Filed Pursuant to Rule 424(b)(5)

Registration No. 333-263221

PROSPECTUS SUPPLEMENT

(To Prospectus Dated March 2, 2022)

PNM Resources, Inc.

Shares of Common Stock

Having an Aggregate Offering Price of up to $200,000,000

This prospectus supplement and the accompanying prospectus relate to the offer and sale from time to time of shares of our common stock, having an aggregate offering price of up to $200,000,000 through BofA Securities, Inc. (“BofA Securities”), MUFG Securities Americas Inc. (“MUFG”) and Wells Fargo Securities, LLC (“Wells Fargo”) as our agents under an at-the-market distribution agreement (the “distribution agreement”). We refer to BofA Securities, MUFG and Wells Fargo collectively as the sales agents. The distribution agreement provides that, in addition to the issuance and sale of common stock by us through the sales agents acting as sales agents or directly to the sales agents acting as principals, we also may enter into forward sale agreements, between us and affiliates of each of BofA Securities, MUFG or Wells Fargo. We refer to these affiliated entities, when acting in such capacity, as forward purchasers. In connection with each such forward sale agreement, and subject to the terms and conditions of the distribution agreement, the relevant forward purchaser will, at our request, borrow from third parties and, through the relevant sales agent, sell a number of shares of our common stock equal to the number of shares of our common stock that will underlie such forward sale agreement to hedge its exposure under such forward sale agreement. We refer to the sales agents, when acting as agents for the forward purchasers, as the forward sellers. In no event will the aggregate number of shares of our common stock sold through the sales agents, each as an agent for us, as principal and as a forward seller, under the distribution agreement have an aggregate sales price in excess of $200,000,000. The offering of common stock pursuant to the distribution agreement will terminate upon the earlier of (1) the sale, under the distribution agreement, of shares of our common stock with an aggregate sales price of $200,000,000, and (2) the termination of the distribution agreement, pursuant to its terms, by either all of the sales agents or us.

We will not initially receive any proceeds from the sale of borrowed shares of our common stock by a forward seller. In the event of full physical settlement of each forward sale agreement (by delivery of our common stock) with the relevant forward purchaser on one or more dates specified by us on or prior to the maturity date of the relevant forward sale agreement, we expect to receive aggregate cash proceeds equal to the product of the initial forward sale price under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale agreement. If, however, we elect to cash settle or net share settle a forward sale agreement, we may not receive any proceeds (in the case of cash settlement) or will not receive any proceeds (in the case of net share settlement), and we may owe cash (in the case of cash settlement) or shares of our common stock (in the case of net share settlement) to the relevant forward purchaser.

The shares of our common stock will be offered at market prices prevailing at the time of sale in “at the market offerings,” as defined in Rule 415 of the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the New York Stock Exchange (the “NYSE”), the existing trading market for shares of our common stock, or sales made to or through a market maker or through an electronic communications network or by such other methods, including privately negotiated transactions (including block transactions), as we and any sales agent agree to in writing. We will submit orders to only one sales agent or one forward seller, as the case may be, relating to the sale of shares of our common stock on any given day. Subject to the terms and conditions of the distribution agreement, the sales agents, forward sellers or forward purchasers have agreed to use their commercially reasonable efforts consistent with their respective normal trading and sales practices to sell on our behalf all of the designated shares.

The distribution agreements also provide that we may sell shares of our common stock to a sales agent as principal for its own account at a price agreed upon at the time of the sale. If we sell shares of our common stock to a sales agent as principal, then we will enter into a separate terms agreement with that sales agent setting forth the terms of such transaction.

We have agreed to pay each sales agent a commission equal to up to 2% of the sales price of all shares of our common stock sold through it as our sales agent under the distribution agreement. In connection with each forward sale agreement, the relevant forward seller will receive, reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale agreement, a commission equal to up to 2% of the volume weighted average of the sales prices of all borrowed shares of our common stock sold during the applicable period by it as a forward seller. In connection with the sale of the shares of common stock on our behalf, each sales agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of each sales agent will be deemed to be underwriting commissions or discounts.

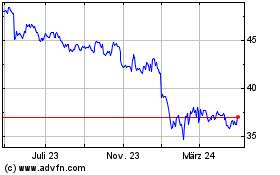

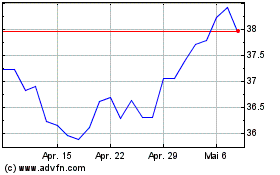

Our common stock is listed on the NYSE under the symbol “PNM.” The last reported sale price of our common stock on the NYSE on November 8, 2022 was $47.06 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement to read important factors you should consider before investing in our common stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

BofA Securities MUFG Wells Fargo Securities

The date of this prospectus supplement is November 10, 2022.

TABLE OF CONTENTS

Prospectus Supplement

| | | | | |

| Page |

| PROSPECTUS SUPPLEMENT SUMMARY | S-1 |

| RISK FACTORS | S-5 |

WHERE CAN YOU FIND MORE INFORMATION | S-8 |

DISCLOSURES REGARDING FORWARD-LOOKING STATEMENTS | S-9 |

USE OF PROCEEDS | S-11 |

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS | S-13 |

PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST) | S-17 |

LEGAL MATTERS | S-23 |

EXERPTS | S-23 |

Base Prospectus

| | | | | |

| Page |

| About This Prospectus | 1 |

| Where You Can Find More Information | 2 |

| PNM Resources, Inc. | 3 |

| Risk Factors | 3 |

| Disclosure Regarding Forward-Looking Statements | 3 |

| Use of Proceeds | 3 |

| Description of Debt Securities | 4 |

| Description of Common Stock and Preferred Stock | 13 |

| Description of Warrants | 16 |

| Description of Securities Purchase Contracts | 18 |

| Description of Units | 19 |

| Plan of Distribution | 20 |

| Legal Matters | 21 |

| Experts | 21 |

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the offering and certain other matters relating to us and our financial condition. The second part, the accompanying base shelf prospectus, gives more general information about securities we may offer from time to time, some of which does not apply to this offering. The accompanying base shelf prospectus dated March 2, 2022 is referred to as the “accompanying prospectus” in this prospectus supplement. Generally, when we refer to the prospectus, we are referring to both parts of this document combined. If this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in this document or to which this document refers you, or in other offering materials filed by us with the SEC. This prospectus supplement, the accompanying prospectus and any free writing prospectus that we prepare or authorize contain and incorporate by reference information that you should consider when making your investment decision. We have not, and the sales agents, forward sellers and forward purchasers have not, authorized anyone to provide you with different information and, if given, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any different or inconsistent information. This document may only be used where it is legal to sell these securities. We are not, and the sales agents, forward sellers and forward purchasers are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein is accurate as of any date other than the date on the front of those documents. Our business, financial condition, results of operations and prospects may have changed since the date of such information.

