As filed with the Securities and Exchange Commission on March 24, 2023 SECURITIES AND EXCHANGE COMMISSION

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934 PRIORITY INCOME FUND, INC.

(Name of Subject Company (Issuer) AND Filing Person (Offeror))

Common Stock, Par Value $0.01 per share

(Title of Class of Securities)

74272V107 – Class R Common Stock

74272V206 – Class RIA Common Stock

74272V305 – Class I Common Stock

(CUSIP Number of Class of Securities)

(Underlying Common Stock)

M. Grier Eliasek

Chief Executive Officer

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Steven B. Boehm, Esq.

Cynthia R. Beyea, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW

Washington, DC 20001

Tel: (202) 383-0100

Fax: (202) 637-3593

| | | | | | | | |

o Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| Check the appropriate boxes below to designate any transactions to which the statement relates: |

| o | Third-party tender offer subject to Rule 14d-1. |

| x | Issuer tender offer subject to Rule 13e-4. |

| o | Going-private transaction subject to Rule 13e-3. |

| o | Amendment to Schedule 13D under Rule 13d-2. |

| | | | | | | | | | | | | | |

o Check the box if the filing is a final amendment reporting the results of the tender offer. |

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon: | | | | | | | | |

| o | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| o | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

Item 1. Summary Term Sheet.

The information set forth in the Offer to Purchase, dated March 24, 2023 (the “Offer to Purchase”), attached hereto as Exhibit 99(a)(1)(A), entitled “Summary Term Sheet” is incorporated herein by reference.

Item 2. Subject Company Information.

(a) Name and Address. The name of the issuer is Priority Income Fund, Inc., an externally managed, non-diversified, closed-end management investment company incorporated in Maryland (the “Company”), the address of its principal executive office is 10 East 40th Street, 42nd Floor, New York, New York 10016, and the telephone number of its principal executive office is (212) 448-0702.

(b) Securities. This Tender Offer Statement on Schedule TO relates to an offer by the Company to purchase up to 1,099,918 shares of its issued and outstanding common stock, par value $0.01 per share (the “Shares”), which amount represents 2.5% of the number of shares outstanding at the close of business on the last day of the prior fiscal year ended June 30, 2022. As of March 24, 2023, there were 52,083,479 Shares issued and outstanding. The purpose of this Offer (as defined below) is to provide stockholders with liquidity because there is otherwise no public market for the Shares. The Offer is made upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal (which, together with any amendments or supplements thereto, collectively constitute the “Offer”). The Offer is for cash at a price equal to the net asset value per Share (“NAV per Share”) as of April 30, 2023 (the “Purchase Price”). As an example, the NAV per Share on March 23, 2023, was $11.49 per Share. The Purchase Price may be higher or lower than this amount.

The information set forth in the Offer to Purchase is incorporated herein by reference.

(c) Trading Market and Price. The Shares are not currently traded on an established trading market.

Item 3. Identity and Background of Filing Person.

(a) Name and Address. The information set forth under Item 2(a) above and in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference.

Item 4. Terms of the Transaction.

(a) Material Terms. The information set forth in the Offer to Purchase under the “Summary Term Sheet”, Section 1 (“Purchase Price; Number of Shares; Expiration Date”), Section 3 (“Certain Conditions of the Offer”), Section 4 (“Procedures for Tendering Shares”), Section 5 (“Withdrawal Rights”), Section 6 (“Payment for Shares”), Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”), Section 10 (“Certain Effects of the Offer”), Section 13 (“Certain United States Federal Income Tax Consequences”) and Section 14 (“Amendments; Extension of the Tender Period; Termination”) is incorporated herein by reference.

(b) Purchases. The information set forth in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e) Agreements Involving the Subject Company’s Securities. The information set forth in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference. Except as set forth therein, the Company does not know of any contract, arrangement, understanding or relationship relating, directly or indirectly, to the Offer (whether or not legally enforceable) between the Company, any of its executive officers or directors, any person controlling the Company or any officer or director of any corporation ultimately in control of the Company and any person with respect to any securities of the Company (including, but not limited to, any contract, arrangement, understanding or relationship concerning the transfer or the voting of any such securities, joint ventures, loan or option arrangements, puts or calls, guarantees of loans, guarantees against loss, or the giving or withholding of proxies, consents or authorizations).

Item 6. Purposes of the Transaction and Plans or Proposals.

