Additional Proxy Soliciting Materials (definitive) (defa14a)

02 Mai 2022 - 10:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under to §240.14a-12 |

Annaly Capital Management, Inc.

(Name of Registrant as Specified in

its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

Commencing on May 2, 2022, Annaly Capital Management, Inc. sent the below

communications to certain stockholders.

ANNALY’S 2022 PROXY STATEMENT

Annaly has significantly enhanced its position as a

leader in the residential housing finance space since the beginning of 2021 through a number of strategic milestones, which include:

| ◾ |

|

March 2021 – Announced agreement to sell Commercial Real Estate business for $2.33 billion

|

| ◾ |

|

April 2021 – Launched residential whole loan correspondent channel |

| ◾ |

|

July 2021 – Published second corporate responsibility report |

| ◾ |

|

August 2021 – Released 2019 and 2020 EEO-1 Reports and pledged to

provide annual disclosure of workforce diversity statistics going forward |

| ◾ |

|

October 2021 – Amended governance documents to reflect integrated Board oversight of ESG

|

| ◾ |

|

November 2021 – Selected as a finalist for 2021 NACD DE&I Awards |

| ◾ |

|

December 2021 – Grew mortgage servicing rights (“MSR”) portfolio to $645 million at year-end |

| ◾ |

|

January 2022 – Included in Bloomberg’s Gender-Equality Index for the fifth consecutive year

|

| ◾ |

|

February 2022 – Published supplemental climate-related disclosures |

| ◾ |

|

February 2022 – Amended bylaws to lower the threshold for stockholders to call a special meeting

|

| ◾ |

|

April 2022 – Announced agreement to sell Middle Market Lending portfolio, which includes assets held on

balance sheet as well as assets managed for third parties, for approximately $2.4 billion |

| 2. |

Focus on Residential Housing Finance |

The Company has taken a series of recent strategic

actions to enhance our focus and capabilities across our core housing finance strategy, including the disposition of our Commercial Real Estate business for approximately $2.33 billion in 2021, the opportune buildout of our MSR platform and the

successful launch of our residential whole loan correspondent channel. Additionally, on April 25, 2022, the Company entered into a definitive agreement to sell substantially all of the assets that comprise our Middle Market Lending portfolio,

including assets held on balance sheet as well as assets managed for third parties, to Ares Management Corporation for approximately $2.4 billion. The transaction is subject to customary closing conditions and is expected to be completed by the

end of the second quarter of 2022. Following the completion of the sale, the Company will have three, complementary housing finance-focused investment strategies: Agency, MSR and Residential Credit.

| 3. |

Executive Compensation Enhancements |

In the Company’s first full year as an

internally-managed company, the Management Development and Compensation Committee introduced a number of additional enhancements to the Company’s executive compensation program, which are intended to institutionalize a market competitive

program that incentivizes strong performance, drives alignment with stockholders and reflects best practices, market insights and robust governance. These enhancements included:

| ◾ |

|

Reducing discretion and providing for a more formulaic approach to determining annual incentive opportunities for

our named executive officers (“NEO”) with 75% based on corporate/organizational metrics and 25% based on individual metrics |

| |

◾ |

|

Increasing the proportion of objective financial metrics as a percentage of corporate/organizational metrics from

50% to 60% |

| ◾ |

|

Introducing pre-established target amounts for all NEO annual incentive

opportunities with payout ranging from 80% to a maximum of 120% of target |

| ◾ |

|

For the CEO, increasing the relative weighting of equity as a percentage of total incentive compensation

opportunity to greater than 50% (with a majority of the NEOs at 50% or greater for 2021 and all NEOs at 50% or greater for 2022) |

| ◾ |

|

For all NEOs, increasing the proportion of performance stock units (“PSUs”) as a percentage of total

equity compensation to 50% |

| 4. |

Expanded Diversity, Equity and Inclusion (“DE&I”) Initiatives

|

In addition to

publicly releasing our EEO-1 Reports, the Company took a number of actions to demonstrate and further its commitment to a diverse, equitable and inclusive workforce in 2021, including:

| ◾ |

|

Becoming a signatory of the CEO Action for Diversity & Inclusion |

| ◾ |

|

Expanding to seven employee-sponsored affinity groups |

| ◾ |

|

Conducting firmwide inclusion educational events on allyship and related topics |

| ◾ |

|

Sponsoring Individual Style Profile assessments for all employees to foster informed and inclusive thinking and

behaviors around different individual styles |

| ◾ |

|

Continuing to monitor key human capital diversity metrics: hiring, turnover, promotion |

| 5. |

Board Composition and Diversity |

The Company remains committed to seeking out highly

qualified candidates of diverse gender and race/ethnicity, as well as taking into account other factors that promote principles of diversity. The composition of our Board reflects this commitment as 45% of our Director nominees are women and 27%

identify as racially/ethnically diverse. In addition, we are proud that all five Committees of the Board are chaired by women.

