UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

(Mark One)

| | | | | |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ___________

Commission file number 001-11459

| | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

PPL EMPLOYEE STOCK OWNERSHIP PLAN

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

PPL Corporation

Two North Ninth Street

Allentown, PA 18101-1179

PPL EMPLOYEE STOCK OWNERSHIP PLAN

FINANCIAL STATEMENTS

FOR THE YEARS ENDED

DECEMBER 31, 2021 AND 2020

&

REPORT OF INDEPENDENT REGISTERED ACCOUNTING FIRM

&

SUPPLEMENTAL SCHEDULE

PPL EMPLOYEE STOCK

OWNERSHIP PLAN

Table of Contents

| | | | | |

| Page |

| Report of Independent Registered Public Accounting Firm | |

| |

| |

| Financial Statements: | |

| |

| Statements of Net Assets Available for Benefits | |

| |

| Statements of Changes in Net Assets Available for Benefits | |

| |

| Notes to the Financial Statements | |

| |

| Supplemental Schedule: | |

| |

| Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year) | |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of PPL Employee Stock Ownership Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the PPL Employee Stock Ownership Plan (the "Plan") as of December 31, 2021 and 2020, the related statements of changes in net assets available for benefits for the years then ended, and the related notes and schedule (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2021, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its forms and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Baker Tilly US, LLP

We have served as the Plan's auditor since 2005.

Philadelphia, Pennsylvania

June 10, 2022

| | | | | | | | | | | | | | |

| PPL EMPLOYEE STOCK OWNERSHIP PLAN |

|

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS AT DECEMBER 31, |

| (Thousands of Dollars) |

| | | | |

| | 2021 | | 2020 |

| ASSETS | | | | |

| Investments, at fair value (Note 4) | | $ | 137,085 | | | $ | 135,985 | |

| Investments, at contract value (Note 3): | | | | |

| Plan interest in PPL Defined Contribution Master Trust | | 895 | | | 878 | |

| Total investments | | 137,980 | | | 136,863 | |

| | | | |

| Receivables: | | | | |

| Accrued dividends | | 1,860 | | | 1,964 | |

| Due from broker for securities sold | | 3 | | | 16 | |

| Total receivables | | 1,863 | | | 1,980 | |

| | | | |

| TOTAL ASSETS | | 139,843 | | | 138,843 | |

| | | | |

| LIABILITIES | | | | |

| Dividends payable to participants | | 1,860 | | | 1,964 | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS | | $ | 137,983 | | | $ | 136,879 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | | | | | | | | | |

| PPL EMPLOYEE STOCK OWNERSHIP PLAN |

|

| STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| FOR THE YEARS ENDED DECEMBER 31, |

| (Thousands of Dollars) |

| | | | |

| | 2021 | | 2020 |

| CHANGES IN NET ASSETS ATTRIBUTABLE TO | | | | |

| Investment income (loss): | | | | |

| Net appreciation (depreciation) in fair value of investments | | $ | 8,929 | | | $ | (35,837) | |

| Dividend income | | 7,650 | | | 7,880 | |

| Plan interest in investment income of PPL Defined Contribution Master Trust (Note 3) | | 38 | | | 38 | |

| Total investment income (loss), net | | 16,617 | | | (27,919) | |

| | | | |

| DEDUCTIONS | | | | |

| Distributions of dividends to participants | | (2,892) | | | (3,091) | |

| Distributions of stock and cash to participants | | (12,620) | | | (8,023) | |

| Administrative expenses | | (1) | | | (1) | |

| Total deductions | | (15,513) | | | (11,115) | |

| | | | |

| Net increase (decrease) | | 1,104 | | | (39,034) | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS | | | | |

| Beginning of year | | 136,879 | | | 175,913 | |

| | | | |

| End of year | | $ | 137,983 | | | $ | 136,879 | |

The accompanying notes are an integral part of these financial statements.

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

1. PLAN DESCRIPTION

The PPL Employee Stock Ownership Plan (the "Plan") was adopted effective January 1, 1975 to provide for employee stock ownership in PPL Corporation ("PPL"). The Plan is currently sponsored by PPL Services Corporation (the "Company"), an unregulated subsidiary of PPL. Amounts contributed to the Plan are used to purchase shares of PPL common stock ("Common Stock"). The following description of the Plan provides only general information. Participants should refer to the plan document for a more complete description of the Plan provisions.

Employees of participating PPL companies, as defined in the plan document, are eligible to participate in the Plan on the first day of the month following their date of hire. Effective January 1, 2015, the Plan was closed to newly-hired salaried employees.

