Ooma, Inc. (NYSE: OOMA), a smart communications platform for

businesses and consumers, today released financial results for the

fiscal first quarter ended April 30, 2023.

Fiscal First Quarter 2024 Financial Highlights:

- Revenue: Total revenue was $56.9 million, up 13%

year-over-year. Subscription and services revenue increased to

$53.0 million from $46.7 million in the first quarter of fiscal

2023, and was 93% of total revenue, primarily driven by the growth

of Ooma Business and the acquisition of OnSIP.

- Net Income/Loss: GAAP net loss was $0.3 million, or

$0.01 per basic and diluted share, compared to GAAP net loss of

$0.8 million, or $0.03 per basic and diluted share, in the first

quarter of fiscal 2023. Non-GAAP net income was $4.0 million, or

$0.16 per diluted share, compared to non-GAAP net income of $3.0

million, or $0.12 per diluted share in the prior year period.

- Adjusted EBITDA: Adjusted EBITDA was $4.8 million,

compared to $3.9 million in the first quarter of fiscal 2023.

For more information about non-GAAP net income and Adjusted

EBITDA, see the section below titled "Non-GAAP Financial Measures"

and the reconciliation provided in this release.

“Ooma achieved a solid start to its fiscal 2024 with Q1 revenue

increasing to $56.9 million and non-GAAP net income of $4.0

million,” said Eric Stang, chief executive officer of Ooma. “Q1

revenue growth of 13%, year-over-year, was driven by 27%

year-over-year growth in business services revenue, which now makes

up 56% of total services revenue. As planned, we made progress in

Q1 introducing new Office Pro+ features, growing our user base in

Europe, expanding our vertical markets and partnerships, and

broadening the capabilities and customer adoption of our AirDial

POTS replacement solution. Looking forward, we intend to continue

to invest in our key strategic initiatives and the development of

new partnerships to drive profitable growth.”

Business Outlook:

For the second quarter of fiscal 2024, Ooma expects:

- Total revenue in the range of $57.4 million to $57.9

million.

- GAAP net loss in the range of $0.6 million to $0.9 million and

GAAP net loss per share in the range of $0.02 to $0.04.

- Non-GAAP net income in the range of $3.5 million to $3.8

million and non-GAAP net income per share in the range of $0.13 to

$0.15.

For the full fiscal year 2024, Ooma expects:

- Total revenue in the range of $235.5 million to $238.5

million.

- GAAP net loss in the range of $0.9 million to $2.9 million, and

GAAP net loss per share in the range of $0.04 to $0.12.

- Non-GAAP net income in the range of $14.5 million to $16.5

million, and non-GAAP net income per share in the range of $0.55 to

$0.63.

The following is a reconciliation of GAAP net loss to non-GAAP

net income and GAAP basic and diluted net loss per share to

non-GAAP diluted net income per share guidance for the second

fiscal quarter ending July 31, 2023 and the fiscal year ending

January 31, 2024 (in millions, except per share data):

Projected range Three Months Ending Fiscal Year

Ending July 31, 2023 January 31, 2024

(unaudited) GAAP net loss

($0.6)-($0.9)

($0.9)-($2.9)

Stock-based compensation and related taxes

3.7

14.6

Amortization of intangible assets

0.7

2.8

Non-GAAP net income

$3.5-$3.8

$14.5-$16.5

GAAP net loss per share

($0.02)-($0.04)

($0.04)-($0.12)

Stock-based compensation and related taxes

0.14

0.56

Amortization of intangible assets

0.03

0.11

Non-GAAP net income per share

$0.13-$0.15

$0.55-$0.63

Weighted-average number of shares used in per share amounts:

Basic

25.2

25.6

Diluted

26.0

26.3

Conference Call Information:

Ooma will host a conference call and live webcast for analysts

and investors today at 5:00 p.m. Eastern time. The news release

with the financial results will be accessible from the company's

website prior to the conference call.

Parties in the United States and Canada can access the call by

dialing +1 (888) 550-5744, using conference ID 4726540.

International parties can access the call by dialing +1 (646)

960-0223, using conference ID 4726540.

The webcast will be accessible on the Events and Presentations

page of Ooma’s investor relations website,

https://investors.ooma.com, for a period of at least one year. A

telephonic replay of the conference call will be available from

approximately two hours after the call is completed or about 8:00

p.m. Eastern time on May 23, 2023 until 11:59 p.m. Eastern time

Tuesday, May 30, 2023. To access the replay, parties in the United

States and Canada should call +1 (800) 770-2030. International

parties should call +1 (647) 362-9199.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”), this press release and the accompanying tables contain

certain non-GAAP financial measures, including: non-GAAP net

income, non-GAAP net income per share, non-GAAP gross profit and

gross margin, non-GAAP operating income, and Adjusted EBITDA.

Adjusted EBITDA represents the net income before interest and other

income, income tax provision, depreciation and amortization of

capital expenditures, amortization of intangible assets, and

stock-based compensation expense and related taxes.

Other non-GAAP financial measures exclude stock-based

compensation expense and related taxes, and amortization of

intangible assets. Non-GAAP weighted-average diluted shares include

the effect of potentially dilutive securities from the company’s

stock-based benefit plans.

