Statement of Changes in Beneficial Ownership (4)

28 März 2023 - 10:20PM

Edgar (US Regulatory)

FORM 4

☐

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

DIMON JAMES |

2. Issuer Name and Ticker or Trading Symbol

JPMORGAN CHASE & CO

[

JPM

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman & CEO |

|

(Last)

(First)

(Middle)

383 MADISON AVENUE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/25/2023 |

|

(Street)

NEW YORK, NY 10179-0001 |

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

|

(City)

(State)

(Zip)

|

Rule 10b5-1(c) Transaction Indication

☐

Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to

satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10.

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 3/25/2023 | | M | | 298970.1204 (1) | A | $0 (2) | 823374.1204 (3) | D | |

| Common Stock | 3/25/2023 | | F | | 165331.1204 | D | $124.3950 | 658043.0000 (3) | D | |

| Common Stock | | | | | | | | 8504.3028 | I | By 401(k) |

| Common Stock | | | | | | | | 3003195.0000 (4) | I | By Family Trusts |

| Common Stock | | | | | | | | 4113090.0000 (5) | I | By GRATs |

| Common Stock | | | | | | | | 152940.0000 | I | By LLC (6) |

| Common Stock | | | | | | | | 695675.0000 | I | By Spouse |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Share Units | (2) | 3/25/2023 | | M | | | 298970.1204 (7) | (7) | (7) | Common Stock | 298970.1204 | $0.0000 | 0.0000 | D | |

| Explanation of Responses: |

| (1) | These shares represent JPMC common stock acquired on March 25, 2023 upon settlement of a Performance Share Unit (PSU) award granted on January 21, 2020 for the three-year performance period ended December 31, 2022 (as previously disclosed on a Form 4 filed on March 23, 2023), and must be held for an additional two-year period, for a total combined vesting and holding period of five years from the date of grant. |

| (2) | Each PSU represents a contingent right to receive one share of JPMC common stock upon vesting based on the attainment of performance goals. |

| (3) | Balance reflects 189,268 shares transferred from a Grantor Retained Annuity Trust (GRAT) to the Grantor on Jan 17, 2023. This transfer is exempt from Section 16 pursuant to Rule 16a-13. |

| (4) | Balance reflects 86,721 shares transferred from a Grantor Annuuity Retained Trust to the Grantor's Family Trusts on Jan 18, 2023. This transfer is exempt from Section 16 pursuant to Rule 16a-13. |

| (5) | Balance reflects a) 189,268 shares transferred from a Grantor Retained Annuity Trust (GRAT) to the Grantor on Jan 17, 2023; and b) 86,721 shares transferred from a GRAT to the Grantor's Family Trusts on Jan 18, 2023. These transfers are exempt from Section 16 pursuant to Rule 16a-13. |

| (6) | Reporting person disclaims beneficial ownership of such shares except to the extent of any pecuniary interest. |

| (7) | Represents PSUs earned (including reinvested dividend equivalents) based on the Firm's attainment of pre-established performance goals for the three-year performance period ended December 31, 2022, as provided under the terms of a PSU award granted on January 21, 2020, and as previously reported on a Form 4 filed on March 23, 2023. The PSUs settled in shares of common stock on March 25, 2023. Shares delivered, after applicable tax withholding, must be held for an additional two-year period, for a total combined vesting and holding period of five years from the date of grant. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

DIMON JAMES

383 MADISON AVENUE

NEW YORK, NY 10179-0001 | X |

| Chairman & CEO |

|

Signatures

|

| /s/ Holly Youngwood under POA | | 3/28/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

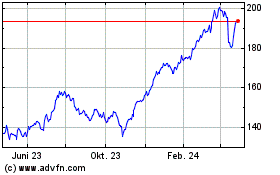

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

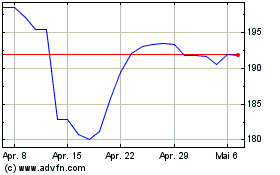

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024