Second quarter revenue increased 34% year over

year to $90.3 million

Second quarter GAAP operating loss of $37.9

million, non-GAAP operating loss of $3.4 million

PagerDuty, Inc. (NYSE:PD), a leader in digital operations

management, today announced financial results for the second

quarter of fiscal 2023, ended July 31, 2022.

“In the second quarter, we again exceeded our guidance ranges

while extending our lead through innovations across PagerDuty's

Operations Cloud,” said Jennifer Tejada, Chairperson and CEO at

PagerDuty. “We continued to see strong demand across regions and

verticals, where our immediate, high ROI is welcome by customers

seeking to improve productivity and efficiency. As essential

infrastructure for modern enterprises, trusted by developers and

leadership alike to orchestrate and drive digital acceleration,

cloud adoption, and DevOps transformation, we are especially well

positioned in an uncertain macro environment. We remain confident

in our ability to continue to execute well as we progress towards

profitability.”

Second Quarter Fiscal 2023 Financial Highlights

- Revenue was $90.3 million, an increase of 33.6% year over

year.

- GAAP operating loss was $37.9 million; GAAP operating margin of

negative 42.0%.

- Non-GAAP operating loss was $3.4 million; non-GAAP operating

margin of negative 3.7%.

- GAAP net loss per share attributable to PagerDuty, Inc. was

$0.44; non-GAAP net loss per share attributable to PagerDuty, Inc.

was $0.04.

- Operating cash flow was $2.8 million, with free cash flow of

$1.0 million.

- Cash, cash equivalents and current investments were $470.8

million as of July 31, 2022.

The section titled “Non-GAAP Financial Measures” below contains

a description of the non-GAAP financial measures and

reconciliations between historical GAAP and non-GAAP

information.

Second Quarter and Recent Highlights

- Total paid customers of 15,174 as of July 31, 2022, compared to

14,169 in the year ago period.

- Customers with annual recurring revenue over $100,000 was 689

as of July 31, 2022, compared to 501 in the year ago period.

- Dollar-based net retention rate of 124% as of July 31, 2022,

compared to 126% in the year ago period.

- International revenue was 23% of total revenue as of July 31,

2022, compared to 24% in the year ago period.

- Held 2022 Global Summit Series.

- Expanded international presence to Japan.

- Appointed Bill Losch to Board of Directors.

- Featured case study: Freedom Pay.

- Lands and Expands include: Booking Holdings, Lumen

Technologies, Public Storage, Toyota and Zoom

Financial Outlook

For the third quarter of fiscal 2023, PagerDuty currently

expects:

- Total revenue of $92.0 million - $94.0 million, representing a

growth rate of 28% - 31% year over year

- Non-GAAP net loss per share attributable to PagerDuty, Inc. of

$0.04 - $0.03 assuming approximately 89 million shares

For the full fiscal year 2023, PagerDuty currently

expects:

- Total revenue of $365.0 million - $370.0 million, representing

a growth rate of 30% - 31% year over year

- Non-GAAP net loss per share attributable to PagerDuty, Inc. of

$0.12 - $0.10 assuming approximately 89 million shares

These statements are forward-looking and actual results may

differ materially. Please refer to the Forward-Looking Statements

section below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

PagerDuty has not reconciled its expectations as to non-GAAP net

loss per share attributable to PagerDuty, Inc. to GAAP net loss per

share attributable to PagerDuty, Inc. because certain items are out

of its control or cannot be reasonably predicted. Accordingly, a

reconciliation for forward-looking non-GAAP net loss per share

attributable to PagerDuty, Inc. is not available without

unreasonable effort.

Conference Call Information:

PagerDuty will host a conference call and live webcast for

analysts and investors at 2:00 p.m. Pacific Time on September 1,

2022. This news release with the financial results will be

accessible from PagerDuty’s website at investor.pagerduty.com prior

to the conference call. A live webcast of the conference call will

be accessible from the PagerDuty investor relations website at

investor.pagerduty.com.

Supplemental Financial and Other Information:

Supplemental financial and other information can be accessed

through PagerDuty’s investor relations website at

investor.pagerduty.com. PagerDuty uses the investor relations

section on its website as the means of complying with its

disclosure obligations under Regulation FD. Accordingly, we

recommend that investors monitor PagerDuty’s investor relations

website in addition to following PagerDuty’s press releases, SEC

filings, social media, including PagerDuty’s LinkedIn account

(https://www.linkedin.com/company/482819), Twitter account

(twitter.com/pagerduty), the Twitter account @jenntejada and

Facebook page (facebook.com/pagerduty), and public conference calls

and webcasts.

