Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

01 Dezember 2022 - 12:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

November, 2022

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on Petros Plan

—

Rio de Janeiro, November 30, 2022 - Petróleo

Brasileiro S.A. – Petrobras informs that it was disclosed by the Fundação Petrobras de Seguridade Social (Petros)

that its Deliberative Council approved the Deficit Equalization Plan (PED) for the year 2021 of the Renegotiated Petros Pension Plan (PPSP-R),

because this plan has exceeded the legal limit of tolerance to technical deficit.

The PED-2021 foresees the equating of the total

value of the deficit recorded in 2021, of R$ 7.7 billion, which will be updated until December 2022. In September 2022, this value updated

by the actuarial target was R$ 8.4 billion.

According to Supplementary Laws 108/2001 and

109/2001, as well as Resolution no. 30/2018 of the National Council for Suplementary Pension (Conselho Nacional de Previdência Complementar

- CNPC), the deficit must be equated equally between the sponsors (Petrobras, Vibra Energia, and Petros) and the PPSP-R participants and

pensioners. Therefore, Petrobras will be responsible for a total amount of R$ 3.9 billion in September 2022.

The disbursement by the sponsors will be decreasing

over the life of the plan, and is estimated, for the first year, to be around R$ 300 million for Petrobras.

The PPSP-R is a defined benefit plan and, according

to Petros, this deficit was directly impacted by the economic environment that affected mainly the fixed income segment, especially because

of the marked-to-market public bonds, which suffered from the increase in the interest rate curves.

The PED-2021 was considered on this date by

Petrobras' Board of Directors and will be forwarded to the Secretariat for Coordination and Governance of State-Owned Companies (SEST).

If there is a favorable opinion from this body, the equalization plan will be implemented by Petros with the start of charging extraordinary

contributions in April 2023, in addition to the normal and extraordinary contributions already in effect.

The actuarial position of the PPSP-R plan was

reflected in note 17.3 - Post-employment benefits in the financial statements of 12.31.2021 and, additionally, the effects of the implementation

of new extraordinary contributions by the PED-2021 will be considered in the actuarial revaluation of 2022.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 19th Floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 30, 2022

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

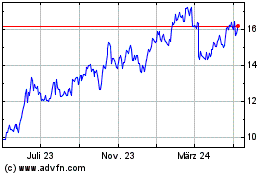

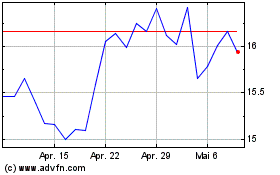

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024