PROSPECTUS SUPPLEMENT SUMMARY

The following information supplements, and should be read together with, the information contained or incorporated by reference in other parts of this prospectus supplement and the accompanying prospectus. This summary highlights selected information from this prospectus supplement and the accompanying prospectus. As a result, it does not contain all of the information you should consider before investing in our common stock. You should carefully read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference, which are described under the caption “Where You Can Find More Information” in this prospectus supplement and the accompanying prospectus.

Unless otherwise indicated or unless the context otherwise requires, all references in this prospectus supplement to “PNMR,” “PNM Resources,” “the Company,” “we,” “our” and “us” refer to PNM Resources, Inc. and its subsidiaries. Unless otherwise indicated, financial information included or incorporated by reference herein is for PNM Resources, Inc. and its subsidiaries on a consolidated basis.

PNM Resources

PNM Resources is an investor-owned holding company with two regulated utilities providing electricity and electric services in New Mexico and Texas. PNMR’s primary subsidiaries are Public Service Company of New Mexico (“PNM”) and Texas-New Mexico Power Company (“TNMP”). PNM is an electric utility that provides electric generation, transmission, and distribution service to its rate-regulated customers in New Mexico. TNMP provides regulated transmission and distribution services to various retail electric providers that, in turn, provide retail electric service to consumers within TNMP’s service area in Texas.

For more information about PNMR and its subsidiaries, visit our website at www.pnmresources.com. Except for documents specifically incorporated into this prospectus supplement, the information contained in, or that can be accessed through, our website is not a part of this prospectus supplement.

Our executive office is located at 414 Silver Ave. SW, Albuquerque, New Mexico 87102-3289, and our telephone number is (505) 241-2700.

The Offering

| | | | | |

| Issuer | PNM Resources, Inc. |

| |

| Common Stock Offered by this Prospectus Supplement | Shares of common stock having an aggregate offering price of up to $200,000,000. |

| Manner of Offering | “At the market offering” that may be made from time to time through the sales agents. We may also sell shares of common stock to each sales agent as principal for its own account at a price agreed upon at the time of sale. If we sell shares of common stock to a sales agent as principal, we will enter into a separate terms agreement with such sales agent and we will describe this terms agreement in a separate prospectus supplement or pricing supplement if required. In addition to the issuance and sale of common stock by us through the sales agents acting as sales agents or directly to the sales agents acting as principals, we also may enter into forward sale agreements, between us and affiliates of each of BofA Securities, MUFG or Wells Fargo. We refer to these affiliated entities, when acting in such capacity, as forward purchasers. In connection with each such forward sale agreement, and subject to the terms and conditions of the distribution agreement, the relevant forward purchaser will, at our request, borrow, from third parties and, through the relevant sales agent, sell a number of shares of our common stock equal to the number of shares of our common stock that will underlie such forward sale agreement to hedge its exposure under such forward sale agreement. We refer to sales agents, when acting as agents for forward purchasers, as forward sellers. See “Plan of Distribution (Conflicts of Interest)” in this prospectus supplement. |

| Use of Proceeds | We intend to use the net proceeds that we receive from the sale of shares of our common stock, after deducting the sales agents’ commissions and our offering expenses, for general corporate purposes, which may include repayment of borrowings under our term loan and our short-term debt, including our unsecured revolving credit facility. We will not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward sellers, as agents for the forward purchasers, in connection with any forward sale agreement as a hedge of the relevant forward purchaser’s exposure under such forward sale agreement. We currently intend to use any cash proceeds that we receive upon physical settlement of any forward sale agreement, if physical settlement applies, or upon cash settlement of any forward sale agreement, if we elect cash settlement and are owed a payment thereunder, for general corporate purposes, which may include repayment of borrowings under our term loan and our short-term debt, including our unsecured revolving credit facility. See “Use of Proceeds.” |

| Listing | Our common stock is listed on the NYSE under the symbol “PNM.” |

| Dividend Policy | We expect to pay dividends on our common stock in amounts determined from time to time by our board of directors. Future dividend levels will be dependent on our results of operations, financial position, cash flows and other factors. |

| | | | | |

| Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders | Certain U.S. federal income and estate tax considerations of the acquisition, ownership and disposition of our common stock for non-U.S. holders are described in “Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders” included elsewhere in this prospectus supplement. |

| Transfer Agent and Registrar | The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. |

Accounting Treatment of Forward Sales

Risk Factors | In the event that we enter into any forward sale agreement, we expect that before the issuance of shares of our common stock, if any, upon physical or net share settlement of any forward sale agreement, the shares issuable upon settlement of that particular forward sale agreement will be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares of our common stock used in calculating diluted earnings per share is deemed to be increased by the excess, if any, of the number of shares of our common stock that would be issued upon full physical settlement of that particular forward sale agreement over the number of shares of our common stock that could be purchased by us in the market (based on the average market price during the relevant period) using the proceeds receivable upon full physical settlement (based on the adjusted forward sale price at the end of the relevant reporting period). Consequently, we anticipate there will be no dilutive effect on our earnings per share except during periods when the average market price of shares of our common stock is above the applicable adjusted forward sale price subject to increase or decrease based on the federal funds rate, less a spread, and subject to decrease by amounts related to expected dividends on shares of our common stock during the term of the relevant forward sale agreement. However, if we decide to physically settle or net share settle any forward sale agreement, delivery of our shares to the relevant forward purchaser on the physical settlement or net share settlement of the forward sale agreement would result in dilution to our earnings per share and return on equity. An investment in our common stock involves various risks, and prospective investors should carefully consider the matters discussed under the caption entitled “Risk Factors” on page S-5 of this prospectus supplement. |

| Conflicts of Interest | We may use a portion of the net proceeds from this offering to repay a portion of the outstanding amounts owed by us under our term loan and our short-term debt, including amounts we owe to the sales agents, the forward sellers and forward purchasers or their respective affiliates who have extended to us loans under such debt, including as lenders under our term loan and our unsecured revolving credit facility as described under “Use of Proceeds” in this prospectus supplement. In addition, the forward purchasers (or their respective affiliates) will receive the net proceeds from any sale of borrowed shares of our common stock sold pursuant to this prospectus supplement in connection with any forward sale agreement. Because certain sales agents or their affiliates are expected to receive part of the net proceeds from the sale of shares of our common stock in connection with any forward sale agreement or in connection with the repayment of a portion of the outstanding amounts owed by us under our term loan and our short-term debt, including our revolving |

| | | | | |

| |

| credit facility, such sales agents would be deemed to have a conflict of interest under Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121 to the extent such sales agents or affiliates receive at least 5% of the net proceeds from the offering. Any sales agent deemed to have a conflict of interest would be required to conduct the distribution of our common stock in accordance with FINRA Rule 5121. If the offering is conducted in accordance with FINRA Rule 5121, such sales agent would not be permitted to confirm a sale to an account over which it exercises discretionary authority without first receiving specific written approval from the account holder. The appointment of a “qualified independent underwriter” (as defined in FINRA Rule 5121) is not necessary for this offering because the shares of common stock being offered have a “bona fide public market” (as defined in FINRA Rule 5121). See “Plan of Distribution (Conflicts of Interest) – Conflicts of Interest” in this prospectus supplement. |

