false

0001364885

0001364885

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2024

Spirit

AeroSystems Holdings, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-33160 |

|

20-2436320 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

3801

South Oliver, Wichita, KS 67210

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including

area code): (316) 526-9000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each

class: |

|

Trading

symbol(s) |

|

Name of exchange on which registered |

| Class A Common Stock, par value $0.01 per share |

|

SPR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure

Spirit AeroSystems Holdings, Inc., a

Delaware corporation (together with its consolidated subsidiaries, the “Company,”

“we,” “us”

or “our”), made available to existing and potential investors on a

confidential basis the information furnished as Exhibit 99.1 to this report (the “Investor Information”),

which had not previously been disclosed publicly by the Company and which exhibit is incorporated herein by reference. The Investor

Information was shared only with those parties subject to a confidentiality agreement, was not prepared with a view toward public

disclosure, and should not be relied upon to make an investment decision with respect to the Company. The disclosure of the Investor

Information in this report should not be regarded as an indication that the Company or any third party considers the Investor

Information to be material non-public information or a reliable prediction of future events, and the Investor Information should not

be relied upon as such. Neither the Company nor any third party makes any representation to any person regarding the accuracy or

completeness of any of the Investor Information or undertakes any obligation to update the Investor Information to reflect

circumstances existing after the date when the Investor Information was prepared or conveyed or to reflect the occurrence of future

events, even if any or all of the assumptions underlying the Investor Information become or are shown to be incorrect.

The information furnished pursuant to this Item

7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it

be deemed to be incorporated by reference into any other filing under the Exchange Act or any filing under the Securities Act of 1933,

as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Cautionary Statement Regarding Forward-Looking Statements

This report of Spirit AeroSystems Holdings, Inc.

(“Spirit”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements reflect our current expectations or forecasts

of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “aim,”

“anticipate,” “believe,” “could,” “continue,” “designed,” “ensure,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,”

“model,” “objective,” “outlook,” “plan,” “potential,” “predict,”

“project,” “seek,” “should,” “target,” “will,” “would,” and other

similar words, or phrases, or the negative thereof, unless the context requires otherwise. Forward-looking statements in this report include

statements regarding cash from operations, capital expenditures and free cash flow. These statements reflect management’s current

views with respect to future events and are subject to risks and uncertainties, both known and unknown, including, but not limited to,

those described in the “Risk Factors” sections of Spirit’s Annual Report on Form 10-K for the fiscal year ended December 31,

2023, filed with the U.S. Securities and Exchange Commission on February 22, 2024 (the “2023 Form 10-K”) and subsequent

Quarterly Reports on Form 10-Q. Our actual results may vary materially from those anticipated in forward-looking statements. We caution

investors not to place undue reliance on any forward-looking statements.

Important factors that could cause actual results

to differ materially from those reflected in such forward-looking statements and that should be considered in evaluating our outlook include,

but are not limited to, the following:

| • | our ability to continue as a going concern and satisfy our liquidity needs, the success of our liquidity enhancement plans, operational

and efficiency initiatives, our ability to access the capital and credit markets (including as a result of any contractual limitations,

including the Merger Agreement (as defined below)), the outcomes of active discussions related to the timing or amounts of repayment for

certain customer advances, and the costs and terms of any additional financing; |

| • | the continued fragility of the global aerospace supply chain including our dependence on our suppliers, as well as the cost and availability

of raw materials and purchased components, including increases in energy, freight, and other raw material costs as a result of inflation

or continued global inflationary pressures; |

| • | our ability and our suppliers’ ability and willingness to meet stringent delivery (including quality and timeliness) standards

and accommodate changes in the build rates or model mix of aircraft under existing contractual commitments, including the ability or willingness

to staff appropriately or expend capital for current production volumes and anticipated production volume increases; |

| • | our ability to maintain continuing, uninterrupted production at our manufacturing facilities and our suppliers’ facilities; |

| • | our ability, and our suppliers' ability, to attract and retain the skilled work force necessary for production and development in

an extremely competitive market; |

| • | the effect of economic conditions, including increases in interest rates and inflation, on the demand for our and our customers’

