Current Report Filing (8-k)

07 November 2022 - 12:05PM

Edgar (US Regulatory)

0001413329false00014133292022-11-072022-11-070001413329us-gaap:CommonStockMember2022-11-072022-11-070001413329pm:A2.625Notesdue2023Member2022-11-072022-11-070001413329pm:A2.125Notesdue2023Member2022-11-072022-11-070001413329pm:A3.600Notesdue2023Member2022-11-072022-11-070001413329pm:A2.875Notesdue20241Member2022-11-072022-11-070001413329pm:A2.875Notesdue20242Member2022-11-072022-11-070001413329pm:A0.625Notesdue2024Member2022-11-072022-11-070001413329pm:A3.250Notesdue2024Member2022-11-072022-11-070001413329pm:A2.750Notesdue2025Member2022-11-072022-11-070001413329pm:A3.375Notesdue2025Member2022-11-072022-11-070001413329pm:A2.750Notesdue2026Member2022-11-072022-11-070001413329pm:A2.875Notesdue2026Member2022-11-072022-11-070001413329pm:A0.125Notesdue2026Member2022-11-072022-11-070001413329pm:A3.125Notesdue2027Member2022-11-072022-11-070001413329pm:A3.125Notesdue2028Member2022-11-072022-11-070001413329pm:A2.875Notesdue2029Member2022-11-072022-11-070001413329pm:A3.375Notesdue2029Member2022-11-072022-11-070001413329pm:A0.800Notesdue2031Member2022-11-072022-11-070001413329pm:A3.125Notesdue2033Member2022-11-072022-11-070001413329pm:A2.000Notesdue2036Member2022-11-072022-11-070001413329pm:A1.875Notesdue2037Member2022-11-072022-11-070001413329pm:A6.375Notesdue2038Member2022-11-072022-11-070001413329pm:A1.450Notesdue2039Member2022-11-072022-11-070001413329pm:A4.375Notesdue2041Member2022-11-072022-11-070001413329pm:A4.500Notesdue2042Member2022-11-072022-11-070001413329pm:A3.875Notesdue2042Member2022-11-072022-11-070001413329pm:A4.125Notesdue2043Member2022-11-072022-11-070001413329pm:A4.875Notesdue2043Member2022-11-072022-11-070001413329pm:A4.250Notesdue2044Member2022-11-072022-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2022

Philip Morris International Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Virginia | | 1-33708 | | 13-3435103 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 120 Park Avenue | New York | New York | | | 10017-5592 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant's telephone number, including area code: (917) 663-2000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | PM | | New York Stock Exchange |