RISK FACTORS

An investment in our common stock involves certain risks. Our business is influenced by many factors that are difficult to predict, involve uncertainties that may materially affect actual results and are often beyond our control. In addition to the risk factors set forth below, you should carefully consider the risks and uncertainties, as well as any cautionary language or other information, contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the information under the caption “Item 1A Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, as modified by our other SEC filings filed after such annual report, which are incorporated by reference in this prospectus supplement, before investing in our common stock. Those risks and the risks set forth below are those that we consider to be the most significant to your decision whether to invest in our common stock. If any of the events described therein occur, our business, financial condition or results of operations could be materially harmed. As a result, the trading price of our common stock could decline and you could lose all or part of your investment. In consultation with your own financial and legal advisers, you should carefully consider, among other matters, the discussions of risks that we have incorporated by reference before deciding whether an investment in this offering is suitable for you. See “Where You Can Find More Information” on page S-8.

Settlement provisions contained in any forward sale agreement subject us to certain risks.

A forward purchaser will have the right to accelerate a forward sale agreement that it enters into with us and require us to physically settle such forward sale agreement (with respect to all or any portion of the transaction under such forward sale agreement that such forward purchaser determines is affected by such event) on a date specified by such forward purchaser if:

•in such forward purchaser’s commercially reasonable judgment, it or its affiliate is unable to hedge (or maintain a hedge of) its exposure under such forward sale agreement in a commercially reasonable manner because (x) insufficient shares of our common stock have been made available for borrowing by securities lenders or (y) the forward purchaser or its affiliate would incur a stock borrowing cost in excess of a specified threshold;

•we declare any dividend, issue or distribution on shares of our common stock

opayable in cash in excess of specified amounts,

othat constitutes an extraordinary dividend under the forward sale agreement,

opayable in securities of another company as a result of a spinoff or similar transaction, or

oof any other type of securities (other than our common stock), rights, warrants or other assets for payment (cash or other consideration) at less than the prevailing market price as determined in a commercially reasonable manner by the applicable calculation agent;

•certain ownership thresholds applicable to such forward purchaser and its affiliates are exceeded;

•an event is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender offers, as well as certain events involving our nationalization, insolvency, a delisting of our common stock, or change in law); or

•certain other events of default or termination events occur (each as more fully described in each forward sale agreement).

A forward purchaser’s decision to exercise its right to accelerate any forward sale agreement and to require us to settle any such forward sale agreement will be made irrespective of our interests, including our need for capital. In such cases, we could be required to issue and deliver shares of our common stock under the terms of the

physical settlement provisions of the applicable forward sale agreement irrespective of our capital needs, which would result in dilution to our earnings per share and return on equity.

We expect that settlement of any forward sale agreement will generally occur no later than the date specified in such forward sale agreement. However, any forward sale agreement may be settled earlier than such specified date in whole or in part at our option. Except under the circumstances described above, we generally have the right to elect physical, cash or net share settlement under each forward sale agreement. Delivery of our common stock upon physical settlement of any forward sale agreement (or, if we elect net share settlement of any forward sale agreement, upon such settlement to the extent we are obligated to deliver our common stock) will result in dilution to our earnings per share and return on equity. If we elect to cash or net share settle all or a portion of the shares of our common stock underlying any forward sale agreement, we would expect the relevant forward purchaser or one of its affiliates to purchase shares of our common stock in secondary market transactions over an unwind period to:

•return shares of our common stock to securities lenders in order to unwind such forward purchaser’s hedge (after taking into consideration any shares of our common stock to be delivered by us to such forward purchaser, in the case of net share settlement); and,

•if applicable, in the case of net share settlement, deliver shares of our common stock to us to the extent required in settlement of such forward sale agreement.

The forward sale price that we expect to receive upon physical settlement of any forward sale agreement will be subject to adjustment on a daily basis based on a floating interest rate factor equal to the federal funds rate less a spread and will be subject to decrease on certain dates specified in the relevant forward sale agreement by the amount per share of quarterly dividends we currently expect to declare during the term of such forward sale agreement. If the federal funds rate is less than the spread on any day, the interest rate factor will result in a daily reduction of the forward sale price. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is above the relevant forward sale price, in the case of cash settlement, we would pay the relevant forward purchaser under such forward sale agreement an amount in cash equal to the difference or, in the case of net share settlement, we would deliver to such forward purchaser a number of shares of our common stock having a value equal to the difference. Thus, we could be responsible for a potentially substantial cash payment in the case of cash settlement. If the volume-weighted average price at which the relevant forward purchaser (or its affiliate) purchases shares during the applicable unwind period under a forward sale agreement is below the relevant forward sale price, in the case of cash settlement, we would be paid the difference in cash by the relevant forward purchaser under such forward sale agreement or, in the case of net share settlement, we would receive from such forward purchaser a number of shares of our common stock having a value equal to the difference. Any such difference could be significant. See “Plan of Distribution (Conflicts of Interest)—Sales Through Forward Sellers.”

In addition, the purchase of our common stock by a forward purchaser or its affiliate to unwind the forward purchaser’s hedge position could cause the price of our common stock to increase over time (or prevent a decrease over time), thereby increasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that we would owe such forward purchaser upon settlement of the applicable forward sale agreement or decreasing the amount of cash (in the case of cash settlement), or the number of shares (in the case of net share settlement), that such forward purchaser would owe us upon settlement of the applicable forward sale agreement, as the case may be.

In the case of our bankruptcy or insolvency, any forward sale agreement that is in effect will automatically terminate, and we would not receive the expected proceeds from any forward sales of our common stock.

If we or a regulatory authority with jurisdiction over us institutes, or we consent to, a proceeding seeking a judgment in bankruptcy or insolvency or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or we or a regulatory authority with jurisdiction over us presents a petition for our winding-up or liquidation, or we consent to such a petition, any forward sale agreements that are then in effect will automatically terminate. If any such forward sale agreement so terminates, we would not be obligated to deliver to

the relevant forward purchaser any shares of our common stock not previously delivered, and the relevant forward purchaser would be discharged from its obligation to pay the applicable forward sale price per share in respect of any shares of our common stock not previously settled under the applicable forward sale agreement. Therefore, to the extent that there are any shares of our common stock with respect to which any forward sale agreement has not been settled at the time of the institution of or consent to any such bankruptcy or insolvency proceedings or any such petition, we would not receive the relevant forward sale price per share in respect of those shares of our common stock.

