | $ | — | | $ | — | | | $ | — | | $ | — | | | $ | — | | $ | — | | | $ | 2,394 | |

| Foreign cash | 11,034 | | 114 | | | 3 | | — | | | 154 | | 3 | | | — | | — | | | 11,308 | |

| Mortgage-backed securities | 415,814 | | 4,312 | | | — | | — | | | — | | — | | | — | | — | | | 420,126 | |

| Corporate debt | 1,388,135 | | 14,395 | | | — | | — | | | — | | — | | | — | | — | | | 1,402,530 | |

| Government securities | 443,124 | | 4,595 | | | — | | — | | | — | | — | | | — | | — | | | 447,719 | |

| Common/collective trust funds | 1,410,136 | | 14,623 | | | 2,994,247 | | 15,455 | | | 494,495 | | 11,344 | | | — | | — | | | 4,940,300 | |

| Equities - common stock | — | | — | | | 449,000 | | 2,318 | | | 169,697 | | 3,893 | | | — | | — | | | 624,908 | |

| Equities - preferred stock | — | | — | | | — | | — | | | 2,328 | | 53 | | | — | | — | | | 2,381 | |

| Futures | (3,557) | | (37) | | | — | | — | | | — | | — | | | — | | — | | | (3,594) | |

| Registered investment companies | 1,272 | | 13 | | | 66,134 | | 341 | | | 1,862 | | 43 | | | 232,913 | | 18,310 | | | 320,888 | |

| Group Trust investments at fair value | 3,668,327 | | 38,040 | | | 3,509,384 | | 18,114 | | | 668,536 | | 15,336 | | | 232,913 | | 18,310 | | | 8,168,960 | |

| Unsettled trades/other | (389,227) | | (4,036) | | | (447) | | (2) | | | 1,342 | | 31 | | | (1,211) | | (98) | | | (393,648) | |

| Fully benefit-responsive investments contracts valued at contract value | — | | — | | | — | | — | | | — | | — | | | 6,424,117 | | 504,979 | | | 6,929,096 | |

| Group Trust net assets | $ | 3,279,100 | | $ | 34,004 | | | $ | 3,508,937 | | $ | 18,112 | | | $ | 669,878 | | $ | 15,367 | | | $ | 6,655,819 | | $ | 523,191 | | | $ | 14,704,408 | |

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

The Plan’s interest in each of the investment fund options within the Group Trust is disclosed below as of December 31, 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AT&T Total Return Bond Fund | | AT&T U.S. Stock Fund | | AT&T International Stock Fund | | AT&T Stable Value Fund | | Group Trust |

| AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | AT&T Master Trust | BellSouth Savings and Security Plan | | Total |

| Interest bearing cash | $ | 15,725 | | $ | 111 | | | $ | — | | $ | — | | | $ | — | | $ | — | | | $ | — | | $ | — | | | $ | 15,836 | |

| Foreign cash | 12,121 | | 85 | | | 3 | | — | | | 49 | | 2 | | | — | | — | | | 12,260 | |

| Mortgage-backed securities | 538,031 | | 3,790 | | | — | | — | | | — | | — | | | — | | — | | | 541,821 | |

| Corporate debt | 1,230,950 | | 8,671 | | | — | | — | | | — | | — | | | — | | — | | | 1,239,621 | |

| Government securities | 317,787 | | 2,239 | | | — | | — | | | — | | — | | | — | | — | | | 320,026 | |

| Common/collective trust funds | 1,353,356 | | 9,534 | | | 2,618,393 | | 3,613 | | | 465,970 | | 7,663 | | | 2,279 | | 178 | | | 4,460,986 | |

| Equities - common stock | — | | — | | | 434,437 | | 599 | | | 181,625 | | 2,986 | | | — | | — | | | 619,647 | |

| Equities - preferred stock | — | | — | | | — | | — | | | 2,376 | | 39 | | | — | | — | | | 2,415 | |

| Futures | (2,492) | | (18) | | | — | | — | | | — | | — | | | — | | — | | | (2,510) | |

| Registered investment companies | 288,210 | | 2,030 | | | 49,779 | | 69 | | | 3,376 | | 55 | | | 114,764 | | 8,943 | | | 467,226 | |

| Group Trust investments at fair value | 3,753,688 | | 26,442 | | | 3,102,612 | | 4,281 | | | 653,396 | | 10,745 | | | 117,043 | | 9,121 | | | 7,677,328 | |

