Current Report Filing (8-k)

27 Juni 2022 - 11:03PM

Edgar (US Regulatory)

0000895421

false

0000895421

2022-06-27

2022-06-27

0000895421

us-gaap:CommonClassAMember

2022-06-27

2022-06-27

0000895421

us-gaap:SeriesAPreferredStockMember

2022-06-27

2022-06-27

0000895421

us-gaap:SeriesEPreferredStockMember

2022-06-27

2022-06-27

0000895421

us-gaap:SeriesFPreferredStockMember

2022-06-27

2022-06-27

0000895421

MS:SeriesIPreferredStockMember

2022-06-27

2022-06-27

0000895421

MS:SeriesKPreferredStockMember

2022-06-27

2022-06-27

0000895421

MS:SeriesLPreferredStockMember

2022-06-27

2022-06-27

0000895421

MS:SeriesOPreferredStockMember

2022-06-27

2022-06-27

0000895421

MS:GlobalMediumTermNotesSeriesAFixedRateStepUpSeniorNotesDue2026ofMorganStanleyFinanceLLCMember

2022-06-27

2022-06-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 27, 2022

Morgan Stanley

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

1-11758 |

36-3145972 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 1585 Broadway, New York, New York |

|

10036 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 761-4000

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

MS |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate

Non-Cumulative Preferred Stock, Series A, $0.01 par value |

MS/PA |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series E, $0.01 par value |

MS/PE |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series F, $0.01 par value |

MS/PF |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series I, $0.01 par value |

MS/PI |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series K, $0.01 par value |

MS/PK |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of 4.875%

Non-Cumulative Preferred Stock, Series L, $0.01 par value |

MS/PL |

New York Stock Exchange |

Depositary Shares, each representing 1/1,000th interest in a share of 4.250%

Non-Cumulative Preferred Stock, Series O, $0.01 par value |

MS/PO |

New York Stock Exchange |

Global Medium-Term Notes, Series A, Fixed Rate Step-Up Senior Notes Due 2026

of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) |

MS/26C |

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On June 27, 2022, Morgan Stanley (the “Company”) announced

it will increase its quarterly common stock dividend to $0.775 per share from the current $0.70 per share, beginning with the common dividend

expected to be declared by the Company’s Board of Directors in the quarter ending September 30, 2022 (the “third quarter”).

In addition, the Company’s Board of Directors authorized a

new multi-year equity share repurchase program of outstanding common stock up to $20 billion, without a set expiration date,

beginning in the third quarter. The share repurchases will be exercised from time to time at prices

the Company deems appropriate subject to various considerations, including current market conditions, the Company’s capital position

and future economic and earnings outlook. The share repurchases may be effected through open market purchases or privately

negotiated transactions, including through Rule 10b5-1 plans.

On June 23, 2022, the Board of Governors of the Federal Reserve System

published summary results of its 2022 supervisory stress tests, as a result of which the Company will be subject to a Stress Capital Buffer of 5.8% from October 1, 2022 to September 30, 2023.

A copy of the press release relating to this announcement is attached

as Exhibit 99.1 hereto and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the

date on which they are made, which reflect management’s current estimates, projections, expectations, assumptions, interpretations

or beliefs and which are subject to risks and uncertainties that may cause actual results to differ materially. The Company does not undertake

to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of forward-looking

statements. For a discussion of additional risks and uncertainties that may affect the future results, financial position or capital of

the Company, please see “Forward-Looking Statements” preceding Part I, Item 1, “Competition” and “Supervision

and Regulation” in Part I, Item 1, “Risk Factors” in Part I, Item 1A, “Legal Proceedings” in Part I, Item

3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and “Quantitative

and Qualitative Disclosures about Risk” in Part II, Item 7A, the Company’s Annual Report on Form 10-K for the year ended December

31, 2021 and other items throughout the Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including any amendments

thereto.

| Item 9.01. |

|

Financial Statements and Exhibits.

|

| (d) |

|

Exhibits

|

| |

|

|

| Exhibit |

|

|

| Number |

|

Description

|

| 99.1 |

|

Press Release issued by Morgan Stanley dated June 27, 2022

|

| 101 |

|

Interactive Data Files pursuant to Rule 406 of Regulation S-T formatted in Inline eXtensible Business Reporting Language (“Inline XBL”) |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

MORGAN STANLEY

(Registrant) |

| |

|

|

| Date: |

June 27, 2022 |

|

By: |

/s/ Martin M. Cohen |

| |

|

|

|

Name: |

Martin M. Cohen |

| |

|

|

|

Title: |

Corporate Secretary |

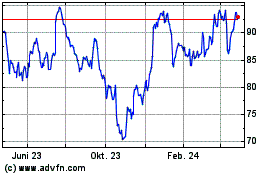

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024