Akero Therapeutics Announces Two Financing Transactions with Pfizer Inc. and Hercules Capital, Inc. Providing Access to Up To $125 Million

16 Juni 2022 - 1:00PM

Akero Therapeutics, Inc. (Nasdaq: AKRO), a clinical-stage

company developing transformational treatments for patients with

serious metabolic diseases marked by high unmet medical need, today

announced two financing transactions. The first is a $25 million

equity investment by Pfizer Inc. (NYSE: PFE) at $9.90 per share.

The second is a term loan facility providing Akero with access to

up to $100 million from Hercules Capital, Inc. (NYSE: HTGC), of

which $10 million will be drawn at transaction close. Together with

existing cash, proceeds will support Akero’s continued development

of efruxifermin (EFX), a long-acting analog of fibroblast growth

factor 21 (FGF21), including two ongoing Phase 2b clinical trials

in patients with pre-cirrhotic and cirrhotic nonalcoholic

steatohepatitis (NASH); manufacture of a drug product-device

combination for use in Phase 3 clinical trials; and starting a

Phase 3 clinical trial program. If the term loan is fully drawn,

proceeds from these two transactions together with budget

optimization efforts are expected to fund Akero’s current operating

plan until the third quarter of 2024. This extends Akero’s

previously announced cash guidance by a full year (from the third

quarter of 2023 to the third quarter of 2024), two years beyond the

anticipated readout of the HARMONY study in the third quarter of

this year.

“Pfizer has deep expertise and history in addressing health

challenges that affect millions of patients around the world,

including cardiometabolic diseases. We are honored and excited to

have their confidence, collaboration and support,” said Andrew

Cheng, M.D. Ph.D., president and chief executive officer of Akero.

“In addition, Hercules Capital has a rich history of investing in

innovative biotechnology companies. We are very grateful for their

significant partnership and support. With our existing cash on

hand, we expect these two financings will extend our cash runway a

full two years beyond our upcoming HARMONY readout, providing us

the flexibility to optimize our capital structure to support the

continued development of EFX.”

Pfizer is investing in Akero through the Pfizer Breakthrough

Growth Initiative (PBGI), which seeks to support biotechnology

companies that share its commitment to delivering transformative

therapies for patients in therapeutic areas consistent with

Pfizer’s core areas of focus. Under the terms of the agreement,

Akero has agreed to sell 2,525,252 shares to Pfizer at a price of

$9.90 per share, for gross proceeds of $25 million. The shares of

common stock were offered and sold to Pfizer in a registered direct

offering conducted without an underwriter or placement agent. The

offering is expected to close on or about June 17, 2022. Following

the transaction, Pfizer will own approximately 6.7% of Akero’s

outstanding common stock. As part of the transaction, Akero will

establish a Scientific Advisory Board, with Pfizer appointing one

member. Akero will maintain ownership and control of EFX, the rest

of its pipeline, and Akero’s operations.

“EFX has quickly emerged as a promising potential NASH therapy,

with a strong record of clinical trial data,” said Jeff

Pfefferkorn, Ph.D., Vice President of Discovery & Development,

Internal Medicine Research Unit, Pfizer, who is expected to join

Akero’s newly formed Scientific Advisory Board. “NASH is a priority

therapeutic area for Pfizer due to the substantial global unmet

medical need it represents, and we are excited to support Akero as

it advances EFX towards a potential Phase 3 study.”

The $100 million term loan facility is being provided by

Hercules Capital, a leader in customized specialty financing for

life science companies. Under the terms of the loan agreement, $10

million will be drawn at closing. An additional $10 million is

immediately available to Akero at its sole discretion. Akero may

draw an additional $35 million in two separate tranches upon

achievement of near-term clinical and financial milestones. An

additional $45 million may be drawn in a third tranche, subject to

the approval of Hercules Capital. The loan bears an initial

interest rate of 7.65% and adjusts with future changes in the prime

rate. Akero will pay interest only for the first 24 months,

extendable to 36 months on achievement of certain milestones. The

loan matures 54 months from closing in December 2026. “We believe

there is tremendous patient and clinical value in financing the

development of potentially innovative treatments for NASH,” said

Cristy Barnes, Managing Director at Hercules Capital. “We’re

excited to support Akero – both now and in the future – in its

continued clinical development of EFX for the treatment of advanced

NASH.”

