CFC’s Initial 2021 Key Ratio Trend Analysis Results Demonstrate Cooperatives’ Financial Strength

17 Juni 2022 - 11:07PM

The National Rural Utilities Cooperative Finance Corporation (CFC)

has analyzed preliminary data for its 2021 Key Ratio Trend Analysis

(KRTA) report, an annual assessment of financial trends among

electric distribution cooperatives nationwide. The results show

electric cooperatives have maintained strong financial metrics and

are experiencing growth across a number of measures, including

consumers, sales, margins and utility plant.

“Rural electric distribution cooperatives’ disciplined

management and their focus on improving the quality of life in the

communities they serve is a testament to the cooperative business

model,” CFC Senior Vice President and Chief Corporate Affairs

Officer Brad Captain said.

Financial performance was strong year-over-year as demonstrated

by coverage ratios, which assess ability to repay debt, and equity

levels. Both times interest earned ratio (TIER) and equity as a

percentage of assets continued to trend upward. TIER rose from 2.80

to 2.95 while equity as a percentage of assets also trended higher

to 45.97 percent, compared with 45.80 percent in 2020.

Consumer growth exceeded 1 percent, the highest in more than a

decade, with nearly 93 percent of cooperatives showing increases,

including notable pockets of greater than 2 percent consumer growth

in Arizona, California, Idaho, Nevada and Utah.

Investment in utility plant also sustained its four-year growth

trend, as demonstrated by an increase in the total utility plant

ratio, which rose 3.95 percent in 2021 compared with 3.79 percent

in 2020. “Electric cooperatives continue to invest in plant and

utility infrastructure, including renewables and fiber, to ensure

they provide their consumers with reliable, affordable and

sustainable electricity into the future,” CFC Senior Vice President

of Strategic Services Mark Snowden said.

In another positive sign, after a slight increase in 2020, both

accounts receivable over 60 days and write-offs declined to

pre-pandemic levels. Accounts receivable fell to 0.09 percent of

operating revenue from 0.13 percent in 2020, and write-offs fell to

0.07 percent of revenue from 0.08 percent in 2020.

Preliminary KRTA results are based on data submitted by 812

electric distribution cooperatives for the year ending Dec. 31,

2021. CFC calculates 145 financial and operational ratios for each

cooperative and provides a report showing the cooperative’s ratio

compared with the U.S. median value. Median reporting minimizes the

effect of outliers and provides a clearer picture of cooperative

performance.

About CFCCreated and owned by America’s

electric cooperative network, the National Rural Utilities

Cooperative Finance Corporation (CFC)—a nonprofit finance

cooperative with $30 billion in assets—provides unparalleled

industry expertise, flexibility and responsiveness to serve the

needs of our member-owners. CFC is an equal opportunity provider.

Visit us online at www.nrucfc.coop.

About KRTACFC has published KRTA—an annual

report that tracks the median value of 145 financial and

operational ratios for participating electric distribution

cooperatives over the previous five years—since 1975. Based on

unaudited data reported by electric distribution cooperatives, KRTA

provides electric cooperative CEOs and directors/trustees with a

complete picture of their system’s financial performance.

Contact:

Brad

CaptainCorporate Relations

Grouppublicrelations@nrucfc.coop800-424-2954

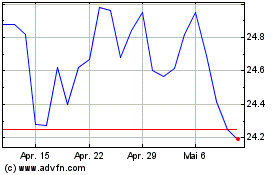

National Rural Utilities... (NYSE:NRUC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

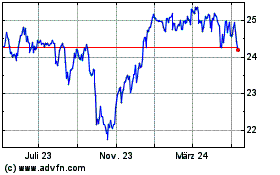

National Rural Utilities... (NYSE:NRUC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024