UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

------------------------------

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2021

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-3215

------------------------------

JOHNSON & JOHNSON

SAVINGS PLAN

(Full title of the Plan)

JOHNSON & JOHNSON

ONE JOHNSON & JOHNSON PLAZA

NEW BRUNSWICK, NEW JERSEY 08933

(Name of issuer of the securities held pursuant to the Plan

and the address of its principal executive office)

REQUIRED INFORMATION

Item 4. Financial Statements and Supplemental Schedules

Financial statements prepared in accordance with the financial reporting requirements of ERISA filed herewith are listed below in lieu of the requirements of Items 1 to 3.

Report of Independent Registered Public Accounting Firm

Financial Statements:

Statements of Net Assets Available for Benefits

Statement of Changes in Net Assets Available for Benefits

Notes to Financial Statements

Supplemental Schedules*:

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

Schedule H, line 4a - Schedule of Delinquent Participant Contributions

Signatures

*Other supplemental schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended, have been omitted because they are not required or are not applicable.

Exhibits:

23. Consent of PricewaterhouseCoopers LLP, dated June 16, 2022

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| JOHNSON & JOHNSON SAVINGS PLAN |

| | |

| Date: June 16, 2022 | By: | /s/ Peter Fasolo |

| | Peter Fasolo |

| | Chairman, Pension and Benefits Committee |

| | |

JOHNSON & JOHNSON SAVINGS PLAN

__________________

FINANCIAL STATEMENTS AND

SUPPLEMENTAL SCHEDULES

DECEMBER 31, 2021 AND 2020

Johnson & Johnson Savings Plan

Index to Financial Statements and Supplemental Schedules

| | | | | |

| Page(s) |

| |

Report of Independent Registered Public Accounting Firm | 1 |

| |

Financial Statements: | |

| |

Statements of Net Assets Available for Benefits | 2 |

| |

Statement of Changes in Net Assets Available for Benefits | 3 |

| |

Notes to Financial Statements | 4 - 16 |

| |

Supplemental Schedules*: | |

| |

Schedule H, line 4i - Schedule of Assets (Held at End of Year) | 17 |

| |

Schedule H, line 4a - Schedule of Delinquent Participant Contributions | 18 |

* Other supplemental schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended, have been omitted because they are not required or are not applicable.

Report of Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of Johnson & Johnson Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Johnson & Johnson Savings Plan (the “Plan”) as of December 31, 2021 and 2020 and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule of Assets (Held at End of Year) as of December 31, 2020 and Schedule of Delinquent Participant Contributions for the year ended December 31, 2021 have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedules are the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedules reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the supplemental schedules, we evaluated whether the supplemental schedules, including their form and content, are presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedules are fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

New York, New York

June 16, 2022

We have served as the Plan’s auditor since at least 1987. We have not been able to determine the specific year we began serving as auditor of the Plan.

Johnson & Johnson Savings Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | | |

| December 31, | |

| 2021 | | 2020 | |

Assets | | | | |

Interest in Johnson & Johnson Pension and Savings Plans Master Trust, at fair value | $ | 24,579,699,618 | | | $ | 21,870,112,671 | | |

| Total investments | 24,579,699,618 | | | 21,870,112,671 | | |

Receivables | | | | |

| Employee contributions | 1,056,470 | | | 816,264 | | |

Employer contributions | 214,325 | | | 209,583 | | |

| Notes receivable from participants | 99,832,008 | | | 104,166,135 | | |

Total receivables | 101,102,803 | | | 105,191,982 | | |

| Other assets | 16,729,766 | | | 9,526,571 | | |

Total assets | 24,697,532,187 | | | 21,984,831,224 | | |

Net assets available for benefits | $ | 24,697,532,187 | | | $ | 21,984,831,224 | | |

The accompanying notes are an integral part of these financial statements.

Johnson & Johnson Savings Plan

Statement of Changes in Net Assets Available for Benefits

| | | | | |

| Year Ended |

| December 31, |

| Additions to net assets attributed to | 2021 |

| Investment Income/Loss | |

Plan's interest in the Johnson & Johnson Pension and Savings Plans Master Trust net investment income/loss | $ | 3,097,406,586 | |

| Contributions | |

Employee contributions | 716,755,393 | |

| Employer contributions | 248,279,576 | |

Total additions | 4,062,441,555 | |

| Deductions from net assets attributed to | |

Benefits paid to participants | 1,356,048,918 | |

| Administrative expenses | 51,270,587 | |

Total deductions | 1,407,319,505 | |

| Net increase | 2,655,122,050 | |

| |

| Asset transfers due to plan mergers | 57,578,913 | |

| Net assets available for benefits | |

| Beginning of year | 21,984,831,224 | |

End of year | $ | 24,697,532,187 | |

The accompanying notes are an integral part of these financial statements.

Johnson & Johnson Savings Plan

Notes to Financial Statements

1. Description of the Plan

General

The Johnson & Johnson Savings Plan (the “Plan”) is a participant directed defined contribution plan which was established on June 1, 1982 for eligible salaried and certain hourly employees of Johnson & Johnson (the “Plan Administrator” or the “Company”) and certain domestic subsidiaries. The Plan was designed to enhance the existing retirement program of eligible employees. The funding of the Plan is made through employee and Company contributions. The net assets of the Plan are held in the Johnson & Johnson Pension and Savings Plans Master Trust (the “Trust” or "the Master Trust"). Transactions in the Trust are executed by the trustee, State Street Bank and Trust Company (“State Street” or “Trustee”). Recordkeeping services are provided by Alight Solutions. The Plan’s interest in the Trust is allocated to the Plan based upon the total of each participant’s share of the Trust.

