UNITED STATES

SECURITIES EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under

the Securities Exchange Act of 1934

(Amendment No. 19)*

MORGAN STANLEY

(Name of Issuer)

Common

Stock, par value $0.01 per Share

(Title of Class of Securities)

617446448

(CUSIP Number)

Iichiro

Takahashi

Managing Director

Mitsubishi UFJ Financial Group, Inc.

7-1, Marunouchi 2-chome

Chiyoda-ku, Tokyo 100-8330 Japan

81-3-3240-1111

(Name, Address and Telephone Number

of Persons Authorized to Receive Notices and Communications)

August 8, 2022

(Date of Event which Requires Filing

of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following

box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all

exhibits. See Section 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934, as amended (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

| 1. |

|

NAME OF REPORTING PERSON:

MITSUBISHI UFJ FINANCIAL GROUP, INC. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐

(b) ☐ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (See Instructions):

N/A |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR

2(e) |

|

☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

TOKYO, JAPAN |

|

|

|

|

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY REPORTING

PERSON WITH

|

|

7. |

|

SOLE VOTING POWER:

22.06%** |

|

|

| |

8. |

|

SHARED VOTING POWER:

N/A |

|

|

| |

9. |

|

SOLE DISPOSITIVE POWER:

22.06%** |

|

|

| |

10. |

|

SHARED DISPOSITIVE POWER:

N/A |

|

|

|

|

|

|

|

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON:

378,708,971 shares** |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See

Instructions) |

|

☐ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

22.06%** |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (See Instructions):

CO |

|

|

| ** |

Includes 1,623,804 shares of common stock of Morgan Stanley that certain affiliates of the reporting person

held solely in a fiduciary capacity as the trustee of trust accounts or as the manager of investment funds, other investment vehicles and managed accounts as of August 3, 2022. Such shares represent approximately 0.09% of the 22.06% reported in row

13 above. The reporting person disclaims beneficial ownership of such shares, and the inclusion of such shares in this statement shall not be construed as an admission that the reporting person is, for purposes of Sections 13(d) or 13(g) of the Act,

the beneficial owner of such shares. |

This statement (this “Amendment”) amends the Statement of Beneficial

Ownership on Schedule 13D, filed on October 23, 2008, as amended by the first amendment thereto, filed on October 30, 2008, the second amendment thereto, filed on May 22, 2009, the third amendment thereto, filed on June 11, 2009, the fourth

amendment thereto, filed on April 1, 2010, the fifth amendment thereto, filed on May 3, 2010, the sixth amendment thereto, filed on November 9, 2010, the seventh amendment thereto, filed on April 25, 2011, the eighth amendment thereto, filed on July

1, 2011, the ninth amendment thereto, filed on October 4, 2013, the tenth amendment thereto, filed on April 7, 2016, the eleventh amendment thereto, filed on November 28, 2017, the twelfth amendment thereto, filed on March 5,

2018, the thirteenth amendment filed on April 18, 2018, the fourteenth amendment filed on October 4, 2018, the fifteenth amendment filed on September 20, 2019, the sixteenth amendment filed on October 28, 2020, the seventeenth

amendment filed on December 11, 2020, and the eighteenth amendment filed on April 13, 2021 (the “Schedule 13D”), by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a joint stock company incorporated in

Japan, with respect to shares of common stock (the “Common Stock”) of Morgan Stanley, a Delaware corporation (the “Company”). Capitalized terms used and not defined in this Amendment shall have the meanings set

forth in the Schedule 13D. Except as specifically provided herein, this Amendment does not modify any of the information previously reported in the Schedule 13D.

Item 2. Identity and Background

Item 2 is amended and restated as follows:

This Statement is being filed by Mitsubishi UFJ Financial Group, Inc. (“MUFG”). The address of the principal business and

principal office of MUFG is 7-1 Marunouchi 2-chome, Chiyoda-ku, Tokyo 100-8330, Japan.