products and services, on the industries and markets in which we operate in the U.S. and globally, and on the global aerospace supply

chain; |

| • | the general effect of geopolitical conditions, including Russia’s invasion of Ukraine and the resultant sanctions being imposed

in response to the conflict, including any trade and transport restrictions; |

| • | the war in Israel and the Gaza Strip and the potential for expansion of the conflict in the surrounding region, which may impact certain

suppliers’ ability to continue production or make timely deliveries of supplies required to produce and timely deliver our products,

and may result in sanctions being imposed in response to the conflict, including trade and transport restrictions; |

| • | our relationships with the unions representing many of our employees, including our ability to successfully negotiate new agreements,

and avoid labor disputes and work stoppages with respect to our union employees; |

| • | the impact of significant health events, such as pandemics, contagions or other public health emergencies (including the COVID-19

pandemic) or fear of such events, on the demand for our and our customers’ products and services, the industries and the markets

in which we operate in the U.S. and globally; |

| • | the timing and conditions surrounding the full worldwide return to service (including receiving the remaining regulatory approvals)

of the B737 MAX, future demand for the aircraft, and any residual impacts of the B737 MAX grounding on production rates for the aircraft; |

| • | our reliance on The Boeing Company (“Boeing”) and Airbus SE and its affiliates for a significant portion of our

revenues; |

| • | the business condition and liquidity of our customers and their ability to satisfy their contractual obligations to the Company; |

| • | the certainty of our backlog, including the ability of customers to cancel or delay orders prior to shipment on short notice, and

the potential impact of regulatory approvals of existing and derivative models; |

| • | our ability to accurately estimate and manage performance, cost, margins, and revenue under our contracts, and the potential for additional

forward losses on new and maturing programs; |

| • | our accounting estimates for revenue and costs for our contracts and potential changes to those estimates; |

| • | our ability to continue to grow and diversify our business, execute our growth strategy, and secure replacement programs, including

our ability to enter into profitable supply arrangements with additional customers; |

| • | the outcome of product warranty or defective product claims and the impact settlement of such claims may have on our accounting assumptions; |

| • | competitive conditions in the markets in which we operate, including in-sourcing by commercial aerospace original equipment manufacturers; |

| • | our ability to successfully negotiate, or re-negotiate, future pricing under our supply agreements with Boeing, Airbus SE and its

affiliates and other customers; |

| • | the possibility that our cash flows may not be adequate for our additional capital needs; |

| • | any reduction in our credit ratings; |

| • | our ability to avoid or recover from cyber or other security attacks and other operations disruptions; |

| • | legislative or regulatory actions, both domestic and foreign, impacting our operations, including the effect of changes in tax laws

and rates and our ability to accurately calculate and estimate the effect of such changes; |

| • | spending by the U.S. and other governments on defense; |

| • | pension plan assumptions and future contributions; |

| • | the effectiveness of our internal control over financial reporting; |

| • | the outcome or impact of ongoing or future litigation, arbitration, claims, and regulatory actions or investigations, including our

exposure to potential product liability and warranty claims; |

| • | adequacy of our insurance coverage; |

| • | our ability to continue selling certain receivables through the receivables financing programs; |

| • | our ability to effectively integrate recent acquisitions, along with other acquisitions we pursue, and generate synergies and other

cost savings therefrom, while avoiding unexpected costs, charges, expenses, and adverse changes to business relationships and business

disruptions; |

| • | the risks of doing business internationally, including fluctuations in foreign currency exchange rates, impositions of tariffs or

embargoes, trade restrictions, compliance with foreign laws, and domestic and foreign government policies; and |

| • | risks and uncertainties relating to the proposed acquisition of Spirit by Boeing (the “Merger”) pursuant to Spirit’s

agreement and plan of merger with Boeing (the “Merger Agreement”) and the transactions contemplated by our term sheet

with Airbus SE (the “Airbus Business Disposition” and, together with the Merger, the “Transactions”),

including, among others, the possibility that we are unable to negotiate and enter into definitive agreements with Airbus SE and its affiliates

with respect to the Airbus Business Disposition; the possible inability of the parties to a Transaction to obtain the required regulatory