About Akero Therapeutics Akero Therapeutics is

a clinical-stage company developing transformational treatments for

patients with serious metabolic diseases marked by high unmet

medical need, including non-alcoholic steatohepatitis (NASH), a

disease without any approved therapies. Akero’s lead product

candidate, efruxifermin (EFX), is a differentiated Fc-FGF21 fusion

protein that has been engineered to mimic the balanced biological

activity profile of native FGF21, an endogenous hormone that

alleviates cellular stress and regulates metabolism throughout the

body. EFX is designed to offer convenient once-weekly subcutaneous

dosing. The consistency and magnitude of observed effects position

EFX to be a potentially best-in-class medicine, if approved, for

treatment of NASH. EFX is currently being evaluated in two Phase 2b

clinical trials: the HARMONY study in patients with pre-cirrhotic

NASH (F2-F3 fibrosis), and the SYMMETRY study in patients with

cirrhotic NASH (F4 fibrosis, compensated). Akero is headquartered

in South San Francisco. Visit www.akerotx.com for more

information.

Forward-Looking Statements Statements contained

in this press release regarding matters that are not historical

facts are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements, including, but not limited to,

statements regarding the Company’s cash runway, including its

extension to the third quarter of 2024, statements about the

completion and timing of the registered offering of the Company’s

common stock to Pfizer Inc., the Company's business plans and

objectives, including future plans or expectations for EFX,

upcoming milestones, and therapeutic effects of EFX, as well as the

dosing, safety and tolerability of EFX; conduct of the Company’s

Phase 2b HARMONY study, including expected timing to report

results; conduct of the Company’s Phase 2b SYMMETRY study,

including expected timing to complete enrollment and report

results; the timely availability of new drug substance and a new

combination drug product-device to support Phase 3 clinical trials;

expectations regarding the Company’s use of capital, expenses and

other future financial results and the potential impact of COVID-19

on strategy, future operations, manufacturing, and clinical trial

enrollment and data collection. Any forward-looking statements in

this press release are based on management's current expectations

of future events and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

and adversely from those set forth in or implied by such

forward-looking statements. Risks that contribute to the uncertain

nature of the forward-looking statements include: risks related to

the impact of COVID-19 on the Company's ongoing and future

operations, including potential negative impacts on the Company’s

employees, third-parties, manufacturers, supply chain and

production as well as on global economies and financial markets;

the success, cost, and timing of the Company's product candidate

development activities and planned clinical trials; the Company's

ability to execute on its strategy; positive results from a

clinical study may not necessarily be predictive of the results of

future or ongoing clinical studies; regulatory developments in the

United States and foreign countries; the Company's ability to fund

operations; as well as those risks and uncertainties set forth more

fully under the caption "Risk Factors" in the Company’s most recent

Quarterly Report on Form 10-Q, as filed with the Securities and

Exchange Commission (SEC) as well as discussions of potential

risks, uncertainties and other important factors in the Company’s

other filings and reports with the SEC. All forward-looking

statements contained in this press release speak only as of the

date on which they were made. The Company undertakes no obligation

to update such statements to reflect events that occur or

circumstances that exist after the date on which they were

made.

Investor Contact:Christina

Tartaglia212.362.1200IR@akerotx.com

Media Contact:650.487.6488media@akerotx.com

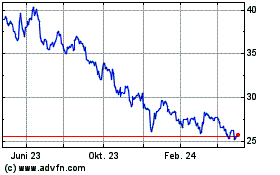

Pfizer (NYSE:PFE)

Historical Stock Chart

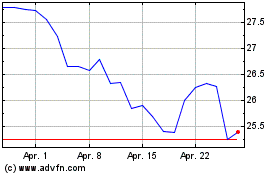

Von Mär 2024 bis Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024