Current Report Filing (8-k)

21 November 2022 - 10:25PM

Edgar (US Regulatory)

0000702165

false

0000702165

2022-11-17

2022-11-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 21, 2022 (November 17,

2022)

________________________________

NORFOLK

SOUTHERN CORPORATION

(Exact name of registrant as specified in its

charter)

______________________________________

| Virginia |

1-8339 |

52-1188014 |

| (State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS

Employer Identification Number) |

| 650 West Peachtree Street NW |

|

Atlanta, Georgia

30308-1925 |

(855) 667-3655 |

| (Address of principal

executive offices, including zip code) |

(Registrant’s telephone

number, including area code) |

No Change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange

on which registered |

Norfolk Southern Corporation

Common Stock (Par Value $1.00) |

|

NSC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 21, 2022, Norfolk Southern Railway

Company (“NSR”), a wholly owned subsidiary of Norfolk Southern Corporation (the “Registrant”), and The

Cincinnati, New Orleans and Texas Pacific Railway Company (“CNO&TP”), a wholly-owned subsidiary of NSR, entered into

an Asset Purchase and Sale Agreement (“Purchase Agreement”) with the Board of Trustees of the Cincinnati Southern

Railway (the “Trustees”) pursuant to which the Trustees agree to sell, and NSR agrees to purchase, (i) approximately

337 miles of railway line that extends from Cincinnati, Ohio to Chattanooga, Tennessee known as the Cincinnati Southern Railway

currently operated by CNO&TP under a lease agreement expiring in 2026, and (ii) certain associated real and personal property

for a cash purchase price of approximately $1.62 billion, subject to certain adjustments. Under the terms of the Purchase Agreement,

the purchase price includes (i) a non-refundable accelerated transaction fee of $4,500,000 payable upon the execution of the

Purchase Agreement and (ii) a deferred transaction fee of $20,000,000 payable upon closing.

In addition to customary conditions

common to transactions of this type, the closing of the transactions contemplated by the Purchase Agreement is conditioned upon (i) certain

changes to Ohio state law applicable to the use of the related sale proceeds, (ii) approval by the voters of the city of Cincinnati, and

(iii) receipt of regulatory approval from the United States Surface Transportation Board (“STB”). NSR has agreed to make reasonable

efforts, at its own expense, to support the Ohio state law change and the Cincinnati voter approval.

The Purchase Agreement also includes

customary termination provisions, including (i) termination at any time prior to the closing by the mutual written consent of the parties,

(ii) termination at any time after December 31, 2024, by the mutual written consent of NSR and the Trustees, (iii) termination by NSR

if the STB takes action that NSR deems unsatisfactory, and (iv) termination by either party if Cincinnati voter approval is not obtained

on or before the later of June 30, 2025 and the calendar day following the date on which polls are open for the 2025 Cincinnati primary

election.

The foregoing description of the

Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the Purchase Agreement

attached hereto as Exhibit 2.1 and incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 17, 2022, the Compensation Committee of Board of Directors of

the Registrant approved changes to the Registrant’s Executive Severance Plan (the “Severance Plan”) as part of its annual

review of such document. The Severance Plan was revised to clarify that employees above the level

of Executive Vice President are covered under the terms of such plan, including the Registrant’s Chief Executive Officer (who was

not previously subject to any such plan). Pursuant to the Severance Plan, the Registrant’s Chief Executive Officer, Executive Vice

Presidents, and other participating officers are entitled to specific severance payments and benefits following the triggering events

set forth therein.

The description of the Severance Plan above is qualified in its entirety

by reference to the copy of the Severance Plan attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 21, 2022, the Registrant issued a press release announcing

the execution of the Purchase Agreement. A copy of the release is furnished herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are filed as part of this Current Report on Form

8-K:

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

NORFOLK SOUTHERN CORPORATION |

| |

(Registrant) |

| |

|

|

| |

|

|

| |

/s/ Denise W. Hutson |

| |

Name: Denise W. Hutson |

| |

Title: Corporate Secretary |

Date: November 21, 2022

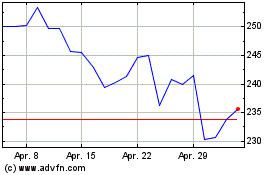

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024