MUFG is a bank holding company and joint stock company (kabushiki kaisha) incorporated in Japan under the Commercial Code of

Japan, and is one of the world’s leading financial groups. MUFG’s services include commercial banking, trust banking, securities, credit cards, consumer finance, asset management and leasing.

The name, business address, present principal occupation or employment, name, principal business and address of any corporation or other

organization in which such employment is conducted and citizenship of each of the directors and executive officers of MUFG are set forth on Annex A hereto.

During the last five years, neither MUFG nor any of its directors nor executive officers has been (i) convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors) or (ii) was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration

In addition to the 377,085,167 shares of Common Stock held by MUFG directly, as of August 3, 2022, certain affiliates of MUFG held in

the aggregate 1,623,804 shares of Common Stock (the “Managed Shares”) solely in a fiduciary capacity as the trustee of trust accounts or as the manager of investment funds, other investment vehicles and managed accounts. MUFG

disclaims beneficial ownership of the Managed Shares, and the inclusion of the Managed Shares in this Amendment shall not be construed as an admission that MUFG is, for purposes of Sections 13(d) or 13(g) of the Act, the beneficial owner of such

shares.

Item 5. Interest in Securities of the Issuer

(a) Rows (7) through (11) and (13) of the cover pages to this Amendment are hereby incorporated by reference.

For purposes of calculating the percentages set forth on the cover pages of this Amendment, the number of shares outstanding is assumed to be 1,716,826,307 (which is the number of shares of Common Stock outstanding as of July 29, 2022 as reported by

the Company in their Form 10-Q for the quarter ended June 30, 2022, filed on August 5, 2022).

As of August 3, 2022, MUFG beneficially owns 377,085,167 shares of Common Stock.

In addition, MUFG may be deemed to be the beneficial owner of the Managed Shares. MUFG disclaims beneficial ownership of the Managed Shares,

and the inclusion of the Managed Shares in this Amendment shall not be construed as an admission that MUFG is, for purposes of Sections 13(d) or 13(g) of the Act, the beneficial owner of such shares.

The shares of Common Stock beneficially owned by MUFG (if MUFG is deemed to have beneficial ownership over the Managed Shares) represent

approximately 22.06% of the outstanding shares of Common Stock.

(b) Subject to the right of clients to withdraw their assets,

including the Managed Shares managed by MUFG’s affiliates, MUFG has the sole power to vote or direct the vote and to dispose or to direct the disposition of shares of Common Stock beneficially owned by it as indicated in rows (7) through

(11) and (13) of the cover pages to this Amendment.

(c) Neither MUFG nor, to its knowledge, any of its

directors or executive officers has engaged in any transactions in shares of Common Stock in the past 60 days except transactions in a fiduciary capacity as described under Item 3.

(d) No other person is known by MUFG to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, any shares of Common Stock beneficially owned by MUFG, except that, if MUFG is deemed to have beneficial ownership of the Managed Shares, dividends and the proceeds from the sale of Managed Shares will be the

property of the customers for whom such Managed Shares are managed.

(e) Not applicable.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: August 8, 2022

|

|

|

| MITSUBISHI UFJ FINANCIAL GROUP, INC. |

|

|

| By: |

|

/s/ Iichiro Takahashi |

| Name: |

|

Iichiro Takahashi |

| Title: |

|

Managing Director |

Annex A

|

|

|

| Name |

|

Present Position at MUFG and other Present Principal Occupation

or Employment |

| Mariko Fujii |

|

Member of the Board of Directors (Outside Director)

Emeritus Professor of The University of Tokyo, an education and research institute which is located in 7-3-1 Hongo, Bunkyo-ku, Tokyo, Japan. |

| Keiko Honda |

|

Member of the Board of Directors (Outside Director)