This brief description of the Plan is provided for general information purposes only. Participants should refer to the Plan document for complete information.

CARES Act

In March 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law. The CARES Act allowed retirement plans to provide participants who were impacted by the coronavirus (as defined in the CARES Act) with greater access to their savings. As permitted by the CARES Act, the Plan implemented the following provisions:

•Through December 31, 2020, qualified individuals were permitted to take a distribution in an amount up to $100,000 from the Plan. Any such distribution was not subject to the 10% early distribution penalty or the mandatory 20% federal income tax withholding rate. Participants who took a qualified distribution had the option to have the distribution taxed over a three-year period, with the ability to re-contribute up to the full amount of the distribution within three years and not be subject to federal income tax as a result.

•Loans repayments with respect to qualified participants could be delayed between March 27, 2020 and December 31, 2020 upon participant request. Loan repayments were resumed in January 2021.

•Required minimum distributions for calendar year 2020 were waived for retired and retirement-aged individuals.

Contributions

In general, full-time salaried employees and certain hourly, part-time and temporary employees can contribute to the Plan. There is no service requirement for employee contributions. If a participant does not take action to enroll or decline enrollment in the Plan within their first 30 days of employment, they will be automatically enrolled for pre-tax employee contributions equal to 6% of their eligible pay and these contributions will be invested in the Plan's default investment option. Prior to September 30, 2019, the default investment option was the Balanced Fund. Effective September 30, 2019, the Plan's default investment option is the Target Retirement Fund that aligns with, or is closest to, the year in which the participant will turn age 62.

Contributions are made to the Plan by participants through payroll deductions and by the Company on behalf of the participants. Participating employees may contribute a minimum of 3% up to a maximum of 50% of eligible pay, as defined by the Plan. Contributions can be pre-tax, Roth, post-tax or a combination of all three. Pre-tax and Roth contributions may not exceed the smaller of (i) 50% of a participant’s base salary (and 1/2 paid commissions, if applicable) or (ii) $19,500 for 2021. The maximum contributions to a participant’s account including participant pre-tax, Roth and post-tax contributions and the Company match is $58,000 for 2021.

Participants age 50 and over are eligible to contribute extra pre-tax and/or Roth contributions (“catch-up contributions”) above the annual Internal Revenue Service ("IRS") limitation up to $6,500 in 2021. Participants can elect an amount to be contributed from each paycheck as their catch-up contribution. This amount will be in addition to the pre-tax, Roth and post-tax contribution percentages that participants have elected. The catch-up contribution is not eligible for the Company matching contribution.

Johnson & Johnson Savings Plan

Notes to Financial Statements

Participants receive a Company matching contribution equal to 75% of the first 6% of a participant’s contributions. The Company matching contribution is comprised of cash and invested in the current investment fund mix chosen by the participant.

Investments

Participants may invest in one or more of the various investment funds offered by the Plan. On September 30, 2019, the Plan eliminated the Balanced Fund and introduced the Target Retirement Funds as new investment options for Plan participants. Each of the Plan's funds represents a mix of various investments. The investment mix chosen by the participant will apply to employee and Company matching contributions. Rollover contributions are invested at the election of the participant.

Participants receive dividends on Johnson & Johnson Common Stock shares held in the Johnson & Johnson Common Stock Fund and Johnson & Johnson Stock Contributions Fund. The dividends are automatically reinvested in the Johnson & Johnson Common Stock Fund unless specific elections are made to receive a cash payment. The 2021 dividend pass-through amount paid to participants of $6,111,398 is reflected in benefits paid to participants in the Statement of Changes in Net Assets Available for Benefits. For all other funds, the Trustee reinvests all dividend and interest income.

Effective September 1, 2020, participants are not permitted to (1) direct more than 20% of any contribution made to the Plan to the Johnson & Johnson Common Stock Fund or (2) transfer or reallocate amounts into the Johnson & Johnson Common Stock Fund if, immediately after such transfer or reallocation, the aggregate value of their investments in the Johnson & Johnson Common Stock Fund and the Johnson & Johnson Stock Contributions Fund would exceed 20% of their aggregate Plan Balance. This limitation does not (a) affect investments resulting from transfers before September 1, 2020 or (b) restrict percentages in excess of 20% that result from investment performance or reinvestment of dividends.

Vesting

A participant's contributions (pre-tax, after-tax, Roth and rollover) and the earnings on them are always fully vested.

For the Company matching contributions, if a participant was hired before March 1, 2017, the Company matching contributions were made to the participant's account after a one-year eligibility period was satisfied. These contributions and the associated earnings are fully vested. If a participant was hired on or after March 1, 2017, the Company matching contributions made to the participant's account, and the earnings on these contributions, become vested after the participant has completed a three-year period of service. These contributions become vested if, while employed by the Company, the participant should die, become disabled, or reach age 55. If the Company matching contributions and associated earnings are not vested when the participant employment ends, they will be forfeited unless the participant returns to employment with the Company before (1) taking a total distribution of their vested account balance and (2) incurs a break in service (a period of at least five consecutive years in which the participant is not employed by the Company).

Forfeitures

Forfeitures of non-vested Company contributions are used to reduce future Company contributions. During 2021 and 2020, $3,302,026 and $2,591,824, respectively, of forfeited participant accounts were used to reduce the Company's contributions. At December 31, 2021, there were $364,801 of forfeitures that have not yet been applied to reduce the Company's contributions.

