Current Report Filing (8-k)

09 August 2022 - 10:36PM

Edgar (US Regulatory)

false00000189260000794323 0000018926 2022-08-05 2022-08-05 0000018926 lumn:Level3ParentLlcMember 2022-08-05 2022-08-05 0000018926 us-gaap:CommonStockMember 2022-08-05 2022-08-05 0000018926 us-gaap:PreferredStockMember 2022-08-05 2022-08-05

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation) |

|

|

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

(Registrant’s telephone number, including area code)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction

of incorporation) |

|

|

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligations of any registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered by Lumen Technologies, Inc. pursuant to Section 12(b) of the Act:

|

|

|

|

|

| |

|

|

|

Name of Each Exchange

on Which Registered |

Common Stock, par value $1.00 per share |

|

|

|

|

Preferred Stock Purchase Rights |

|

|

|

|

Indicate by check mark whether any registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously disclosed, on July 25, 2022, Lumen Technologies, Inc. (“Lumen” or the “Company”) announced that it and its indirect wholly owned subsidiaries, Level 3 Financing, Inc. (“Level 3 Financing”) and Embarq Florida, Inc. (“Embarq Florida”), commenced cash tender offers, pursuant to which (i) Level 3 Financing offered to purchase any and all of its outstanding 5.375% Senior Notes due 2025 (the “2025 Notes”) and 5.250% Senior Notes due 2026 (the “2026 Notes” and, together with the 2025 Notes, the “Any and All Notes”) (collectively, the “Any and All Tender Offers”) and (ii) Embarq Florida offered to purchase its 7.125% Senior Notes due 2023 (the “2023 Notes”) and 8.375% Senior Notes due 2025 (the “8.375% 2025 Notes” and, together with the 2023 Notes, the “Embarq Notes”) and the Company offered to purchase its outstanding 5.125% Senior Notes due 2026 (the “Lumen Notes” and, together with the Embarq Notes, the “Maximum Tender Notes” and together with the Any and All Notes, the “Notes”) (collectively, the “Maximum Tender Offers” and, together with the Any and All Tender Offers, the “Tender Offers”), each of which is subject to the limitations, restrictions, terms and conditions set forth in the Company’s Offer to Purchase and Consent Solicitation Statement dated July 25, 2022 (the “Offer to Purchase and Solicitation Statement”).

In conjunction with the Any and All Tender Offers, Level 3 Financing also commenced consent solicitations (the “Consent Solicitations”) seeking consents from the holders of the 2025 Notes and the 2026 Notes to amend certain provisions (the “Proposed Amendments”) of the indentures pursuant to which the 2025 Notes and the 2026 Notes were issued, respectively.

On August 5, 2022, the Company issued a press release announcing early results with respect to the Tender Offers and Consent Solicitations (the “August 5 Press Release”), and on August 9, 2022, the Company settled the purchase of all of the Notes validly tendered (and not validly withdrawn) prior to 5:00 p.m., New York City time, on August 5, 2022 (such date and time, the “Early Tender Date”) in the manner contemplated by the August 5 Press Release.

The Tender Offers and the Consent Solicitations are only being made pursuant to the Offer to Purchase and Solicitation Statement. This Current Report on Form

8-K

is neither an offer to purchase nor a solicitation of an offer to sell any Notes in the Tender Offers.

|

Submission of Matters to a Vote of Security Holders. |

As of the Early Tender Date, Level 3 Financing had not received the requisite consents needed from holders of the 2025 Notes and the 2026 Notes to effect the Proposed Amendments to the applicable indenture in connection with the Consent Solicitations, as described further in the August 5 Press Release.

A copy of the August 5 Press Release is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

For further information on the Tender Offers and Consent Solicitations, including information of the expiration date applicable thereto and the passage of the deadline for withdrawing tenders of Notes (and, if applicable, for validly revoking consents), see the Offer to Purchase and Solicitation Statement and the August 5 Press Release.

|

Financial Statements and Exhibits. |

|

|

|

| |

|

|

|

|

99.1 |

|

|

|

|

104 |

|

Cover page formatted in Inline XBRL and contained in Exhibit 101. |

Pursuant to the requirements of the Securities Exchange Act of 1934, Lumen Technologies, Inc. and Level 3 Parent, LLC have duly caused this Current Report on Form

8-K

to be signed on their behalf by the undersigned officer hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: August 9, 2022 |

|

|

|

By: |

|

|

|

|

|

|

|

|

Stacey W. Goff |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

Dated: August 9, 2022 |

|

|

|

By: |

|

|

|

|

|

|

|

|

|

|

|

|

Stacey W. Goff |

|

|

|

|

|

|

Executive Vice President and General Counsel |

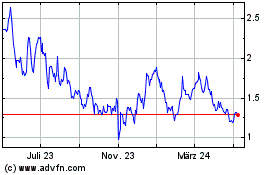

Lumen Technologies (NYSE:LUMN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

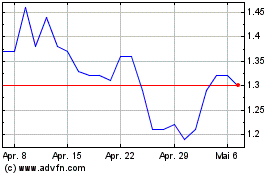

Lumen Technologies (NYSE:LUMN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024