Ocwen Financial Corporation (NYSE: OCN) (“Ocwen” or the “Company”),

a leading non-bank mortgage servicer and originator, issued the

following statement in response to the minimum financial

eligibility requirements for enterprise seller/servicers and Ginnie

Mae issuers announced by the Federal Housing Finance Agency

(“FHFA”) and Ginnie Mae (“GNMA”).

“We are currently in compliance with the new FHFA and GNMA

liquidity and capital standards and expect to be in compliance when

they take effect in September 2023, with the exception of the GNMA

risk-based capital ratio. We are having discussions with GNMA with

respect to their risk-based capital requirements, which take effect

at year-end 2023. We are evaluating our alternatives, as well as

the costs and benefits of achieving compliance with the GNMA

risk-based capital requirements. GNMA forward servicing and

originations is not a material portion of our business activities,

comprising approximately 4% of our total servicing UPB as of June

30, 2022 and less than 10% of our year-to-date origination volume

as of August 31, 2022. The alternatives we are evaluating include

but are not limited to external investor solutions, structural

solutions or exiting GNMA forward originations and owned servicing.

Regardless, we expect we will continue to subservice GNMA forward

mortgages and originate, subservice and own GNMA Reverse mortgages

(or HECMs), as we do not believe these activities will be impacted

by the new regulations. We intend to manage our business

appropriately to achieve compliance with the risk-based capital

standards when these rules take effect. We expect to continue to

repurchase shares under our previously announced share repurchase

program.”

Earlier this year, Ocwen’s mortgage subsidiary, PHH Mortgage,

was recognized for servicing excellence through Freddie Mac’s Gold

Servicer Honors and Rewards Program (SHARP)SM award in the top tier

servicing group and Fannie Mae’s Servicer Total Achievement and

Rewards (STAR)TM performer recognition for General Servicing,

Solution Delivery and Timeline Management, and achieved HUD’s Tier

1 servicer ranking.

About Ocwen Financial Corporation

Ocwen Financial Corporation (NYSE: OCN) is a leading non-bank

mortgage servicer and originator providing solutions through its

primary brands, PHH Mortgage and Liberty Reverse Mortgage. PHH

Mortgage is one of the largest servicers in the country, focused on

delivering a variety of servicing and lending programs. Liberty is

one of the nation’s largest reverse mortgage lenders dedicated to

education and providing loans that help customers meet their

personal and financial needs. We are headquartered in West Palm

Beach, Florida, with offices and operations in the United States,

the U.S. Virgin Islands, India and the Philippines, and have been

serving our customers since 1988. For additional information,

please visit our website (www.ocwen.com).

Forward-Looking Statements

This presentation contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements may be identified by a reference

to a future period or by the use of forward-looking terminology.

Forward-looking statements are typically identified by words such

as “expect”, “believe”, “foresee”, “anticipate”, “intend”,

“estimate”, “goal”, “strategy”, “plan” “target” and “project” or

conditional verbs such as “will”, “may”, “should”, “could” or

“would” or the negative of these terms, although not all

forward-looking statements contain these words, and includes

statements in this press release regarding our assessment of our

future ability to comply with the FHFA and GNMA financial

eligibility requirements, the impact of these requirements on our

business, and the courses of action we are considering in response

to these new requirements. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain.

Our business has been undergoing substantial change and we are

experiencing significant changes within the mortgage lending and

servicing ecosystem which has magnified such uncertainties. Readers

should bear these factors in mind when considering such statements

and should not place undue reliance on such statements.

Forward-looking statements involve a number of assumptions,

risks and uncertainties that could cause actual results to differ

materially. In the past, actual results have differed from those

suggested by forward looking statements and this may happen again.