Payment of Benefits

Participants are allowed to withdraw an amount equal to their pre-August 1, 2003 post-tax contributions and earnings thereon, unmatched post-tax contributions made after August 1, 2003 by the employee and earnings thereon, rollover contributions and earnings thereon, and pre-2003 Company match and earnings thereon, at any time. Prior to December 13, 2019, participants were able to withdraw pre-tax, Roth or post-tax matched contributions, and the vested employer match after August 1, 2003, only upon meeting certain hardship conditions. Effective December 13, 2019, participants are able to withdraw from all vested contribution types upon meeting certain hardship conditions. The benefits to which participants are entitled are the amounts provided by contributions (Company and participant) and investment earnings thereon, including net realized and unrealized gains and losses which have been allocated to the participant’s account balance. Participants have the option of receiving all or part of their vested balance in the Johnson & Johnson Common Stock Fund and/or the Johnson &

Johnson & Johnson Savings Plan

Notes to Financial Statements

Johnson Stock Contributions Fund as either cash or in shares of Johnson & Johnson Common Stock (plus cash for fractional shares) for lump sum distributions other than a hardship.

Benefits are also paid to participants upon termination of employment, long-term disability or retirement. Effective January 1, 2020, participants can elect to defer payment until (a) age 70 1/2 for members who attain age 70 1/2 before January 1, 2020 and (b) age 72 for participants who attain age 70 1/2 after December 31, 2019 if their vested account balances are greater than $5,000. Distributions are paid either in a lump sum payment, partial payments or installment payments made on a monthly, quarterly, or annual basis over a period of years selected by the participant.

A participant’s vested account may be distributed to his/her beneficiaries in lump sum, partials, in installments or maintained in the Trust upon the participant’s death only if the beneficiary is a spouse. Otherwise, it is paid to the beneficiary in a lump sum, either directly or rolled over to an Individual Retirement Account ("IRA").

Administrative Expenses

All third-party administrative expenses are paid by the Plan, unless otherwise provided for by the Company.

Notes Receivable from Participants

Participants may borrow up to a maximum of 50% of their vested account balance. The minimum loan amount is $1,000 and the maximum amount of all outstanding loans cannot exceed $50,000. Loans bear an interest rate of prime plus 1% and are repayable within one to five years. Due to acquisitions, there are some existing loans extending beyond five years, which must be allowed to continue once transferred into the Johnson & Johnson Savings Plan. The collateralized balances in the participant’s accounts have interest rates that range from 4.25% to 11.33%. Principal and interest is paid ratably through payroll deductions for active employees. Loans must be paid within two months following retirement or termination of employment with the Company. If the loan is not repaid in full, the unpaid balance, plus accrued interest, will be deducted from the participant’s account balance and reported to the IRS as a distribution.

Termination

Although it has not expressed an intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of a partial or full Plan termination, all Plan funds must be used exclusively for the benefit of the Plan participants, in that each participant would receive the respective value in their account.

2. Summary of Significant Accounting Policies

Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU) 2018-13, Fair Value Measurement (Topic 820), Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement which removes, modifies and adds disclosures to Topic 820. The amendments in this ASU 2018-13 apply to all entities that are required, under existing U.S. Generally Accepted Accounting Principles (GAAP), to make disclosures about recurring or nonrecurring fair value measurements. The amendments in this ASU 2018-13 are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The adoption of this update did not have a material impact on the Plan's financial statements.

Basis of Accounting

The financial statements of the Plan are prepared under the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America.

Investment Valuation and Income Recognition of the Trust

The Plan’s interest in the Trust is stated at fair value, except for the fully benefit-responsive investment contracts which are stated at contract value. The investment in the Trust represents the Plan's interest in the net assets of the Trust.

Johnson & Johnson Savings Plan

Notes to Financial Statements

As the investment funds contain various underlying assets such as stocks and short-term investments, the participant’s account balance is reported in units of participation, which allows for immediate transfers in and out of the funds. The purchase or redemption price of the units is determined by the Trustee, based on the current market value of the underlying assets of the funds. Each fund’s net asset value for a single unit is computed by adding the value of the fund’s investments, cash and other assets, and subtracting liabilities, then dividing the result by the number of units outstanding.

Purchases and sales of securities are recorded on a trade-date basis. Gains and losses on the sale of investment securities are determined on the average cost method. Dividend income is recorded on the ex-dividend date. Interest income and administrative expenses are recorded on an accrual basis.

The Plan presents, in the Statement of Changes in Net Assets Available for Benefits, the net investment income/loss for the Plan's interest in the Trust which consists of the Plan’s allocated change in unrealized appreciation and depreciation of the underlying investments, realized gains and losses on sales of investments and investment income/loss based upon the total of each participant's share of the Trust.

Payment of Benefits

Benefit payments to participants are recorded upon distribution.

Derivatives

The Trust mitigates risk through structured trading with reputable parties and continual monitoring procedures. The Trust enters into forward foreign exchange contracts to hedge against adverse changes in foreign exchange rates related to non-U.S. dollar denominated investments. The Trust is exposed to credit risk for non-performance by the counterparty and to market risk for changes in interest and currency rates. The Trust accounts for forward foreign exchange contracts at fair value.

The fair value of a forward foreign exchange contract is the aggregation by currency of all future cash flows discounted to its present value at the prevailing market interest rates and subsequently converted to the U.S. Dollar at the current spot foreign exchange rate.

