GXO Logistics: An Undervalued Stock With Massive Upside Potential

10 November 2022 - 10:21PM

Finscreener.org

The market sell-off in 2022 has

dragged the valuations of several stocks lower. While the stock

market volatility is quite turbulent, investors can now consider

buying quality companies at a discount.

One such company part of the

logistics vertical is GXO Logistics

(NYSE:

GXO). Valued at a market

cap of 4.4 billion, GXO stock is currently trading almost 70% below

its 52-week high.

Let’s see why I’m bullish on GXO

stock right now.

The bull case for GXO stock in 2022

GXO provides logistics services

globally that include warehousing and distribution, order

fulfillment, and e-commerce, in addition to reverse logistics or

returns management services. The company ended Q3 with 950

warehouse locations across 28 countries, spanning 200 million in

total square feet. Around 25% of the Fortune 500 companies are

GXO’s customers allowing it to end 2021 with almost $8 billion in

sales.

In Q3 of 2022, GXO increased

sales by 16% year over year to $2.3 billion. Its net income and

adjusted EBITDA (earnings before interest, tax, depreciation, and

amortization) stood at $63 million and $192 million, respectively.

Further, the company reported an operating cash flow and free cash

flow of $116 million and $47 million, respectively, in the December

quarter. Its EBITDA surged by 20%, while adjusted earnings were up

34% year over year in Q3.

GXO explained that new business

wins in Q3 are likely to generate $158 million of additional sales

each year. The company signed new contracts with existing and new

customers as it continues to grow its market share with several

international brands. GXO signed new contracts with giants such

as Boeing (NYSE:

BA),

Nike (NYSE:

NKE), and LVMH in the September quarter.

Based on its customer wins, GXO

has secured close to $500 million of incremental sales for 2023,

providing stakeholders with enough revenue visibility for the next

year. Its sales pipeline remains strong globally, and its

warehousing outsourcing business has a pipeline of $2 billion in

2023.

GXO states, “We’ve seen in the

past that this demand for our services and solutions will

accelerate during a period of economic uncertainty, as customers

look to reduce costs, while improving the consumer

experience.”

What next for GXO stock price and

investors?

GXO reported the seventh

consecutive quarter of double-digit revenue growth in Q3 on the

back of stellar revenue retention rates that are well over 90%. Its

adjusted earnings surged higher due to a rise in EBITDA and lower

cost of financing. The return on invested capital remains above the

company’s target of 30%, making it among the top stocks to buy

right now.

Analysts tracking the company

expect GXO’s sales to rise by 13.8% to $9 billion in 2022 and by

8.3% to $9.8 billion in 2023. Its adjusted earnings per share might

expand from $2.09 in 2021 to $2.89 in 2023.

So, GXO stock is priced at less

than 0.5x forward sales and 12.8x forward earnings, which is quite

reasonable, as the bottom line is forecast to rise by almost 14%

annually in the next five years.

Analysts tracking the stock

remain bullish on GXO and expect shares to rise by 80% in the next

year. GXO is truly an undervalued stock that is trading at a

discount and is well-poised to stage a turnaround when the market

recovers in 2023.

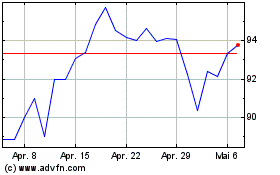

Nike (NYSE:NKE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Nike (NYSE:NKE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024