Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

14 Februar 2023 - 12:11PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-269690

FINAL TERM SHEET

Philip

Morris International Inc.

Dated February 13, 2023

|

|

|

| 4.875% Notes due 2026

4.875% Notes due 2028 5.125% Notes

due 2030 5.375% Notes due 2033 |

|

|

| Issuer: |

|

Philip Morris International Inc. |

|

|

| Offering Format: |

|

SEC Registered |

|

|

| Security: |

|

4.875% Notes due 2026 (the “2026 Notes”)

4.875% Notes due 2028 (the “2028 Notes”)

5.125% Notes due 2030 (the “2030 Notes”)

5.375% Notes due 2033 (the “2033 Notes”) |

|

|

| Aggregate Principal Amount: |

|

2026 Notes: $ 1,250,000,000

2028 Notes: $ 1,000,000,000

2030 Notes: $ 1,500,000,000

2033 Notes: $ 1,500,000,000 |

|

|

| Maturity Date: |

|

2026 Notes: February 13, 2026

2028 Notes: February 15, 2028

2030 Notes: February 15, 2030

2033 Notes: February 15, 2033 |

|

|

| Coupon: |

|

2026 Notes: 4.875%

2028 Notes: 4.875%

2030 Notes: 5.125%

2033 Notes: 5.375% |

|

|

| Interest Payment Dates: |

|

2026 Notes: Semi-annually on each February 13 and August 13, commencing August 13, 2023

2028 Notes: Semi-annually on each February 15 and August 15, commencing August 15, 2023

2030 Notes: Semi-annually on each February 15 and August 15, commencing August 15, 2023

2033 Notes: Semi-annually on each February 15 and August 15, commencing August 15,

2023 |

|

|

|

|

|

| Record Dates: |

|

2026 Notes: February 1 and August 1

2028 Notes: February 1 and August 1

2030 Notes: February 1 and August 1

2033 Notes: February 1 and August 1 |

|

|

| Price to Public: |

|

2026 Notes: 99.651% of principal amount

2028 Notes: 99.414% of principal amount

2030 Notes: 99.178% of principal amount

2033 Notes: 99.793% of principal amount |

|

|

| Underwriting Discount: |

|

2026 Notes: 0.200% of principal amount

2028 Notes: 0.300% of principal amount

2030 Notes: 0.350% of principal amount

2033 Notes: 0.450% of principal amount |

|

|

| Net Proceeds: |

|

2026 Notes: $1,243,137,500 (before expenses)

2028 Notes: $991,140,000 (before expenses)

2030 Notes: $1,482,420,000 (before expenses)

2033 Notes: $1,490,145,000 (before expenses) |

|

|

| Benchmark Treasury: |

|

2026 Notes: 4.000% due February 15, 2026

2028 Notes: 3.500% due January 31, 2028

2030 Notes: 3.500% due January 31, 2030

2033 Notes: 3.500% due February 15, 2033 |

|

|

| Benchmark Treasury Price/Yield: |

|

2026 Notes: 99-14 / 4.202%

2028 Notes: 98-05+ / 3.909%

2030 Notes: 98-02+ / 3.817%

2033 Notes: 98-10+ / 3.702% |

|

|

| Spread to Benchmark Treasury: |

|

2026 Notes: +80 basis points

2028 Notes: +110 basis points

2030 Notes: +145 basis points

2033 Notes: +170 basis points |

|

|

|

|

|

| Yield to Maturity: |

|

2026 Notes: 5.002%

2028 Notes: 5.009%

2030 Notes: 5.267%

2033 Notes: 5.402% |

|

|

| Optional Redemption: |

|

2026 Notes:

Make-whole redemption at Treasury plus 15 bps at any time

2028 Notes:

Prior to January 15, 2028: Make-whole redemption at Treasury plus 20 bps

On or after January 15, 2028: Redemption at par

2030 Notes:

Prior to December 15, 2029: Make-whole redemption at Treasury plus 25 bps

On or after December 15, 2029: Redemption at par

2033 Notes:

Prior to November 15, 2032: Make-whole redemption at Treasury plus 30 bps

On or after November 15, 2032: Redemption at par |

|

|

| Settlement Date (T+2): |

|

February 15, 2023 |

|

|

| CUSIP/ISIN: |

|

2026 Notes: CUSIP Number: 718172 CY3

ISIN Number: US718172CY31

2028 Notes: CUSIP Number: 718172 CZ0

ISIN Number: US718172CZ06

2030 Notes: CUSIP Number: 718172 DA4

ISIN Number: US718172DA46

2033 Notes: CUSIP Number: 718172 DB2

ISIN Number: US718172DB29 |

|

|

| Listing: |

|

None |

|

|

|

|

|

| Joint Book-Running Managers: |

|

Barclays Capital Inc.