The Trust actively manages risk by periodically investing in interest rate swaps, credit default swaps and fixed income options. Interest rate swaps are used to manage interest rate risk and provide an effective means to adjust portfolio duration, maturity mix and term-structure. Credit default swaps are used to either synthetically add or reduce credit risk to an individual issuer or a basket of issuers. Depending on the type of contract, the counterparty risk exposure can be either with the exchange or another counterparty. Fixed income options are used in various ways including: to pursue upside exposure to a portion of the yield curve, to capitalize on anticipated changes in market volatility, to focus on generating income, and to serve as a hedge. The Trust records interest rate swaps, credit default swaps and options at fair value. Interest rate swaps are valued daily using underlying yield curves based upon broker/dealer sources, the present value of expected cash flows, and frequency of which they compound and pay. Credit default swaps are valued using daily underlying yield curves and/or credit curves and spreads based upon broker/dealer/index sources, the present value of expected cash flows, and the frequency of which they compound and pay including a weighted default calculation. Options are valued using market-based inputs to models, broker or dealer quotations, or alternative pricing sources with reasonable levels of price transparency, where such inputs and models are available. Alternatively, the values may be obtained through unobservable management determined inputs and/or management’s proprietary models. Where models are used, the selection of a particular model to value an option depends upon the contractual terms of, and specific risks inherent in, the option as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, measures of volatility and correlations of such inputs.

The Trust may also enter into total return swap contracts, which are contracts in which one party agrees to make periodic payments based on the change in market value of the underlying assets, which may include a specified security, basket of securities or security indexes during the specified period, in return for periodic payments based on a fixed or variable interest rate of the total return from other underlying assets. Total return swap agreements may be used to obtain exposure to a security or market without owning or taking physical custody of such security or market. Total return swaps involve not only the risk associated with the investment in the underlying securities, but also the risk of the counterparty not fulfilling its obligations under the agreement. Total return swaps are valued daily using underlying index levels for fixed and financing legs. We determine the fair value of our total return

Johnson & Johnson Savings Plan

Notes to Financial Statements

swaps based on published index prices. The total market value is the sum of the market value of both the fixed and the float legs. The market value of the fixed leg is determined by the change in price of the asset times the units. The market value of the float leg is determined by the accrued financing given the reset frequency and financing index. The MTM/ SWAP value is collateralized daily.

A futures contract is an agreement to buy or sell a security or other asset for a set price on a future date. These contracts are traded on major exchanges and are marked to market daily, thus minimizing counterparty risk. The Trust enters into futures contracts mainly to manage the duration and refine the curve positioning of the fixed income portfolios, thus, allowing the investment managers to achieve the overall investment portfolios' objectives. These contracts are priced by an exchange and the fair value is the daily mark to market, which is a function of price movements for the contract relative to the level it was originally entered into.

There have been no changes in the methodologies used at December 31, 2021 and 2020.

Use of Estimates

The preparation of the Plan’s financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of Net Assets Available for Benefits at the date of the financial statements and the Changes in Net Assets Available for Benefits during the reporting period and the applicable disclosures of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan provides for various investment options in funds which can invest in a combination of equity, fixed income securities and other investments. Investments are exposed to various risks, such as interest rate, market and credit. Due to the level of risk associated with certain investments, it is at least reasonably possible that changes in risks in the near term could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statement of Changes in Net Assets Available for Benefits.

Reporting of Fully Benefit-Responsive Investment Contracts

Fully benefit-responsive investment contracts are reported at contract value. Contract value is the relevant measurement criteria for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

3. Johnson & Johnson Pension and Savings Plans Master Trust

The assets of the Johnson & Johnson Savings Plan, the Johnson & Johnson Retirement Savings Plan, the Retirement Plan of Johnson & Johnson and Affiliated Companies, the Johnson & Johnson Retirement Plan for Union Represented Employees, and the Johnson & Johnson Retirement Plan for Puerto Rico Employees comprise the total of the Trust which is held by State Street.

The following table presents the net assets of the Master Trust and the Plan's interest in the net assets of the Master Trust as of December 31, 2021 and 2020.

Johnson & Johnson Savings Plan

Notes to Financial Statements

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Savings Plan's |

| | Master Trust | | Interest in Master Trust |

| | | | | | | | |

| | 2021 | | 2020 | | 2021 | | 2020 |

| | | | | | | | |

| ASSETS | | | | | | | | |

| Investments, at fair value | | | | | | | | |

| Short-term investment funds | | $ | 1,389,861,183 | | | $ | 1,189,683,373 | | | $ | 614,954,452 | | | $ | 716,285,594 | |

| Government and agency securities | | 4,603,175,965 | | | 3,704,625,243 | | | 669,223,893 | | | 653,713,985 | |

| Debt Securities | | 4,102,056,257 | | | 4,566,270,808 | | | 650,281,521 | | | 676,349,037 | |

| Equity Securities | | 24,083,032,474 | | | 22,572,712,824 | | | 12,128,696,350 | | | 11,181,457,192 | |

| Exchange Traded Funds | | 9,565,350 | | | — | | | — | | | — | |

| Common collective trusts | | 14,811,487,642 | | | 12,585,925,043 | | | 8,259,927,909 | | | 6,337,913,003 | |

| Partnership/joint venture interests | | 1,968,982,495 | | | 1,111,970,701 | | | 130,417,893 | | | 123,504,175 | |

| Total Investments at Fair Value | | $ | 50,968,161,366 | | | $ | 45,731,187,992 | | | $ | 22,453,502,018 | | | $ | 19,689,222,986 | |

| | | | | | | | |

| Other assets | | | | | | | | |

| Guaranteed and synthetic investment | | | | | | | |

| contracts at contract value | | $ | 2,240,845,017 | | | $ | 2,340,548,670 | | | $ | 2,190,054,990 | | | $ | 2,289,059,719 | |

| Receivable for investments sold | | 104,991,312 | | | 294,865,280 | | | 64,268,585 | | | 239,026,068 | |