| 2.625% Notes due 2023 | | PM23 | | New York Stock Exchange |

| 2.125% Notes due 2023 | | PM23B | | New York Stock Exchange |

| 3.600% Notes due 2023 | | PM23A | | New York Stock Exchange |

| | | | | | | | | | | | | | |

| 2.875% Notes due 2024 | | PM24 | | New York Stock Exchange |

| 2.875% Notes due 2024 | | PM24C | | New York Stock Exchange |

| 0.625% Notes due 2024 | | PM24B | | New York Stock Exchange |

| 3.250% Notes due 2024 | | PM24A | | New York Stock Exchange |

| 2.750% Notes due 2025 | | PM25 | | New York Stock Exchange |

| 3.375% Notes due 2025 | | PM25A | | New York Stock Exchange |

| 2.750% Notes due 2026 | | PM26A | | New York Stock Exchange |

| 2.875% Notes due 2026 | | PM26 | | New York Stock Exchange |

| 0.125% Notes due 2026 | | PM26B | | New York Stock Exchange |

| 3.125% Notes due 2027 | | PM27 | | New York Stock Exchange |

| 3.125% Notes due 2028 | | PM28 | | New York Stock Exchange |

| 2.875% Notes due 2029 | | PM29 | | New York Stock Exchange |

| 3.375% Notes due 2029 | | PM29A | | New York Stock Exchange |

| 0.800% Notes due 2031 | | PM31 | | New York Stock Exchange |

| 3.125% Notes due 2033 | | PM33 | | New York Stock Exchange |

| 2.000% Notes due 2036 | | PM36 | | New York Stock Exchange |

| 1.875% Notes due 2037 | | PM37A | | New York Stock Exchange |

| 6.375% Notes due 2038 | | PM38 | | New York Stock Exchange |

| 1.450% Notes due 2039 | | PM39 | | New York Stock Exchange |

| 4.375% Notes due 2041 | | PM41 | | New York Stock Exchange |

| 4.500% Notes due 2042 | | PM42 | | New York Stock Exchange |

| 3.875% Notes due 2042 | | PM42A | | New York Stock Exchange |

| 4.125% Notes due 2043 | | PM43 | | New York Stock Exchange |

| 4.875% Notes due 2043 | | PM43A | | New York Stock Exchange |

| 4.250% Notes due 2044 | | PM44 | | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

As previously disclosed, on May 11, 2022, Philip Morris International Inc. (the “Company”) entered into that certain 364-day bridge credit agreement (as amended or modified from time to time prior to the date hereof, the “Bridge Credit Agreement”) among the Company, the lenders from time to time party thereto and Citibank Europe PLC, UK Branch as facility agent, in connection with the Company’s all-cash recommended public offer to the shareholders of Swedish Match AB, a public limited liability company organized under the laws of the Kingdom of Sweden (“Swedish Match”), for all the outstanding shares of Swedish Match (the “Offer”). On June 23, 2022, the Company entered into that certain term loan credit agreement (as amended or modified from time to time prior to the date hereof, the “Term Loan Credit Agreement”) among the Company, the lenders from time to time party thereto and Citibank Europe PLC, UK Branch as facility agent, also in connection with the Offer.

In connection with the consummation of the Offer, on November 7, 2022, the Company delivered notices of borrowing for aggregate advances of $7.9 billion under the Bridge Credit Agreement and notices of borrowing providing an advance under a three-year loan of €3.0 billion (approximately $3.0 billion) and a five-year loan of €2.5 billion (approximately $2.5 billion) under the Term Loan Credit Agreement. Further information regarding the Bridge Credit Agreement and the Term Loan Credit Agreement is set forth in the Company’s Current Reports on Form 8-K filed on May 11, 2022, and June 28, 2022, respectively, as well as the Company’s Current Report on Form 8-K filed on September 2, 2022, each of which is incorporated herein by reference.

| | | | | |

Item 7.01. | Regulation FD Disclosure. |

On November 7, 2022, the Company issued a press release announcing that Philip Morris Holland Holdings B.V., an affiliate of the Company, completed its offer for Swedish Match and will become the owner of the 82.59% of Swedish Match shares (excluding 4,285,810 treasury shares held by Swedish Match) tendered in the Offer through November 4, 2022. The press release also announced the extension of the offer period for shareholders of Swedish Match who had not tendered their shares through November 4, 2022, and a price adjustment during the extension period due to a scheduled Swedish Match dividend. The foregoing is qualified in its entirety by the full text of the press release, which is filed as Exhibit 99.1 to this Current Report on 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such filing or document.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

| | | | | |

104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| PHILIP MORRIS INTERNATIONAL INC. |

| |

| By: | | /s/ DARLENE QUASHIE HENRY |

| Name: | | Darlene Quashie Henry |

| Title: | | Vice President, Associate General Counsel & Corporate Secretary |

Date: November 7, 2022

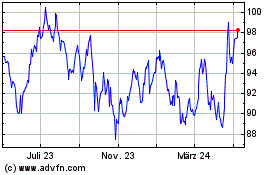

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

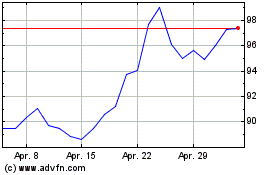

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024