Current Report Filing (8-k)

12 Mai 2022 - 10:26PM

Edgar (US Regulatory)

0000812074

false

0000812074

2022-05-09

2022-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

May 9, 2022

Date of Report (Date of earliest event reported)

O-I

GLASS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-9576 |

|

22-2781933 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

|

One Michael Owens Way

Perrysburg, Ohio

(Address

of principal executive offices) |

43551-2999

(Zip

Code) |

(567) 336-5000

(Registrant’s telephone number, including

area code)

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol |

Name of each exchange on which

registered |

| Common stock, $.01 par value |

OI |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 7.01. |

REGULATION FD DISCLOSURE. |

On May 9, 2022, O-I Canada Corp. (“O-I Canada”),

an indirect wholly owned subsidiary of O-I Glass, Inc. (the “Company”), completed a sale and leaseback transaction with an

affiliate of Crestpoint Real Estate Investments Ltd. (“Crestpoint”), pursuant to which such affiliate purchased O-I Canada’s

plant in Brampton, Ontario, Canada for a purchase price of CAD $244 million (approximately USD $191 million).

In connection with this transaction, O-I Canada,

as tenant, and the Company, as a guarantor, entered into a lease with Crestpoint’s affiliate to lease the Brampton, Ontario plant

for an initial term of 10 years. The lease requires O-I Canada to make base rent payments of approximately CAD $9.3 million (USD $7.3

million) in the first year, gradually increasing to approximately CAD $11.6 million (USD $9.1 million) in the tenth year. O-I Canada,

in its discretion, has the option to extend the lease for up to 13 additional years, via two options to extend for an additional five

years each along with a third option to extend for an additional three years. O-I Canada also has the right to terminate the lease during

the initial term at no cost as early as May 9, 2029, subject to O-I Canada providing the required advance notice. Crestpoint has placed

CAD $5 million (approximately USD $4 million) in an escrow account for the benefit of O-I Canada for the purposes of making future repairs

to the property after closing, which amount is separate from and in addition to the purchase price paid pursuant to the acquisition.

On May 12, 2022, the Company issued a press release

announcing the completion of this sale and leaseback transaction. A copy of the press release is attached hereto as Exhibit 99.1 and is

incorporated herein by reference.

The information set forth in this Item 7.01, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 7.01, including

Exhibit 99.1, shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

O-I GLASS, INC. |

| |

|

|

| Date: May 12, 2022 |

By: |

/s/ John A. Haudrich |

| |

Name: |

John A. Haudrich |

| |

Title: |

Senior Vice President and Chief Financial Officer |

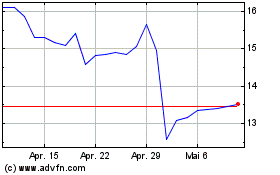

OI Glass (NYSE:OI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

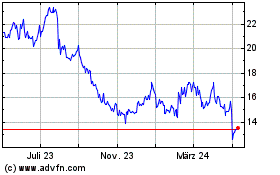

OI Glass (NYSE:OI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024