These non-GAAP financial measures are presented to provide

investors with additional information regarding our financial

results and core business operations. Ooma considers these non-GAAP

financial measures to be useful measures of the operating

performance of the company, because they contain adjustments for

unusual events or factors that do not directly affect what

management considers to be Ooma's core operating performance and

are used by the company's management for that purpose. Management

also believes that these non-GAAP financial measures allow for a

better evaluation of the company's performance by facilitating a

meaningful comparison of the company's core operating results in a

given period to those in prior and future periods. In addition,

investors often use similar measures to evaluate the operating

performance of a company.

Non-GAAP financial measures are presented for supplemental

informational purposes only to aid an understanding of the

company's operating results. The non-GAAP financial measures should

not be considered a substitute for financial information presented

in accordance with GAAP and may be different from non-GAAP

financial measures presented by other companies. A limitation of

the non-GAAP financial measures presented is that the adjustments

relate to items that the company generally expects to continue to

recognize. The adjustment of these items should not be construed as

an inference that the adjusted gains or expenses are unusual,

infrequent or non-recurring. Therefore, both GAAP financial

measures of Ooma's financial performance and the respective

non-GAAP measures should be considered together. Please see the

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP measure in the tables below.

Disclosure Information

Ooma uses the investor relations section on its website as a

means of complying with its disclosure obligations under Regulation

FD. Accordingly, investors should monitor Ooma's investor relations

website in addition to following Ooma's press releases, Securities

and Exchange Commission (“SEC”) filings, and public conference

calls and webcasts.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995. In particular,

the financial projections under “Business Outlook” and the

statements contained in the quotations of our Chief Executive

Officer with respect to expectations regarding the Company’s growth

initiatives may constitute forward-looking statements.

Forward-looking statements can be identified by the fact that they

do not relate strictly to historical facts and generally contain

words such as "believes”, "expects”, "may”, "will”, "should”,

"seeks”, "approximately”, "intends”, "plans”, "estimates”,

"anticipates”, and other expressions that are predictions of or

indicate future events. Although the forward-looking statements

contained in this press release are based upon information

available at the time the statements are made and reflect

management's good faith beliefs, forward-looking statements

inherently involve known and unknown risks, uncertainties and other

factors, which may cause the actual results, performance or

achievements to differ materially from anticipated future results.

Important factors that could cause actual results to differ

materially from expectations include, among others: our inability

to attract new customers on a cost-effective basis; our inability

to retain customers; our inability to realize expected returns from

our investments made in connection with our international expansion

efforts and development of new product features; failure to realize

AirDial opportunities; intense competition; loss of key retailers

and reseller partnerships; our reliance on vendors to manufacture

the on-premise appliances and end-point devices we sell; our

reliance on third parties for our network connectivity and

co-location facilities; our reliance on third parties for some of

our software development, quality assurance and operations; our

reliance on third parties to provide the majority of our customer

service and support representatives; and interruptions to our

service. You should not place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

We do not undertake to update or revise any forward-looking

statements after they are made, whether as a result of new

information, future events, or otherwise, except as required by

applicable law.

The forward-looking statements contained in this press release

are also subject to other risks and uncertainties, including those

more fully described in our filings which we make with the SEC from

time to time, including the risk factors contained in our Annual

Report on Form 10-K for the year ended January 31, 2023, filed with

the SEC on April 7, 2023. The forward-looking statements in this

press release are based on information available to Ooma as of the

date hereof, and Ooma disclaims any obligation to update any

forward-looking statements, except as required by law.

About Ooma, Inc.

Ooma (NYSE: OOMA) creates powerful connected experiences for

businesses and consumers, delivered from its smart cloud-based SaaS

platform. For businesses of all sizes, Ooma provides advanced voice

and collaboration features including messaging, intelligent virtual

attendants, and video conferencing to help them run more

efficiently. For consumers, Ooma’s residential phone service

provides PureVoice HD voice quality, advanced functionality and

integration with mobile devices. Learn more at www.ooma.com or

www.ooma.ca in Canada.

OOMA, INC CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited, amounts in thousands)

April 30,

January 31,

2023

2023

Assets Current assets: Cash and cash equivalents

$

27,390

$

24,137

Short-term investments

987

2,723

Accounts receivable, net

8,734

7,131

Inventories

25,320

26,246

Other current assets

13,620

14,368

Total current assets

76,051

74,605

Property and equipment, net

8,448

7,996

Operating lease right-of-use assets

16,887

12,702

Intangible assets, net

9,722

10,463

Goodwill

8,655

8,655

Other assets

17,972

16,584

Total assets

$

137,735

$

131,005

Liabilities and stockholders' equity Current

liabilities: Accounts payable

$

18,872

$

13,462

Accrued expenses and other current liabilities

20,600

26,726

Deferred revenue

16,630

17,216

Total current liabilities

56,102

57,404

Long-term operating lease liabilities

13,987

10,426

Other liabilities

23

31

Total liabilities

70,112

67,861

Stockholders' equity: Common stock

5

5

Additional paid-in capital

200,398

195,605

Accumulated other comprehensive loss

(11

)