The shares of Common Stock ("Shares") allocated to a participant's account may not exceed the maximum permitted by law. All Shares credited to a participant's account are 100% vested and nonforfeitable, but cannot be pledged as security by the participant. Each participant is entitled to exercise voting rights attributable to the shares attributed to his/her account. The Common Stock is held by Fidelity Management Trust Company (the "Trustee").

The Plan allows for dividends on Shares held to be reinvested in the Plan or paid in cash to participants. Under existing income tax laws, PPL is permitted to deduct the amount of those dividends for income tax purposes on its consolidated federal income tax return and to contribute the resulting tax savings (dividend-based contribution) to the Plan. The dividend-based contribution can be made in Shares or in cash that is used to buy Shares. The dividend-based contribution is expressly conditioned upon the deductibility of the contribution for federal income tax purposes. Shares are allocated to participants' accounts, 75% on the basis of Shares held in a participant's account and 25% on the basis of the participant's compensation.

Participants may elect to withdraw from their accounts Shares that have been allocated with respect to a plan year ending at least 36 months prior to the end of the plan year in which the election is made. Participants so electing may receive cash or Common Stock for the number of whole Shares and cash for any fractional Shares available for withdrawal, or may make a rollover to a qualified plan.

Participants who have attained age 55 and have completed ten years of participation in the Plan may elect to withdraw Shares or diversify the value of Shares held into other investment options under the Plan. For the first five years after meeting the requirement, participants may withdraw or diversify up to an aggregate of 25% of such Shares. In the sixth year, qualified participants may withdraw or diversify up to an aggregate of 50% of such Shares. Participants who elect to diversify may direct the Trustee to invest their eligible diversification amounts into various mutual funds and investments, which are similar to those provided through PPL's 401(k) savings plans.

Upon termination of service with a participating PPL company, participants are entitled to make a withdrawal and receive cash or Common Stock for the number of whole Shares and cash for any fractional Shares allocated to them, or may make a rollover to a qualified plan. Participants who

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

terminate service with a participating PPL company and whose account balance exceeds, or exceeded at the time of any prior distribution, $1,000, may defer distribution of the Shares in their account until April 1st of the calendar year following the year in which the participant attains age 72. If a participant wishes to withdraw prior to the age requirement, the entire account balance must be withdrawn.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 ("ERISA"), as amended. The plan is designed to comply with section 4975(e)(7) and the regulations of the Internal Revenue Code of 1986, as amended (IRC).

Provisions of the plan regarding vesting, distributions and other matters are more fully described in the plan document and Summary Plan Description.

The Plan is administered by the Employee Benefit Plan Board (the "Plan Administrator"), which is composed of certain PPL officers and employees appointed by the Board of Directors of PPL.

Company contributions are held and managed by the Trustee, which invests securities and cash received, interest, and dividend income and makes distributions to participants. The Plan pays investment and certain administrative expenses directly.

Certain administrative functions of the Plan are performed by employees of the Company. No such employees receive compensation from the Plan.

Certain professional fees and administrative expenses incurred by the Plan are paid by the Company and are not included in these financial statements.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements have been prepared under the accrual basis of accounting.

For the following note disclosures dollar amounts are presented in thousands.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of additions and deductions during the reporting period. Actual results could differ from those estimates.

Investments are reported at fair value (except for fully benefit-responsive investment contracts, which are reported at contract value). Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan Administrator determines the Plan’s valuation policies utilizing information provided by the investment advisors, Trustee and insurance companies. See Note 4 for discussion of fair value measurements.

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the gains and losses on investments bought and sold as well as held during the year.

Distributions to participants who terminate service for reasons other than retirement, disability or death are recorded in the period during which service is terminated unless such participants defer the distributions. Single sum distributions for active, retired, deceased, disabled and deferred terminated participants are recorded as distributed. Installment payments are recorded as distributed.

3. INTEREST IN PPL DEFINED CONTRIBUTION MASTER TRUST

PPL maintains the PPL Defined Contribution Master Trust (the "Master Trust") with the Trustee to pool the investments of its defined contribution benefit plans. The Blended Interest Rate Fund (the "Fund") is the only investment option of the Plan included in the Master Trust, and represented less than 1% of plan assets at December 31, 2021 and 2020. Therefore, no detailed disclosures related to the Master Trust have been presented in these financial statements. The Fund is structured as a synthetic investment contract and meets the fully benefit-responsive investment contract criteria to be measured at contract value. Contract value is the amount received by participants initiating transactions under the terms of the Plan. Contract value represents contributions made, plus earnings, less withdrawals and administrative expenses.

