Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

26 Oktober 2022 - 1:08PM

Edgar (US Regulatory)

Filed pursuant to Rule 497(a)

File No. 333-235356

Rule 482ad

Priority Income Fund is Now Available on the Schwab Alternative Investment OneSource® Platform for Registered Investment Advisers

NEW YORK, October 26, 2022 /BusinessWire/ -- Priority Income Fund, Inc. ("Priority Income Fund" or the "Fund") announced today that the Fund is now available to registered investment advisers on the Schwab Alternative Investment OneSource® platform.

The Schwab Alternative Investment OneSource® platform provides access to a diversified portfolio of non-listed alternative investments issued by well-known asset managers—all with streamlined execution, consolidated reporting, and no annual custody fees.

“We are pleased to have joined the Schwab Alternative Investment OneSource platform,” said Grier Eliasek, President and Chief Executive Officer of the Fund. “We are making Priority Income Fund even more accessible to registered investment advisers.”

The Fund, which has raised $1.0 billion in cumulative capital (including commitments under the Fund’s credit facility), focuses on providing investors with current income and long-term capital appreciation by investing in broad pools of senior secured loans made primarily to U.S. companies.

Through September 30, 2022, the Fund has declared 34 quarterly bonus distributions in addition to 107 consecutive monthly base distributions, resulting in a total annualized distribution rate for I shares of 11.6%, based on a current class I offering price of $11.55 per common share.

About Priority Income Fund

Priority Income Fund, Inc. is a registered closed-end fund that was created to acquire and grow an investment portfolio primarily consisting of senior secured loans or pools of senior secured loans known as collateralized loan obligations ("CLOs"). Such loans will generally have a floating interest rate and include a first lien on the assets of the respective borrowers, which typically are private and public companies based in the United States. The Fund is managed by Priority Senior Secured Income Management, LLC, which is led by a team of investment professionals from the investment and operations team of Prospect Capital Management L.P. For more information, visit priorityincomefund.com.

About Prospect Capital Management L.P.

Prospect is an SEC-registered investment adviser that, along with its predecessors and affiliates, has a more than 30-year history of investing in and managing high-yielding debt and equity investments using both private partnerships and publicly traded closed-end structures. Prospect and its affiliates employ a team of approximately 100 professionals who focus on credit-oriented investments yielding attractive current income. Prospect, together with its affiliates, has $8.6 billion of assets under management as of June 30, 2022. For more information, call 212.448.0702 or visit prospectcapitalmanagement.com.

About Preferred Capital Securities, LLC

Preferred Capital Securities, LLC serves as the dealer manager for Priority Income Fund, Inc. and has been a member of FINRA/SIPC since 2015. Formed in 2013, PCS is a boutique investment banking firm that distributes real estate and credit investment products in private and public structures through broker dealers and registered investment advisers. PCS has raised over $3.6 billion of capital as a wholesale distributor for various alternative investment strategies. For more information, visit http://pcsalts.com.

For Sales:

salesdesk@pcsalts.com

(855) 330-6594

For Service:

investorservices@pcsalts.com

(855) 422-3223

Additional Information

Past performance is not indicative of future performance. Our distributions may exceed our earnings, and therefore, portions of the distributions that we make may be a return of the money that you originally invested and represent a return of capital to you for tax purposes. Such a return of capital is not immediately taxable, but reduces your tax basis in our shares, which may result in higher taxes for you even if your shares are sold at a price below your original investment.

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus and summary prospectus contains this and other information relevant to an investment in the fund. Please read the prospectus or summary prospectus carefully before you invest or send money. To obtain a prospectus, please contact your investment representative or Investor Services at 866.655.3650.

Schwab and the Schwab Alternative lnvestment OneSource® platform are trademarks of Charles Schwab & Co., Inc. and used with permission. Priority Income Fund, Inc., Prospect Capital Management, LP, and Preferred Capital Securities, LLC, are not affiliated with Charles Schwab & Co., Inc.

Charles Schwab & Co., Inc. (member SIPC) receives remuneration from fund companies in the Schwab Alternative Investment OneSource® platform for recordkeeping and shareholder services, and other administrative services.

Schwab does not provide investment advisors, or their clients, advice or make recommendations about potential investments in any funds on the Schwab Alternative Investment OneSource platform, funds made available on third-party platforms that participate in the Schwab Alternative Investment Marketplace platform, and funds that may be held in custody. It is each investment advisor's responsibility to determine the suitability of such an investment for its clients. Alternative investments are risky and an advisor's clients may lose their entire investment in a fund.

Forward-Looking Statements

This press release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future performance of Priority Income Fund, Inc. Words such as "believes," "expects," "projects," and "future" or similar expressions are intended to identify forward-looking statements. Any such statements, other than statements of historical fact, are highly likely to be affected by unknowable future events and conditions, including elements of the future that are or are not under the control of Priority Income Fund, Inc. and that Priority Income Fund, Inc. may or may not have considered; accordingly, such statements cannot be guarantees or assurances of any aspect of future performance. Actual developments and results are highly likely to vary materially from any forward-looking statements. Such statements speak only as of the time when made, and Priority Income Fund, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

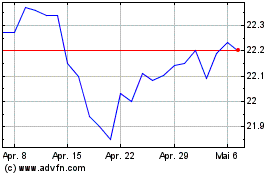

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

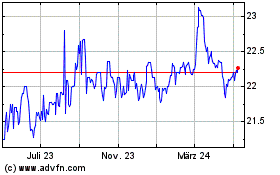

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Apr 2023 bis Apr 2024