approvals for such Transaction and to satisfy the other conditions to the closing of such Transaction (including, in the case of the Merger,

approval of the Merger Agreement by Spirit stockholders) on a timely basis or at all; the possible occurrence of events that may give

rise to a right of one or more of the parties to the Merger Agreement to terminate the Merger Agreement; the risk that the Merger Agreement

is terminated under circumstances requiring us to pay a termination fee; the risk that we are unable to consummate the Transactions on

a timely basis or at all for any reason, including, without limitation, failure to obtain the required regulatory approvals, failure to

obtain Spirit stockholder approval of the Merger Agreement or failure to satisfy other conditions the closing of either of the Transactions;

the potential for the pendency of the Transactions or any failure to consummate the Transactions to adversely affect the market price

of Spirit common stock or our financial performance or business relationships; risks relating to the value of Boeing common stock to be

issued in the Merger; the possibility that the anticipated benefits of the Transactions cannot be realized in full or at all or may take

longer to realize than expected; the possibility that costs or difficulties related to the integration of our operations with those of

Boeing will be greater than expected; risks relating to significant transaction costs; the intended or actual tax treatment of the Transactions;

litigation or other legal or regulatory action relating to the Transactions or otherwise relating to us or other parties to the Transactions

instituted against us or such other parties or Spirit’s or such other parties’ respective directors and officers and the effect

of the outcome of any such litigation or other legal or regulatory action; risks associated with contracts containing provisions that

may be triggered by the Transactions; potential difficulties in retaining and hiring key personnel or arising in connection with labor

disputes during the pendency of or following the Transactions; the risk of other Transaction-related disruptions to our business, including

business plans and operations; the potential for the Transactions to divert the time and attention of management from ongoing business

operations; the potential for contractual restrictions under the agreements relating to the Transactions to adversely affect our ability

to pursue other business opportunities or strategic transactions; and competitors’ responses to the Transactions. |

These factors are not exhaustive, and it is not possible for us to

predict all factors that could cause actual results to differ materially from those reflected in our forward-looking statements. These

factors speak only as of the date hereof, and new factors may emerge or changes to the foregoing factors may occur that could impact our

business. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances.

Except to the extent required by law, we undertake no obligation to, and expressly disclaim any obligation to, publicly update or revise

any forward-looking statements, whether as a result of new information, future events, or otherwise. You should review carefully the sections

captioned “Risk Factors” in the 2023 Form 10-K and Spirit’s subsequent Quarterly Reports on Form 10-Q for a more complete

discussion of these and other factors that may affect our business.

Non-GAAP Financial Measures

In addition to reporting financial information using generally accepted

accounting principles in the United States (“GAAP”), management believes that certain non-GAAP measures provide investors

with important perspectives into the Company’s ongoing business performance. The non-GAAP measure we use in this report is Free

Cash Flow, which is described further below. The Company does not intend for this information to be considered in isolation or as a substitute

for the related GAAP measure. Other companies may define and calculate the measure differently than the Company does, limiting the usefulness

of the measure for comparison with other companies. Free Cash Flow is defined as GAAP cash provided by (used in) operating activities

(also referred to herein as “cash from operations”), less capital expenditures for property, plant and equipment. Management

believes Free Cash Flow provides investors with an important perspective on the cash available for stockholders, debt repayments including

capital leases, and acquisitions after making the capital investments required to support ongoing business operations and long-term value

creation. Free Cash Flow does not represent the residual cash flow available for discretionary expenditures as it excludes certain mandatory

expenditures. The most comparable GAAP measure is cash provided by (used in) operating activities. Management uses Free Cash Flow as a

measure to assess both business performance and overall liquidity.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SPIRIT AEROSYSTEMS HOLDINGS, INC. |

| |

|

|

| Date: November 5, 2024 |

By: |

/s/ Irene M. Esteves |

| |

|

Irene M. Esteves |

| |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

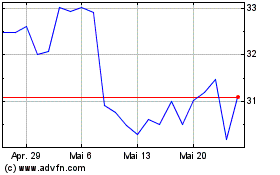

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Nov 2023 bis Nov 2024