| | | | | | | | |

| Interest receivables | | 45,563,518 | | | 46,781,754 | | | 26,726,591 | | | 37,275,084 | |

| Dividend receivables | | 14,623,451 | | | 12,296,717 | | | 8,951,489 | | | 9,968,064 | |

| Other receivables | | 8,263,756 | | | 11,264,732 | | | 5,058,513 | | | 9,131,508 | |

| Total Other Assets | | $ | 2,414,287,054 | | | $ | 2,705,757,153 | | | $ | 2,295,060,168 | | | $ | 2,584,460,443 | |

| | | | | | | | |

| Total Master Trust assets | | $ | 53,382,448,420 | | | $ | 48,436,945,145 | | | $ | 24,748,562,186 | | | $ | 22,273,683,429 | |

| | | | | | | | |

| | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payables for investments purchased | | $ | (259,981,986) | | | $ | (484,343,393) | | | $ | (159,143,400) | | | $ | (392,622,342) | |

| | | | | | | | |

| All other payables | | (15,877,554) | | | (13,506,088) | | | (9,719,168) | | | (10,948,416) | |

| Total Liabilities | | $ | (275,859,540) | | | $ | (497,849,481) | | | $ | (168,862,568) | | | $ | (403,570,758) | |

| | | | | | | | |

| | | | | | | | |

| Net Master Trust assets | | $ | 53,106,588,880 | | | $ | 47,939,095,664 | | | $ | 24,579,699,618 | | | $ | 21,870,112,671 | |

| | | | | | | | |

The following table presents the changes in net assets for the Master Trust for the year ended December 31, 2021:

| | | | | |

| 2021 |

| Changes in Net Assets: | |

| Net appreciation (depreciation) in fair value of investments | $ | 5,627,895,274 | |

| Interest | 332,992,838 | |

| Dividends | 408,386,035 | |

| Total net investment income (loss) | 6,369,274,147 | |

| |

| Contributions received, benefits paid and other, net | (1,201,780,931) | |

| |

| Increase (decrease) in net assets | 5,167,493,216 | |

| Net assets | |

| Beginning of year | 47,939,095,664 | |

| End of year | $ | 53,106,588,880 | |

Johnson & Johnson Savings Plan

Notes to Financial Statements

a. Fair Value Measurements

The Plan’s valuation methodologies were applied to all of the Trust's investments carried at fair value. Fair value is based upon quoted market prices, where available. If listed prices or quotes are not available, fair value is based upon models that primarily use, as inputs, market-based or independently sourced market parameters, including yield curves, interest rates, volatilities, equity or debt prices, foreign exchange rates and credit curves.

While the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date.

Valuation Hierarchy

FASB Accounting Standards Codification (ASC) 820, Fair Value Measurements and Disclosures, provides the framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

•Level 1 - Quoted prices in active markets for identical assets and liabilities.

•Level 2 - Significant other observable inputs.

•Level 3 - Significant unobservable inputs.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The following is a description of the valuation methodologies used for the investments measured at fair value:

•Short-term investment funds - The assets are comprised of cash and quoted short-term instruments which are valued at the closing price or the amount held on deposit by the custodian bank where quoted prices are available in an active market and are classified as Level 1. Other investments are through investment vehicles valued using the Net Asset Value ("NAV") provided by the administrator of the fund. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. The NAV is a quoted price in a market that is not active and classified as Level 2. In addition, derivatives are included in this category. In general, derivatives that are exchange listed and actively traded are classified as Level 1, while derivatives that are not exchange listed but still actively traded in observable markets are classified as Level 2.

•Government and agency securities - The assets are comprised of government and agency securities and U.S. Treasury bills and notes of varying maturities. These are all considered Level 2 fair values which are estimated by using pricing models, quoted prices of securities with similar characteristics or discounted cash flows.

•Debt instruments - The assets are comprised of corporate debt and commercial loans and mortgages. Fair values are estimated by using pricing models, quoted prices of securities with similar characteristics or discounted cash flows and are generally classified as Level 2. Level 3 debt instruments are priced based on unobservable inputs.

•Equity securities - U.S. and International equity securities are valued at the closing price reported on the major market on which the individual securities are traded. Substantially all equity securities are classified within Level 1 of the valuation hierarchy.

Johnson & Johnson Savings Plan

Notes to Financial Statements

•Exchange Traded Funds (ETF) - ETFs are valued at the closing price reported on the major market on which the ETF is traded. ETFs are classified as Level 1 of the valuation hierarchy.

•Common Collective Trusts (CCT's) - The fair value of all CCT interests have been determined using NAV as a practical expedient. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. The CCT's are included in Investments measured at Net Asset Value. A majority of the CCT's are used for liquidity purposes for both the defined benefit and defined contribution plans within the Trust. The CCTs are primarily passive funds that provide daily liquidity with no prior notice for participant transactions, and 2-day prior notice for Plan Sponsor transactions for the various Plan investment options. Participant directed purchases and sales are transacted at the NAV. At December 31, 2021 and 2020, approximately 77% and 68%, respectively, of the CCT's are invested in passive strategies that mimic the indices, and 23% and 32%, respectively, in active strategies. Additionally, at December 31, 2021 and 2020, 65% and 65%, respectively, of the active and passive CCT's are invested in U.S. equities, 23% and 24%, respectively, are invested in global equities and emerging markets, and the remaining 12% and 11%, respectively, are invested in fixed income. There are no unfunded commitments for any of the CCT's that the Trust invests in.