Adjunct Professor and Adjunct Senior Research Scholar of Columbia University School of International and Public Affairs, an education and research institute

which is located in 420 West 118th Street New York, NY 10027, USA. |

| Kaoru Kato |

|

Member of the Board of Directors (Outside Director)

Senior Advisor of NTT DOCOMO, INC., a mobile telecommunications company which is located in Sanno Park Tower 11-1, Nagata-cho 2-chome, Chiyoda-ku, Tokyo, Japan. |

| Satoko Kuwabara |

|

Member of the Board of Directors (Outside Director)

Partner of Gaien Partners, a law office which is located in Meiji Seimei Kan 4th Floor,

2-1-1 Marunouchi, Chiyoda-ku, Tokyo, Japan. |

| Toby S. Myerson |

|

Member of the Board of Directors (Outside Director)

Chairman & CEO of Longsight Strategic Advisors LLC, an advisory company which is located in 175 S. Harbor Drive Key Largo, Florida 33037,

USA. |

| Hirofumi Nomoto |

|

Member of the Board of Directors (Outside Director)

Chairman & Representative Director of TOKYU CORPORATION, a transportation and real estate company which is located in

5-6 Nampeidai-cho, Shibuya-ku, Tokyo, Japan. |

| Yasushi Shingai |

|

Member of the Board of Directors (Outside Director) |

| Koichi Tsuji |

|

Member of the Board of Directors (Outside Director)

Certified Public Accountant |

| Tarisa Watanagase |

|

Member of the Board of Directors (Outside Director) |

| Ritsuo Ogura |

|

Member of the Board of Directors |

| Kenichi Miyanaga |

|

Member of the Board of Directors |

| Kanetsugu Mike |

|

Member of the Board of Directors Chairman

(Corporate Executive) |

| Hironori Kamezawa |

|

Member of the Board of Directors

President & Group CEO (Representative Corporate Executive) |

| Iwao Nagashima |

|

Member of the Board of Directors |

| Junichi Hanzawa |

|

Member of the Board of Directors |

| Makoto Kobayashi |

|

Member of the Board of Directors |

| Yoshitaka Shiba |

|

Senior Managing Corporate Executive |

| Tetsuya Yonehana |

|

Senior Managing Corporate Executive (Representative Corporate Executive) |

| Naomi Hayashi |

|

Senior Managing Corporate Executive (Representative Corporate Executive) |

| Atsushi Miyata |

|

Senior Managing Corporate Executive (Representative Corporate Executive) |

| Takayuki Yasuda |

|

Senior Managing Corporate Executive |

| Teruyuki Sasaki |

|

Senior Managing Corporate Executive |

| Hiroshi Mori |

|

Managing Corporate Executive |

| Masakazu Osawa |

|

Managing Corporate Executive |

| Yutaka Miyashita |

|

Managing Corporate Executive (Representative Corporate Executive) |

| Keitaro Tsukiyama |

|

Managing Corporate Executive |

| Fumitaka Nakahama |

|

Managing Corporate Executive |

| Toshiki Ochi |

|

Managing Corporate Executive |

| Hiroyuki Seki |

|

Managing Corporate Executive |

| Hideaki Takase |

|

Managing Corporate Executive |

| Kenichi Yamato |

|

Managing Corporate Executive |

| Shuichi Yokoyama |

|

Managing Corporate Executive |

The present positions above are at MUFG unless noted otherwise. The business address of each of the directors and executive

officers above is Mitsubishi UFJ Financial Group, Inc., 7-1, Marunouchi 2-Chome, Chiyoda-ku, Tokyo

100-8330, Japan.

Each of the directors and executive officers above is a citizen of Japan, except

Mr. Tsukiyama who is a citizen of the United States of America as well, Mr. Myerson who is a citizen of the United States of America and Ms. Watanagase who is a citizen of Thailand.

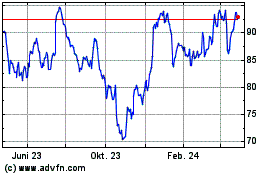

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024