Non-GAAP Financial Measures:

This press release and the accompanying tables contain the

following non-GAAP financial measures: non-GAAP gross profit,

non-GAAP gross margin, non-GAAP research and development, non-GAAP

sales and marketing, non-GAAP general and administrative, non-GAAP

operating loss, non-GAAP operating margin, non-GAAP net loss

attributable to PagerDuty, Inc., non-GAAP net loss per share

attributable to PagerDuty, Inc., and free cash flow.

PagerDuty believes that non-GAAP financial measures, when taken

collectively, may be helpful to investors because they provide

consistency and comparability with past financial performance and

can assist in comparisons with other companies, some of which use

similar non-GAAP financial measures to supplement their GAAP

results. The non-GAAP financial information is presented for

supplemental informational purposes only, should not be considered

a substitute for financial information presented in accordance with

GAAP, and may be different from similarly-titled non-GAAP measures

used by other companies.

The principal limitation of these non-GAAP financial measures is

that they exclude significant expenses and income that are required

by GAAP to be recorded in PagerDuty’s financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgment by PagerDuty’s management about which

expenses and income are excluded or included in determining these

non-GAAP financial measures. A reconciliation is provided below for

each historical non-GAAP financial measure to the most directly

comparable financial measure presented in accordance with GAAP.

Specifically, PagerDuty excludes the following from its

historical and prospective non-GAAP financial measures, as

applicable:

Stock-based Compensation: PagerDuty utilizes stock-based

compensation to attract and retain employees. It is principally

aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational

performance for any particular period. As a result, stock-based

compensation expenses vary for reasons that are generally unrelated

to financial and operational performance in any particular

period.

Employer Taxes Related to Employee Stock Transactions: PagerDuty

views the amount of employer taxes related to its employee stock

transactions as an expense that is dependent on its stock price,

employee exercise and other award disposition activity, and other

factors that are beyond PagerDuty’s control. As a result, employer

taxes related to employee stock transactions vary for reasons that

are generally unrelated to financial and operational performance in

any particular period.

Amortization of Acquired Intangible Assets: PagerDuty views

amortization of acquired intangible assets as items arising from

pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased

intangibles is an expense that is not typically affected by

operations during any particular period.

Acquisition-Related Expenses: PagerDuty views

acquisition-related expenses, such as transaction costs,

acquisition-related retention payments, and acquisition-related

asset impairment, as events that are not necessarily reflective of

operational performance during a period. In particular, PagerDuty

believes the consideration of measures that exclude such expenses

can assist in the comparison of operational performance in

different periods which may or may not include such expenses.

Amortization of Debt Issuance Costs: The imputed interest rate

of the Convertible Senior Notes (the "Notes") was approximately

1.93%. This is a result of the debt issuance costs, which reduce

the carrying value of the convertible debt instruments. The debt

issuance costs are amortized as interest expense. The expense for

the amortization of the debt issuance costs is a non-cash item, and

we believe the exclusion of this interest expense will provide for

a more useful comparison of our operational performance in

different periods.

Acquisition-Related Income Tax Benefit: PagerDuty views

acquisition-related income tax benefits as events that are not

necessarily reflective of operational performance during a period.

In particular, PagerDuty believes the consideration of measures

that exclude such benefits can assist in the comparison of

operational performance in different periods which may or may not

include such benefits.

PagerDuty defines non-GAAP operating loss as GAAP loss from

operations excluding stock-based compensation expense, employer

taxes related to employee stock transactions, amortization of

acquired intangible assets, and acquisition-related expenses.

PagerDuty defines non-GAAP net loss attributable to PagerDuty, Inc.

(which is used in calculating non-GAAP net loss per share

attributable to PagerDuty, Inc.) as GAAP net loss attributable to

PagerDuty, Inc. excluding amortization of debt issuance costs and

debt discount, stock-based compensation expense, employer taxes

related to employee stock transactions, amortization of acquired

intangible assets, acquisition-related expenses, and

acquisition-related income tax benefits. There are a number of

limitations related to the use of these non-GAAP measures as

compared to GAAP operating loss and net loss, including that the

non-GAAP measures exclude stock-based compensation expense, which

has been, and will continue to be for the foreseeable future, a

significant recurring expense in PagerDuty’s business and an

important part of its compensation strategy.