•Limited Partnerships ("LP") - The Trust invests in LP investments including a Hedge Fund, Emerging Market Long-Only Equity Funds and Private Market Funds. As of December 31, 2021 and 2020, approximately 16% and 24%, respectively, of these investments are invested in the Hedge Fund, 22% and 38%, respectively, in Emerging Market Long-Only Equity Funds and 62% and 38%, respectively, in Private Market Funds.

The Trust's private market program has invested as a limited partner in a well-diversified portfolio of funds managed by general partners. The program is being managed to ensure adequate diversification by general partner, strategy type (private equity, real assets, and private credit), and geographic region. As of December 31, 2021 and 2020, approximately 58% and 57%, respectively, of these investments are invested in private equity, 15% and 22%, respectively, in real assets, and 27% and 21%, respectively, in private credit. The Trust has entered into a number of private markets agreements that commit the Trust, upon request, to make additional investment purchases up to predetermined amounts. As of December 31, 2021, and 2020, the Trust had aggregate unfunded commitments of $1,547,368,813 and $1,343,995,206 respectively. These commitments are expected to be satisfied with distributions from existing funds, reinvestment of proceeds and/or periodic rebalancing of existing investments. The LP investments have target maturity dates ranging from 2022 to at least 2034 with the possibility of 2 to 4 years of extensions in accordance with the respective LP's governing documents. Distributions to the Trust from LP investments are driven by portfolio company liquidation in the public and private markets. Otherwise, the LP investments are not redeemable. The fair value of the Trust's LP investments has been determined using NAV provided by the respective general partners as a practical expedient. The NAV is the pro-rata share of the Trust's position based on the value of the underlying assets owned by the LP, minus its liabilities.

2021 Master Trust Investments Measured at Fair Value

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quoted market

prices inputs | | Observable

inputs | | | | Investments measured at Net | | Total Assets |

| December 31, 2021 | | (Level 1) | | (Level 2) | | | | Asset Value | | |

| Short-term investment funds | | $ | 7,666,727 | | | $ | 1,382,194,456 | | | | | $ | — | | | $ | 1,389,861,183 | |

| Government and agency securities | | — | | | 4,603,175,965 | | | | | — | | | 4,603,175,965 | |

| Debt instruments | | — | | | 4,102,056,257 | | | | | — | | | 4,102,056,257 | |

| Equity Securities | | 24,080,008,304 | | | 3,024,170 | | | | | — | | | 24,083,032,474 | |

| Exchange Traded Funds | | 9,565,350 | | | — | | | | | — | | | 9,565,350 | |

| Common collective trusts | | — | | | — | | | | | 14,811,487,642 | | | 14,811,487,642 | |

| Partnership/joint venture interests | | — | | | — | | | | | 1,968,982,495 | | | 1,968,982,495 | |

| Trust investments at fair value | | $ | 24,097,240,381 | | | $ | 10,090,450,848 | | | | | $ | 16,780,470,137 | | | $ | 50,968,161,366 | |

Johnson & Johnson Savings Plan

Notes to Financial Statements

2020 Master Trust Investments Measured at Fair Value

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quoted market

prices inputs | | Observable

inputs | | | | Investments measured at Net | | Total Assets |

| December 31, 2020 | | (Level 1) | | (Level 2) | | | | Asset Value | | |

| Short-term investment funds | | $ | 59,112,562 | | | $ | 1,130,570,811 | | | | | $ | — | | | $ | 1,189,683,373 | |

| Government and agency securities | | — | | | 3,704,625,243 | | | | | — | | | 3,704,625,243 | |

| Debt instruments | | — | | | 4,566,270,808 | | | | | — | | | 4,566,270,808 | |

| Equity securities | | 22,569,563,572 | | | 3,149,252 | | | | | — | | | 22,572,712,824 | |

| Common Collective Trusts | | — | | | — | | | | | 12,585,925,043 | | | 12,585,925,043 | |

| Partnership/joint venture interests | | — | | | — | | | | | 1,111,970,701 | | | 1,111,970,701 | |

| Trust investments at fair value | | $ | 22,628,676,134 | | | $ | 9,404,616,114 | | | | | $ | 13,697,895,744 | | | $ | 45,731,187,992 | |

b. Synthetic Investment Contracts

The Trust holds investments in synthetic GICs. The weighted average insurance financial strength rating of the insurers for these contracts is Aa3. These investments are recorded at their book values. The synthetic GICs’ contract value represents book value plus reinvested income adjusted for net cash flows. The synthetic GICs are fully benefit-responsive. Participants may under most circumstances direct the withdrawal or transfer of all or a portion of their investment at contract value. Currently no reserves are needed against contract values for credit risk of the contract issuers or otherwise.

The synthetic GICs provide a return over a period of time through a fully benefit-responsive contract, or wrapper contract, which is backed by the underlying assets owned by the Trust. The portfolio of assets with overall Aa1/AA+ credit quality, underlying the synthetic GICs primarily includes government and agency securities, corporate debt, mortgage backed securities, and asset backed securities. The contract value of the synthetic GICs was $2,240,845,017 and $2,340,548,670 at December 31, 2021 and December 31, 2020, respectively.

