Additional Proxy Soliciting Materials (definitive) (defa14a)

29 März 2023 - 7:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrant ☒ |

|

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☒ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

|

PPG Industries, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| Promoting Accountability and

Strong Corporate Governance

Practices

Track record of robust shareholder

engagement and responsiveness

Ensuring Effective,

Independent Oversight with a

Strong Lead Director in Place

Strong independent Lead Director with

broad responsibilities that are clearly

defined in our Corporate Governance

Guidelines

Commitment to Regular

Board Refreshment Ensuring

Composition In Line With Strategy

Regular refreshment provides new

perspectives and skillsets aligned with

our strategy

Focusing on PPG’s ESG

Programs and Practices

In 2021, the Board conducted a

comprehensive review of the

Company’s ESG oversight

PPG’s Board is Committed to Independent Oversight,

Delivering Value for Shareholders and Strong

Corporate Governance and ESG Practices

2

3

1

5

1. Data sourced from 2022 Spencer Stuart Board Index

1 ✓ Achieved record full-year 2022 reported net sales, driven by strong organic growth

✓ Continued focus on optimizing cost structure through simplification of supply chain and

capturing acquisition-related synergies

✓ Thoughtful capital allocation focused on maintaining strong balance sheet / liquidity,

pursuing focused M&A and continuing our legacy of returning capital through buybacks

and dividends, including 51 consecutive years of per share dividend increases

4

6.8 7.8

PPG S&P 500

Average Director Tenure (Years)

1

7 independent directors added since 2014

% of outstanding shares held

by active, institutional investors

with whom we met in 2022

Extensive Shareholder Engagement

60%

% of outstanding shares held

by institutional investors with

whom we held governance-focused meetings in 2022

45%

Board believes shareholders are best served by retaining flexibility to determine a

leadership structure, which may include an independent Board Chair when appropriate

Delivering Results

for Shareholders

The Board is actively engaged in

developing and overseeing our

strategy and execution which is

delivering results

✓ Strong Lead Director role provides robust independent Board leadership and oversight

✓ Current PPG leadership transition enabled by flexible Board leadership structure

✓ ESG programs and practices are overseen by the Board and each of its committees

resulting in PPG’s first DE&I report and Science-Based Target commitment

✓ Newly-created position of Vice President, Global Sustainability works with the

Sustainability Committee to coordinate PPG’s ESG programs

GRI SASB TCFD SDGs Best-in-Class

ESG Reporting

✓ Significant shareholder outreach to obtain the necessary votes – including adjourning the

2022 annual meeting to allow additional time for shareholders to vote

✓ As a result, eliminated supermajority voting and implemented annual director elections |

| PPG 2023 Annual Meeting of Shareholders

Proposal Roadmap

Please refer to our 2023 Proxy Statement for additional details on all voting matters;

voting inquiries can be directed to our proxy solicitor, D.F. King & Co., Inc.

Shareholders Call Toll-Free: (800) 290-6426

All Others Call: (212) 269-5550

Email: PPG@dfking.com

Proposal Board Recommendations

1. To elect as directors the five named nominees to

serve in a class whose term expires in 2025

FOR

2. To vote on a nonbinding resolution to approve the

compensation of the Company’s named executive

officers on an advisory basis

FOR

3. To vote on the frequency of future advisory votes on

executive compensation on an advisory basis

ONE YEAR

4. To ratify the appointment of PricewaterhouseCoopers

LLP as the Company’s independent registered public

accounting firm for 2023

FOR

5. To vote on a shareholder proposal to adopt a policy

requiring an independent Board chair, if properly

presented

AGAINST

PPG's Board Recommends Voting FOR Proposals 1, 2 and 4,

ONE YEAR on Proposal 3 and

AGAINST Proposal 5 to Require an Independent Board Chair

2 |

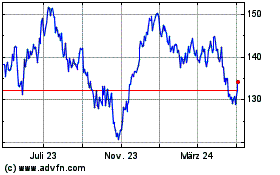

PPG Industries (NYSE:PPG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

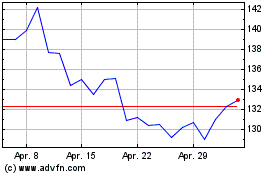

PPG Industries (NYSE:PPG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024