| Receivable from the TTT West Coast, Inc 401(k) Retirement Savings Plan | 976 | | — | | | — | | — | | | 328 | | — | | | 797 | | — | | | 2,101 | |

| Unsettled trades/other | (311,740) | | (2,196) | | | (172) | | — | | | 1,101 | | 18 | | | (1,141) | | (88) | | | (314,218) | |

| Fully benefit-responsive investments contracts valued at contract value | — | | — | | | — | | — | | | — | | — | | | 6,962,932 | | 542,598 | | | 7,505,530 | |

| Group Trust net assets | $ | 3,442,924 | | $ | 24,246 | | | $ | 3,102,440 | | $ | 4,281 | | | $ | 654,825 | | $ | 10,763 | | | $ | 7,079,631 | | $ | 551,631 | | | $ | 14,870,741 | |

Net Appreciation in Fair Value of Group Trust Investments and

Total Investment Income for the Year Ended December 31, 2021

| | | | | |

| | |

| | Group Trust |

| Net appreciation in fair value of Group Trust Investments | $ | 537,716 | |

| Investment Income: | |

| Interest | 199,836 | |

| Dividends | 16,042 | |

| Less: investment management expenses | (10,452) | |

| Net investment income of Group Trust Investments | $ | 743,142 | |

| | |

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

The following tables sets forth by level, within the fair value hierarchy, the Group Trust’s assets at fair value as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Group Trust Assets at Fair Value December 31, 2021 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Corporate debt | $ | — | | | $ | 1,402,530 | | | $ | — | | | $ | 1,402,530 | |

| Mortgage-backed securities | — | | | 420,126 | | | — | | | 420,126 | |

| Interest bearing cash | — | | | 2,394 | | | — | | | 2,394 | |

| Foreign cash | 11,308 | | | — | | | — | | | 11,308 | |

| Equities - common stock | 624,908 | | | — | | | — | | | 624,908 | |

| Equities - preferred stock | 2,381 | | | — | | | — | | | 2,381 | |

| Futures | (3,576) | | | (18) | | | — | | | (3,594) | |

| Registered investment companies | 320,888 | | | — | | | — | | | 320,888 | |

| Government securities | — | | | 447,719 | | | — | | | 447,719 | |

| Total assets in fair value hierarchy | $ | 955,909 | | | $ | 2,272,751 | | | $ | — | | | $ | 3,228,660 | |

| | | | | | | | |

| Investments measured at net asset value | | | | | | | |

U.S. common/collective trusts1 | | | | | | | 4,365,469 | |

International common/collective trusts2 | | | | | | | 206,738 | |

103-12 investments3 | | | | | | | 299,101 | |

Non-publicly traded registered investments companies4 | | | | | | | 68,992 | |

| Total assets at fair value | | | | | | | $ | 8,168,960 | |

| | | | | | | | |

1 The objective of the common/collective trust funds held in the AT&T U.S. Stock Fund is to deliver diversified exposure to the large-capitalization U.S. equity market as represented by the Russell 3000 Index. The objective of the common/collective trust funds held in the AT&T Total Return Bond Fund is to deliver diversified exposure to the fixed income market as represented by the Bloomberg Barclays Aggregate Index. There are currently no redemption restrictions on these investments.

2 The objective of the common/collective trust funds held in the AT&T International Stock Fund is to provide diversified exposure to international markets as represented by the All Country World Index ex U.S., MSCI Emerging Markets Net Dividend Index, MSCI Australia Index and MSCI Canada Index. There are currently no redemption restrictions on these investments.

3 The objective of these equity commingled funds is to provide diversified exposure to international markets as represented by the All Country World Index ex U.S. that invest in both developed and emerging countries. These funds have redemption restrictions limited to daily and monthly settlement.

