Current Report Filing (8-k)

21 Juli 2022 - 10:58PM

Edgar (US Regulatory)

FALSE000188031900018803192022-07-212022-07-210001880319us-gaap:CommonStockMember2022-07-212022-07-210001880319us-gaap:WarrantMember2022-07-212022-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2022

PERIMETER SOLUTIONS, SA

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Grand Duchy of Luxembourg | | 001-41027 | | 98-1632942 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS. Employer Identification No.) |

12E rue Guillaume Kroll, L-1882 Luxembourg

Grand Duchy of Luxembourg

352 2668 62-1

(Address of principal executive offices, including zip code)

(314) 396-7343

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary Shares, nominal value $1.00 per share | | PRM | | New York Stock Exchange |

| Warrants for Ordinary Shares | | PRMFF | | OTC Markets Group Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 21, 2022, Perimeter Solutions, SA, duly registered with the Registre de Commerce et des Sociétés, Luxembourg (Luxembourg Trade and Companies Register) under number B 256.548 (the “Company”) held its 2022 Annual Meeting of Shareholders in a virtual format (the "Annual Meeting"). At the Annual Meeting, the shareholders voted on (i) the election of seven director nominees for a one-year term (Proposal 1), (ii) the approval of the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022 and BDO Audit SA as statutory auditor of the Company for the year ending December 31, 2022 (Proposal 2), (iii) the approval of the annual accounts for the financial period from June 21, 2021 (inception) to December 31, 2021 (Proposal 3), (iv) the approval of the audited consolidated financial statements for the financial period from June 21, 2021 (inception) to December 31, 2021 (Proposal 4), (v) the allocation of the results shown in the annual accounts for the financial period from June 21, 2021 (inception) to December 31, 2021 (Proposal 5), (vi) the discharge of each of the directors for the performance of their mandates as directors of the Company in relation to the financial period from June 21, 2021 (inception) to December 31, 2021 (Proposal 6), (vii) the approval of the compensation of certain of the non-employee independent directors of the Company for 2021 (Proposal 7) and (viii) the approval and ratification of a share repurchase program whereby the board of directors of the Company may repurchase outstanding ordinary shares of the Company within certain limits (Proposal 8).

Proposal 1

The shareholders voted in favor of the election of the following director nominees as directors for a term of office expiring at the 2023 Annual Meeting of Shareholders or, in each case, until his or her successor is duly elected and qualified.

| | | | | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| W. Nicholas Howley | 116,265,620 | | | 218,193 | | | 58,837 | | | 6,435,191 |

| William N. Thorndike, Jr. | 115,509,412 | | | 974,401 | | | 58,837 | | | 6,435,191 |

| Edward Goldberg | 116,482,940 | | | 873 | | | 58,837 | | | 6,435,191 |

| Tracy Britt Cool | 116,210,625 | | | 273,288 | | | 58,737 | | | 6,435,191 |

| Sean Hennessy | 114,312,486 | | | 2,171,327 | | | 58,837 | | | 6,435,191 |

| Robert S. Henderson | 113,134,323 | | | 3,349,490 | | | 58,837 | | | 6,435,191 |

| Bernt Iversen II | 116,358,191 | | | 622 | | | 183,837 | | | 6,435,191 |

Proposal 2

The shareholders approved the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022 and BDO Audit SA as statutory auditor of the Company for the year ending December 31, 2022.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 122,919,091 | | 1,110 | | 57,640 | | — |

Proposal 3

The shareholders approved of the annual accounts for the financial period from June 21, 2021(inception) to December 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 122,911,109 | | 322 | | 66,410 | | — |

Proposal 4

The shareholders approved of the audited consolidated financial statements for the financial period from June 21, 2021 (inception) to December 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 122,919,839 | | 22 | | 57,980 | | — |

Proposal 5

The shareholders approved of the allocation of the results shown in the annual accounts for the financial period from June 21, 2021 (inception) to December 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 122,918,764 | | 1,072 | | 58,005 | | — |

Proposal 6

The shareholders approved of the discharge of each of the directors for the performance of their mandates as directors of the Company in relation to the financial period from June 21, 2021 (inception) to December 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 116,393,398 | | 1,187 | | 148,065 | | 6,435,191 |

Proposal 7

The shareholders approved of the compensation of certain of the non-employee independent directors of the Company for 2021.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 101,614,067 | | 14,869,865 | | 58,718 | | 6,435,191 |

Proposal 8

The shareholders approved and ratified a share repurchase program whereby the board of directors of the Company may repurchase outstanding ordinary shares of the Company within certain limits.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Vote |

| 114,490,441 | | 1,994,572 | | 57,637 | | 6,435,191 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Perimeter Solutions, SA |

| | |

| Date: July 21, 2022 | By: | /s/ Charles Kropp |

| | Charles Kropp |

| | Chief Financial Officer |

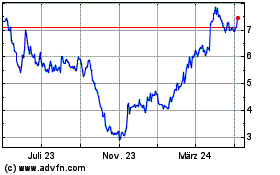

Perimeter Solutions (NYSE:PRM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

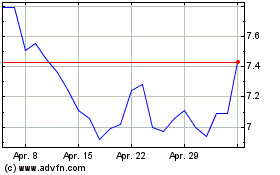

Perimeter Solutions (NYSE:PRM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024