(a) Purposes. The information set forth in the Offer to Purchase under Section 2 (“Purpose of the Offer; Plans or Proposals of the Company”) is incorporated herein by reference.

(b) Use of Securities Acquired. The information set forth in the Offer to Purchase under Section 2 (“Purpose of the Offer; Plans or Proposals of the Company”) and Section 10 (“Certain Effects of the Offer”) is incorporated herein by reference.

(c) Plans. Except as referred to in the Offer to Purchase under Section 2 (“Purpose of the Offer; Plans or Proposals of the Company”), Section 7 (“Source and Amount of Funds”) and Section 10 (“Certain Effects of the Offer”), each of which is incorporated herein by reference, the Company does not have any present plans or proposals and are not engaged in any negotiations that relate to or would result in:

(i) any extraordinary transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries;

(ii) other than in connection with transactions in the ordinary course of the Company’s operations and for purposes of funding the Offer, any purchase, sale or transfer of a material amount of assets of the Company or any of its subsidiaries;

(iii) any material change in the Company’s present dividend rate or policy, or indebtedness or capitalization of the Company;

(iv) any change in the present board of directors or management of the Company, including, but not limited to, any plans or proposals to change the number or the term of directors or to fill any existing vacancies on the Board or to change any material term of the employment contract of any executive officer;

(v) any other material change in the Company’s corporate structure or business, including any plans or proposals to make any changes in the Company’s investment policy for which a vote would be required by Section 13 of the Investment Company Act of 1940, as amended (the “1940 Act”);

(vi) any class of equity securities of the Company to be delisted from a national securities exchange or to cease to be authorized to be quoted in an automated quotations system operated by a national securities association;

(vii) any class of equity securities of the Company becoming eligible for termination of registration under Section 12(g)(4) of the Securities Exchange Act or 1934, as amended (the “Exchange Act”);

(viii) the suspension of the Company’s obligation to file reports pursuant to Section 15(d) of the Exchange Act;

(ix) the acquisition by any person of additional securities of the Company, or the disposition of securities of the Company; or

(x) any changes in the Company’s charter, bylaws or other governing instruments or other actions that could impede the acquisition of control of the Company.

Item 7. Source and Amount of Funds or Other Consideration.

(a) Source of Funds. The information set forth in the Offer to Purchase under Section 7 (“Source and Amount of Funds”) is incorporated herein by reference.

(b) Conditions. Not applicable.

(d) Borrowed Funds. Not applicable.

Item 8. Interest in Securities of the Subject Company.

(a) Securities Ownership. The information set forth in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference.

(b) Securities Transactions. The information set forth in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) Solicitations or Recommendations. Not applicable.

Item 10. Financial Statements.

(a) Financial Information. Not applicable. Financial statements have not been included since the consideration offered to security holders consists solely of cash; the Offer is not subject to any financing condition; and the Company is a public reporting company under Section 13(a) of the Exchange Act and files its reports electronically on the EDGAR system.

(b) Pro Forma Financial Information. Not applicable.

Item 11. Additional Information.

(a) Agreements, Regulatory Requirements and Legal Proceedings.

(1) The information set forth in the Offer to Purchase under Section 9 (“Interest of Directors, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares”) is incorporated herein by reference.

(2)-(5) Not applicable.

(c) Other Material Information. The entire text of the Offer to Purchase and the related Letter of Transmittal, attached hereto as Exhibit 99(a)(1)(B), are incorporated herein by reference.

Item 12. Exhibits.

| | | | | | | | |

EXHIBIT

NUMBER | | DESCRIPTION |

| | Offer to Purchase, dated March 24, 2023. |

| | Letter of Transmittal (including Instructions to Letter of Transmittal). |

| | Notice of Tender Cancellation. |

| | Letter to Stockholders, dated March 24, 2023. |

| | Calculation of Filing Fees Table |

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 24, 2023

| | |

|

Priority Income Fund, Inc. |

|

By: /s/ M. Grier Eliasek |

| Name: M. Grier Eliasek |

Title: Chairman, Chief Executive Officer and President |

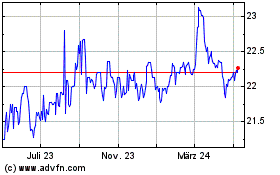

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

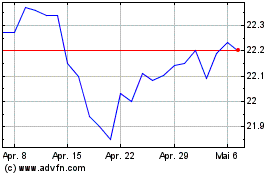

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Apr 2023 bis Apr 2024