Philip Morris Expects FX to Continue to Hurt Earnings -- Currency Comment

21 Juli 2022 - 3:46PM

Dow Jones News

By Paulo Trevisani

Philip Morris International Inc. said Thursday that currency

translations had a negative impact in its second quarter and are

expected to hurt results in the current period and the full

year.

The New York-based tobacco company said it expects an adverse

pro forma currency impact of 86 cents a share, at prevailing

exchange rates, on full-year results.

The company forecast reported diluted per-share earnings of

$5.73 to $5.88 this year, excluding the FX hit and compared to

$5.83 a share in 2021.

For the third quarter, Philip Morris forecast an adjusted profit

of $1.23 to $1.28 a share, including an unfavorable currency impact

of around 24 cents.

The company reported second quarter per-share earnings of $1.43,

up from $1.39 a year earlier, with a negative impact of 16 cents

from FX.

The US dollar has shown strength this year as the Federal

Reserves raised rates more aggressively than other central banks,

but is falling today as the European Central Bank bumped its rates

more than expected.

Write to Paulo Trevisani at paulo.trevisani@wsj.com

(END) Dow Jones Newswires

July 21, 2022 09:31 ET (13:31 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

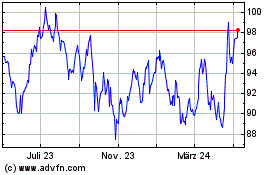

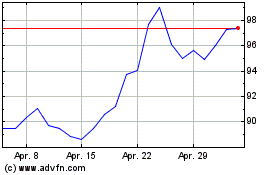

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024