PagerDuty defines free cash flow as net cash provided by (used

in) operating activities, less cash used for purchases of property

and equipment and capitalized internal-use software. In addition to

the reasons stated above, PagerDuty believes that free cash flow is

useful to investors as a liquidity measure because it measures

PagerDuty’s ability to generate or use cash in excess of its

capital investments in property and equipment to strengthen its

balance sheet and further invest in its business and potential

strategic initiatives. PagerDuty uses free cash flow in conjunction

with traditional GAAP measures as part of its overall assessment of

its liquidity, including the preparation of PagerDuty’s annual

operating budget and quarterly forecasts, to evaluate the

effectiveness of its business strategies, and to assess its

liquidity.

There are a number of limitations related to the use of free

cash flow as compared to net cash provided by (used in) operating

activities, including that free cash flow includes capital

expenditures, the benefits of which are realized in periods

subsequent to those when expenditures are made.

PagerDuty encourages investors to review the related GAAP

financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measures, which it includes in press releases announcing quarterly

financial results, including this press release, and not to rely on

any single financial measure to evaluate PagerDuty’s business.

Please see the reconciliation tables at the end of this release

for the reconciliation of GAAP and non-GAAP results.

Forward-Looking Statements:

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding our future financial performance and

outlook and market positioning. Words such as “expect,” “extend,”

“anticipate,” “should,” “believe,” “hope,” “target,” “project,”

“accelerate,” “goals,” “estimate,” “potential,” “predict,” “may,”

“will,” “might,” “could,” “intend,” “shall” and variations of these

terms or the negative of these terms and similar expressions are

intended to identify these forward-looking statements.

Forward-looking statements are subject to a number of risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control. Our actual results could differ materially

from those stated or implied in forward-looking statements due to a

number of factors, including but not limited to, risks and other

factors detailed in our Annual Report on Form 10-K filed with the

Securities and Exchange Commission (SEC) on March 17, 2022.

Additional information will be made available in our Quarterly

Report on Form 10-Q for the quarter ended July 31, 2022 and other

filings and reports that we may file from time to time with the

SEC. In particular, the following risks and uncertainties, among

others, could cause results to differ materially from those

expressed or implied by such forward-looking statements: the effect

of uncertainties related to the COVID-19 pandemic on U.S. and

global markets, our business, operations, revenue results, cash

flow, operating expenses, demand for our solutions, sales cycles,

customer retention and our customers’ businesses; our ability to

achieve and maintain future profitability; our ability to attract

new customers and retain and sell additional functionality and

services to our existing customers; our ability to sustain and

manage our growth; our dependence on revenue from a single product;

our ability to compete effectively in an increasingly competitive

market; and general global market, political, economic, and

business conditions.

Past performance is not necessarily indicative of future

results. The forward-looking statements included in this press

release represent our views as of the date of this press release.

We anticipate that subsequent events and developments will cause

our views to change. We undertake no intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

About PagerDuty

PagerDuty, Inc. (NYSE:PD) is a leader in digital operations

management. In an always-on world, organizations of all sizes trust

PagerDuty to help them deliver a perfect digital experience to

their customers, every time. Teams use PagerDuty to identify issues

and opportunities in real time and bring together the right people

to fix problems faster and prevent them in the future. Notable

customers include Cisco, DocuSign, DoorDash, Electronic Arts,

Genentech, Shopify, Zoom and more. To learn more and try PagerDuty

for free, visit www.pagerduty.com. Follow our blog and connect with

us on Twitter, LinkedIn, YouTube and Facebook. We’re also hiring,

visit https://www.pagerduty.com/careers/ to learn more.

