Current Report Filing (8-k)

12 Mai 2022 - 11:01PM

Edgar (US Regulatory)

0000812074

false

0000812074

2022-05-10

2022-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

May 10, 2022

Date of Report (Date of earliest event reported)

O-I

GLASS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-9576 |

|

22-2781933 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

|

One Michael Owens Way

Perrysburg, Ohio

(Address

of principal executive offices) |

43551-2999

(Zip

Code) |

(567) 336-5000

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol |

Name of each exchange on which

registered |

| Common stock, $.01 par value |

OI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 5.02 |

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

O-I Glass, Inc. Third Amended and Restated

2017 Incentive Award Plan

As noted below under Item 5.07, at the Annual

Meeting of Share Owners (the “Annual Meeting”) of O-I Glass, Inc. (the “Company”) held on May 10, 2022, the Company’s

share owners, upon the recommendation of the Board of Directors, approved the O-I Glass, Inc. Third Amended and Restated 2017 Incentive

Award Plan (the “Plan”), which was adopted by the Board of Directors on April 28, 2022, subject to the approval by the share

owners. The Plan amends and restates the Company’s Second Amended and Restated 2017 Incentive Award Plan in its entirety.

The Plan, among other things, increases the number

of shares of the Company’s common stock that may be issued thereunder by an additional 3,350,000 shares to a total of 18,350,000

shares. The Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, dividend

equivalents and other stock or cash awards to employees, consultants and non-employee directors of the Company and its subsidiaries.

A more detailed description of the material terms

of the Plan was included in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission

(“SEC”) on March 30, 2022, as supplemented by the Supplement to Proxy Statement filed with the SEC on April 29, 2022 (collectively,

the “Proxy Statement”), and such description is hereby incorporated by reference herein. The foregoing and the summary in

the Proxy Statement are not complete summaries of the terms of the Plan and are qualified by reference to the text of the Plan, which

is included as Exhibit 10.1 hereto and is incorporated by reference herein.

| ITEM 5.07 | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

The Annual Meeting was held on May 10, 2022. On

the record date of March 15, 2022, there were 156,149,154 shares of the Company’s common stock outstanding. The following proposals

were submitted to a vote of the share owners at the Annual Meeting, each of which is described in detail in the Proxy Statement:

Proposal 1 – Election of Directors:

Each of the nominees for the Company’s Board of Directors was

elected to serve a one-year term by vote of the share owners as follows:

| | |

Aggregate Vote | |

| Name | |

| For | | |

| Against | | |

| Abstentions | | |

| Broker Non-Votes | |

| Samuel R. Chapin | |

| 128,936,947 | | |

| 1,455,448 | | |

| 517,248 | | |

| 8,521,658 | |

| David V. Clark, II | |

| 128,139,375 | | |

| 2,246,970 | | |

| 523,298 | | |

| 8,521,658 | |

| Gordon J. Hardie | |

| 128,685,782 | | |

| 1,748,010 | | |

| 475,851 | | |

| 8,521,658 | |

| John Humphrey | |

| 127,736,219 | | |

| 2,649,062 | | |

| 524,362 | | |

| 8,521,658 | |

| Andres A. Lopez | |

| 128,546,841 | | |

| 2,098,228 | | |

| 264,574 | | |

| 8,521,658 | |

| Alan J. Murray | |

| 122,534,407 | | |

| 6,275,694 | | |

| 2,099,542 | | |

| 8,521,658 | |

| Hari N. Nair | |

| 127,473,249 | | |

| 2,936,803 | | |

| 499,591 | | |

| 8,521,658 | |

| Joseph D. Rupp | |

| 127,441,497 | | |

| 2,944,871 | | |

| 523,275 | | |

| 8,521,658 | |

| Catherine I. Slater | |

| 129,242,029 | | |

| 1,154,617 | | |

| 512,997 | | |

| 8,521,658 | |

| John H. Walker | |

| 126,928,689 | | |

| 3,501,849 | | |

| 479,105 | | |

| 8,521,658 | |

| Carol A. Williams | |

| 127,653,877 | | |

| 2,859,310 | | |

| 396,456 | | |

| 8,521,658 | |

Proposal 2 – Ratification of Appointment of Independent Registered

Public Accounting Firm:

The appointment of Ernst & Young LLP as the

Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 was ratified by vote of the

share owners as follows:

| Aggregate Vote | |

| | For | | |

| Against | | |

| Abstentions | | |

| Broker Non-Votes | |

| | 134,910,371 | | |

| 3,951,514 | | |

| 569,416 | | |

| 0 | |

Proposal 3 — Approval of the Company’s Third Amended and

Restated 2017 Incentive Award Plan:

The Plan was approved by vote of the share owners as follows:

| Aggregate Vote | |

| | For | | |

| Against | | |

| Abstentions | | |

| Broker Non-Votes | |

| | 104,962,115 | | |

| 25,433,969 | | |

| 513,559 | | |

| 8,521,658 | |

Proposal 4 —Advisory Vote to Approve Named Executive Officer

Compensation:

The compensation of the Company’s named executive officers was

approved by an advisory (non-binding) vote of the share owners as follows:

| Aggregate Vote | |

| | For | | |

| Against | | |

| Abstentions | | |

| Broker Non-Votes | |

| | 126,041,996 | | |

| 4,456,865 | | |

| 410,782 | | |

| 8,521,658 | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

| Exhibit No. |

|

Description |

| 10.1 |

|

O-I Glass, Inc. Third Amended and Restated 2017 Incentive Award Plan (filed as Appendix A to O-I Glass, Inc.’s Supplement to Proxy Statement on Schedule 14A filed April 29, 2022, File No. 1-9576, and incorporated herein by reference) |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 12, 2022 |

O-I GLASS, INC. |

| |

|

| |

By: |

/s/ John A. Haudrich |

| |

|

John A. Haudrich |

| |

|

Senior Vice President and Chief Financial Officer |

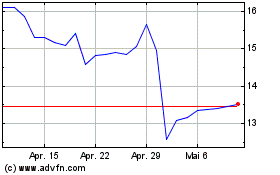

OI Glass (NYSE:OI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024