Toronto Stocks Down; Empire Co. Shares Tumble as Higher Costs Hit Profits in 1Q

15 September 2022 - 6:39PM

Dow Jones News

By Adriano Marchese

Stocks in Toronto were moderately lower at midday on Thursday,

in line with global markets that have been down in the morning. In

the session, producer manufacturing and transportation were the

biggest gainers, offset by Canada's materials and energy sectors,

which were the main laggards. Shares of the Nova Scotia-based food

retailer, Empire Co., fell after it reported lower-than-expected

first-quarter profit as costs increased in the period.

Mid-trading, Canada's S&P/TSX Composite Index was down 0.43%

to 19643.87 and the blue-chip S&P/TSX 60 fell by 0.33% to

1187.06.

Empire Co. shares slid 6.5% to C$35.35 after reporting increased

selling and administrative expenses in the period with profit

falling to 187.5 million Canadian dollars ($142.4 million) from

C$188.5 million a year earlier. The company said it continues to

experience inflationary pressures, especially related to costs of

the goods it sells but also fuel.

Other market movers:

Air Canada agreed to buy 30 electric hybrid aircraft from Heart

Aerospace and will also purchase a stake in the Swedish electric

airplane maker. Shares gained 3% to C$19.29.

Shares in High Tide Inc. rose by 5.3% at C$2.00 after the

company reported revenue nearly doubled in its third quarter,

better than analysts forecasted.

Newmont Corp.'s Toronto-listed shares dipped 1.5% to C$55.64

after it said it will delay its investment decision for a sulfide

project in Peru to the second half of 2024 following a review of

the scope and schedule.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

September 15, 2022 12:24 ET (16:24 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

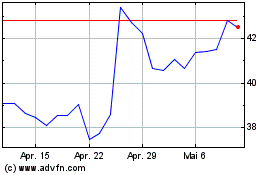

Newmont (NYSE:NEM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

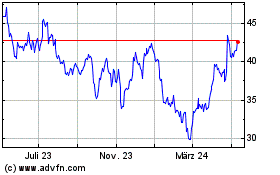

Newmont (NYSE:NEM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024