There are certain events not initiated by Plan participants that limit the ability of the Plan to transact with the issuer of a GIC (synthetic or traditional) at its contract value. Specific coverage provided by each synthetic GIC may be different from each issuer. Examples of such events include: the Plan’s failure to qualify under the Internal Revenue Code ("IRC") of 1986 as amended; full or partial termination of the Plan; involuntary termination of employment as a result of a corporate merger, divestiture, spin-off, or other significant business restructuring, which may include early retirement incentive programs or bankruptcy; changes to the administration of the Plan which decreases employee or employer contributions, the establishment of a competing plan by the plan sponsor, the introduction of a competing investment option, or other Plan amendment that has not been approved by the contract issuers; dissemination of a participant communication that is designed to induce participants to transfer assets from this investment option; events resulting in a material and adverse financial impact on the contract issuer, including changes in the tax code, laws or regulations. The Plan fiduciaries believe that the occurrence of any of the aforementioned events, which would limit the Plan’s ability to transact with the issuer of a GIC at its contract value, is not probable.

c. Derivatives

Presented in the following table is the fair value of derivatives within the Trust as of December 31, 2021 and 2020. The net unrealized appreciation/depreciation of these derivative instruments is included in the Interest in Johnson & Johnson Pension and Savings Plans Master Trust, at fair value in the Statements of Net Assets Available for Benefits.

Johnson & Johnson Savings Plan

Notes to Financial Statements

| | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | Asset | Liability | | Asset | Liability |

| Fair Value of Derivatives | | | | | | |

| Forward Foreign Exchange Contracts | | $ | 438,417 | | $ | 2,403,478 | | | $ | 976,178 | | $ | 4,353,037 | |

| Futures | | 88,202 | | — | | | 1,193,068 | | — | |

| Interest Rate Swaps | | 1,506,889 | | — | | | — | | 1,710,662 | |

| Credit Default Swaps | | 748,928 | | — | | | 467,456 | | — | |

| Options | | 38,655 | | — | | | 52,209 | | — | |

| Total Return Swaps | | 12,366,796 | | — | | | — | | — | |

| Total | | $ | 15,187,887 | | $ | 2,403,478 | | | $ | 2,688,911 | | $ | 6,063,699 | |

The following table provides information on the investment gains/(losses) on derivatives within the Trust for the year ended December 31, 2021. These amounts are included in the Plan’s interest in the Johnson & Johnson Pension and Savings Plans Master Trust net investment income/loss on the Statement of Changes in Net Assets Available for Benefits.

| | | | | | | | | | | | | | |

| | 2021 |

| | Realized (Loss)/Gain | Unrealized (Loss)/Gain | Total Investment (Loss)/Gain |

| Forward Foreign Exchange Contracts | | $ | (832,665) | | $ | 1,411,799 | | $ | 579,134 | |

| Futures | | 20,681,930 | | (2,356,418) | | 18,325,512 | |

| Interest Rate Swaps | | (288,964) | | 3,217,552 | | 2,928,588 | |

| Credit Default Swaps | | 1,192,100 | | 281,472 | | 1,473,572 | |

| Options | | — | | (13,554) | | (13,554) | |

| Total Return Swaps | | 8,250,332 | | 12,366,796 | | 20,617,128 | |

| Total | | $ | 29,002,733 | | $ | 14,907,647 | | $ | 43,910,380 | |

The following table provides information on collateral pledged by and owed to the Trust as of December 31, 2021 and 2020.

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | Pledged/ (Owed) | | Pledged/ (Owed) |

| | Cash | | Cash |

| Forward Foreign Exchange Contracts | | $ | 2,658,000 | | | $ | 290,000 | |

| Futures | | 1,206,000 | | | — | |

| Swaps | | (6,083,000) | | | 2,952,000 | |

Johnson & Johnson Savings Plan

Notes to Financial Statements

The following table provides the average notional value of derivatives held by the Trust as of December 31, 2021 and 2020.

| | | | | | | | | | | |

| | Average Notional Value |

| | 2021 | 2020 |

| Purchased Forward Foreign Exchange Contracts | | $ | 12,028,311 | | $ | 20,469,817 | |

| Sold Forward Foreign Exchange Contracts | | 94,994,204 | | 100,524,775 | |

| Purchased Futures Contracts | | 355,608,079 | | 77,352,451 | |

| Sold Futures Contracts | | 23,380,775 | | 34,488,525 | |

| | | |

| Written Options Contracts | | 23,548,000 | | 43,451,667 | |

| Interest Rate Swaps | | 341,985,970 | | 190,386,522 | |

| Written Credit Default Swaps | | 196,338,893 | | 47,188,250 | |

| Total Return Swaps | | 257,780,226 | | — | |

For the written credit default swaps, the recourse provisions are determined either by the International Swaps and Derivatives Association ("ISDA") agreements or the exchange. Where the Trust is a seller of credit default swaps and if a credit event occurs due to the default of the underlying security or the underlying tranche, this would result in a net loss to the Trust. At December 31, 2021, the maximum payout for outstanding credit default swaps aggregated to $255,751,000 with terms as follows:

| | | | | | | | |

| December 31, 2021 | |

| Number of Contracts | Maturity | Total Value |

| 4 | Less than 1 Year | $ | 8,000,000 | |

| 5 | 1 Year | 1,800,000 | |

| 8 | 2 Years | 5,100,000 | |

| 7 | 3 Years | 12,651,000 | |

| 7 | 4 Years | 9,700,000 | |

| 8 | 5 Years | 96,200,000 | |

| 2 | 9 Years | 13,400,000 | |

| 1 | 10 Years | 108,900,000 | |

At December 31, 2020, the maximum payout for outstanding credit default swaps aggregated to $83,421,000

with terms as follows:

| | | | | | | | |

| December 31, 2020 | |

| Number of Contracts | Maturity | Total Value |

| 17 | Less than 1 Year | $ | 31,600,000 | |

| 5 | 2 Years | 2,900,000 | |

| 9 | 3 Years | 5,600,000 | |

| 10 | 4 Years | 28,321,000 | |

| 3 | 5 Years | 15,000,000 | |

4. Notes Receivable from Participants

The Plan had participant loans outstanding at December 31, 2021 and December 31, 2020 of $100 million and $104 million, respectively. The net decrease of $4 million for 2021 represents loan issuances of $48 million less loan retirements and payments toward outstanding loans of $52 million. Delinquent notes receivable from participants are reclassified to benefit payments based on terms of the Plan document.