Investments directed by participants to the Fund within the Master Trust are combined with similar investments applicable to other plans participating in the Master Trust and invested in high-grade investment contracts issued by insurance companies and banks, as well as other high-quality debt obligations and short-term money market instruments. Wrapper contracts are purchased from another party, which are agreements that allow for the Fund to maintain a constant net asset value (“NAV”) and provide for participant transactions to be made at contract value. In a typical wrapper contract, the wrapper issuer agrees to pay the Fund the difference between the contract value and the market value of the covered assets if the market value becomes totally exhausted as a result of significant participant redemptions. Purchasing wrapper contracts is similar to buying insurance, in that the Fund pays a relatively small amount to protect against the relatively unlikely event of participant redemption of most of the shares of the Fund. The fair value of the wrapper contracts is determined using the replacement cost methodology that incorporates various inputs including the difference between the market for wrapper fees and the actual wrapper fees currently charged.

Wrapper contracts accrue interest using a formula called the "crediting rate." Wrapper contracts use the crediting rate formula to convert market value changes in the covered assets into income distributions in order to minimize the difference between the market and contract value of the covered assets over time. Using the crediting rate formula, an estimated future market value is calculated by compounding the Fund's current market value at the Fund's current yield to maturity for a period equal to the Fund's duration. The crediting rate is the discount rate that

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

equates estimated future market value with the Fund's current contract value. Crediting rates are reset monthly.

4. FAIR VALUE MEASUREMENTS

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described as follows:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 - Inputs to the valuation methodology include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in inactive markets, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 - Inputs to the valuation methodology are unobservable. Management believes such inputs are predicated on the assumptions market participants would use to measure the asset at fair value.

The asset or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs.

The following tables summarize instruments measured at fair value on a recurring basis at December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value Measurements at December 31, 2021 |

| | Total | | Level 1 | | Level 2 | | Level 3 |

| Common stock | | $ | 134,156 | | | $ | 134,156 | | | $ | — | | | $ | — | |

| Mutual funds | | 31 | | | 31 | | | — | | | — | |

| | $ | 134,187 | | | $ | 134,187 | | | $ | — | | | $ | — | |

| Common collective trust funds (a) | | 2,898 | | | | | | | |

| | $ | 137,085 | | | | | | | |

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value Measurements at December 31, 2020 |

| | Total | | Level 1 | | Level 2 | | Level 3 |

| Common stock | | $ | 132,881 | | | $ | 132,881 | | | $ | — | | | $ | — | |

| Mutual funds | | 14 | | | 14 | | | — | | | — | |

| | $ | 132,895 | | | $ | 132,895 | | | $ | — | | | $ | — | |

| Common collective trust funds (a) | | 3,090 | | | | | | | |

| | $ | 135,985 | | | | | | | |

(a)In accordance with accounting guidance certain investments that are measured at fair value using NAV, or its equivalent, practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2021 and 2020.

The fair value measurement of common stock, classified as Level 1, is based on its quoted market price in an active market.

The fair value measurements of mutual funds, classified as Level 1, are valued at the daily closing prices as reported by the funds. Mutual funds held by the Plan are open-end mutual funds that are registered with the U.S. Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

The fair value measurements of common collective trust funds are valued at the NAV of units of a bank collective trust. The NAV, as provided by the Trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV. There are no unfunded commitments. Participant transactions (purchases and sales) may occur daily. If the Plan was to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business fashion.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different value measurement at the reporting date.

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

5. NONPARTICIPANT - DIRECTED INVESTMENTS

The Plan's investments in Common Stock at December 31 are as follows:

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Number of Shares | | 4,462,933 | | | 4,712,080 | |

| | | | |

| Cost | | $ | 85,418 | | | $ | 89,161 | |

| Fair Value | | $ | 134,156 | | | $ | 132,881 | |

The fair value per share of Common Stock at December 31, 2021 and 2020 was $30.06 and $28.20, respectively.

The changes in nonparticipant-directed investments were as follows:

| | | | | | | | | | | | | | |

| | Year Ended December 31, 2021 | | Year Ended December 31, 2020 |

| Dividends | | $ | 7,650 | | | $ | 7,880 | |

| Net appreciation (depreciation) | | 8,533 | | | (36,410) | |

| Benefits paid to participants | | (14,656) | | | (10,778) | |

| Transfers to participant-directed investments | | (252) | | | (283) | |

| | $ | 1,275 | | | $ | (39,591) | |

6. RELATED PARTY AND PARTY-IN INTEREST TRANSACTIONS

The Plan investments are primarily PPL Common Stock. Transactions involving Shares qualify as party-in-interest transactions under the provisions of ERISA. Total sales at market value related to PPL Common Stock for 2021 and 2020 were $11,511 and $7,971, respectively. In 2021 and 2020, Participants elected to purchase additional shares of stock using dividends received on their existing shares totaling $4,758 and $4,789, respectively.