We have broad discretion in the use of the net proceeds from this offering and may use them in a manner that does not improve our financial performance or operating results.

We intend to use the net proceeds from this offering, if any, after deducting the sales agents’ commissions and our offering expenses, for general corporate purposes, which may include, among other things, repayment of borrowings under our term loan and our short-term debt, including our unsecured revolving credit facility. See the section of this prospectus supplement entitled “Use of Proceeds.” Although we plan to use the net proceeds from this offering as described, we have not designated the amount of net proceeds from this offering to be used for any specific purpose. Pending their use, we may invest the net proceeds from this offering in investment-grade, interest-bearing obligations, highly liquid cash equivalents, certificates of deposit, or direct or guaranteed obligations of the United States of America. These investments may not yield a favorable return to our shareholders. We will have broad discretion in the use of the net proceeds. You will be relying on the judgment of our management regarding the application of the proceeds from this offering. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our shares of common stock.

The shares of common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices and therefore may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and number of shares sold from time to time in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

You may experience significant dilution as a result of this offering, which may adversely affect the per share trading price of our common stock.

This issuance of common stock in this offering, as well as any shares issued by us in connection with a physical or net share settlement in respect of a forward sale agreement, may have a dilutive effect on our earnings per share. The actual amount of dilution from the issuance of common stock in this offering, as well as any shares issued by us in connection with a physical or net share settlement in respect of a forward sale agreement, or from any future offering of our common or preferred stock, will be based on numerous factors, particularly the use of proceeds and the return generated on those proceeds, and cannot be determined at this time.

The issuance of substantial numbers of shares of common stock or securities convertible into shares of common stock, or the perception that those issuances might occur, could materially adversely affect us, including the per share trading price of shares of our common stock, and could be dilutive to our stockholders.

The vesting of equity awards granted to certain directors, executive officers and other employees under our equity incentive plans and other issuances of our common stock could have an adverse effect on the per share trading price of our common stock, and may adversely affect the terms upon which we may be able to obtain additional capital through the sale of equity securities.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the SEC, and these filings are publicly available through the SEC’s website at www.sec.gov.

This prospectus supplement and the accompanying prospectus, which include information incorporated by reference, are part of a registration statement on Form S-3ASR we have filed with the SEC relating to the common stock offered hereby. As permitted by the SEC’s rules, this prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You should read the registration statement and the exhibits and schedules for more complete information about us and our common stock.

The registration statement, exhibits and schedules are also available through the SEC’s website.

You may obtain a free copy of our filings with the SEC by writing or telephoning us at our principal executive offices: PNM Resources, Inc., 414 Silver Ave. SW, Albuquerque, New Mexico, 87102-3289, Attention: Shareholder Services, telephone number (505) 241-2868. The filings are also available through the Investors section of our website: is www.pnmresources.com. The information on our website is not incorporated into this prospectus supplement by reference, and you should not consider it a part of this prospectus supplement.

The SEC allows us to “incorporate by reference” into this prospectus supplement and the accompanying prospectus information we file with the SEC. This means that we can disclose important information to you by referring you to documents that we have previously filed with the SEC or documents that we will file with the SEC in the future. The information we incorporate by reference is considered to be an important part of this prospectus supplement and the accompanying prospectus. Information that we file later with the SEC that is incorporated by reference into this prospectus supplement and the accompanying prospectus will automatically update and supersede this information.

We are “incorporating by reference” in this prospectus supplement and the accompanying prospectus information we file with the SEC, which means that we are disclosing important information to you by referring you to those documents. Our combined filings with the SEC present separate filings by PNMR, PNM and TNMP. Information contained therein relating to an individual registrant is filed by that registrant on its own behalf and each registrant makes no representation as to information relating to other registrants. The information we incorporate by reference is considered to be part of this prospectus supplement, unless it is updated or superseded by the information contained in this prospectus supplement or the information we file subsequently with the SEC that is incorporated by reference in this prospectus supplement.

We are incorporating by reference the following documents that we have filed with the SEC (except those portions of filings that relate to PNM or TNMP as separate registrants), other than any information in these documents that is deemed not to be “filed” with the SEC:

•Our Current Reports on Form 8-K as filed on January 3, 2022, March 1, 2022, March 11, 2022, March 22, 2022, May 11, 2022, May 16, 2022, May 19, 2022, May 24, 2022, June 30, 2022, July 21, 2022, July 28, 2022, August 5, 2022 and September 6, 2022 (only with respect to Item 8.01); •The description of our common stock contained in our Current Report on Form 8-K filed on December 31, 2001 and any amendment or report filed for the purpose of updating such description.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the documents they incorporate by reference contain statements that are not historical fact and constitute “forward-looking statements.” When we use words like “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “will,” “would” and similar expressions, or when we discuss our strategy or plans, we are making forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Our future results may differ materially from those expressed in these forward-looking statements. These statements are necessarily based upon various assumptions involving judgments with respect to the future and other risks, including, among others:

•The expected timing and likelihood of completion of the pending merger of NM Green Holdings, Inc., a New Mexico corporation (“Merger Sub”) and wholly-owned subsidiary of Avangrid, Inc., a New York corporation (“Avangrid”), with and into the Company pursuant to the Agreement and Plan of Merger, dated October 20, 2020, as amended, between the Company, Avangrid and Merger Sub (the “Merger Agreement”), with the Company surviving as a direct, wholly-owned subsidiary of Avangrid (the “Merger”), including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending Merger that could reduce anticipated benefits or cause the parties to abandon the transaction;

•The occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement;

•The risk that the parties may not be able to satisfy the conditions to the proposed Merger in a timely manner or at all;

•The risk that the proposed Merger could have an adverse effect on the ability of the Company to retain and hire key personnel and maintain relationships with its customers and suppliers, and on its operating results and businesses generally;

•The ability of PNM and TNMP to recover costs and earn allowed returns in regulated jurisdictions, including the prudence of PNM’s undepreciated investments in the Four Corners Power Plant (“Four Corners”) and recovery of PNM’s investments and other costs associated with that plant, revisions to its rates to remove San Juan Generating Station (“SJGS”) by issuing rate credits prior to issuing Energy transition bonds (“Securitized Bonds”) and the establishment of the Energy Transition Charge, and the impact on service levels for PNM customers if the ultimate outcomes do not provide for the recovery of costs and operating and capital expenditures, as well as other impacts of federal or state regulatory and judicial actions;

•The ability of the Company to successfully forecast and manage its operating and capital expenditures, including aligning expenditures with the revenue levels resulting from the ultimate outcomes of regulatory proceedings, or resulting from potential mid-term or long-term impacts related to COVID-19;

