Amended Statement of Beneficial Ownership (sc 13d/a)

06 September 2022 - 2:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

| New York City REIT, Inc. |

| (Name of Issuer) |

| |

| Class A common stock, $0.01 par value per share |

| (Title of Class of Securities) |

| |

| 649439205 |

| (CUSIP Number) |

| |

|

Michael R. Anderson

General Counsel

Bellevue Capital Partners, LLC

222 Bellevue Avenue

Newport, RI 02840

212-415-6500 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| September 2,

2022 |

| (Date of Event which Requires Filing of this Statement) |

If the filing person has previously filed a

statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of

Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ¨

Note: Schedules filed

in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties

to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 2 of 12 |

| 1 |

NAME OF REPORTING PERSON

Bellevue Capital Partners, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

2,547,980 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

2,547,980 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,547,980 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

17.5% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 3 of 12 |

| 1 |

NAME OF REPORTING PERSON

AR Global Investments, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

413,893 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

413,893 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

413,893 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.8% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 4 of 12 |

| 1 |

NAME OF REPORTING PERSON

American Realty Capital III, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

413,893 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

413,893 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

413,893 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.8% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 5 of 12 |

| 1 |

NAME OF REPORTING PERSON

New York City Special Limited Partnership, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

413,893 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

413,893 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

413,893 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.8% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 6 of 12 |

| 1 |

NAME OF REPORTING PERSON

New York City Advisors, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

413,893 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

413,893 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

413,893 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.8% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 7 of 12 |

| 1 |

NAME OF REPORTING PERSON

Nicholas S. Schorsch |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☒ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

2,667,884 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

2,667,884 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,667,884 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

18.3% |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 8 of 12 |

| 1 |

NAME OF REPORTING PERSON

Edward M. Weil, Jr. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

12,210 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

12,210 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12,210 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.1% |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 9 of 12 |

Item 1. Security and Issuer.

This Amendment No.7 (the “Amendment”) to Schedule 13D amends

and supplements the Schedule 13D originally filed with the United States Securities and Exchange Commission (the “SEC”) on

February 11, 2022 relating to the shares of Class A common stock, par value $0.01 per share (the “Class A Common Stock”),

of New York City REIT, Inc., a Maryland corporation (the “Issuer”), as subsequently amended (the “Schedule 13D”).

Unless indicated otherwise, all items left blank remain unchanged and any items which are reported are deemed to amend and supplement

the existing items in the Schedule 13D. Capitalized terms used herein without definition shall have the meaning set forth in the Original

Schedule 13D.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is amended and supplemented by inserting

the following information:

Bellevue Capital Partners

On September 2, 2022, Bellevue Capital Partners acquired 632,911

shares of Class A Common Stock in an open market purchase at a price of $3.16 per share.

Additionally, the following transactions were previously effected by Bellevue

Capital Partners pursuant to the Bellevue 10b5-1 Plan:

| Trade Date |

|

Buy/Sell |

|

Number of

Shares of

Class A

Common Stock |

|

Weighted Average Price Per

Share of

Class A

Common Stock(1) |

|

Price Range(2) |

| July 12, 2022 |

|

Buy |

|

10,000 |

|

$4.86 |

|

$4.76-$4.93 |

| (1) | These shares were purchased in multiple transactions at the price ranges

set forth in the column labeled “Price Range”. Bellevue Capital Partners undertakes to provide to the staff of the Securities

and Exchange Commission, upon request, full information regarding the number of shares purchased at each separate price within such range. |

| (2) | Price ranges are inclusive. |

New York City Advisors

On September 2, 2022, New York City Advisors received from the Issuer

151,194 shares of Class A Common Stock in lieu of approximately $500,000 of fees payable on such date to New York City Advisors

pursuant to the Advisory Agreement. Additionally, subject to the terms and conditions of the Side Letter, on August 1, 2022,

Bellevue Capital Partners received from the Issuer 124,685 shares of Class A Common Stock in connection with approximately $500,000

of fees payable on such date to New York City Advisors pursuant to the Advisory Agreement. All such shares were issued by the Issuer

pursuant to the 2020 Advisor Omnibus Incentive Compensation Plan of the Issuer.

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page

10 of 12 |

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is amended and supplemented by incorporating

by reference the information set forth in Item 3 above.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is amended and supplemented by incorporating

by reference the information set forth in boxes (11) and (13) of the cover pages to this Amendment for each of the Reporting Persons,

and such information is incorporated herein by reference. The percentages reported herein are calculated based upon 14,594,973 outstanding

shares of Class A Common Stock as of September 2, 2022.

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page

11 of 12 |

SIGNATURES

After reasonable inquiry and to

the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and

correct.

Dated: September 6, 2022

| |

BELLEVUE CAPITAL PARTNERS, LLC |

|

| |

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson

Title: General Counsel |

|

Dated: September 6, 2022

| |

AR GLOBAL INVESTMENTS, LLC |

|

| |

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson

Title: General Counsel |

|

Dated: September 6, 2022

| |

AMERICAN REALTY CAPITAL III, LLC |

|

| |

|

|

| |

By: |

AR GLOBAL INVESTMENTS, LLC, its sole member |

|

| |

|

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson

Title: General Counsel |

|

Dated: September 6, 2022

| |

NEW YORK CITY SPECIAL LIMITED PARTNERSHIP, LLC |

|

| |

|

|

| |

By: |

AMERICAN REALTY CAPITAL III, LLC, its sole member |

|

| |

|

|

|

| |

By: |

AR GLOBAL INVESTMENTS, LLC, its sole member |

|

| |

|

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson

Title: General Counsel |

|

| CUSIP No. 649439205 |

SCHEDULE 13D |

Page 12 of 12 |

Dated: September 6, 2022

| |

NEW YORK CITY ADVISORS, LLC |

|

| |

|

|

| |

By: |

/s/ Edward M. Weil, Jr. |

|

| |

|

Name: Edward M. Weil, Jr.

Title: Chief Executive Officer |

|

Dated: September 6, 2022

| |

NICHOLAS S. SCHORSCH |

|

| |

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson, as Attorney-in-Fact |

|

Dated: September 6, 2022

| |

EDWARD M. WEIL, JR. |

|

| |

|

|

| |

By: |

/s/ Michael R. Anderson |

|

| |

|

Name: Michael R. Anderson, as Attorney-in-Fact |

|

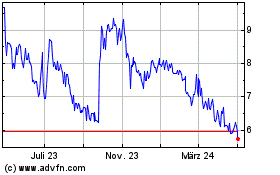

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

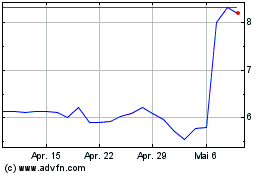

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024