Current Report Filing (8-k)

25 April 2022 - 10:26PM

Edgar (US Regulatory)

ANNALY CAPITAL MANAGEMENT INC 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock false 0001043219 0001043219 2022-04-25 2022-04-25 0001043219 us-gaap:CommonStockMember 2022-04-25 2022-04-25 0001043219 nly:A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-04-25 2022-04-25 0001043219 nly:A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-04-25 2022-04-25 0001043219 nly:A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-04-25 2022-04-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

April 25, 2022

Annaly Capital Management, Inc.

(Exact name of registrant as specified in its charter)

Commission file number 001-13447

|

|

|

| Maryland |

|

22-3479661 |

(State of

incorporation) |

|

(I.R.S. Employer

Identification No.) |

1211 Avenue of the Americas

New York, New York

10036

(Address of principal executive offices)

(212) 696-0100

Registrant’s telephone number, including area code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

|

NLY |

|

New York Stock Exchange |

| 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.F |

|

New York Stock Exchange |

| 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.G |

|

New York Stock Exchange |

| 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.I |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Entry into Purchase Agreement

On April 25, 2022, certain subsidiaries and affiliates (the “Sellers”) of Annaly Capital Management, Inc., a Maryland corporation (the “Company” or “Annaly”), entered into a Commercial Loan Purchase Agreement (the “Purchase Agreement”) with Ares Capital Management LLC (the “Purchaser”) pursuant to which the Sellers will sell all of the commercial loan interests held by the Middle Market Lending (“MML”) business operated by Annaly (the “Transactions”).

Pursuant to the Purchase Agreement, the Purchaser will pay an aggregate purchase price of approximately $2.4 billion, subject to certain adjustments specified therein. The aggregate purchase price represents substantially all of the assets of the MML business held on the Company’s balance sheet as well as assets managed for third parties. The Purchase Agreement contains customary representations, warranties and covenants by each party that are subject, in some cases, to specified exceptions and qualifications contained in the Purchase Agreement.

Each party’s obligation to consummate the Transactions pursuant to the Purchase Agreement is subject to customary closing conditions as set out therein, including, among others, (i) subject to certain exceptions, the accuracy of the representations and warranties of the parties; (ii) performance in all material respects by each of the parties of its covenants and agreements; (iii) receipt of certain third-party consents; and (iv) the absence of any law or order from any governmental entity prohibiting consummation of the Transaction. The parties expect that the transfer of all of the commercial loan interests held by the Sellers will be completed by the end of the second quarter of 2022.

The Purchase Agreement includes certain customary termination rights for each of the Sellers and the Purchaser.

Press Release

On April 25, 2022, the Company issued a press release announcing the entry into the Purchase Agreement. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in Item 8.01 to this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 8.01 to this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed incorporated by reference into any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

2

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

The exhibits to this report are listed in the Exhibit Index below and are incorporated by reference herein.

Exhibit Index

Forward- Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act and Private Securities Litigation Reform Act, as amended, including those relating to the expected consummation of the Transactions and other statements that are predictive in nature. These forward-looking statements are based on current expectations, forecasts and projections about the Transactions, industry and markets in which the Company operates and management’s current beliefs and assumptions. These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential,” “predict,” “project,” “should,” “would” and similar expressions and the negatives of those terms. These statements relate to future and involve known and unknown risks, uncertainties, and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company’s filings with the SEC. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

| Date: April 25, 2022 |

|

|

|

ANNALY CAPITAL MANAGEMENT, INC.

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Anthony C. Green |

|

|

|

|

Name: |

|

Anthony C. Green

|

|

|

|

|

Title: |

|

Chief Corporate Officer & Chief Legal Officer |

4

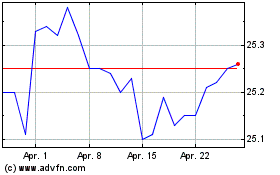

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Annaly Capital Management Inc (New York Börse): 0 Nachrichtenartikel

Weitere Annaly Capital Management Inc News-Artikel