•Uncertainty relating to PNM's decision to return the currently leased generating capacity in the Palo Verde Nuclear Generating Station (“PVNGS”) Units 1 and 2 at the expiration of their lease terms in 2023 and 2024, including future regulatory outcomes relating to the ratemaking treatment;

•Uncertainty surrounding the status of PNM’s participation in jointly-owned generation projects, including the changes in PNM's generation entitlement share for PVNGS following termination of the leases in 2023 and 2024, the proposed exit from Four Corners and the exit and abandonment of SJGS;

•Uncertainty regarding the requirements and related costs of decommissioning power plants and reclamation of coal mines supplying certain power plants, as well as the ability to recover those costs from customers, including the potential impacts of current and future regulatory proceedings;

•The impacts on the electricity usage of customers and consumers due to performance of state, regional, and national economies, energy efficiency measures, weather, seasonality, alternative sources of power, advances in technology, the impacts of COVID-19 on customer usage, and other changes in supply and demand;

•Uncertainty related to the potential for regulatory orders, legislation or rulemakings that provide for municipalization of utility assets or public ownership of utility assets, including generation resources, or which would delay or otherwise impact the procurement of necessary resources in a timely manner;

•The Company’s ability to maintain its debt and access the financial markets in order to provide financing to repay or refinance debt as it comes due, as well as for ongoing operations and construction expenditures, including disruptions in the capital or credit markets, actions by ratings agencies, and fluctuations in interest rates, including any negative impacts that could result from the ultimate outcomes of regulatory proceedings, from the economic impacts of COVID-19, actions by the Federal Reserve to address inflationary concerns or other market conditions, geopolitical activity, or from the entry into the Merger Agreement;

•The risks associated with completion of generation, transmission, distribution, and other projects, including uncertainty related to regulatory approvals and cost recovery, the ability of counterparties to meet their obligations under certain arrangements (including coal supply agreements, renewable energy resources, and approved power purchase agreements related to replacement resources for facilities to be retired or for which the leases will terminate), and supply chain or other outside support services that may be disrupted;

•The potential unavailability of cash from the Company’s subsidiaries due to regulatory, statutory, or contractual restrictions or subsidiary earnings or cash flows;

•The performance of generating units, transmission systems, and distribution systems, which could be negatively affected by operational issues, fuel quality and supply chain issues (disruptions), unplanned outages, extreme weather conditions, wildfires, terrorism, cybersecurity breaches, and other catastrophic events, including the impacts of COVID-19, as well as the costs the Company may incur to repair its facilities and/or the liabilities the Company may incur to third parties in connection with such issues;

•State and federal regulation or legislation relating to environmental matters and renewable energy requirements, the resultant costs of compliance, and other impacts on the operations and economic viability of PNM’s generating plants;

•State and federal regulatory, legislative, executive, and judicial decisions and actions on ratemaking, and taxes, including guidance related to the Tax Cuts and Jobs Act, and other matters;

•Risks related to climate change, including potential financial risks resulting from climate change litigation and legislative and regulatory efforts to limit greenhouse gas emissions, including the impacts of the New Mexico Energy Transition Act;

•Employee workforce factors, including cost control efforts and issues arising out of collective bargaining agreements and labor negotiations with union employees;

•Variability of prices and volatility and liquidity in the wholesale power and natural gas markets;

•Changes in price and availability of fuel and water supplies, including the ability of the mines supplying coal to PNM’s coal-fired generating units and the companies involved in supplying nuclear fuel to provide adequate quantities of fuel;

•Regulatory, financial, and operational risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainties;

•The impacts of decreases in the values of marketable securities maintained in trusts to provide for decommissioning, reclamation, pension benefits, and other postretirement benefits, including potential increased volatility resulting from international developments and the impacts of COVID-19;

•Uncertainty surrounding counterparty performance and credit risk, including the ability of counterparties to supply fuel and perform reclamation activities and impacts to financial support provided to facilitate the coal supply at SJGS;

•The effectiveness of risk management regarding commodity transactions and counterparty risk;

•The outcome of legal proceedings, including the extent of insurance coverage; and

•Changes in applicable accounting principles or policies.

USE OF PROCEEDS

The amount of proceeds from this offering will depend upon the number of shares of common stock sold and the market price at which they are sold and, with respect to any forward sale transaction, the settlement method as described below. There can be no assurance that we will be able to sell any shares under or fully utilize the distribution agreement.

We currently intend to use the net proceeds from this offering, after deducting the sales agents’ commissions and our offering expenses, for general corporate purposes, which may include repayment of borrowings under our term loan and our short-term debt, including our unsecured revolving credit facility. As of September 30, 2022, we had $1.0 billion drawn under the PNM Resources term loan bearing interest at a variable rate of 4.13% and a maturity date of May 18, 2025. With respect to our short-term borrowings, as of September 30, 2022, we had $60.2 million outstanding on a consolidated basis, which included $57.2 million outstanding at the Company, with a weighted average interest rate of 4.45%. Of these short-term borrowings at the Company, $57.2 million was drawn under our unsecured revolving credit facility, with a weighted average interest rate at September 30, 2022 of 4.47% and a maturity date of October 31, 2024.Pending the use of the net proceeds as described above, we intend to invest these net proceeds in investment-grade interest-bearing obligations, highly liquid cash equivalents, certificates of deposit, or direct or guaranteed obligations of the United States of America.

The expected use of net proceeds from this offering represents our intentions based upon our present plans and business conditions. We cannot predict with certainty all of the particular uses for the proceeds from this offering or the amounts that we will actually spend on the uses set forth above. Accordingly, our management will have significant flexibility in applying the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations.

We will not initially receive any proceeds from the sale of borrowed shares of our common stock by the forward sellers, as agents for the forward purchasers, in connection with any forward sale agreement. The initial forward sale price for a particular forward sale agreement will be set through sales of borrowed shares of our common stock by an affiliate of the forward purchaser in an “at the market offering” as described in this prospectus supplement. The forward sale price we expect to receive upon physical settlement of a particular forward sale agreement will be subject to adjustment on a daily basis based on a floating interest rate factor equal to the federal funds rate less a spread and reduced by a commission of up to 2% of the volume-weighted average of the gross sales prices of all borrowed shares of our common stock sold during the applicable forward hedge selling period by the applicable sales agent, as a forward seller. In addition, the forward sale price will be subject to decrease on certain dates specified in the relevant forward sale agreement by the amount per share of quarterly dividends that, as of the time of entry into such forward sale agreement, we expect to declare during the term of such forward sale agreement. The forward sale price may also be subject to decrease if the cost to the forward purchaser of borrowing the number of shares of our common stock underlying the particular forward sale agreement exceeds a specified amount. If the federal funds rate is less than the spread on any day, the interest factor will result in a daily reduction of the forward sale price.

