Adams Diversified Equity Fund Announces First-Half Performance and Declares Distribution

21 Juli 2022 - 10:10PM

The Board of Directors of Adams Diversified Equity Fund, Inc.

(NYSE: ADX) today declared a distribution of $.05 per share from

net investment income payable September 1, 2022, to shareholders of

record August 18, 2022. This represents the third payment this year

toward the Fund’s annual 6% minimum distribution rate commitment.

Details regarding the Fund’s annual 6% minimum distribution rate

commitment can be found at adamsfunds.com.

FIRST-HALF PERFORMANCE

“In the first half of 2022, the arrival of a bear market offered

both challenges and opportunities for our Fund. Our investments in

Industrials, Health Care, and Consumer Discretionary were the

primary contributors to our relative performance,” said Mark

Stoeckle, CEO of Adams Funds.

For the six months ended June 30, 2022, the total return on

Adams Diversified Equity’s net asset value, with dividends and

capital gains reinvested, was -19.7%. This compares to a -20.0%

total return for both the S&P 500 and the Morningstar U.S.

Large Blend category. The total return on the market price of the

Fund’s shares for the period was -20.5%.

For the twelve months ended June 30, 2022, the total return on

Adams Diversified Equity’s net asset value, with dividends and

capital gains reinvested, was -9.4%. Comparable figures for the

S&P 500 and the Morningstar U.S. Large Blend category were

-10.6% and -11.6%, respectively. The Fund’s total return on market

price for the period was -10.2%.

NET ASSET VALUE

|

|

6/30/2022 |

6/30/2021 |

|

Net assets |

$2,118,629,378 |

$2,548,945,247 |

|

Shares outstanding |

117,873,571 |

111,027,121 |

|

Net asset value per share |

$17.97 |

$22.96 |

The Semi-Annual Report to Shareholders is expected to be

released on or about July 27, 2022.

###

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 80 years across many

market cycles. The Funds are committed to paying an annual

distribution rate of 6% or more, providing reliable income to

long-term investors. Shares can be purchased through our transfer

agent or through a broker. For more information about Adams Funds,

please visit: adamsfunds.com.

Contact:

800.638.2479 │

investorrelations@adamsfunds.com

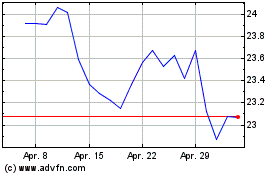

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024