PagerDuty, Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except per share

data)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Revenue

$

90,253

$

67,536

$

175,624

$

131,127

Cost of revenue(1)

18,367

11,976

34,083

22,394

Gross profit

71,886

55,560

141,541

108,733

Operating expenses:

Research and development(1)

34,014

22,909

65,303

43,508

Sales and marketing(1)

50,331

40,814

95,883

78,048

General and administrative(1)

25,429

20,294

50,700

36,872

Total operating expenses

109,774

84,017

211,886

158,428

Loss from operations

(37,888

)

(28,457

)

(70,345

)

(49,695

)

Interest income

830

783

1,378

1,601

Interest expense

(1,387

)

(1,378

)

(2,712

)

(2,695

)

Other expense, net

(364

)

(586

)

(1,154

)

(1,202

)

Loss before benefit from (provision for)

income taxes

(38,809

)

(29,638

)

(72,833

)

(51,991

)

Benefit from (provision for) income

taxes

210

(23

)

1,414

(228

)

Net loss

$

(38,599

)

$

(29,661

)

$

(71,419

)

$

(52,219

)

Net loss attributable to redeemable

non-controlling interest

(100

)

—

(100

)

—

Net loss attributable to PagerDuty,

Inc.

$

(38,499

)

$

(29,661

)

$

(71,319

)

$

(52,219

)

Net loss per share, basic and diluted,

attributable to PagerDuty, Inc.

$

(0.44

)

$

(0.35

)

$

(0.81

)

$

(0.63

)

Weighted-average shares used in

calculating net loss per share, basic and diluted

88,153

83,895

87,648

83,413

(1) Includes stock-based compensation expense as follows:

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Cost of revenue

$

1,787

$

1,023

$

3,011

$

1,699

Research and development

10,567

5,607

19,242

10,047

Sales and marketing

8,148

4,401

14,529

8,355

General and administrative

9,623

5,445

18,252

9,987

Total

$

30,125

$

16,476

$

55,034

$

30,088

PagerDuty, Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

As of July 31, 2022

As of January 31, 2022

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

278,331

$

349,785

Investments

192,464

193,571

Accounts receivable, net of allowance for

credit losses of $1,727 and $1,809 as of July 31, 2022 and January

31, 2022, respectively

59,305

75,279

Deferred contract costs, current

17,397

16,672

Prepaid expenses and other current

assets

12,087

9,777

Total current assets

559,584

645,084

Property and equipment, net

18,502

18,229

Deferred contract costs, non-current

26,211

26,159

Lease right-of-use assets

17,925

20,227

Goodwill

118,862

72,126

Intangible assets, net

42,658

23,133

Other assets

1,021

1,490

Total assets

$

784,763

$

806,448

Liabilities, redeemable non-controlling

interest, and stockholders’ equity

Current liabilities:

Accounts payable

$

6,600

$

9,505

Accrued expenses and other current

liabilities

18,268

13,640

Accrued compensation

28,857

35,327

Deferred revenue, current

166,501

162,881

Lease liabilities, current

5,838

5,637

Total current liabilities

226,064

226,990

Convertible senior notes, net

281,984

281,069

Deferred revenue, non-current

3,033

7,343

Lease liabilities, non-current

17,928

20,912

Other liabilities

3,671

3,159

Total liabilities

532,680

539,473

Redeemable non-controlling interest

1,811

—

Stockholders’ equity:

Common stock

—

—

Additional paid-in-capital

672,126

616,467

Accumulated other comprehensive loss

(1,712

)

(669

)

Accumulated deficit

(420,142

)

(348,823

)

Total stockholders’ equity

250,272

266,975

Total liabilities, redeemable

non-controlling interest, and stockholders’ equity

$

784,763

$

806,448

PagerDuty, Inc.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Cash flows from operating

activities

Net loss attributable to PagerDuty,

Inc.

$

(38,499

)

$

(29,661

)

$

(71,319

)

$

(52,219

)

Net loss attributable to redeemable

non-controlling interest

(100

)

—

(100

)

—

Net loss

(38,599

)

(29,661

)

(71,419

)

(52,219

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

4,689

2,055

8,280

4,027

Amortization of deferred contract

costs

4,791

3,562

9,256

6,812

Amortization of debt issuance costs

468

460

915

898

Stock-based compensation

30,125

16,476

55,034

30,088

Non-cash lease expense

1,157

1,112

2,302

2,209

Tax benefit related to release of

valuation allowance

—

—

(1,330

)

—

Other

56

892

1,810

1,695

Changes in operating assets and

liabilities:

Accounts receivable

1,259

(10,892

)

16,521

6,473

Deferred contract costs

(5,035

)

(5,753

)

(10,033

)

(9,485

)

Prepaid expenses and other assets

481

(1,189

)

(1,510

)

(2,762

)