| 6. |

Delivering for Our Shareholders |

In 2021, the Company navigated a year of tremendous

change and opportunity to continue delivering strong performance, including:

| ◾ |

|

11.3% dividend yield at the end of 2021 |

| ◾ |

|

$6.1 billion of originations across the Company’s credit businesses in 2021 |

| ◾ |

|

$1.4 billion of common and preferred dividends declared in 2021 |

| ◾ |

|

Reduced GAAP leverage to 4.7x from 5.1x in the prior year |

| ◾ |

|

Reduced operating expense ratio to 1.35% from 1.55% in the prior year following our management internalization

and Commercial Real Estate sale |

| 7. |

Stockholder Engagement |

The Company is committed to year-round engagement

with retail and institutional stockholders. Since the beginning of 2021, the Company’s outreach efforts have encompassed approximately 90% of our institutional investors, including 100% of the Company’s 100 largest investors. During the

same time, the Company hosted over 100 meetings with investors across the globe. Annaly’s stockholder engagement efforts have generated significant feedback for both the Board and management, which informed a number of recent corporate

governance enhancements, including the decisions to further enhance the Company’s executive compensation program, expand the Company’s DE&I initiatives, augment the Company’s stockholder rights framework and focus on corporate

responsibility and ESG initiatives.

| 8. |

Augmented Stockholder Rights Framework |

The Board continually enhances its corporate

governance framework in response to evolving best practices, stockholder feedback and the results of the Board’s annual self-evaluation and success planning processes. The Company conducted extensive stockholder outreach to assess desired

enhancements to our stockholder rights framework, and as a result the Board in February 2022 proactively amended our bylaws to lower the threshold for stockholders to call a special meeting from the previous majority threshold to the more standard

threshold of 25% of shares outstanding.

| 9. |

Corporate Responsibility Report |

The Company published its second Corporate

Responsibility Report, Leading with Purpose, in July 2021, demonstrating our commitment to transparency and robust ESG practices. Among other things, the report outlines the Company’s progress towards meeting the ESG goals and

commitments outlined in our inaugural Corporate Responsibility Report, which span five key ESG areas: corporate governance, human capital, responsible investments, risk management and the environment. The report also includes new ESG goals and

commitments, including a pledge to further assess climate change risks and opportunities taking into consideration the recommendations of the TCFD.

| 10. |

Virtual Shareholder Meeting |

Annaly will hold its 2022 Annual Meeting of

Stockholders via an online (virtual) format on May 18, 2022 at 9:00 am EST. The Company has successfully conducted virtual stockholder meetings since 2018 and designs our meetings to provide the same rights to participate as you would have at in-person meeting, including providing opportunities to vote, make statements and ask questions.

Annaly’s Board

of Directors unanimously recommends that you vote FOR each of the Director nominees (Proposal 1), FOR the advisory approval of the Company’s executive compensation (Proposal 2) and FOR the ratification of the appointment of Ernst &

Young LLP as the Company’s independent auditors (Proposal 3).

The Company is pleased that the proxy advisory firm Glass Lewis has recommended

that Annaly stockholders vote FOR each of the Company’s three proposals.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This definitive additional proxy materials contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some

of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors,

including, but not limited to, risks and uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions; changes in

interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the

market value of our assets; changes in business conditions and the general economy; operational risks or risk management failures by us or critical third parties, including cybersecurity incidents; our ability to grow our residential credit

business; the sale of our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets and corporate debt; risks

related to investments in mortgage servicing rights; our ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting our business; our ability to maintain our qualification as a REIT for

U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company

does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances

after the date of such statements, except as required by law.

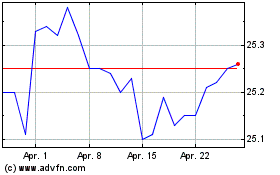

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Annaly Capital Management Inc (New York Börse): 0 Nachrichtenartikel

Weitere Annaly Capital Management Inc News-Artikel