(23

)

Accumulated deficit

(132,769

)

(132,443

)

Total stockholders' equity

67,623

63,144

Total liabilities and stockholders' equity

$

137,735

$

131,005

OOMA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited, amounts in

thousands, except share and per share data)

Three Months Ended April 30,2023 April

30,2022 Revenue: Subscription and services

$

53,049

$

46,723

Product and other

3,803

3,614

Total revenue

56,852

50,337

Cost of revenue: Subscription and services

14,725

13,209

Product and other

6,175

5,176

Total cost of revenue

20,900

18,385

Gross profit

35,952

31,952

Operating expenses: Sales and marketing

17,990

16,151

Research and development

11,953

10,498

General and administrative

6,617

6,062

Total operating expenses

36,560

32,711

Loss from operations

(608

)

(759

)

Interest and other income, net

415

33

Loss before income taxes

(193

)

(726

)

Income tax provision

(133

)

(40

)

Net loss

$

(326

)

$

(766

)

Net loss per share of common stock: Basic and diluted

$

(0.01

)

$

(0.03

)

Weighted-average shares of common stock outstanding: Basic

and diluted

25,178,008

24,116,144

OOMA, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited, amounts in

thousands)

Three Months Ended April 30,2023 April

30,2022 Cash flows from operating activities: Net loss

$

(326

)

$

(766

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Stock-based compensation expense

3,500

3,336

Depreciation and amortization of capital expenditures

1,063

850

Amortization of intangible assets

741

326

Amortization of operating lease right-of-use assets

647

717

Other

(2

)

15

Changes in operating assets and liabilities: Accounts receivable,

net

(1,603

)

1,688

Inventories and deferred inventory costs

965

(493

)

Prepaid expenses and other assets

(755

)

(2,681

)

Accounts payable, accrued expenses and other liabilities

(2,352

)

(1,950

)

Deferred revenue

(594

)

(223

)

Net cash provided by operating activities

1,284

819

Cash flows from investing activities: Proceeds from

maturities and sales of short-term investments

1,750

4,800

Purchases of short-term investments

—

(3,380

)

Capital expenditures

(1,374

)

(1,459

)

Business acquisition, working capital adjustments

300

—

Net cash provided by (used in) investing activities

676

(39

)

Cash flows from financing activities: Proceeds from

issuance of common stock

1,724

1,554

Shares repurchased for tax withholdings on vesting of restricted

stock units

(431

)

(348

)

Net cash provided by financing activities

1,293

1,206

Net increase in cash and cash equivalents

3,253

1,986

Cash and cash equivalents at beginning of period

24,137

19,667

Cash and cash equivalents at end of period

$

27,390

$

21,653

OOMA, INC.

Reconciliation of Non-GAAP

Financial Measures

(Unaudited, amounts in

thousands, except percentages, shares and per share data)

Three Months Ended April 30,2023 April

30,2022 Revenue

$

56,852

$

50,337

GAAP gross profit

$

35,952

$

31,952

Stock-based compensation and related taxes

260

248

Amortization of intangible assets

110

73

Non-GAAP gross profit

$

36,322

$

32,273

Gross margin on a GAAP basis

63

%

63

%

Gross margin on a Non-GAAP basis

64

%

64

%

GAAP operating loss

$

(608

)

$

(759

)

Stock-based compensation and related taxes

3,595

3,440

Amortization of intangible assets

741

326

Non-GAAP operating income

$

3,728

$

3,007

GAAP net loss

$

(326

)

$

(766

)

Stock-based compensation and related taxes

3,595

3,440

Amortization of intangible assets

741

326

Non-GAAP net income

$

4,010

$

3,000

GAAP basic and diluted net loss per share

$

(0.01

)

$

(0.03

)

Stock-based compensation and related taxes

0.14

0.14

Amortization of intangible assets

0.03

0.01

Non-GAAP net income per basic share

$

0.16

$

0.12

Non-GAAP net income per diluted share

$

0.16

$

0.12

GAAP weighted-average basic and diluted shares

25,178,008

24,116,144

Non-GAAP weighted-average diluted shares

25,665,906

24,909,140

GAAP net loss

$

(326

)

$

(766

)

Reconciling items: Interest and other income, net

(415

)

(33

)

Income tax provision

133

40

Depreciation and amortization of capital expenditures

1,063

850

Amortization of intangible assets

741

326

Stock-based compensation and related taxes

3,595

3,440

Adjusted EBITDA

$

4,791

$

3,857

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230523005999/en/

INVESTOR CONTACT: Matthew S. Robison Director of IR and

Corporate Development Ooma, Inc. ir@ooma.com (650) 300-1480

MEDIA CONTACT: Mike Langberg Director of Corporate

Communications Ooma, Inc. press@ooma.com (650) 566-6693

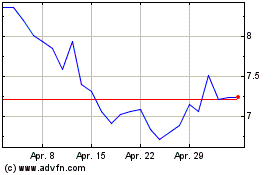

Ooma (NYSE:OOMA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ooma (NYSE:OOMA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024