FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For

August 25, 2022

Commission

File Number: 001-10306

NatWest

Group plc

RBS,

Gogarburn, PO Box 1000

Edinburgh

EH12 1HQ

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

___

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(1):_________

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule

101(b)(7):_________

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ___

No X

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

________

The following information was issued as Company announcements

in London, England and is furnished pursuant to General Instruction

B to the General Instructions to Form

6-K:

NatWest Group plc

General Meeting and Class Meeting Statement

25 August 2022

NatWest Group plc will hold a General Meeting at 2.00 p.m. today to

be followed immediately by a Class Meeting of Ordinary

Shareholders. The meetings will deal with the proposed resolutions

as set out in the Circular and Notice of General Meeting and Class

Meeting issued to shareholders on 9 August 2022 and a proposed

amendment to resolution 2, the details of which are referenced

below.

The following is an extract from the remarks to be made by Howard

Davies, Chairman, at the meetings.

The strength of NatWest Group's balance sheet and financial

performance mean that we are well positioned to grow our lending to

customers responsibly and to support those customers, colleagues

and communities who are likely to need it most. We are also

continuing to invest in the transformation of the bank while

delivering sustainable returns to shareholders.

At our first half results we announced our intention to pay an

ordinary interim dividend of 3.5 pence per share alongside the

special dividend and share consolidation that are being voted on

today.

The special dividend of 16.8 pence

per share would return

approximately £1.75 billion to ordinary shareholders.

The accompanying share consolidation would result in ordinary

shareholders receiving 13 new ordinary shares for every 14 ordinary

shares currently held, maintaining the comparability, so far as

practicable, of the Group's share price before and after the

special dividend is paid.

Combining a share consolidation with a special dividend is a common

approach when a large amount of capital is being distributed and we

believe it is in the best interests of the bank and its

shareholders.

There are three main reasons why the

Board has chosen to implement the distribution

of excess capital in this way:

First, it allows us to return a significant amount of capital to

shareholders quickly compared to an on-market buyback

programme.

Secondly, by undertaking the share consolidation alongside

the special dividend, it is accretive to the Group's earnings per

share and tangible book value per share, similar to the financial

effects of an on-market buyback programme.

And finally, it does not increase the relative proportion of the

government's shareholding in NatWest Group which could be the case

if a further on-market buyback programme was launched without

sell-downs from HM Treasury.

If these resolutions are approved, NatWest Group will have

announced capital returns of approximately £3.3 billion so far

this year through a directed buyback from HM Treasury and both the

interim and special dividend.

We completed our £750 million on-market buy-back programme

announced at Full Year.

We have maintained capacity to participate in an off-market

directed buyback of HM Treasury's shareholding in the Group. As

ever, any such off-market directed buyback would require the

government to seek to sell down their holding and could only take

place after 29 March 2023 onwards, 12 months after our most recent

transaction.

I would like to draw your attention to a proposed amendment to

resolution 2, which is an ordinary resolution relating to the

proposed share transaction. Resolution 2, as set out in the

Notice of Meeting, includes a reference in the second line to

c.10.406 billion existing ordinary shares of £1 each in the

capital of the Company being consolidated into one intermediate

ordinary share of £14.00 each in the capital of the

Company. Rather than referring to the issued share capital

being consolidated into one intermediate ordinary share, the

resolution should instead have made clear that it is every 14

existing ordinary shares (including treasury shares) that are being

consolidated into one intermediate ordinary share in the capital of

the Company and each intermediate ordinary share will then be

divided into 13 new ordinary shares.

The proposed amendment involves no departure from the substance of

the resolution set out in the Notice of Meeting and is necessary to

correct this patent error.

To deal with this, it is necessary for the meeting to consider

first whether this amendment should be approved and then, assuming

that the meeting approves the amendment, for the substantive

resolution to be put to the meeting.

To close, I would reiterate that the Board considers the

resolutions to be voted on today to be in the best interests of the

Company and our shareholders and is recommending our shareholders

vote in favour of them.

For more information contact:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Forward-looking statements

This document may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest Group's future economic results, business plans and

strategies. In particular, this document may include

forward-looking statements relating to NatWest Group in respect of,

but not limited to: its economic and political risks, its

regulatory capital position and related requirements, its financial

position, profitability and financial performance (including

financial, capital, cost savings and operational targets), the

impact of the Share Consolidation and the Special Dividend, the

implementation of its purpose-led strategy, its environmental,

social, governance and climate related targets, its access to

adequate sources of liquidity and funding, increasing competition

from new incumbents and disruptive technologies, the impact of the

COVID-19 pandemic, its exposure to third party risks, its ongoing

compliance with the UK ring-fencing regime and ensuring operational

continuity in resolution, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, the transition of LIBOR and IBOR rates to

alternative risk free rates and NatWest Group's exposure to

operational risk, conduct risk, cyber, data and IT risk, financial

crime risk, key person risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, future growth initiatives (including

acquisitions, joint ventures and strategic partnerships), the

outcome of legal, regulatory and governmental actions and

investigations, the level and extent of future impairments and

write-downs (including with respect to goodwill), legislative,

political, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

interest and exchange rate fluctuations, general economic and

political conditions, the impact of climate-related risks and the

transitioning to a net zero economy and the impact of the COVID-19

pandemic. These and other factors, risks and uncertainties that may

impact any forward-looking statement or NatWest Group's actual

results are discussed in NatWest Group's UK 2021 Annual Report and

Accounts (ARA), NatWest Group's Interim Results for Q1 2022 and H1

2022 and NatWest Group's filings with the US Securities and

Exchange Commission, including, but not limited to, NatWest Group's

most recent Annual Report on Form 20-F and Reports on Form 6-K. The

forward-looking statements contained in this document speak only as

of the date of this document and NatWest Group does not assume or

undertake any obligation or responsibility to update any of the

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise, except to

the extent legally required.

No statement in this document is or is intended to be a profit

forecast or to imply that the earnings of NatWest Group for the

current or future financial years will necessarily match or exceed

the historical or published earnings of NatWest Group.

Any information contained in this document on the price at which

shares or other securities in NatWest Group have been bought or

sold in the past, or on the yield on such shares or other

securities, should not be relied upon as a guide to future

performance.

Date: 25

August 2022

|

|

NATWEST

GROUP plc (Registrant)

|

|

|

|

|

|

By: /s/

Jan Cargill

|

|

|

|

|

|

Name:

Jan Cargill

|

|

|

Title:

Chief Governance Officer and Company Secretary

|

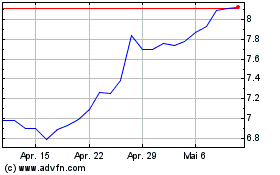

NatWest (NYSE:NWG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

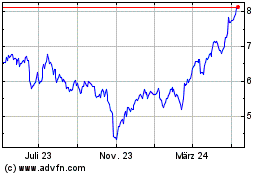

NatWest (NYSE:NWG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024