In the event of full physical settlement of a forward sale agreement, which we expect to occur on or prior to the maturity date of such forward sale agreement, we expect to receive aggregate cash proceeds equal to the product of the initial forward sale price under such forward sale agreement and the number of shares of our common stock underlying such forward sale agreement, subject to the price adjustment and other provisions of such forward sale agreement. If, however, we elect to cash settle or net share settle any forward sale agreement, we would expect to receive an amount of proceeds that is significantly lower than the product set forth in the immediately preceding sentence (in the case of any cash settlement) or will not receive any cash proceeds (in the case of any net share settlement), and we may owe cash (in the case of any cash settlement) or shares of our common stock (in the case of any net share settlement) to the relevant forward purchaser. We intend to use any cash proceeds that we receive upon physical settlement of any forward sale agreement, if physical settlement applies, or upon cash settlement of any forward sale agreement, if we elect cash settlement, for the purposes provided in the second paragraph of this section.

All of the sales agents, either directly or through affiliates, have extended to us loans under our short-term

debt, including in some cases as lenders under our term loan and revolving credit facility and accordingly may receive a portion of the proceeds from this offering pursuant to the repayment of borrowings under such short-term debt. In addition, the forward purchasers will receive the net proceeds from any sale of borrowed shares of our common stock sold pursuant to this prospectus supplement in connection with any forward sale agreement. See “Plan of Distribution (Conflicts of Interest)—Conflicts of Interest” in this prospectus supplement.

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS

FOR NON-U.S. HOLDERS

The following discussion summarizes material U.S. federal income and (to the limited extent set forth below) estate tax considerations relevant to the acquisition, ownership and disposition of shares of our common stock, but does not purport to be a complete analysis of all potential U.S. federal income and estate tax considerations. This discussion only applies to shares of our common stock that are purchased in this offering by Non-U.S. Holders (as defined below), and that are held as capital assets within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “Code”). This summary is based on the Code, administrative pronouncements, judicial decisions and regulations of the Treasury Department, changes to any of which subsequent to the date of this prospectus supplement may affect the tax consequences described herein. This discussion does not describe all of the U.S. federal income tax considerations that may be relevant to Non-U.S. Holders in light of their particular circumstances or to Non-U.S. Holders subject to special rules, such as certain financial institutions, tax-exempt organizations, insurance companies, traders or dealers in securities or commodities, persons holding shares of our common stock as part of a straddle, hedge, conversion transaction or other integrated or risk-reduction transaction, shareholders that acquired our common stock through the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement plan, persons that directly, indirectly or constructively hold in excess of 5% of our common stock, “controlled foreign corporations,” “passive foreign investment companies,” real estate investment trusts, regulated investment companies, governmental organizations, qualified foreign pension funds (or any entities all of the interests of which are held by a qualified foreign pension fund), persons subject to the alternative minimum tax, accrual method taxpayers subject to special tax accounting rules as a result of their use of financial statements or certain former citizens or residents of the United States. This discussion does not address any U.S. federal income or estate tax consequences for any beneficial owner of shares of our common stock that is a United States person within the meaning of Section 7701(a)(30) of the Code (a “United States person”) or any entity or arrangement treated as a partnership for U.S. federal income tax purposes. Furthermore, this discussion does not describe the effect of U.S. federal estate (except to the limited extent set forth below), generation-skipping or gift tax laws, the Medicare tax on investment income or the effect of any applicable foreign, state or local laws. Persons considering the purchase of shares of our common stock are urged to consult their tax advisors with regard to the application of the U.S. federal income and estate tax laws to their particular situations as well as any tax consequences arising under other U.S. federal laws or the laws of any state, local or foreign taxing jurisdiction.

We have not and will not seek any rulings or opinions from the Internal Revenue Service (the “IRS”) with respect to the matters discussed below. There can be no assurance that the IRS will not take a different position concerning the tax consequences of the acquisition, ownership or disposition of shares of our common stock or that any such position would not be sustained.

Prospective investors should consult their own tax advisors with regard to the application of the U.S. federal income and estate tax considerations discussed below to their particular situations as well as the application of any state, local, foreign or other tax laws, including gift tax laws.

For purposes of this summary, a “Non-U.S. Holder” means a beneficial owner of shares of our common stock that is an individual, corporation (or entity treated as a corporation for U.S. federal income tax purposes), estate or trust and, for U.S. federal income tax purposes, is not: (i) an individual that is a citizen or resident of the United States; (ii) a corporation or other entity treated as a corporation for U.S. federal income tax purposes that is created or organized under the laws of the United States, any state thereof or the District of Columbia; (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust if (A) a court within the United States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all substantial decisions of such trust, or (B) the trust has made an election under the applicable Treasury regulations to be treated as a United States person. If a partnership, or other entity or arrangement treated as a partnership for U.S. federal income tax purposes, holds shares of our common stock, the tax treatment of a partner in such a partnership will generally depend upon the status of the partner and the activities of the partnership. Partners in a partnership holding shares of our common stock should consult their tax advisors as to the particular U.S. federal income tax considerations relevant to the acquisition, ownership and disposition of such shares of our common stock applicable to them.

Distributions

In general, a distribution that we make to a Non-U.S. Holder with respect to shares of our common stock will constitute a dividend for U.S. federal income tax purposes to the extent paid out of our current or accumulated earnings and profits as determined under the Code. To the extent the amount of a distribution exceeds our current and accumulated earnings and profits, such excess will constitute a return of capital and will first reduce the Non-U.S. Holder’s adjusted tax basis in our common stock, but not below zero, and then will be treated as gain from the sale of our common stock (see “—Sale or Other Taxable Disposition of Our Common Stock” below). Dividends paid to a Non-U.S. Holder that are not effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States will generally be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends (unless such dividend is eligible for a reduced rate under an applicable income tax treaty). In order to obtain a reduced rate of withholding under an applicable income tax treaty, a Non-U.S. Holder is generally required to provide to the applicable withholding agent an IRS Form W-8BEN or IRS Form W-8BEN-E (or a suitable substitute form) properly certifying such Non-U.S. Holder’s eligibility for the reduced rate. Non-U.S. Holders that do not timely provide the applicable withholding agent with the required certification, but that qualify for a reduced withholding rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for a refund with the IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under an applicable income tax treaty and the timing and manner of claiming the benefits.