Accounts payable

(2,283

)

2,743

(2,226

)

1,179

Accrued expenses and other liabilities

3,877

1,441

3,243

3,373

Accrued compensation

1,020

581

(6,658

)

(3,830

)

Deferred revenue

2,225

7,946

(1,546

)

4,030

Lease liabilities

(1,390

)

(1,368

)

(2,783

)

(2,504

)

Net cash provided by (used in)

operating activities

2,841

(11,595

)

(144

)

(10,016

)

Cash flows from investing

activities

Purchases of property and equipment

(862

)

(364

)

(2,940

)

(1,291

)

Capitalization of internal-use software

costs

(965

)

(915

)

(1,737

)

(1,917

)

Business acquisition, net of cash

acquired

—

—

(66,262

)

(160

)

Asset acquisition

(1,845

)

—

(1,845

)

—

Purchases of available-for-sale

investments

(53,783

)

(38,572

)

(95,468

)

(116,103

)

Proceeds from maturities of

available-for-sale investments

54,760

49,146

95,200

116,150

Proceeds from sales of available-for-sale

investments

—

27,380

—

27,380

Net cash (used in) provided by

investing activities

(2,695

)

36,675

(73,052

)

24,059

Cash flows from financing

activities

Investment from redeemable non-controlling

interest holder

1,908

—

1,908

—

Proceeds from employee stock purchase

plan

5,736

4,889

5,736

4,889

Proceeds from issuance of common stock

upon exercise of stock options

2,974

4,596

6,560

7,430

Employee payroll taxes paid related to net

share settlement of restricted stock units

(6,153

)

(6,073

)

(12,323

)

(11,003

)

Net cash provided by financing

activities

4,465

3,412

1,881

1,316

Effects of foreign currency exchange rates

on cash, cash equivalents, and restricted cash

(139

)

—

(139

)

—

Net increase (decrease) in cash, cash

equivalents, and restricted cash

4,472

28,492

(71,454

)

15,359

Cash, cash equivalents, and restricted

cash at beginning of period

273,859

326,033

349,785

339,166

Cash, cash equivalents, and restricted

cash at end of period

$

278,331

$

354,525

$

278,331

$

354,525

PagerDuty, Inc.

Reconciliation of GAAP to

Non-GAAP Data

(in thousands, except percentages

and per share data)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Reconciliation of gross profit and

gross margin

GAAP gross profit

$

71,886

$

55,560

$

141,541

$

108,733

Plus: Stock-based compensation

1,787

1,023

3,011

1,699

Plus: Employer taxes related to employee

stock transactions

34

30

41

56

Plus: Amortization of acquired intangible

assets

2,156

280

3,365

560

Non-GAAP gross profit

$

75,863

$

56,893

$

147,958

$

111,048

GAAP gross margin

79.6

%

82.3

%

80.6

%

82.9

%

Non-GAAP adjustments

4.5

%

1.9

%

3.6

%

1.8

%

Non-GAAP gross margin

84.1

%

84.2

%

84.2

%

84.7

%

Reconciliation of operating

expenses

GAAP research and development

$

34,014

$

22,909

$

65,303

$

43,508

Less: Stock-based compensation

(10,567

)

(5,607

)

(19,242

)

(10,047

)

Less: Employer taxes related to employee

stock transactions

(176

)

(208

)

(357

)

(406

)

Less: Acquisition-related expenses

(891

)

(457

)

(2,362

)

(906

)

Less: Amortization of acquired intangible

assets

(116

)

—

(116

)

—

Non-GAAP research and development

$

22,264

$

16,637

$

43,226

$

32,149

GAAP sales and marketing

$

50,331

$

40,814

$

95,883

$

78,048

Less: Stock-based compensation

(8,148

)

(4,401

)

(14,529

)

(8,355

)

Less: Employer taxes related to employee

stock transactions

(145

)

(157

)

(320

)

(358

)

Less: Amortization of acquired intangible

assets

(660

)

(595

)

(1,293

)

(1,190

)

Non-GAAP sales and marketing

$

41,378

$

35,661

$

79,741

$

68,145

GAAP general and administrative

$

25,429

$

20,294

$

50,700

$

36,872

Less: Stock-based compensation

(9,623

)

(5,445

)

(18,252

)

(9,987

)

Less: Employer taxes related to employee

stock transactions

(166

)

(315

)

(455

)

(571

)

Less: Acquisition-related expenses

(8

)

2

(1,290

)

(8

)

Less: Amortization of acquired intangible

assets

(29

)

—

(29

)

—

Non-GAAP general and administrative

$

15,603

$

14,536

$

30,674

$

26,306

Note: Certain figures may not sum due to rounding.

