Snap Stock Plunges Post Q2 Results

01 August 2022 - 11:36AM

Finscreener.org

It’s not inconceivable

that Snap (NYSE:

SNAP) shareholders think

they are on a rollercoaster. This social network stock has been

very volatile in the past year.

Snap stock rose from $10 per

share in March 2020 to $83 in September 2021. ItU+02019s currently

trading at $9.88 per share at the time of writing. Snap earnings

day was a disappointment in July, and it crashed 39% in a single

trading session last month.

That’s been Snap’s story in 2022.

The stock has always shown glimpses of potential, which makes it

rise, but these glimpses are followed by long periods of

disappointment. The stock has fallen almost 79% this

year.

Snap missed estimates in Q2

Snap reported its Q2 numbers

after market close on Thursday, July 21. Revenue came in at $1.11

billion compared to analyst estimates of $1.14 billion. Revenue was

up 13% compared to the corresponding quarter in 2021, but top-line

growth is slowing down. For example, sales in Q1 grew 38%

year-over-year.

Further, the average revenue per

user was down 4.5%. And the most damming factor was the fact that

Snap didn’t give Q3 guidance. Instead, CEO Evan Spiegel said, in a

release, “While the continued growth of our community increases the

long-term opportunity for our business, our financial results for

Q2 do not reflect our ambition.”

One inexplicable announcement was

a $500 million stock buyback program. Snap reported an adjusted EPS

of -$0.02 in the June quarter as net losses came in at $422 million

compared to $152 million in the year-ago period. At a time when

growth is slowing down, and the business environment is uncertain,

a company would ideally shore up its cash reserves instead of

spending it on a stock buyback program. As of June 30, 2022, Snap

had $4.9 billion in cash and equivalents.

Is it all bad for Snap stock and investors?

Snap’s number of daily active

users came in at 347 million versus an estimated 343.2 million. It

also said, “The daily average number of Snapchatters aged 25 and

older engaging with shows and publisher content increased by more

than 40% year-over-year.” The dark lining here is that the company

hasn’t figured out how to monetize them.

The company is betting big on AR

(Augmented Reality). It launched Lens Cloud, a collection of

backend services that expands AR experiences developers can create.

Snap has tied up with brands like Vogue and Tiffany with different

offerings.

Earlier in 2022, Snap estimated

revenue growth of 18% for Q2. However, the company said it would

likely miss its guidance and alluded to a shaky business

environment on May 23. It had filed a letter with the SEC that

said, “The macroeconomic environment has deteriorated further and

faster than anticipated.” The letter said that Apple’s privacy

policy changes made it harder to sell targeted advertising, and

demand was slowing down.

Snap’s quarterly letter to

shareholders said, “We are also seeing increasing competition for

advertising dollars that are now growing more slowly.” This is an

indication of the pressure TikTok is exerting on its

peers.

Snap depends a lot on large

brands for its advertising. In an economy still struggling with

supply-chain issues, high inflation, rising interest rates, and a

potential recession, it is likely that these brands will cut down

on their ad budgets leading to more pain for Snap.

The average consensus target for

Snap stock is $25.3, a potential upside of over 154%. Snap is a

stock with a tremendous payoff, but it also comes with a lot of

risks.

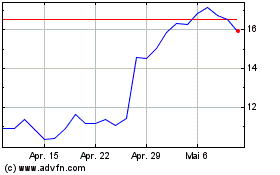

Snap (NYSE:SNAP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Snap (NYSE:SNAP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024