4 These are non-publicly traded registered investment companies, consisting of a short-term floating rate portfolio plus publicly-traded high-yield and asset-backed fixed income securities. The fair value of the investments in this group have been estimated using the net asset values reported by the fund manager. These funds are utilized on a discretionary basis as part of a broad fixed income mandate. These are open-ended funds, with no final termination dates. There are currently no redemption restrictions on this investment.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Group Trust Assets at Fair Value December 31, 2020 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Corporate debt | $ | — | | | $ | 1,239,621 | | | $ | — | | | $ | 1,239,621 | |

| Mortgage-backed securities | — | | | 541,821 | | | — | | | 541,821 | |

| Interest bearing cash | 13,187 | | | 2,649 | | | — | | | 15,836 | |

| Foreign cash | 12,260 | | | — | | | — | | | 12,260 | |

| Equities - common stock | 619,647 | | | — | | | — | | | 619,647 | |

| Equities - preferred stock | 2,415 | | | — | | | — | | | 2,415 | |

| Futures | (2,510) | | | — | | | — | | | (2,510) | |

| Registered investment companies | 467,226 | | | — | | | — | | | 467,226 | |

| Government securities | — | | | 320,026 | | | — | | | 320,026 | |

| Total assets in fair value hierarchy | $ | 1,112,225 | | | $ | 2,104,117 | | | $ | — | | | $ | 3,216,342 | |

| | | | | | | | |

| Investments measured at net asset value | | | | | | | |

U.S. common/collective trusts1 | | | | | | | 3,906,243 | |

International common/collective trusts2 | | | | | | | 184,000 | |

103-12 investments3 | | | | | | | 292,090 | |

Non-publicly traded registered investments companies4 | | | | | | | 78,653 | |

| Total assets at fair value | | | | | | | $ | 7,677,328 | |

| | | | | | | | |

1 The objective of the common/collective trust funds held in the AT&T U.S. Stock Fund is to deliver diversified exposure to the large-capitalization U.S. equity market as represented by the Russell 3000 Index. The objective of the common/collective trust funds held in the AT&T Total Return Bond Fund is to deliver diversified exposure to the fixed income market as represented by the Bloomberg Barclays Aggregate Index. There are currently no redemption restrictions on these investments.

2 The objective of the common/collective trust funds held in the AT&T International Stock Fund is to provide diversified exposure to international markets as represented by the All Country World Index ex U.S., MSCI Emerging Markets Net Dividend Index, MSCI Australia Index and MSCI Canada Index. There are currently no redemption restrictions on these investments.

3 The objective of these equity commingled funds is to provide diversified exposure to international markets as represented by the All Country World Index ex U.S. that invest in both developed and emerging countries. These funds have redemption restrictions limited to daily and monthly settlement.

4 These are non-publicly traded registered investment companies, consisting of a short-term floating rate portfolio plus publicly-traded high-yield and asset-backed fixed income securities. The fair value of the investments in this group have been estimated using the net asset values reported by the fund manager. These funds are utilized on a discretionary basis as part of a broad fixed income mandate. These are open-ended funds, with no final termination dates. There are currently no redemption restrictions on this investment.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

Derivative Financial Instruments

In the normal course of operations, Group Trust assets and liabilities held in the AT&T Stable Value Fund (Stable Value Fund) may include derivative financial instruments (futures and foreign currency forward contracts). These instruments involve, in varying degrees, elements of credit and market volatility risks in excess of more traditional investment holdings such as equity and debt instruments. The intent is to use derivative financial instruments as an economic hedge to manage market volatility and foreign currency exchange rate risk associated with the Stable Value Fund’s investment assets. The gains (losses) are located on the Statement of Changes in Net Assets Available for Benefits as Net Income from Investment in AT&T Savings Group Investment Trust to the extent of the Plan’s ownership in the Group Trust. The Group Trust’s fiduciaries do not anticipate any material adverse effect on the Group Trust’s financial position resulting from its involvement in these instruments.

In addition to the derivative financial instruments held by the Group Trust, the Plan also holds derivative financial instruments as Plan investments in its own trust. The income is located on the Statements of Changes in Net Assets Available for Benefits a component of net appreciation in fair value of investments.

At December 31, 2021 and 2020, the fair value of derivative financial instruments held by the Group Trust and the Plan was not material.