PagerDuty, Inc.

Reconciliation of GAAP to

Non-GAAP Data

(in thousands, except percentages

and per share data)

(unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Reconciliation of operating loss and

operating margin

GAAP operating loss

$

(37,888

)

$

(28,457

)

$

(70,345

)

$

(49,695

)

Plus: Stock-based compensation

30,125

16,476

55,034

30,088

Plus: Employer taxes related to employee

stock transactions

521

710

1,173

1,391

Plus: Amortization of acquired intangible

assets

2,961

875

4,803

1,750

Plus: Acquisition-related expenses

899

455

3,652

914

Non-GAAP operating loss

$

(3,382

)

$

(9,941

)

$

(5,683

)

$

(15,552

)

GAAP operating margin

(42.0

) %

(42.1

) %

(40.1

) %

(37.9

) %

Non-GAAP adjustments

38.3

%

27.4

%

36.9

%

26.0

%

Non-GAAP operating margin

(3.7

) %

(14.7

) %

(3.2

) %

(11.9

) %

Reconciliation of net loss

GAAP net loss attributable to PagerDuty,

Inc.

$

(38,499

)

$

(29,661

)

$

(71,319

)

$

(52,219

)

Plus: Stock-based compensation

30,125

16,476

55,034

30,088

Plus: Employer taxes related to employee

stock transactions

521

710

1,173

1,391

Plus: Amortization of debt discount

468

460

915

898

Plus: Amortization of acquired intangible

assets

2,961

875

4,803

1,750

Plus: Acquisition-related expenses

899

455

3,652

914

Less: Tax benefit associated with

acquisition

—

—

(1,330

)

—

Non-GAAP net loss attributable to

PagerDuty, Inc.

$

(3,525

)

$

(10,685

)

$

(7,072

)

$

(17,178

)

Reconciliation of net loss per share,

basic and diluted

GAAP net loss per share, basic and

diluted, attributable to PagerDuty, Inc.

$

(0.44

)

$

(0.35

)

$

(0.81

)

$

(0.63

)

Non-GAAP adjustments to net loss

attributable to PagerDuty, Inc.

0.40

0.23

0.73

0.42

Non-GAAP net loss per share, basic and

diluted, attributable to PagerDuty, Inc.

$

(0.04

)

$

(0.13

)

$

(0.08

)

$

(0.21

)

Weighted-average shares used in

calculating net loss per share, basic and diluted

88,153

83,895

87,648

83,413

Note: Certain figures may not sum due to rounding.

PagerDuty, Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(in thousands, except percentages

and per share data)

(unaudited)

Free Cash Flow

Three Months Ended July

31,

Six Months Ended July

31,

2022

2021

2022

2021

Net cash provided by (used in) operating

activities

$

2,841

$

(11,595

)

$

(144

)

$

(10,016

)

Less:

Purchases of property and equipment

(862

)

(364

)

(2,940

)

(1,291

)

Capitalization of internal-use software

costs

(965

)

(915

)

(1,737

)

(1,917

)

Free cash flow

$

1,014

$

(12,874

)

$

(4,821

)

$

(13,224

)

Net cash (used in) provided by investing

activities

$

(2,695

)

$

36,675

$

(73,052

)

$

24,059

Net cash provided by financing

activities

$

4,465

$

3,412

$

1,881

$

1,316

Free cash flow margin

1.1

%

(19.1

) %

(2.7

) %

(10.1

) %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220901005765/en/

Investor Relations Contact: Tony Righetti

investor@pagerduty.com

SOURCE PagerDuty

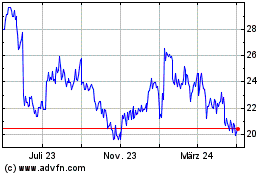

PagerDuty (NYSE:PD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

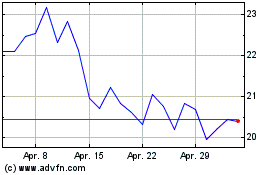

PagerDuty (NYSE:PD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024