Dividends that are effectively connected with a Non-U.S. Holder’s conduct of a trade or business within the United States (and, if an applicable income tax treaty so requires, are attributable to a permanent establishment maintained by the Non-U.S. Holder in the United States) are not subject to U.S. federal withholding tax but generally will be subject to U.S. federal income taxation on a net-income basis in the same manner as if such dividends were received by a United States person. The Non-U.S. Holder is generally required to provide to the applicable withholding agent a properly executed IRS Form W-8ECI (or a suitable substitute form) in order to claim the exemption from U.S. federal withholding tax. In addition, a “branch profits tax” may be imposed at a 30% rate (or a reduced rate under an applicable income tax treaty) on a foreign corporation’s effectively connected earnings and profits for the taxable year, as adjusted for certain items.

Sale or Other Taxable Disposition of Our Common Stock

Subject to the discussions below under “—Information Reporting and Backup Withholding” and “—Foreign Account Tax Compliance Act,” a Non-U.S. Holder generally will not be subject to U.S. federal withholding tax with respect to gain, if any, recognized on the sale or other taxable disposition of shares of our common stock. A Non-U.S. Holder will also generally not be subject to U.S. federal income tax with respect to any such gain unless (i) the gain is effectively connected with the conduct by such Non-U.S. Holder of a trade or business within the United States (and, if an applicable income tax treaty so requires, is attributable to a permanent establishment maintained by the Non-U.S. Holder in the United States), (ii) in the case of a Non-U.S. Holder that is a nonresident alien individual, such Non-U.S. Holder is present in the United States for 183 or more days in the taxable year of the disposition and certain other conditions are satisfied, or (iii) our common stock constitutes a U.S. real property interest by reason of our status as a U.S. real property holding corporation (a “USRPHC”) for U.S. federal income tax purposes.

In the case described in (i) above, gain recognized on the disposition of shares of our common stock generally will be subject to U.S. federal income taxation on a net-income basis in the same manner as if such gain were recognized by a United States person, and, in the case of a Non-U.S. Holder that is a foreign corporation, may also be subject to the branch profits tax at a rate of 30% (or a lower applicable treaty branch profits tax rate). In the case described in (ii) above, the Non-U.S. Holder will be subject to a 30% tax (or a lower applicable treaty rate) on any capital gain recognized on the disposition of shares of our common stock (after being offset by certain U.S.-source capital losses).

Generally, a U.S. corporation is a USRPHC if the fair market value of its U.S. real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business (all as determined for U.S. federal income tax purposes). We have not determined whether we are a USRPHC; however, even if we are or become a USRPHC, so long as shares of our common stock continue to be regularly traded on an established securities market, within the meaning of applicable

Treasury regulations, a Non-U.S. Holder will not be subject to U.S. federal income tax on the disposition of shares of our common stock if the Non-U.S. Holder has not held more than 5% (directly, indirectly or constructively) of our total outstanding common stock at any time during the shorter of the five-year period preceding the date of disposition, or such Non-U.S. Holder’s holding period. If our common stock were not considered to be regularly traded on an established securities market, a Non-U.S. Holder (regardless of the percentage of shares of our common stock owned) generally would be subject to U.S. federal income tax on a taxable disposition of shares of our common stock at the regular rates applicable to United States persons and a 15% withholding tax generally would apply to the gross proceeds from such disposition.

Non-U.S. Holders should consult their tax advisors regarding the U.S. federal income tax consequences of investing in our common stock if we were to be treated as a USRPHC. Non-U.S. Holders should also consult their tax advisors regarding potentially applicable income tax treaties that may provide for different rules.

Information Reporting and Backup Withholding

Payors must report annually to the IRS and to each Non-U.S. Holder the amount of any distributions paid to such holder (whether or not the distribution represents a taxable dividend), the name and address of the recipient and any tax withheld with respect to such distributions, regardless of whether withholding was required. Copies of the information returns reporting such distributions and withholding also may be made available to the tax authorities in the country in which the Non-U.S. Holder resides under the provisions of an applicable tax treaty.

A Non-U.S. Holder may be subject to backup withholding for dividends paid to such holder unless such holder certifies on IRS Form W-8BEN or IRS Form W-8BEN-E (or another appropriate form) that it is a Non-U.S. Holder (and the payor does not have actual knowledge or reason to know that such holder is a United States person), or such holder otherwise establishes an exemption.

Information reporting and, depending on the circumstances, backup withholding may apply to the proceeds of a sale or other taxable disposition of our common stock by a Non-U.S. Holder within the United States or conducted through certain U.S.-related financial intermediaries, unless the beneficial owner certifies on IRS Form W-8BEN or IRS Form W-8BEN-E (or another appropriate form) that it is a Non-U.S. Holder (and the withholding agent does not have actual knowledge or reason to know that the beneficial owner is a United States person), or such owner otherwise establishes an exemption.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder’s U.S. federal income tax liability provided the required information is timely furnished to the IRS.

Foreign Account Tax Compliance Act

Sections 1471 to 1474 of the Code and related IRS guidance (commonly referred to as the Foreign Account Tax Compliance Act (“FATCA”)) impose a 30% U.S. withholding tax on any dividends on our common stock and (subject to proposed Treasury regulations discussed below) on the gross proceeds from a disposition of our common stock, in each case if paid to a “foreign financial institution” or a “non-financial foreign entity” (including, in some cases, when such foreign financial institution or entity is acting as an intermediary), unless (i) in the case of a foreign financial institution, such institution enters into an agreement with the U.S. government to withhold on certain payments, and to collect and provide to the U.S. tax authorities substantial information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S. owners), (ii) in the case of a non-financial foreign entity, such entity certifies that it does not have any substantial U.S. owners or provides the withholding agent with a certification (generally on an IRS Form W-8BEN-E) identifying the direct and indirect substantial U.S. owners of the entity, or (iii) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS Form W-8BEN-E). Under certain circumstances, a holder of our common stock might be eligible for refunds or credits of such taxes. Although withholding under FATCA would have applied to payments of gross proceeds from the taxable disposition of our common stock on or after January 1, 2019, proposed Treasury regulations eliminate FATCA withholding on payments of gross proceeds entirely. Taxpayers generally may rely on these proposed Treasury regulations until

final Treasury regulations are issued. Intergovernmental agreements governing FATCA between the United States and certain other countries may modify the foregoing requirements for certain holders of our common stock. Prospective investors should consult their own tax advisors regarding FATCA and whether it may be relevant to the ownership and disposition of shares of our common stock.

Federal Estate Tax

Shares of our common stock beneficially owned by an individual who is not a citizen or resident of the United States (as defined for U.S. federal estate tax purposes) at the time of death will generally be includable in the decedent’s gross estate for U.S. federal estate tax purposes unless an applicable income tax treaty provides otherwise.

PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We have entered into a distribution agreement, dated November 10, 2022, with each of the sales agents, forward sellers and forward purchasers under which we may issue and sell up to $200,000,000 in the aggregate of shares of our common stock from time to time through the sales agents acting as sales agents or directly to the sales agents acting as principals for the offer and sale of shares of our common stock. Further, the distribution agreement provides that, in addition to the issuance and sale of shares of our common stock by us to or through the sales agents, we also may deliver from time to time instructions to any sales agent specifying that such sales agent, as a forward seller, use commercially reasonable efforts consistent with their respective normal trading and sales practices to sell shares of our common stock borrowed by the applicable forward purchaser in connection with one or more forward sale agreements, as described below. In no event will the aggregate number of shares of our common stock sold through the sales agents, each as an agent for us, as principal and as a forward seller, under the distribution agreement have an aggregate sales price in excess of $200,000,000.

The sales, if any, of shares of our common stock under the distribution agreement will be made in “at the market offerings” as defined in Rule 415 of the Securities Act, including sales made directly on the New York Stock Exchange, the existing trading market for shares of our common stock, or sales made to or through a market maker or through an electronic communications network. In addition, shares of our common stock may be offered and sold by such other methods, including privately negotiated transactions (including block transactions), as we and any sales agent agree to in writing.

The distribution agreement also provides that we may sell shares of common stock to a sales agent as principal for its own account at a price agreed upon at the time of the sale. If we sell shares of common stock to a sales agent as principal, then we will enter into a separate terms agreement with that sales agent setting forth the terms of such transaction, and if required, we will describe that terms agreement in a separate prospectus supplement or pricing supplement.

We have also agreed to reimburse the sales agents, the forward sellers and the forward purchasers for their reasonable and documented out-of-pocket expenses, including the fees and expenses of counsel in connection with this offering up to an agreed aggregate amount, with the excess to be paid by the sales agents and forward purchasers. These reimbursed fees and expenses are deemed to be underwriting compensation to the sales agents under FINRA Rule 5110.

In connection with the sale of our common stock as contemplated in this prospectus supplement, the sales agents and the forward purchasers may be deemed to be “underwriters” within the meaning of the Securities Act, and the compensation paid to the sales agents and the forward purchasers may be deemed to be underwriting commissions or discounts. We have agreed to indemnify the sales agents and the forward purchasers against certain liabilities, including liabilities under the Securities Act.

If a sales agent or we have reason to believe that the exemptive provisions set forth in Rule 101(c)(1) of Regulation M under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are not satisfied, that party will promptly notify the other and sales of common stock under the distribution agreement will be suspended until that or other exemptive provisions have been satisfied in the judgment of the sales agents and us.

We estimate that the total expenses from this offering payable by us, excluding compensation payable to the sales agents under the distribution agreement, will be approximately $562,050.

We intend to report to the SEC at least quarterly (1) the number of shares of our common stock sold to or through the sales agents in connection with at-the-market sales as described below under “—Sales Through Sales Agents,” (2) the number of borrowed shares of our common stock sold by the forward sellers, as agents for the forward purchasers, in connection with the forward sale agreements as described below under “—Sales Through Forward Sellers” and (3) the net proceeds received by us and the compensation paid by us to the sales agents in connection with transactions described in clauses (1) and (2).

Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the sales agents may agree upon. The offering of common stock pursuant to the distribution agreement will terminate upon the earlier of (1) the sale, under the distribution agreement, of shares of our common stock with an aggregate sales price of $200,000,000, and (2) the termination of the distribution agreement, pursuant to its terms, by either all of the sales agents or us.

In the ordinary course of their business, certain of the sales agents and/or their affiliates have in the past performed, and may continue to perform, investment banking, broker dealer, lending, financial advisory or other services for us for which they have received, or may receive, separate fees. For example, under our term loan, Wells Fargo Bank, N.A., an affiliate of Wells Fargo Securities, LLC, is the administrative agent and a lender, an affiliate of BofA Securities, Inc. is a lender and an affiliate of MUFG Securities Americas Inc. is a lender. Additionally, under the revolving credit facility, Wells Fargo Securities, LLC, MUFG Union Bank, N.A., an affiliate of MUFG Securities Americas Inc. and BofA Securities, Inc. are joint lead arrangers and co-bookrunners and an affiliate of Wells Fargo Securities, LLC is the administrative agent and a lender, an affiliate of MUFG Securities Americas Inc. is a lender and an affiliate of BofA Securities, Inc. is a lender.

The sales agents and their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing, market making, brokerage and other financial and non-financial activities and services. In the ordinary course of their business, the sales agents and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and such investment and securities activities may involve securities and/or instruments of the Company. The sales agents and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Sales Through Sales Agents

From time to time during the term of the distribution agreement, and subject to the terms and conditions set forth therein, we may deliver instructions to any of the sales agents. Upon receipt of such instructions from us, and subject to the terms and conditions of the distribution agreement, each sales agent has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices to sell the amount of shares of our common stock specified in our instructions. We or the relevant sales agent may suspend the offering of shares of our common stock at any time upon proper notice to the other, upon which the selling period will immediately terminate. Settlement for sales of shares of our common stock will occur on the second trading day following the date on which the sales were made unless another date shall be agreed to in writing by us and the relevant sales agent. The obligation of any sales agent under the distribution agreement to sell shares of our common stock pursuant to our instructions is subject to a number of conditions, which such sales agent reserves the right to waive in its sole discretion.

We will pay each sales agent a commission equal to up to 2% of the sales price of all shares of our common stock sold through it as our agent under the distribution agreement.

Sales Through Forward Sellers

From time to time during the term of the distribution agreement, and subject to the terms and conditions set forth therein, we may enter into one or more forward sale agreements with a forward purchaser and deliver instructions to its sales agent, requesting that the sales agent execute sales of borrowed shares of our common stock as a forward seller in connection with the applicable forward sale agreement, and subject to the terms and conditions of the distribution agreement, the relevant forward purchaser will, at our request, borrow from third parties, and such forward seller will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell, such shares of our common stock on such terms to hedge such forward purchaser’s exposure under such forward sale agreement. We or the relevant forward seller may immediately suspend the offering of shares of our common stock at any time upon proper notice to the other. We expect settlement between a forward purchaser and the relevant forward seller of sales of borrowed shares of our common stock, as well as the settlement between the

relevant forward seller and buyers of such shares in the market, to occur on the second trading day following each date on which the sales are made unless another date shall be agreed to in writing by us and the relevant sales agent. The obligation of each forward seller under the distribution agreement to execute such sales of shares of our common stock is subject to a number of conditions, which each forward seller reserves the right to waive in its sole discretion.

In connection with each forward sale agreement, the relevant forward seller will receive, reflected in a reduced initial forward sale price payable by the relevant forward purchaser under its forward sale agreement, a commission equal to up to 2% of the volume weighted average of the sales prices of all borrowed shares of our common stock sold during the applicable period by it as a forward seller. We refer to this commission rate as the forward selling commission.