Futures Contracts

The primary risk managed by the Group Trust using futures contracts is the price risk associated with investments. On behalf of the Group Trust, investment managers enter into various futures contracts to economically hedge investments. These contracts, which are considered derivatives under Accounting Standards Codification Topic 815, Derivatives and Hedging are agreements between two parties to buy or sell a security or financial interest at a set price on a future date and are standardized and exchange-traded. Upon entering into such a contract on behalf of the Group Trust, the investment manager is required to pledge to the broker an amount of cash or securities equal to the minimum “initial margin” requirements of the exchange on which the contract is traded. Pursuant to the contract, the investment manager agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as variation margin and are recorded on a daily basis by the trustee as a realized gain or loss equal to the difference in the value of the contract between daily closing prices. Upon entering into such contracts, the Group Trust bears the risk of interest or exchange rates or securities prices moving unexpectedly, in which case, the Group Trust may not achieve the anticipated benefits of the futures contracts and may realize a loss. With futures, there is minimal counterparty credit risk to the Group Trust since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default. The investments in the Group Trust are subject to equity price risk and interest rate risk, in the normal course of pursuing its investment objectives. The U.S. interest rate futures held in the portfolio as of December 31, 2021 and 2020 were used primarily to hedge and manage the duration risk of the portfolio.

The futures held in the Plan as of December 31, 2021 and 2020, were used primarily to maintain the target allocations of the portfolio.

Foreign Currency Contracts

The primary risks managed by the Group Trust using foreign currency forward contracts is the foreign currency exchange rate risk associated with the Group Trust’s investments denominated in foreign currencies. On behalf of the Group Trust, investment managers enter into forward foreign currency contracts, which are agreements to exchange foreign currencies at a specified future date at a specified rate, the terms of which are not standardized on an exchange. These contracts are intended to minimize the effect of currency fluctuations on the performance of investments denominated in foreign currencies. Although in some cases, forward foreign currency contracts are used to express a view on the direction of a particular currency, risk arises both from the possible inability of the counterparties to meet the terms of the contracts (credit risk) and from movement in foreign currency exchange rates (market risk). Foreign currency forward contracts are entered into with major banks to minimize credit risk, and accordingly, no credit reserve has been established against these amounts. The contracts are recorded at fair value on the date the contract is entered into, which is typically zero.

Fully Benefit-Responsive Investment Contracts

The Stable Value Fund consists of fully benefit-responsive investment contracts with various financial institutions and insurance companies which can be accounted for by the Plans at contract value. Generally contract value represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

The investments held by the Stable Value Fund as of December 31, 2021 and 2020 include Synthetic GICs which are fully benefit-responsive investment contracts. Synthetic GICs are constructed by combining a stable value insurance wrapper contract and a fixed income portfolio. The assets supporting the Synthetic GICs are owned by the Group Trust and generally consist of high quality fixed income securities.

Traditional Guaranteed Investment Contracts (“Traditional GICs” also known as “General Account GICs”) are issued by insurance companies and typically pay a guaranteed fixed or floating rate of interest over the life of the contract with a repayment of principal at maturity. A Synthetic GIC is similar to a Traditional GIC but has unbundled the insurance and investment components of the Traditional GIC.

Wrapper contracts are typically issued by a bank or insurance company, and seek to provide preservation of principal by permitting daily liquidity at contract value for participant directed transactions, in accordance with the provisions of the Plans. Wrapper contracts amortize the realized and unrealized gains and losses on the underlying fixed income investments through adjustments to the future interest crediting rate of the contract. Wrapper contracts typically contain contractual provisions that prevent the interest crediting rate from falling below zero.

In certain circumstances, the amount withdrawn from the wrapper contract could be payable at fair value rather than at contract value. These events include termination of the Plans, a material adverse change to the provisions of the Plans, if AT&T elects to withdraw from a wrapper contract in order to switch to a different investment provider or, in the event of a spin-off or sale of a division, if the terms of the successor plan do not meet the contract issuers’ underwriting criteria for issuance of a clone wrapper contract. Events that would permit a wrapper contract issuer to terminate a wrapper contract upon short notice include the Plans’ loss of qualified status, un-cured material breaches of responsibilities or material and adverse changes to the provisions of the Plans. The Company does not believe any of the events are probable of occurring in the foreseeable future.

Interest Bearing Cash

At December 31, 2021 and 2020, the Plan held approximately $701 and $499, respectively, of unallocated interest bearing cash related to contributions, uncashed checks and fees pending allocation to participant accounts or clearance through the plan funds.

Investment Risk

Investments held by the Group Trust and the Plan are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investments, it is at least reasonably possible that changes in the values of investments could occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits. Participants’ accounts that are invested in the Company stock fund option are exposed to market risk in the event of a significant decline in the value of AT&T stock.

