Current Report Filing (8-k)

14 Februar 2022 - 11:32PM

Edgar (US Regulatory)

ANNALY CAPITAL MANAGEMENT INC 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock false 0001043219 0001043219 2022-02-14 2022-02-14 0001043219 us-gaap:CommonStockMember 2022-02-14 2022-02-14 0001043219 nly:A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-02-14 2022-02-14 0001043219 nly:A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-02-14 2022-02-14 0001043219 nly:A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-02-14 2022-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2022

Annaly Capital Management, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

1-13447

|

|

22-3479661

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1211 Avenue of the Americas

New York, New York

|

|

10036

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 696-0100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

NLY

|

|

New York Stock Exchange

|

|

6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.F

|

|

New York Stock Exchange

|

|

6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.G

|

|

New York Stock Exchange

|

|

6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.I

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

(b)

|

Departure of Chief Credit Officer

|

On February 14, 2022, Annaly Capital Management, Inc. (the “Company”) and Timothy P. Coffey mutually agreed that Mr. Coffey will step down from his position as Chief Credit Officer of the Company and separate from employment with the Company, effective February 14, 2022.

In connection with Mr. Coffey’s departure, Mr. Coffey will receive the severance payments and benefits provided under the Company’s Executive Severance Plan, effective as of July 1, 2020, as previously filed with the Securities and Exchange Commission, as well as the continued vesting of Mr. Coffey’s outstanding equity awards pursuant to the terms of the applicable equity award agreement (including, as applicable, the satisfaction of any time and/or performance conditions therein), subject to his execution and non-revocation of a release of claims and compliance with post-termination restrictive covenants.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ANNALY CAPITAL MANAGEMENT, INC.

(REGISTRANT)

|

|

|

|

|

|

Date: February 14, 2022

|

|

By:

|

|

/s/ Anthony C. Green

|

|

|

|

Name:

|

|

Anthony C. Green

|

|

|

|

Title:

|

|

Chief Corporate Officer & Chief Legal Officer

|

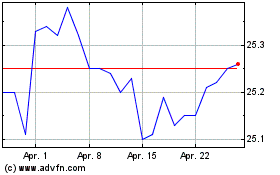

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Annaly Capital Management (NYSE:NLY-F)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Annaly Capital Management Inc (New York Börse): 0 Nachrichtenartikel

Weitere Annaly Capital Management Inc News-Artikel