No dividend-based contributions were made to the Plan for the years ended December 31, 2021 and 2020.

Certain investments held in the Plan are shares of mutual funds managed by Fidelity Investments. Fidelity Investments is an affiliate of the Trustee and therefore, transactions in these investments qualify as party-in-interest transactions that are exempt from the prohibited transaction rules.

7. PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants would receive distribution of their accounts.

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

8. TAX STATUS

The Plan obtained its latest determination letter dated May 13, 2014, in which the Internal Revenue Service (the "IRS") stated that the Plan, as then designed, was in compliance with the applicable requirements of the IRC. The Plan Administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC and therefore, believes that the Plan is qualified, and the related trust is tax exempt.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2018.

9. RISK AND UNCERTAINTIES

The Plan investments consist primarily of PPL Common Stock in addition to various investment funds, which are exposed to various risks, such as interest rate, market, and credit risks, as well as valuation assumptions based on earnings, cash flows, and other such techniques. Due to the level of risk associated with these investments and to uncertainties inherent in estimates and assumptions, it is at least reasonably possible that changes in the value will occur in the near term and that such changes could materially affect the amounts reported in the Statements of Net Assets Available for Benefits.

For additional information, Plan participants should refer to PPL’s periodic reports and other filings with the Securities and Exchange Commission with respect to PPL and its Common Stock, and the applicable prospectus with respect to each of the various available investment funds.

10. RECONCILIATION TO FORM 5500

For financial reporting purposes, the investment in the Master Trust related to fully benefit-responsive investment contracts is presented at contract value. However, this investment should be reported at fair value on the Form 5500.

The following is a reconciliation of Net Assets Available for Benefits per the financial statements to the Form 5500 at December 31:

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Net assets available for benefits per the financial statements | | $ | 137,983 | | | $ | 136,879 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | | 7 | | | 31 | |

| Net assets available for benefits per the Form 5500 | | $ | 137,990 | | | $ | 136,910 | |

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

The following reconciliation details the reporting differences from the Plan's financial statements to the Form 5500 for the Plan investment income from the Master Trust and the adjustment for fair value reporting of fully benefit-responsive contracts for the years ended December 31:

| | | | | | | | | | |

| | 2021 | | |

| Investment income in Master Trust per the financial statements | | $ | 38 | | | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts previous year | | (31) | | | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts current year | | 7 | | | |

| Investment gain in Master Trust per the Form 5500 | | $ | 14 | | | |

11. PENDING LITIGATION

In January 2022, the law firm Schlichter, Bogard & Denton (Schlichter) filed a class action lawsuit against PPL in the United States District Court for the Eastern District of Pennsylvania on behalf of five current and former employees who participate in the Plan as well as the PPL Employee Savings Plan, PPL Deferred Savings Plan, and LG&E and KU Savings Plan. The lawsuit claims plan fiduciaries breached their duties by (1) failing to remove the allegedly underperforming Northern Trust Focus Funds as an investment option in the Plan as well as the PPL Employee Savings Plan, PPL Deferred Savings Plan, and the LG&E and KU Energy Savings Plan and (2) selecting higher-cost share classes when lower-cost share classes of the same investment option were available. The lawsuit also claims that PPL failed to monitor appointed fiduciaries. PPL filed a motion to dismiss the lawsuit on April 5, 2022.

12. SUBSEQUENT EVENTS

Acquisition

On March 17, 2021, subsidiaries of PPL entered into binding agreements with subsidiaries of National Grid Plc (National Grid) for (i) the disposition of PPL WPD Investments Limited, an indirect wholly-owned subsidiary of PPL (WPD Sale), and (ii) the acquisition of The Narragansett Electric Company, an indirect wholly-owned subsidiary of National Grid (Narragansett Electric Acquisition).

The WPD Sale closed on June 14, 2021, after receiving all required regulatory approvals. PPL has not had and will not have any significant involvement with the U.K. utility business since completion of the sale.

The Narragansett Electric Acquisition closed on May 25, 2022, after receiving all required regulatory approvals and waivers.