Additionally, the Group Trust invests in securities with contractual cash flows, such as asset backed securities, collateralized mortgage obligations and commercial mortgage-backed securities. The value, liquidity and related income of these securities are sensitive to changes in economic conditions, including real estate value, delinquencies or defaults, or both, and may be adversely affected by shifts in the market’s perception of the issuers and changes in interest rates.

NOTE 5. PARTIES-IN-INTEREST TRANSACTIONS

The Plan may, at the discretion of the Plan’s participants or via the Company match, invest in the Company’s common stock. The Plan held 9,301,425 and 9,796,649 shares of the Company’s common stock as of December 31, 2021 and 2020, respectively. Dividends earned by the Plan on the Company’s common stock were $18,740 for the year ended December 31, 2021.

Plan assets are invested in AT&T stock either directly or through the Group Trust. Because the Company is the plan sponsor, transactions involving the Company’s stock qualify as party-in-interest transactions. In addition, certain investments held by the Plan and Group Trust are managed by BNY Mellon and Fidelity as trustee and record keeper, respectively, as defined by various agreements. Therefore, these transactions and fees paid to these entities qualify as parties-in-interest transactions. All of these transactions are exempt from the prohibited transactions rules.

BellSouth Savings and Security Plan

Notes to Financial Statements (Continued)

(Dollars in Thousands)

NOTE 6. TAX STATUS

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated June 4, 2015, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (IRC) and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan administrator has indicated that it will take the necessary steps, if any, to bring the Plan’s operations into compliance with the Code.

Accounting principles generally accepted in the United States require Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, there were no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE 7. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31:

| | | | | | | | | | | |

| | 2021 | | 2020 |

| Net Assets Available for Benefits per the financial statements | $ | 2,660,555 | | | $ | 2,537,524 | |

| Distributions payable to participants | (486) | | | (363) | |

| Net Assets Available for Benefits per the Form 5500 | $ | 2,660,069 | | | $ | 2,537,161 | |

| | | | |

Distributions payable to participants are recorded on the Form 5500 for benefit claims that have been processed and approved for payment prior to December 31, but not yet paid as of that date. The following is a reconciliation of distributions to participants per the financial statements to the Form 5500 for the year ended December 31, 2021:

| | | | | |

| Distributions to participants per the financial statements | $ | 223,817 | |

Distributions payable to participants at December 31, 2020 | (363) | |

Distributions payable to participants at December 31, 2021 | 486 | |

| Distributions to participants per the Form 5500 | $ | 223,940 | |

| | |

NOTE 8. SUBSEQUENT EVENTS

During March 2022, AT&T initiated a review with the recordkeeper to identify where participants maintained balances within the Plan. When participant balances were identified as “inactive” in the Plan, those balances were merged into existing participants active accounts or newly created accounts in the AT&T Retirement Savings Plan. As a result, $59,020 of participant balances and assets were transferred from the Plan into the AT&T Retirement Savings Plan during first quarter of 2022.

On April 8, 2022, AT&T completed the separation and distribution of its WarnerMedia business, and merger of a wholly-owned subsidiary of AT&T formed to hold the WarnerMedia business, with a subsidiary of Discovery, Inc. The transaction resulted in the creation of a new Warner Bros. Discovery Stock Fund in the Plan to hold the new Warner Bros. Discovery common stock received as part of the transaction. The Warner Bros. Discovery Stock Fund will remain in the Plan for approximately twelve (12) months unless terminated earlier by the fiduciary.

BELLSOUTH SAVINGS AND SECURITY PLAN

EIN 58-1533433, PLAN NO. 004

SCHEDULE H, LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2021

(Dollars in Thousands)

