Philip Morris Succeeds in Bid For Swedish Match

07 November 2022 - 12:34PM

Dow Jones News

By Dominic Chopping

Philip Morris International Inc. said Monday that it is moving

ahead to complete its $16 billion acquisition of tobacco company

Swedish Match AB despite failing to reach the planned level of

shareholder support.

The U.S. maker of Marlboro cigarettes said investors holding

82.6% of Swedish Match shares have accepted the deal--including the

top 10 shareholders--and although this is short of the 90% target,

it has decided to move ahead and complete the acquisition.

"We are today extending the acceptance period until November 25

to allow those shareholders who have not tendered...additional time

to accept the offer, while waiving the 90% acceptance condition to

provide certainty to those shareholders who have already tendered,"

Chief Executive Jacek Olczak said.

Philip Morris plans to delist Swedish Match shares after

reaching an ownership of more than 90%.

The acquisition gives Philip Morris access to Swedish Match's

smokeless tobacco portfolio which counts the U.S. as its largest

market and holds large market share positions with it's nicotine

pouch and chewing tobacco products.

Philip Morris offered 106 Swedish kronor ($9.71) a share for the

company in May but came back with an improved final bid of SEK116

last month.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

November 07, 2022 06:19 ET (11:19 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

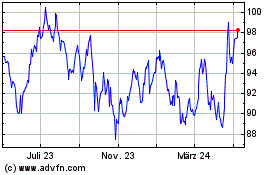

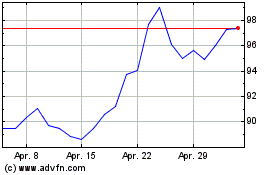

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024