Important factors that could cause actual results to differ

materially from those suggested by the forward-looking statements

include, but are not limited to, the potential for ongoing

disruption in the financial markets and in commercial activity

generally as a result of international events, changes in monetary

and fiscal policy, and other sources of instability; the impacts of

inflation, employment disruption, and other financial difficulties

facing our borrowers; uncertainty relating to the continuing

impacts of the COVID-19 pandemic, including the response of the

U.S. government, state governments, the Federal National Mortgage

Association (Fannie Mae) and Federal Home Loan Mortgage Corporation

(Freddie Mac) (together, the GSEs), Ginnie Mae and regulators; our

ability to improve our financial performance through cost and

productivity improvements; the extent to which our MSR asset

vehicle (MAV), other transactions and our enterprise sales

initiatives will generate additional subservicing volume, increase

market share within the subservicing market, and result in

increased profitability; the timing and amount of presently

anticipated forward and reverse loan boarding; whether we will

increase the total investment commitments in MAV, and if so, when

and on what terms; our ability to close acquisitions of MSRs and

other transactions, including the ability to obtain regulatory

approvals; the quantity, timing and long-term impact of additional

stock repurchases; our ability to continue to grow our reverse

servicing business; our ability to retain clients and employees of

acquired businesses, and the extent to which acquisitions and our

other strategic initiatives will contribute to achieving our growth

objectives; the extent to which we will be able to execute call

rights transactions, and whether such transactions will generate

the returns anticipated; the adequacy of our financial resources,

including our sources of liquidity and ability to sell, fund and

recover servicing advances, forward and reverse whole loans, and

HECM and forward loan buyouts and put backs, as well as repay,

renew and extend borrowings, borrow additional amounts as and when

required, meet our MSR or other asset investment objectives and

comply with our debt agreements, including the financial and other

covenants contained in them; increased servicing costs based on

increased borrower delinquency levels or other factors; the future

of our long-term relationship with Rithm Capital Corp.; the

performance of our lending business in a competitive market and

uncertain interest rate environment; our ability to execute on

identified business development and sales opportunities;

uncertainty related to past, present or future claims, litigation,

cease and desist orders and investigations regarding our servicing,

foreclosure, modification, origination and other practices brought

by government agencies and private parties, including state

regulators, the Consumer Financial Protection Bureau (CFPB), State

Attorneys General, the Securities and Exchange Commission (SEC),

the Department of Justice or the Department of Housing and Urban

Development (HUD); adverse effects on our business as a result of

regulatory investigations, litigation, cease and desist orders or

settlements and the reactions of key counterparties, including

lenders, the GSEs and Ginnie Mae; our ability to comply with the

terms of our settlements with regulatory agencies and the costs of

doing so; increased regulatory scrutiny and media attention; any

adverse developments in existing legal proceedings or the

initiation of new legal proceedings; our ability to effectively

manage our regulatory and contractual compliance obligations; our

ability to interpret correctly and comply with liquidity, net worth

and other financial and other requirements of regulators, the GSEs

and Ginnie Mae, as well as those set forth in our debt and other

agreements; our ability to comply with our servicing agreements,

including our ability to comply with the requirements of the GSEs

and Ginnie Mae and maintain our seller/servicer and other statuses

with them; our ability to fund future draws on existing loans in

our reverse mortgage portfolio; our servicer and credit ratings as

well as other actions from various rating agencies, including any

future downgrades; as well as other risks and uncertainties

detailed in our reports and filings with the SEC, including our

annual report on Form 10-K for the year ended December 31, 2021 and

any current report or quarterly report filed with the SEC since

such date.

Anyone wishing to understand Ocwen’s business should review our

SEC filings. Our forward-looking statements speak only as of the

date they are made and, we disclaim any obligation to update or

revise forward-looking statements whether as a result of new

information, future events or otherwise.

FOR FURTHER INFORMATION CONTACT:

| Dico Akseraylian |

| T: (856) 917-0066 |

| E: mediarelations@ocwen.com |

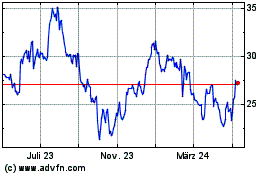

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

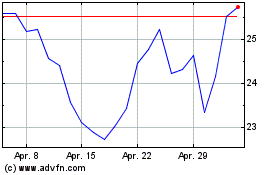

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024