| | | | | | | | |

| | |

| Identity of Issue | Description of Investment | Current Value |

| | | | | | | | |

| Interest Bearing Investments | | |

| U S TREASURY BILL | 0.000% 04/21/2022 DD 04/22/21 | $ | 1,000 | |

| U S TREASURY BILL | 0.000% 03/24/2022 DD 03/25/21 | 2,300 | |

| U S TREASURY BILL | 0.000% 01/13/2022 DD 07/15/21 | 999 | |

| Total Interest Bearing Investments | | 4,299 | |

| | |

| AT&T Common Stock | | |

| * AT&T INC | 9,301,425 SHARES | 228,815 | |

| | |

| Mutual Funds or Exchange-Traded Funds | | |

| DREYFUS GOVT CAS MGMT INST 289 | VAR RT 12/31/2075 DD 06/03/97 | 21,076 | |

| | |

| Futures | | |

| S&P500 EMINI FUTURE (CME) | EXP MAR 22 | 36 | |

| US 10YR NOTE FUTURE (CBT) | EXP MAR 22 | 178 | |

| Total Futures | | 214 | |

| | |

| U.S. Index Stock Funds | | |

| * NORTHERN TRUST S&P 500 INDEX STOCK FUND | COMMON/COLLECTIVE TRUST FUND: 19,565 UNITS | 343,197 | |

* BLACKROCK RUSSELL 1000 INDEX FUND | COMMON/COLLECTIVE TRUST FUND: 6,050,343 UNITS | 357,777 | |

| EXTENDED EQUITY MARKET FUND F | COMMON/COLLECTIVE TRUST FUND: 712,565 UNITS | 80,429 | |

| BGI US EQUITY MARKET FUND F | COMMON/COLLECTIVE TRUST FUND: 148,786 UNITS | 26,246 | |

| Total U.S. Index Stock Funds | | 807,649 | |

| | |

| International Index Stock Fund | | |

| BGI MSCI ACWI EX-US INDEX | BGI MSCI ACWI EX-US INDEX SUPERFUND F | 81,116 | |

| | |

| Blended Equity & Debt Funds | | |

| LIFEPATH 2065 FUND | BLACKROCK INSTITUTIONAL TRUST CO NA INVT | 210 | |

| LIFEPATH 2060 FUND | BLACKROCK INSTITUTIONAL TRUST CO NA INVT | 68 | |

| LIFEPATH INDEX 2055 FUND | COMMON/COLLECTIVE TRUST FUND: 7,056 UNITS | 250 | |

| LIFEPATH INDEX 2050 FUND | COMMON/COLLECTIVE TRUST FUND: 236,936 UNITS | 6,451 | |

| LIFEPATH INDEX 2045 FUND | COMMON/COLLECTIVE TRUST FUND: 2,556,655 UNITS | 83,627 | |

BELLSOUTH SAVINGS AND SECURITY PLAN

EIN 58-1533433, PLAN NO. 004

SCHEDULE H, LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2021

(Dollars in Thousands)

| | | | | | | | |

| | |

| Identity of Issue | Description of Investment | Current Value |

| | | | | | | | |

| LIFEPATH INDEX 2040 FUND | COMMON/COLLECTIVE TRUST FUND: 5,582,804 UNITS | 191,231 | |

| LIFEPATH INDEX 2035 FUND | COMMON/COLLECTIVE TRUST FUND: 6,232,738 UNITS | 188,523 | |

| LIFEPATH INDEX 2030 FUND | COMMON/COLLECTIVE TRUST FUND: 4,421,426 UNITS | 135,541 | |

| LIFEPATH INDEX 2025 FUND | COMMON/COLLECTIVE TRUST FUND: 3,146,929 UNITS | 84,660 | |

| LIFEPATH INDEX RETIREMENT FUND | COMMON/COLLECTIVE TRUST FUND: 5,961,773 UNITS | 156,129 | |

| Total Blended Equity & Debt Funds | | 846,690 | |

| | |

| Bond Index Fund | | |

| NTGI QM AGG BND INDEX | COMMON/COLLECTIVE TRUST FUND: 48,137 UNITS | 29,784 | |

| | |

| * Notes Receivable from Participants | 4.25% - 10.50% | 50,937 | |

| | |

| Total | | $ | 2,070,580 | |

| | |

| * Party-in-Interest | | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustee (or other persons who administer the employee benefit plan) has duly caused this annual report to be signed by the undersigned thereunto duly authorized.

| | | | | | | | |

| | | BellSouth Savings and Security Plan |

| | | By: AT&T Services, Inc., |

| | | Plan Administrator for the Foregoing Plan |

| | |

| By | /s/ Debra L. Dial |

| | | Debra L. Dial |

| | | Senior Vice President and Controller |

Date: June 28, 2022

EXHIBIT INDEX

Exhibit identified below, Exhibit 23 filed herein as exhibit hereto.

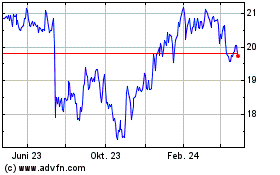

AT&T (NYSE:T-C)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

AT&T (NYSE:T-C)

Historical Stock Chart

Von Apr 2023 bis Apr 2024