Harvest Portfolios Group Inc. Extends Big Pharma Split Corp. Maturity Date; Announces Appointment to Board of Directors

24 Oktober 2022 - 1:30PM

Business Wire

Harvest Portfolios Group Inc. (“Harvest”) is pleased to announce

that Big Pharma Split Corp. (the “Company”) (TSX:PRM)

(TSX:PRM.PR.A) will extend the maturity date of the Class A Shares

and Preferred Shares of the Company (together, the “Shares”) from

December 31, 2022 to December 31, 2027.

In connection with the extension, the Company may amend the rate

of cumulative preferential quarterly cash distributions to be paid

to the Preferred Shares and the distribution policy for the Class A

Shares for the five-year renewal period, commencing January 1,

2023. Based on current market rates for preferred shares with

similar terms, the fixed cumulative quarterly cash distributions

will remain at $0.125 per Preferred Share ($0.50 per annum). The

distribution policy for the Class A Shares is to pay monthly

non-cumulative distributions to the holders of Class A Shares in

the amount of $0.1031 per Class A Share and will remain the same,

but the Company may pay a higher monthly distribution if, after

payment of the distribution, the NAV per Unit would not be less

than $23.50.

Holders of Preferred Shares have received a total of $2.4266 in

distributions per Preferred Share since inception and holders of

Class A Shares have received a total of $6.6958 in distributions

per Class A Share since inception.

In relation to the maturity date extension, the Company has a

non-concurrent retraction right for those shareholders not wishing

to continue holding their investment, allowing existing

shareholders to tender one or both classes of Shares and receive a

retraction price based on the December 31, 2022 net asset value per

unit. Shares must be surrendered for retraction by 5:00 p.m. on

November 30, 2022. Alternatively, shareholders may sell their

Shares for the market price at any time, or shareholders may take

no action and continue to hold their Shares.

In addition, Harvest is pleased to announce that Mary Medeiros

was appointed to the Board of Directors of the Company (the

“Board”) effective September 27, 2022. Ms. Medeiros replaces

Townsend Haines who retired from the Board on the same date.

Harvest is the manager and the portfolio manager of the

Company.

For additional information: Please visit

www.harvestportfolios.com, e-mail info@harvestportfolios.com or

call toll free 1-866-998-8298.

About Harvest Portfolios Group Inc.

Founded in 2009, Harvest is an independent Canadian Investment

Fund Manager managing $2.6 billion in assets for Canadian

Investors. At Harvest ETFs, our guiding principles are premised on

building wealth for our clients through ownership of strong

businesses that have the potential to grow & generate steady

income over time. Harvest ETFs offers an innovative suite of

exchange traded funds, mutual funds and publicly-listed structured

fund products designed to satisfy the long-term growth and income

needs of investors. We pride ourselves in creating trusted

investment solutions that meet the expectations of our

investors.

You will usually pay brokerage fees to your dealer if you

purchase or sell shares of the investment fund on the TSX. If the

shares are purchased or sold on the TSX, investors may pay more

than the current net asset value when buying shares of the

investment fund and may receive less than the current net asset

value when selling them. There are ongoing fees and expenses

associated with owning shares of an investment fund. Investment

funds are not guaranteed, their values change frequently and past

performance may not be repeated. An investment fund must prepare

disclosure documents that contain key information about the

investment fund. You can find more detailed information about the

investment fund in these documents.

Forward-Looking Statements

Certain statements included in this press release constitute

forward-looking statements. Forward-looking statements include

statements that are predictive in nature, depend upon or refer to

future events or conditions, or include words or expressions such

as “believe”, “plan”, “expect”, “intend”, “target” or negative

versions thereof and other similar expressions or future or

conditional verbs such as “may”, “will”, “should”, “would” and

“could” and similar expressions to the extent they relate to the

Company or Harvest including information regarding the distribution

targets on the Company’s shares. The forward-looking statements are

not historical facts but reflect the expectations of the Company or

Harvest regarding future results or events as at the date of this

press release. Such forward-looking statements reflect the

Company’s or Harvest’s current beliefs and are based on information

currently available to them. Forward-looking statements involve

significant risks and uncertainties. A number of factors could

cause actual results or events to differ materially from current

expectations. Some of these risks, uncertainties and other factors

are described in the Current AIF under “Risk Factors”. Although the

forward-looking statements contained in this Prospectus are based

upon assumptions that the Company and Harvest believe to be

reasonable, neither the Company nor Harvest can assure investors

that actual results will be consistent with these forward-looking

statements. The forward-looking statements contained herein were

prepared for the purpose of providing investors with information

about the Company and may not be appropriate for other purposes.

Neither the Company nor Harvest assumes any obligation to update or

revise them to reflect new events or circumstances, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221024005246/en/

www.harvestportfolios.com info@harvestportfolios.com

1-866-998-8298

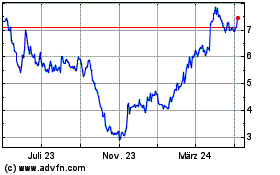

Perimeter Solutions (NYSE:PRM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

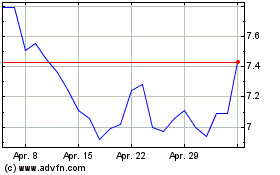

Perimeter Solutions (NYSE:PRM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024