PPL EMPLOYEE STOCK OWNERSHIP PLAN

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

Common Stock Dividends

In November 2021, PPL declared its quarterly common stock dividend, payable January 3, 2022, at 41.50 cents per share. In February 2022, PPL declared its quarterly common stock dividend, payable April 1, 2022, at 20.00 cents per share. On June 9, 2022, PPL declared its quarterly common stock dividend, payable July 1, 2022, at 22.50 cents per share. The increase from the first quarter dividend follows the closing of the Narragansett Electric Acquisition in May 2022. Future dividends will be declared at the discretion of the Board of Directors of PPL and will depend upon future earnings, cash flows, financial and legal requirements and other factors.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Plan Name: PPL EMPLOYEE STOCK OWNERSHIP PLAN | | Plan Number: 002 |

| | |

Plan Sponsor: PPL SERVICES CORPORATION | | EIN: 23-3041441 |

| | | | | | | | |

| Schedule H, Line 4(i) - SCHEDULE OF ASSETS (Held at End of Year) |

| | | | | | | | |

| December 31, 2021 |

| | | | | | | | |

| (a) | (b) | | (c) | | (d) | | | (e) |

| Identity of Issue, Borrower, Lessor or Similar Party | | Description of Investment

including maturity date, rate of interest, collateral, par or maturity value | | Cost | | | Current Value |

| * | PPL Corporation | | 4,462,933 Shares of PPL Corp Common Stock - $0.01 par value | | $ | 85,417,593 | | | | $ | 134,155,779 | |

| Dodge & Cox Stock Fund | | Mutual Fund | | 15,690 | | ** | | 21,305 | |

| PIMCO All Asset Inst | | Mutual Fund | | 3,885 | | ** | | 3,841 | |

| PIMCO Income Inst | | Mutual Fund | | 5,870 | | ** | | 5,818 | |

| BlackRock LP Index Retirement | | Common Collective Trust Fund | | 926,816 | | ** | | 1,090,325 | |

| BlackRock LP Index 2025 | | Common Collective Trust Fund | | 173,485 | | ** | | 210,247 | |

| BlackRock LP Index 2030 | | Common Collective Trust Fund | | 37,700 | | ** | | 48,765 | |

| BlackRock LP Index 2035 | | Common Collective Trust Fund | | — | | ** | | 13 | |

| BlackRock LP Index 2040 | | Common Collective Trust Fund | | 444 | | ** | | 625 | |

| BlackRock LP Index 2045 | | Common Collective Trust Fund | | 19 | | ** | | 27 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Northern Trust S&P 500 Index Fund | | Common Collective Trust Fund | | 221,146 | | ** | | 363,984 | |

| Northern Trust Extended Equity Market Index Fund | | Common Collective Trust Fund | | 18,690 | | ** | | 21,601 | |

| Northern Trust Aggregate Bond Index Fund | | Common Collective Trust Fund | | 33,718 | | ** | | 37,702 | |

| Northern Trust ACWI ex-US Fund | | Common Collective Trust Fund | | 29,764 | | ** | | 39,378 | |

| FIAM Small/Mid Cap Core | | Common Collective Trust Fund | | 35,249 | | ** | | 44,858 | |

| Mawer International Equity Fund A | | Common Collective Trust Fund | | 8,174 | | ** | | 12,200 | |

| * | Fidelity Growth Co Pool Class 2 | | Common Collective Trust Fund | | 884,811 | | ** | | 937,234 | |

| Prudential Core Plus Bond Fund Class 15 | | Common Collective Trust Fund | | 90,705 | | ** | | 91,107 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | Total | | $ | 87,903,759 | | | | $ | 137,084,809 | |

*Represents a Party-in-interest.

**Cost information provided for participant directed investments is not required, but is disclosed because it is readily available.

EXHIBIT INDEX

| | | | | | | | |

| EXHIBIT | | |

| Consent of Baker Tilly US, LLP, Independent Registered Public |

| Accounting Firm Dated | June 10, 2022 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Employee Benefit Plan Board has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PPL Employee Stock Ownership Plan |

| | | |

| | By: | /s/ Christine Hess |

| | | Christine Hess |

| | | Chair, Employee Benefit Plan Board |

| | | PPL Corporation |

| Dated: | June 10, 2022 | | |

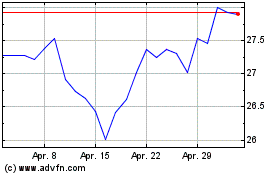

PPL (NYSE:PPL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

PPL (NYSE:PPL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024