BofA Securities, Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Mizuho Securities USA LLC

SMBC Nikko Securities America, Inc.

BBVA Securities Inc.

Credit Suisse Securities (USA) LLC

Santander US Capital Markets LLC

Standard Chartered Bank

Wells Fargo Securities, LLC |

|

|

| Senior Co-Manager: |

|

Bank of China (Europe) S.A. |

|

|

| Co-Managers: |

|

Commerz Markets LLC

Intesa Sanpaolo S.p.A.

MUFG Securities Americas Inc.

UBS Securities LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allocations: |

|

2026 Notes |

|

|

2028 Notes |

|

|

2030 Notes |

|

|

2033 Notes |

|

| BofA Securities, Inc. |

|

$ |

158,375,000 |

|

|

$ |

126,700,000 |

|

|

$ |

190,050,000 |

|

|

$ |

190,050,000 |

|

| Citigroup Global Markets Inc. |

|

$ |

148,750,000 |

|

|

$ |

119,000,000 |

|

|

$ |

178,500,000 |

|

|

$ |

178,500,000 |

|

| Mizuho Securities USA LLC |

|

$ |

91,250,000 |

|

|

$ |

73,000,000 |

|

|

$ |

109,500,000 |

|

|

$ |

109,500,000 |

|

| SMBC Nikko Securities America, Inc. |

|

$ |

91,250,000 |

|

|

$ |

73,000,000 |

|

|

$ |

109,500,000 |

|

|

$ |

109,500,000 |

|

| Barclays Capital Inc. |

|

$ |

83,750,000 |

|

|

$ |

67,000,000 |

|

|

$ |

100,500,000 |

|

|

$ |

100,500,000 |

|

| BBVA Securities Inc. |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Credit Suisse Securities (USA) LLC |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Deutsche Bank Securities Inc. |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| HSBC Securities (USA) Inc. |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Santander US Capital Markets LLC |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Standard Chartered Bank |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Wells Fargo Securities, LLC |

|

$ |

75,875,000 |

|

|

$ |

60,700,000 |

|

|

$ |

91,050,000 |

|

|

$ |

91,050,000 |

|

| Bank of China (Europe) S.A. |

|

$ |

51,875,000 |

|

|

$ |

41,500,000 |

|

|

$ |

62,250,000 |

|

|

$ |

62,250,000 |

|

| Commerz Markets LLC |

|

$ |

46,875,000 |

|

|

$ |

37,500,000 |

|

|

$ |

56,250,000 |

|

|

$ |

56,250,000 |

|

| MUFG Securities Americas Inc. |

|

$ |

31,250,000 |

|

|

$ |

25,000,000 |

|

|

$ |

37,500,000 |

|

|

$ |

37,500,000 |

|

| UBS Securities LLC |

|

$ |

8,750,000 |

|

|

$ |

7,000,000 |

|

|

$ |

10,500,000 |

|

|

$ |

10,500,000 |

|

| Intesa Sanpaolo S.p.A. |

|

$ |

6,750,000 |

|

|

$ |

5,400,000 |

|

|

$ |

8,100,000 |

|

|

$ |

8,100,000 |

|

| Total |

|

$ |

1,250,000,000 |

|

|

$ |

1,000,000,000 |

|

|

$ |

1,500,000,000 |

|

|

$ |

1,500,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No EEA or UK PRIIPs KID – No EEA or UK PRIIPs key information document (KID) has been prepared as not available to

retail in the EEA or the UK.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays Capital Inc.

toll free at 1-888-603-5847, BofA Securities, Inc. toll free at

1-800-294-1322, Citigroup Global Markets Inc. toll free at 1-800-831-9146, Deutsche Bank Securities Inc. toll free at 1-800-503-4611, HSBC

Securities (USA) Inc. toll free at 1-866-811-8049, Mizuho Securities USA LLC toll free at 1-866-271-7403 and SMBC Nikko Securities America, Inc. toll free at

1-888-868-6856.

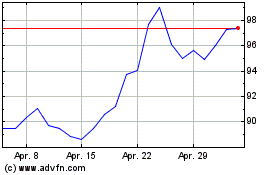

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

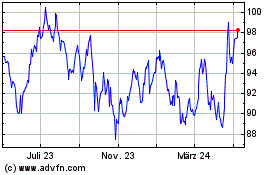

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024