Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

18 September 2024 - 2:23PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL

Publicly-held Company

Corporate Taxpayer’s ID: 33.042.730/0001-04

NIRE 35-3.0039609.0

MATERIAL FACT

Companhia

Siderúrgica Nacional ("Company") informs its shareholders and the market in general, pursuant to article

157, paragraph 4th of Law No. 6,404/76 and to Resolution CVM No. 44/2021, further to the information provided in the material

facts published on February 22, 2024, May 2, 2024 and July 24, 2024, that the Company, InterCement Participações

S.A. ("InterCement") and the direct controlling shareholder of InterCement reached an agreement to extend, until October

16, 2024, under the same conditions as the previous agreements, the exclusivity rights of the Company with respect to a potential acquisition

of shares representing 100% of InterCement's capital stock, and as a consequence, of its subsidiaries ("Potential Transaction").

The exclusivity period will automatically terminate if, at any time between the date of this document and October 16, 2024, the extrajudicial

reorganization plan executed by InterCement and certain creditors on September 16, 2024 is no longer in valid. The exclusivity period

shall be automatically extended until November 16, 2024 if and the extent InterCement’s deadline for entering into a transaction

is extended.

The Company informs that it remains interested

in the Potential Transaction, but, until the date hereof, no binding documents have been entered with any counterparty which create an

obligation or firm commitment to pursue the Potential Transaction.

The Company will keep its shareholders

and the general market duly informed of the development of the Potential Transaction, pursuant to applicable law.

São Paulo, September 18, 2024.

Antonio Marco Campos Rabello

Chief Financial Officer and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 18, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Antonio Marco Campos Rabello

|

| |

Antonio Marco Campos Rabello

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

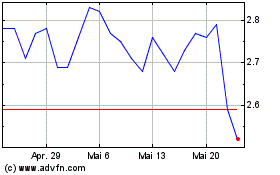

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

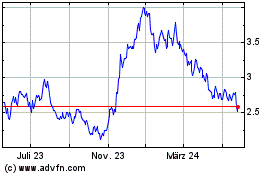

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

Von Nov 2023 bis Nov 2024