Current Report Filing (8-k)

02 Mai 2022 - 10:32PM

Edgar (US Regulatory)

PERRIGO Co plc 00-0000000 false 0001585364 0001585364 2022-04-29 2022-04-29 0001585364 us-gaap:CommonStockMember 2022-04-29 2022-04-29 0001585364 prgo:M4.000NotesDue2023Member 2022-04-29 2022-04-29 0001585364 prgo:M3.900NotesDue2024Member 2022-04-29 2022-04-29 0001585364 prgo:M4.375NotesDue2026Member 2022-04-29 2022-04-29 0001585364 prgo:M3.150NotesDue2030Member 2022-04-29 2022-04-29 0001585364 prgo:M5.300NotesDue2043Member 2022-04-29 2022-04-29 0001585364 prgo:M4.900NotesDue2044Member 2022-04-29 2022-04-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2022

Perrigo Company plc

(Exact name of registrant as specified in its charter)

Commission file number 001-36353

|

|

|

| Ireland |

|

Not Applicable |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

The Sharp Building, Hogan Place, Dublin 2, Ireland D02 TY74

+353 1 7094000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered pursuant to section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary shares |

|

PRGO |

|

New York Stock Exchange |

| 4.000% Notes due 2023 |

|

PRGO23 |

|

New York Stock Exchange |

| 3.900% Notes due 2024 |

|

PROG24 |

|

New York Stock Exchange |

| 4.375% Notes due 2026 |

|

PRGO26 |

|

New York Stock Exchange |

| 3.150% Notes due 2030 |

|

PRGO30 |

|

New York Stock Exchange |

| 5.300% Notes due 2043 |

|

PRGO43 |

|

New York Stock Exchange |

| 4.900% Notes due 2044 |

|

PRGO44 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 2.01 |

Completion of Acquisition or Disposition of Assets. |

As previously disclosed, on October 20, 2021, Perrigo Company plc (the “Company”) and Habsont Unlimited Company, a wholly owned subsidiary of the Company (the “Purchaser”), entered into a Securities Sale Agreement (the “Purchase Agreement”) with funds affiliated with Astorg Partners and the private equity arm of Goldman Sachs and certain other parties thereto (collectively, the “Sellers”).

On April 29, 2022, pursuant to the terms of the Purchase Agreement, the Purchaser completed the acquisition of certain holding companies holding all of the outstanding equity interests of Héra SAS (“HRA”) from the Sellers for cash (the “Transaction”). The Transaction values HRA at approximately €1.8 billion, or approximately $1.9 billion based on current exchange rates, on an enterprise value basis and using a lockbox mechanism set forth in the Purchase Agreement.

The foregoing description of the Transaction does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement. A copy of the Purchase Agreement was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on October 21, 2021, and the terms of the Purchase Agreement are incorporated herein by reference.

| ITEM 7.01 |

Regulation FD Disclosure. |

On May 2, 2022, the Company issued a press release regarding the completion of the Transaction. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

| ITEM 9.01 |

Financial Statements and Exhibits. |

(a) Financial statements of businesses or funds acquired.

The financial statements required by Item 9.01(a) of Form 8-K will be filed by an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed.

(b) Pro forma financial information.

The pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed.

(d) Exhibits

| * |

Pursuant to Item 601(b)(2) of Regulation S-K, the schedules and attachments have been omitted and will be furnished to the SEC supplementally upon request. |

Certain statements in this Current Report on Form 8-K are “forward-looking statements.” These statements relate to future events or the Company’s future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “forecast,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including: the effect of the coronavirus (COVID-19) pandemic and its variants and the associated supply chain impacts on the Company’s business; general economic, credit, and market conditions; the impact of the war in Ukraine, including the effects of economic and political sanctions imposed by the United States, European Union, and other countries related thereto, and/or the outbreak or escalation of conflict in other regions where we do business; future impairment charges; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than the Company does; pricing pressures from customers and consumers; resolution of uncertain tax positions, including the Company’s appeal of the draft and final Notices of Proposed Assessment (“NOPAs”) issued by the U.S. Internal Revenue Service and the impact that an adverse result in any such proceedings would have on operating results, cash flows, and liquidity; pending and potential third-party claims and litigation, including litigation relating to the Company’s restatement of previously-filed financial information and litigation relating to uncertain tax positions, including the NOPAs; potential impacts of ongoing or future government investigations and regulatory initiatives; potential costs and reputational impact of product recalls or sales halts; the impact of tax reform legislation and healthcare policy; the timing, amount and cost of any share repurchases; fluctuations in currency exchange rates and interest rates; the Company’s ability to achieve the benefits expected from the sale of its Rx business and the risk that potential costs or liabilities incurred or retained in connection with that transaction may exceed the Company’s estimates or adversely affect the Company’s business or operations; the Company’s ability to achieve the benefits expected from the acquisition of HRA Pharma and the risks that the Company’s synergy estimates are inaccurate or that the Company faces higher than anticipated integration or other costs in connection with the acquisition; the consummation and success of other announced and unannounced acquisitions or dispositions, and the Company’s ability to realize the desired benefits thereof; and the Company’s ability to execute and achieve the desired benefits of announced cost-reduction efforts and strategic and other initiatives. An adverse result with respect to the Company’s appeal of any material outstanding tax assessments or pending litigation, including securities or drug pricing matters, could ultimately require the use of corporate assets to pay such assessments, damages from third-party claims, and related interest and/or penalties, and any such use of corporate assets would limit the

assets available for other corporate purposes. These and other important factors, including those discussed under “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2021, as well as the Company’s subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this Current Report on Form 8-K are made only as of the date hereof, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

PERRIGO COMPANY PLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Todd W. Kingma |

| Dated: May 2, 2022 |

|

|

|

|

|

Todd W. Kingma |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

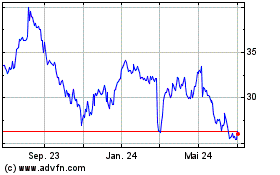

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

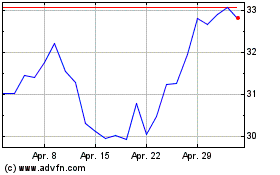

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024