Johnson & Johnson Savings Plan

Notes to Financial Statements

5. Tax Status

The Plan received a favorable determination letter from the IRS dated August 17, 2017. Although the Plan has been amended since receiving the determination letter, the Plan Administrator believes that the Plan is currently designed and is currently being operated in compliance with the applicable requirements of the IRC.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain tax position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has concluded that as of December 31, 2021 and December 31, 2020, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

6. Related Party Transactions

Certain Plan investments, such as shares of CCT's managed by State Street Global Advisors, a division of State Street, and shares of State Street common stock and bonds, qualify as party-in interest transactions as State Street is the Trustee as defined by the Plan. As of December 31, 2021 and December 31, 2020, the total market value of investments in these interests allocated to the Plan and managed by State Street was $8,155,078,339 and $6,218,652,107, respectively.

The Plan also invests in shares of the Company. The Company is the Plan sponsor and, therefore, these transactions qualify as party-in-interest transactions. As of December 31, 2021 and December 31, 2020, the fair value of investments in Johnson & Johnson Common Stock was $3,901,623,940 and $3,756,929,248, respectively. During the year ended December 31, 2021, the Plan made purchases of $89,028,191 and sales of $266,568,843 of the Company’s common stock. The total dividend income received during 2021 was $97,185,508. The total realized and unrealized gains during 2021 were $142,418,984 and $2,123,158,986, respectively.

7. Asset Transfers

As a result of business acquisitions by the Plan Administrator, the following transfers into the Plan were completed in 2021:

| | | | | | | | |

| Plan Name | Amount Transferred | Date of Transfer |

| TARIS Biomedical 401 (k) Plan | $ | 2,293,460 | | January 2021 |

| Auris 401 (k) Plan | 19,963,468 | | February 2021 |

| Actelion 401 (k) Retirement Plan | 109 | | February 2021 |

| Momenta 401 (k) Plan | 35,321,876 | | November 2021 |

All transfers are reflected in the Statement of Changes in Net Assets Available for Benefits

Johnson & Johnson Savings Plan

Notes to Financial Statements

8. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500: | | | | | | | | | | | | | | |

| | December 31, |

| | 2021 | | 2020 |

Net assets available for benefits per the financial statements | | $ | 24,697,532,187 | | | $ | 21,984,831,224 | |

Deemed distributions | | (781,150) | | | (835,310) | |

Amounts allocated to withdrawing participants | | (1,970,280) | | | (2,771,992) | |

Net assets available for benefits per the Form 5500 | | $ | 24,694,780,757 | | | $ | 21,981,223,922 | |

The following is a reconciliation of the net increase in net assets available for benefits per the financial statements to the Form 5500: | | | | | |

| December 31, 2021 |

Net increase in net assets available for benefits per the financial statements | $ | 2,655,122,050 | |

Less: Amounts allocated to withdrawing participants at December 31, 2021 (not yet paid) | (1,970,280) | |

Less: Deemed distributions | (188,972) | |

Add: Amounts allocated to withdrawing participants at December 31, 2020 | 2,771,992 | |

Add: Loan offset | 243,132 | |

Net increase in net assets available for benefits per the Form 5500 | $ | 2,655,977,922 | |

9. Subsequent Events

In November 2021, the Company announced its intention to separate the Company's Consumer Health business, with the intent to create a new, publicly traded company. The Company is targeting completion of the planned separation in 18 to 24 months after initial announcement. The planned separation may not be completed on the terms or timeline currently contemplated, if at all, and may not achieve the expected results. The impacts of this decision is not yet known, but are being closely monitored throughout 2022.

The Plan has assessed subsequent events through the date that the financial statements were available to be issued and has determined that no other items require disclosure.

Johnson & Johnson Savings Plan

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2021

| | | | | | | | | | | | | | | | | | | | |

Identity of Issue, Borrower, Lessor, or Similar Party | | Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value | | Cost | | Current Value |

Plan's interest in the Trust | | Plan's interest in the Johnson & Johnson Pension and Savings Plans Master Trust | | ** | | $ | 24,579,699,618 | |

*Participant loans | | Interest rates ranging from 4.25% to 11.33%. Maturities ranging from 2022 - 2040 | | ** | | $ | 99,832,008 | |

* Represents party-in-interest transactions

** Not applicable

Johnson & Johnson Savings Plan

Schedule H, line 4a - Schedule of Delinquent Participant Contributions

For the year ended December 31, 2021

| | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to Plan | Total that Constitute Nonexempt Prohibited Transaction | Total Fully Corrected Under VFCP and PTE 2002-51 |

Check here if Late Participant Loan Repayments are included: q | Contributions Not Corrected | Contributions Corrected Outside VFCP | Contributions Pending Correction in VFCP | |

| $ 0 | $ 1,755* | $ 0 | $ 0 |

*All delinquent contributions, adjusted for earnings, have been contributed to the Plan.

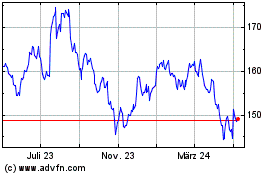

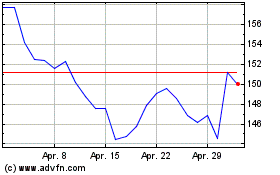

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024